Serenity and MTA Real Estate have partnered to launch a blockchain-based real estate investment portal in Dubai, enabling global crypto holders to buy property with regulatory compliance. Backed by Dubai Land Department, the platform offers KYC, smart contracts, and exclusive incentives, supporting the city's $16B tokenized property vision.

Read the full article on Zawya

This tech company grew 32,481%..

No, it's not Nvidia. It's Mode Mobile, 2023’s fastest-growing software company according to Deloitte.

Nasdaq ticker $MODE secured—invest at $0.30/share before their share price changes on 5/1.

*An intent to IPO is no guarantee that an actual IPO will occur. Please read the offering circular and related risks at invest.modemobile.com.

*The Deloitte rankings are based on submitted applications and public company database research.

Dubai’s property market surged in February, with total sales hitting $14 billion, up 40% from last year. Villa sales nearly doubled to 3,679 units, driving the growth, while apartment sales rose 21%. Over 60% of all purchases were off-plan, underscoring strong investor demand.

Read the full article on Arabian Gulf Business Insight

Branded residences in Dubai now command a 42% premium over non-branded properties, averaging AED 3,288 per sqft. Sales surged 48% in late 2024, driven by investor demand, luxury appeal, and tax-free incentives. Dubai leads globally in branded residences, with 43,000+ units and rapid expansion underway.

Read the full article on Khaleej Times

Sponsored

Alex & Books Newsletter

Join 50,000+ subscribers and get the best 5-minute book summaries every week + my list of 100 life-changing books.

U.S.-based 5D Capital Partners has increased its stake in Dubai’s EP Real Estate, aiming to transform it into a market leader. The strategic partnership brings capital, innovation, and global expertise to accelerate EP’s growth, marking a major shift in Dubai’s real estate sector toward value-driven, tech-enabled excellence.

Read the full article on Digital Journal

Turkish investment in Dubai real estate is rising, driven by high rental yields, tax-free incentives, and the golden visa program. Turks now rank seventh among top investors, with spending on overseas property up 20.5% in 2024. Experts predict Turkey could enter Dubai’s top five investor countries by 2025.

Read the full article on Zawya

Off-plan property investment is gaining popularity in Dubai for its lower upfront costs, flexible payment plans, and strong capital appreciation potential. Developers like Emaar lead the market with attractive launches and phased payments. While off-plan offers financial flexibility, risks include delays and lower liquidity. Fractional ownership offers an alternative.

Read the full article on The National

Sponsored

Alex & Books Newsletter

Join 50,000+ subscribers and get the best 5-minute book summaries every week + my list of 100 life-changing books.

Dubai’s real estate market grew 35.5% in 2024, with off-plan properties attracting diverse global investors in early 2025. Indian buyers increased their share to 28%, while Mexican investors entered with 11%. Competitive pricing, flexible payment plans, and high capital appreciation continue to drive strong demand.

Read the full article on Arabian Business

Dubai’s mortgage transactions rose 4.76% in February 2025, reaching AED 5.5 billion, driven by the U.S. Federal Reserve’s decision to hold interest rates steady. Stable borrowing costs boosted buyer confidence, especially for residential properties, supporting continued growth in Dubai’s real estate market amid strong investor demand and government incentives.

Read the full article on Business Outreach

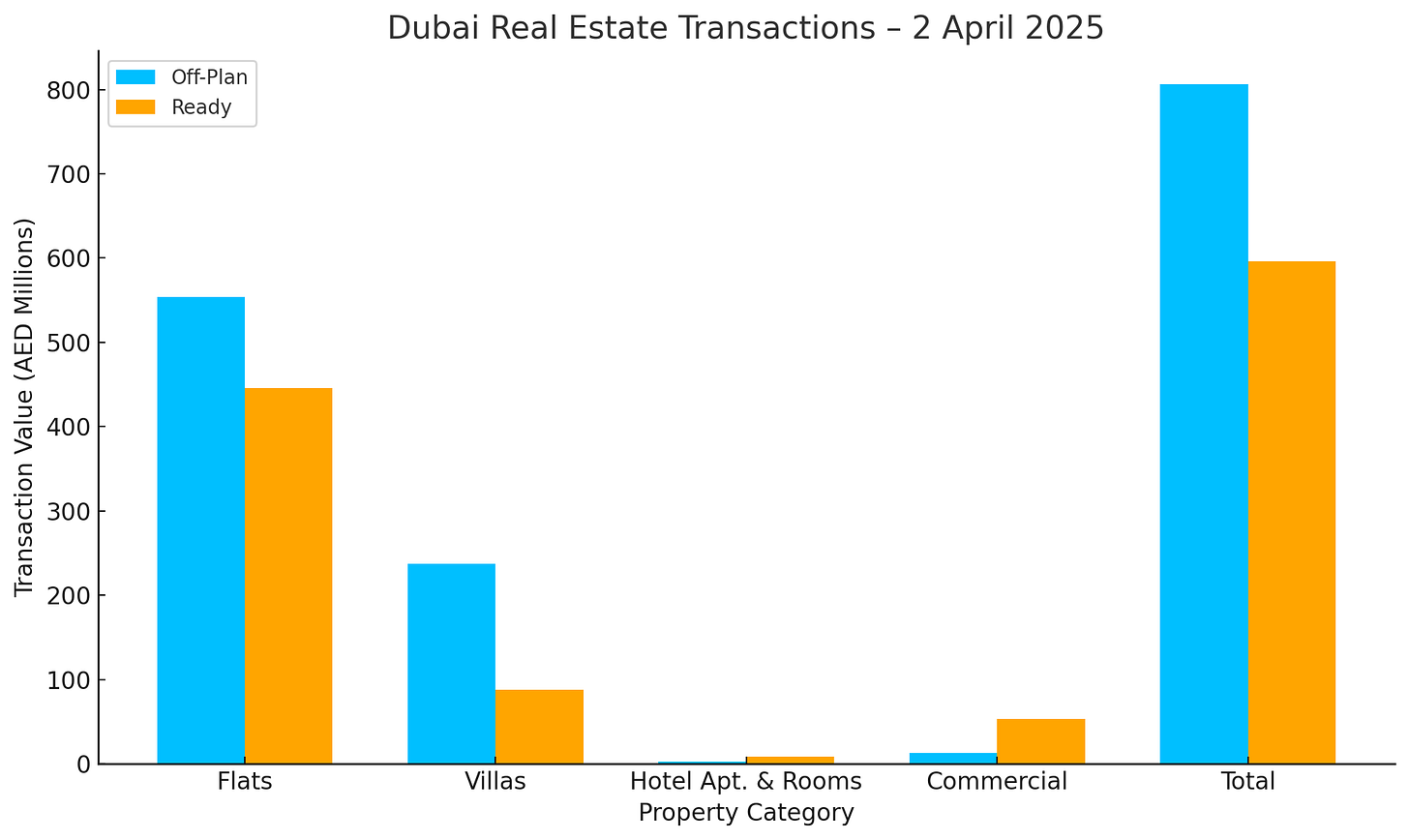

Dubai Real Estate Transactions as Reported on the 2nd of April 2025

Dubai’s real estate market continued its robust performance on 2 April 2025, recording a total transaction value of AED 1,401,884,211. The market activity was led by a dominant off-plan segment, complemented by steady activity in the ready property market.

Market Composition Overview

Off-Plan Transactions: AED 805,978,888 (57.5% of total market)

Ready Transactions: AED 595,905,323 (42.5% of total market)

This balanced distribution showcases sustained investor interest in both new developments and ready-to-move-in properties.

Off-Plan Segment Breakdown

Off-plan properties accounted for the larger share of daily activity, with strong interest in flats and villas:

Flats: AED 553,646,950 (68.7% of off-plan total)

Villas: AED 236,591,354 (29.4%)

Hotel Apartments & Rooms: AED 2,603,300 (0.3%)

Commercial: AED 13,137,284 (1.6%)

Off-plan flats continue to dominate, driven by flexible payment plans and attractive entry pricing. Villas also maintained strong investor traction.

Ready Segment Breakdown

The ready market posted solid numbers, led by residential flats:

Flats: AED 445,570,866 (74.8% of ready total)

Villas: AED 88,014,390 (14.8%)

Hotel Apartments & Rooms: AED 9,301,609 (1.6%)

Commercial: AED 53,018,459 (8.9%)

Flats remain the top choice for both end-users and short-term investors, while ready villas and commercial properties show consistent demand.

Key Takeaways

Off-plan flats and villas are driving investor demand, thanks to flexible pricing models and capital appreciation potential.

Ready flats dominate resale activity, appealing to both residents and income-focused investors.

Commercial properties in both categories are seeing stable activity, highlighting investor interest in Dubai’s expanding business and rental market.

Conclusion

Dubai’s real estate market continues to attract both local and international investors. With a strong pipeline of developments, supportive regulations, and world-class infrastructure, the city remains one of the world’s leading property investment destinations.

Data Source: Dubai Land Department