Monthly Transaction Overview

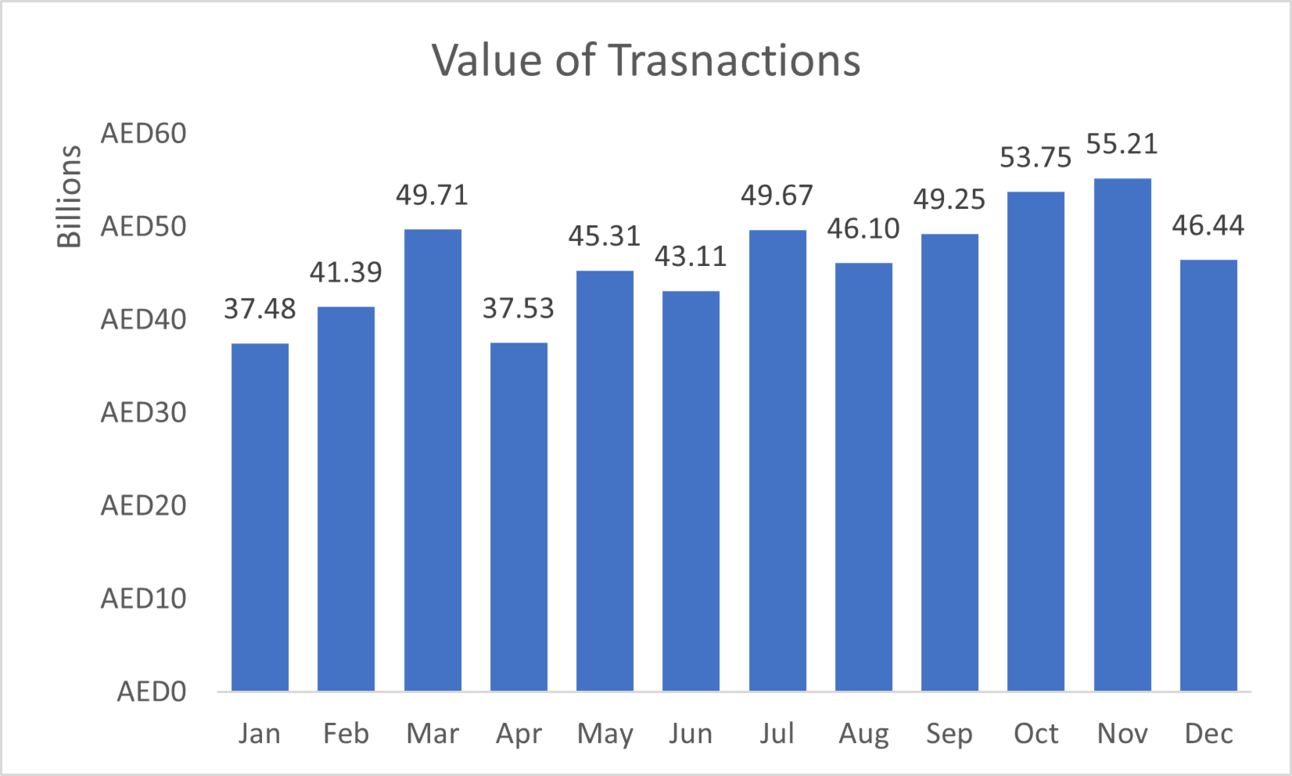

The first quarter of the year started strong with January posting transactions worth AED 37.5 billion, followed by a steady rise in February and March, with March seeing the highest monthly figure of approximately AED 49.7 billion. This surge is potentially indicative of investor confidence and the culmination of strategic sales initiatives.

The second quarter, while starting lower in April at AED 37.5 billion, showed a healthy rebound in May and June, ending the half-year mark with a solid performance.

July echoed the first quarter's strength with transactions worth nearly AED 49.7 billion, followed by a modest decline in August. September and October saw significant growth, with October marking the year's peak at over AED 53.7 billion, possibly due to seasonal buying trends and the introduction of new market incentives.

The year concluded with November registering the highest value of transactions at AED 55.2 billion, before a dip in December, ending the year on a strong note with overall transactions far exceeding the half-trillion dirham mark.

Transaction Categories Breakdown

The total value of transactions was predominantly driven by sales, which amounted to AED 401.3 billion, underscoring a vibrant sales market. Mortgages also played a substantial role, indicating a healthy financing environment, totaling over AED 121 billion.

The off-plan market segment performed robustly with transactions totaling AED 152.2 billion, which could be attributed to investor optimism and the launch of new developments. The 'ready' property segment matched this enthusiasm, showcasing a transaction value of AED 402.7 billion, reflecting the market's depth and investor preference for immediate occupancy options.

Gift transactions, while the least in total value at AED 32.7 billion, highlight a niche yet noteworthy component of the market that encompasses familial transfers and endowments.

Property Type Insights

The land transactions stood out with an impressive AED 276.5 billion, indicating strong investment in development and commercial activities. Flats followed with AED 205.2 billion, showing a consistent demand in the urban living sector.

Villas, with transactions worth AED 44.7 billion, and other types of properties accounting for AED 28.7 billion, reflect targeted investment preferences and diversification within the real estate portfolio of investors.

Price per Square Meter Analysis

The average price per square meter provides critical insights into property valuations across different property types. Land transactions averaged AED 3,254.98 per sqm, suggesting a premium on undeveloped property, potentially due to location desirability and development potential.

Flats commanded an average of AED 18,602.37 per sqm, indicating a higher valuation possibly due to premium locations or inclusion of luxury amenities. Villas, with a lower average of AED 11,479.07 per sqm, may indicate larger property sizes or varying locations affecting the average pricing.

Most active areas

Top 10 Areas by Transaction Value for Ready Properties

Palm Jumeirah stood at the forefront with transactions worth AED 14.6 billion.

Burj Khalifa area followed closely with AED 13.7 billion in transactions.

Business Bay witnessed transactions amounting to AED 11.1 billion.

Dubai Marina was also a strong contender with over AED 10.2 billion.

Jumeirah Village Circle showcased AED 6.2 billion in transactions.

Jumeirah Lakes Towers recorded AED 5.2 billion.

Dubai Creek Harbour tallied AED 4.7 billion.

Dubai Hills captured AED 4.3 billion in transactions.

Jumeirah Beach Residence had AED 3.9 billion.

Emirate Living rounded up the top ten with AED 2.5 billion.

Top 10 Areas by Number of Transactions for Ready Properties

Business Bay led the way with 6,985 transactions.

Jumeirah Village Circle was a close second with 6,905 transactions.

Dubai Marina counted 5,233 transactions.

Burj Khalifa saw 4,408 transactions.

Jumeirah Lakes Towers had 3,595 transactions.

Palm Jumeirah recorded 2,552 transactions.

International City PH 1 had 2,548 transactions.

Dubai Creek Harbour with 2,168 transactions.

Dubai Land Residence Complex also had 2,163 transactions.

Dubai Hills registered 2,055 transactions.

Top 10 Areas by Transaction Value for Off-Plan Properties

Palm Jumeirah led with AED 12.9 billion in transaction value.

Marsa Dubai registered AED 11.1 billion.

Business Bay had transactions totaling AED 10.9 billion.

Dubai Harbour came in with AED 10 billion.

Jumeirah Village Circle noted AED 8 billion.

Burj Khalifa had AED 7.8 billion.

Dubai Creek Harbour accumulated AED 7.7 billion.

Sobha Heartland stood at AED 5.9 billion.

Dubai Hills posted AED 4.3 billion.

Jumeirah Lakes Towers had AED 4 billion.

Top 10 Areas by Number of Transactions for Off-Plan Properties

Jumeirah Village Circle was the busiest with 9,136 transactions.

Business Bay followed with 4,995 transactions.

Arjan saw 3,449 transactions.

Dubai Creek Harbour had 3,189 transactions.

Meydan One notched up 3,128 transactions.

Sobha Heartland recorded 2,777 transactions.

Jumeirah Lakes Towers had 2,667 transactions.

Dubai Hills with 2,223 transactions.

Marsa Dubai had 2,069 transactions.

Burj Khalifa rounded off the list with 1,985 transactions.

The data presents a dynamic real estate landscape in Dubai, with Palm Jumeirah taking the lead in both ready and off-plan markets by transaction value. The prominence of Business Bay in terms of the number of transactions highlights its popularity and the high turnover of properties.

The ready property market showed a considerable spread of transactions across various districts, indicating a widespread demand for immediate occupancy. Off-plan transactions were led by Jumeirah Village Circle, suggesting a significant interest in upcoming developments.

Conclusion

The Dubai real estate market in 2023 demonstrated a strong and diverse transaction portfolio with significant activity across all property types and transaction categories. The robust sales figures, healthy mortgage market, and considerable investments in off-plan and ready properties indicate a market with a solid foundation and optimistic growth trajectory.

As Dubai continues to solidify its position as a global real estate hub, the trends observed in 2023 suggest an adaptable and resilient market capable of attracting a wide range of investors and meeting various buyer preferences.

Data Source: Dubai Land Department