Keep This Stock Ticker on Your Watchlist

They’re a private company, but Pacaso just reserved the Nasdaq ticker “$PCSO.”

No surprise the same firms that backed Uber, eBay, and Venmo already invested in Pacaso. What is unique is Pacaso is giving the same opportunity to everyday investors. And 10,000+ people have already joined them.

Created a former Zillow exec who sold his first venture for $120M, Pacaso brings co-ownership to the $1.3T vacation home industry.

They’ve generated $1B+ worth of luxury home transactions across 2,000+ owners. That’s good for more than $110M in gross profit since inception, including 41% YoY growth last year alone.

And you can join them today for just $2.90/share. But don’t wait too long. Invest in Pacaso before the opportunity ends September 18.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

Al Rasikhoon Real Estate launched “Al Qasimiya Gate” in Sharjah, 9.63m sq ft, more than AED1bn, via a two-day sales event ending Sept 2, 2025. In Al Qasimia Industrial City on Dubai–Hatta Road, it offers freehold to all nationalities, fee waivers, competitive pricing, and prime logistics access for industrial/commercial investors.

Read the full article on Zawya

Dubai real estate is highly sensitive to interest rates tied to the dirham’s US-dollar peg. Rate shifts change mortgage affordability, demand, prices, foreign capital flows, and investor strategies—differently across residential and commercial sectors. Understanding cycles helps investors time purchases, structure financing, and rebalance portfolios effectively.

Read the full article on BNO News

Dubai’s PRYPCO Blocks launched the UAE’s first upfront rental guarantee for fractional investors: a 5% annual net yield paid within two months of investing. It also cut entry fees to 1% (from 1.5%). DFSA-regulated, the platform aims to boost liquidity, reinvestment and access.

Read the full article on Gulf Business

Dubai real estate sector recorded $4.4bn of transactions last week, including $10m Bugatti apartment

The Dubai real estate sector recorded AED16.12bn ($4.4bn) of transactions last week, according to data from the Land Department.

Read the full article on Arabian Business

Most coverage tells you what happened. Fintech Takes is the free newsletter that tells you why it matters. Each week, I break down the trends, deals, and regulatory shifts shaping the industry — minus the spin. Clear analysis, smart context, and a little humor so you actually enjoy reading it.

Dubai logged AED51.1bn sales in Aug (+7.9% YoY) across 18,678 deals (+15.4%). Apartments led (AED30.2bn); villa volumes fell; avg psf rose 15% to AED1,720. Business Bay topped areas. Developer first sales dominated (74% vol). A AED161m Palm Jumeirah villa was the priciest deal.

Read the full article on Economy Middle East

Dubai’s Court of Cassation upheld the sale of a Dh295m, 19-storey Al Mamzar building, rejecting the seller’s appeal. The seller failed to clear a registered mortgage within 30 days; the bank required Dh435m repayment. Claims the buyer delayed payment were dismissed; the lien persisted.

Read the full article on Gulf News

UAE real estate stays robust in 2025 on economic resilience and foreign inflows. Dubai/Abu Dhabi see strong off-plan demand, record sales, rising occupancy and rents; industrial also growing. Dubai hit AED100bn sales by March 4 and leads the $10m+ global luxury home market.

Read the full article on MSN

Dubai’s next “accidental property millionaires” are buyers of sub-$1m homes likely to appreciate past $1m, aided by infrastructure (Blue Line, Al Maktoum Airport). Likely areas: Dubai Creek Harbour, Dubai Islands, Dubai Harbour, Palm Jebel Ali, City Walk, Dubai South. Knight Frank counts 110,500 $1m+ units, including 39,000 accidental owners.

Read the full article on Gulf News

Main Realty, led by CEO Mohammed Aamir Siddiq, brings “Miami vibes meets Dubai bling” to Dubai, prioritizing prime locations, quality, and lifestyle-led design. Flagships: Primero Residences (Al Furjan) and Flow Residences (Dubai Islands). The firm stresses long-term value, community, ethics, and generational wealth over quick flips.

Read the full article on Gulf News

The company confirmed the addition of a fourth residential project in Al Jaddaf area, featuring a direct view of the Burj Khalifa.

Read the full article on Construction Week Online

Seeking impartial news? Meet 1440.

Every day, 3.5 million readers turn to 1440 for their factual news. We sift through 100+ sources to bring you a complete summary of politics, global events, business, and culture, all in a brief 5-minute email. Enjoy an impartial news experience.

Funds must go to RERA escrow (Law 8/2007). Check developer via DLD/Dubai Rest, monitor progress/Mollak, escalate to RERA if you see any issues. Make sure the area is freehold. Secure heirs via DIFC/Dubai Courts will.

Read the full article on MSN

RAK Properties now lets international buyers purchase RAK homes via crypto through Hubpay, converting USDT/BTC/ETH to AED on settlement. It won’t hold crypto. 800 Mina units due by year-end; H1 2025 revenue Dh774.8m, profit +80% to Dh160.6m, amid wider UAE crypto-payments adoption.

Read the full article on Khaleej Times

UAE construction will grow from $66.9bn (2024) to $96.1bn by 2030 (6.06% CAGR), driven by real estate expansion, expat demand, landmark projects and pro-investor reforms. Digitalization (BIM, IoT, AI, drones) is rising, while cost overruns, material volatility, labor shortages and permitting delays remain key risks.

Read the full article on Globe Newswire

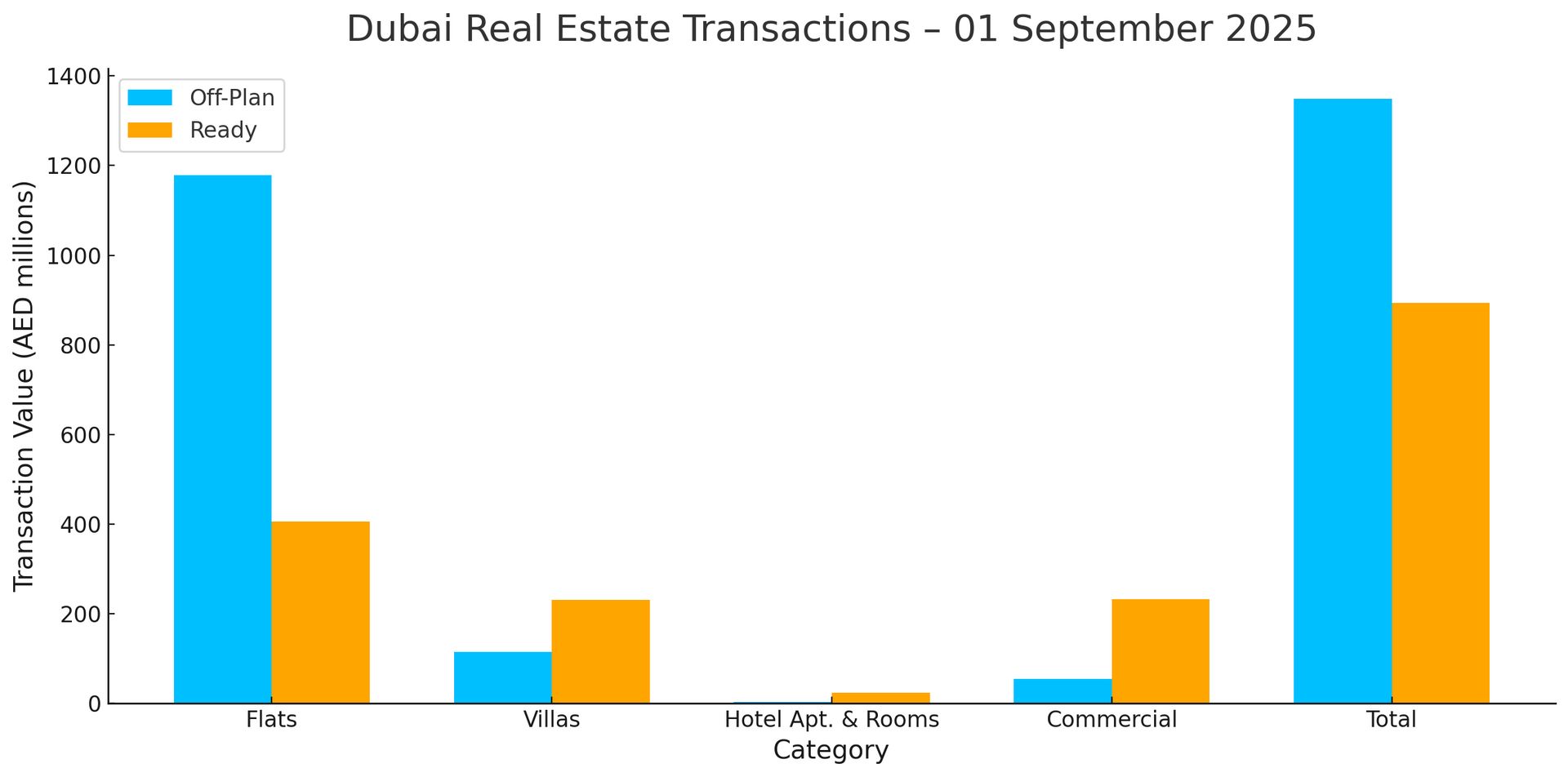

Dubai Real Estate Transactions as Reported on the 1st of September 2025

Total transacted value reached AED 2.243bn. Off-plan dominated with AED 1.350bn (60.2%), while Ready accounted for AED 0.894bn (39.8%).

Category | Off-Plan (AED million) | Ready (AED million) |

|---|---|---|

Flats | 1,178.6 | 405.2 |

Villas | 114.4 | 231.5 |

Hotel Apts & Rooms | 2.5 | 24.4 |

Commercial | 54.2 | 232.6 |

Total | 1,349.7 | 893.7 |

Off-Plan Market Performance

Total Value: AED 1.350bn

Flats: AED 1,178.6m (87.3%)

Villas: AED 114.4m (8.5%)

Hotel Apts & Rooms: AED 2.5m (0.2%)

Commercial: AED 54.2m (4.0%)

Off-plan activity was overwhelmingly apartment-led, with villas and other types a small share.

Ready Market Performance

Total Value: AED 0.894bn

Flats: AED 405.2m (45.3%)

Villas: AED 231.5m (25.9%)

Hotel Apts & Rooms: AED 24.4m (2.7%)

Commercial: AED 232.6m (26.0%)

Ready transactions were broad-based but still flat-heavy, with villas providing a meaningful quarter of activity.

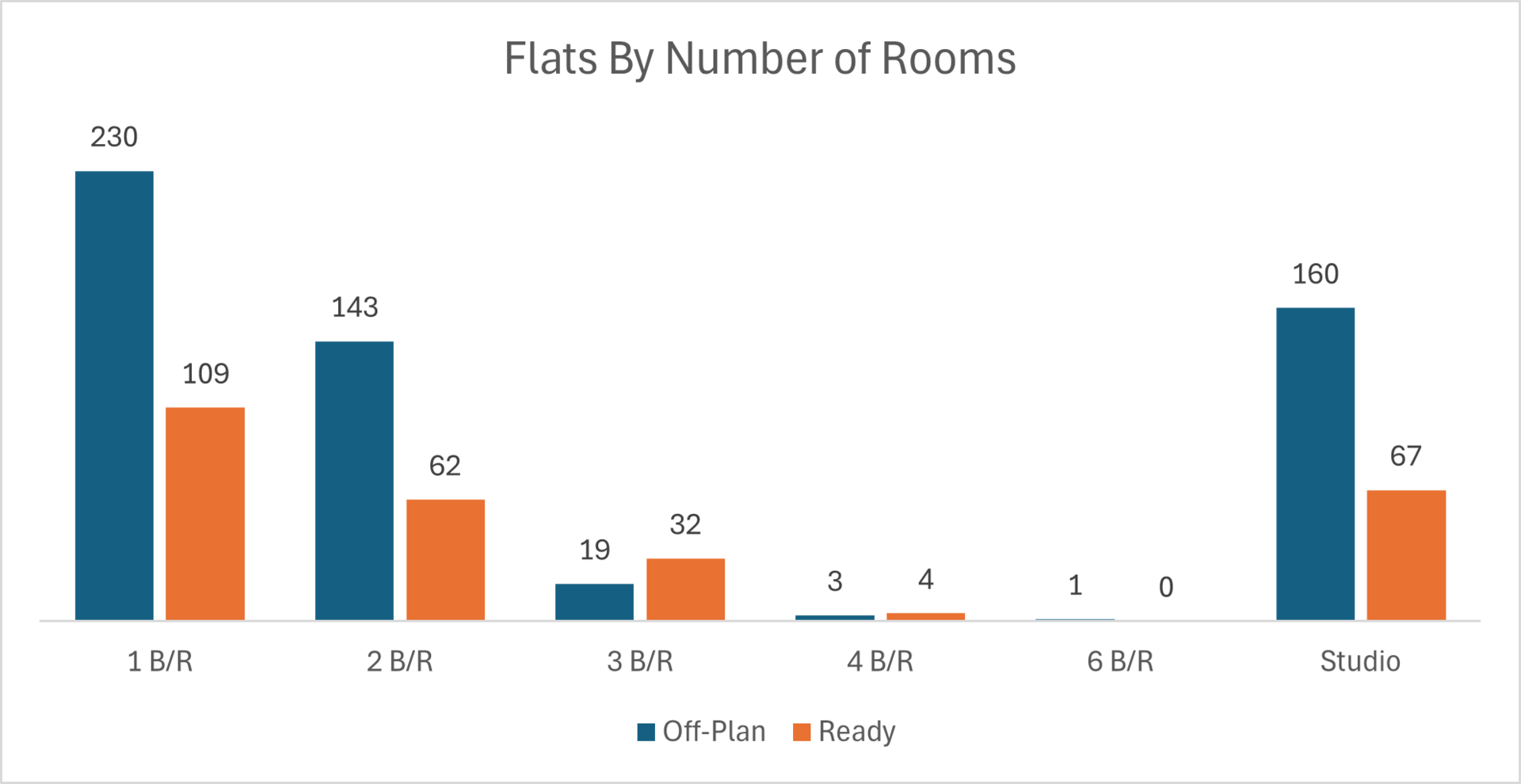

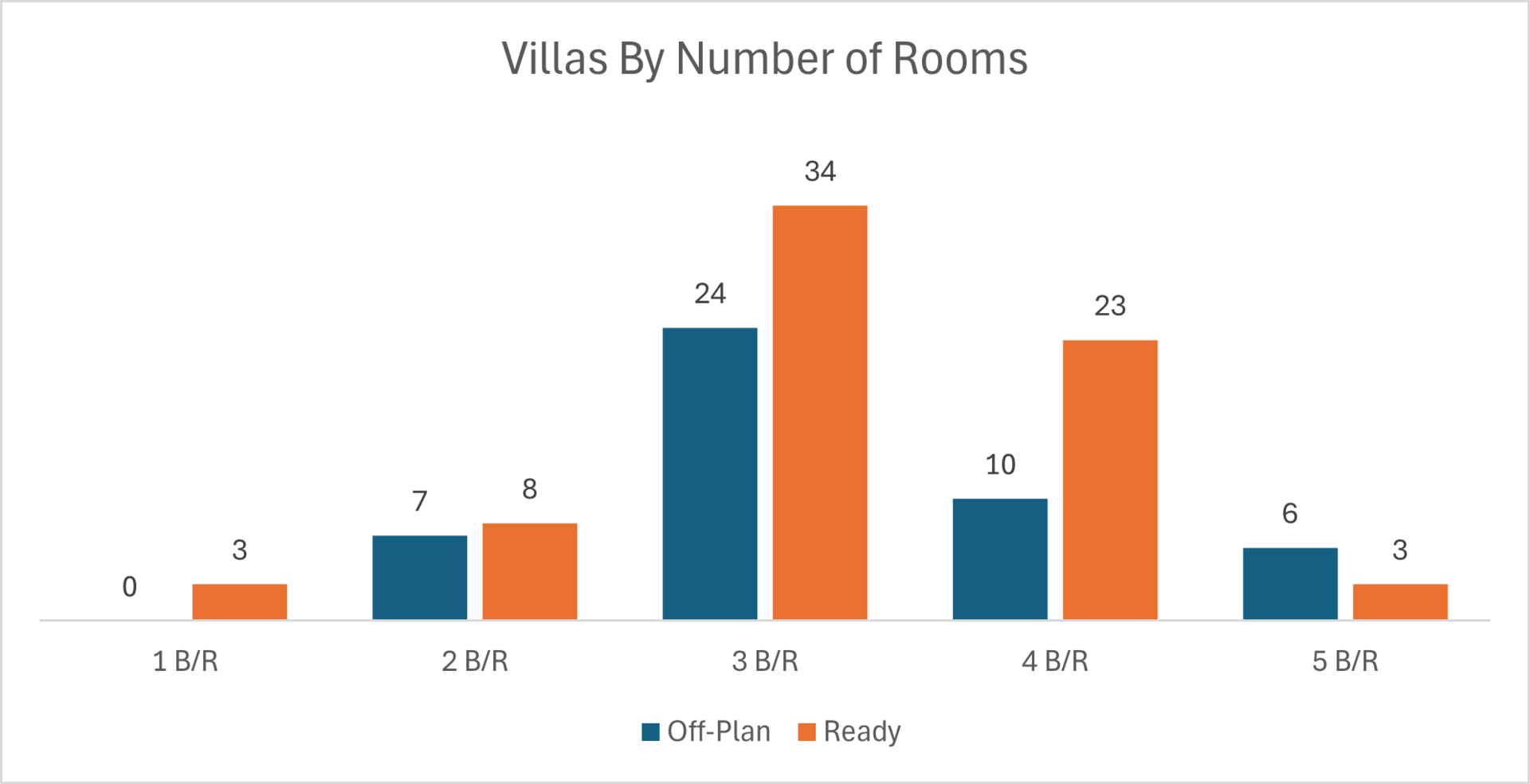

On The Micro Level

Market Insights & Outlook

Apartments drove both segments, especially off-plan, underscoring demand for mid-ticket investments and new-build inventory. Ready villas and commercial assets showed healthy participation, pointing to a mix of end-user and income-focused demand as launch momentum continues.

Data Source: Dubai Land Department