How 433 Investors Unlocked 400X Return Potential

Institutional investors back startups to unlock outsized returns. Regular investors have to wait. But not anymore. Thanks to regulatory updates, some companies are doing things differently.

Take Revolut. In 2016, 433 regular people invested an average of $2,730. Today? They got a 400X buyout offer from the company, as Revolut’s valuation increased 89,900% in the same timeframe.

Founded by a former Zillow exec, Pacaso’s co-ownership tech reshapes the $1.3T vacation home market. They’ve earned $110M+ in gross profit to date, including 41% YoY growth in 2024 alone. They even reserved the Nasdaq ticker PCSO.

The same institutional investors behind Uber, Venmo, and eBay backed Pacaso. And you can join them. But not for long. Pacaso’s investment opportunity ends September 18.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

Millennium Hotels & Resorts MEA launched its first branded residences. Millennium Residences Saadiyat Island in Abu Dhabi, 85 studios to two-bedroom apartments with Gulf/skyline views. In the cultural district, it offers hotel-style services, full kitchens, rooftop pool, gyms and beach access, suited for short or long stays.

Read the full article on Zawya

The UAE leads crypto-real estate with clear VARA/CBUAE rules, AED settlement via licensed platforms, and DLD-driven tokenization enabling fractional ownership. Low taxes lure investors, though VAT treatment of tokens is evolving. Investors benefit from early access, diversification into tangible assets, and regulatory certainty.

Read the full article on AInvest

Tashas Group has struck a AED100 million ($27 million) joint venture with UAE developer Arada to open at least 10 new restaurants across the Gulf over the next two years. The deal bets that demand for premium dining is moving beyond the malls and downtown districts of Dubai and Abu Dhabi.

Read the full article on Arabian Business

Barco Developers launched Livia Residences in Dubai South, a six-storey, 71-apartment project priced from AED 555,000, completing Q4 2027. Aimed at mid-income buyers, it features LA-inspired design, smart-home tech, and 20+ amenities, and marks Barco’s plan to deliver 2m sq ft across Dubai and other emirates.

Read the full article on Zawya

The Gold standard for AI news

AI will eliminate 300 million jobs in the next 5 years.

Yours doesn't have to be one of them.

Here's how to future-proof your career:

Join the Superhuman AI newsletter - read by 1M+ professionals

Learn AI skills in 3 mins a day

Become the AI expert on your team

Dubai real estate sales hit AED40bn ($10.9bn) in August 2025, up 13.2% year-on-year, driven by off-plan launches, secondary sales and population growth past 4m.

Read the full article on Arabian Business

Aldar will launch 450 townhomes for UAE nationals at Al Deem, northeast of Yas Island, on 12 September. Three- and four-bed units include a majlis and multiple entrances; 26 are live-work homes. It’s the seventh cluster, with two new bridges providing direct access to Yas Island and the airport.

Read the full article on Zawya

Dubai’s luxury market hit another milestone. A Palm Jumeirah Signature Villa sold for Dh161m, the island’s priciest secondary villa in 2025 and Dubai’s No.2 price/sq ft (Dh14,679). Amid record sales and scarce ultra-prime supply, HNWI demand keeps Palm, Jumeirah Bay and Emirates Hills leading.

Read the full article on Gulf News

Dubai logged 16,993 residential deals in Aug 2025 (+13.2% YoY), AED40bn total. Off-plan led: 12,917 deals, AED28.3bn (+22.1%). Secondary: 4,076, AED11.7bn (+5.8%). Commercial hit AED8.12bn; rentals 12,181 leases, AED1.1bn. Population reached 4.0m (+3.6% YTD), supporting demand and market maturity.

Read the full article on Economy Middle East

AI You’ll Actually Understand

Cut through the noise. The AI Report makes AI clear, practical, and useful—without needing a technical background.

Join 400,000+ professionals mastering AI in minutes a day.

Stay informed. Stay ahead.

No fluff—just results.

Dubai real estate developer OMNIYAT has announced that its LUMENA tower is now fully sold out, just two months after its launch on June 18, 2025.

Read the full article on Arabian Business

UAE real estate is surging in 2025, powered by economic resilience, oil rebound and foreign capital. Dubai leads with record sales, rising $10m+ deals and strong off-plan demand. A new First-Time Home Buyer Programme targets end-user ownership. Offices, logistics and hotels see rental growth; retail remains supply-constrained.

Read the full article on Gulf Business

Etihad Rail, the UAE’s $13bn, 1,200km network launching commercially in 2026, is already lifting real estate. Developers forecast 20–30% price gains and 20% rent rises near stations as mixed-use hubs emerge, benefiting Al Ain, Fujairah and Al Dhafra. Analysts urge early investment, citing Shinkansen/TGV precedents

Read the full article on Gulf News

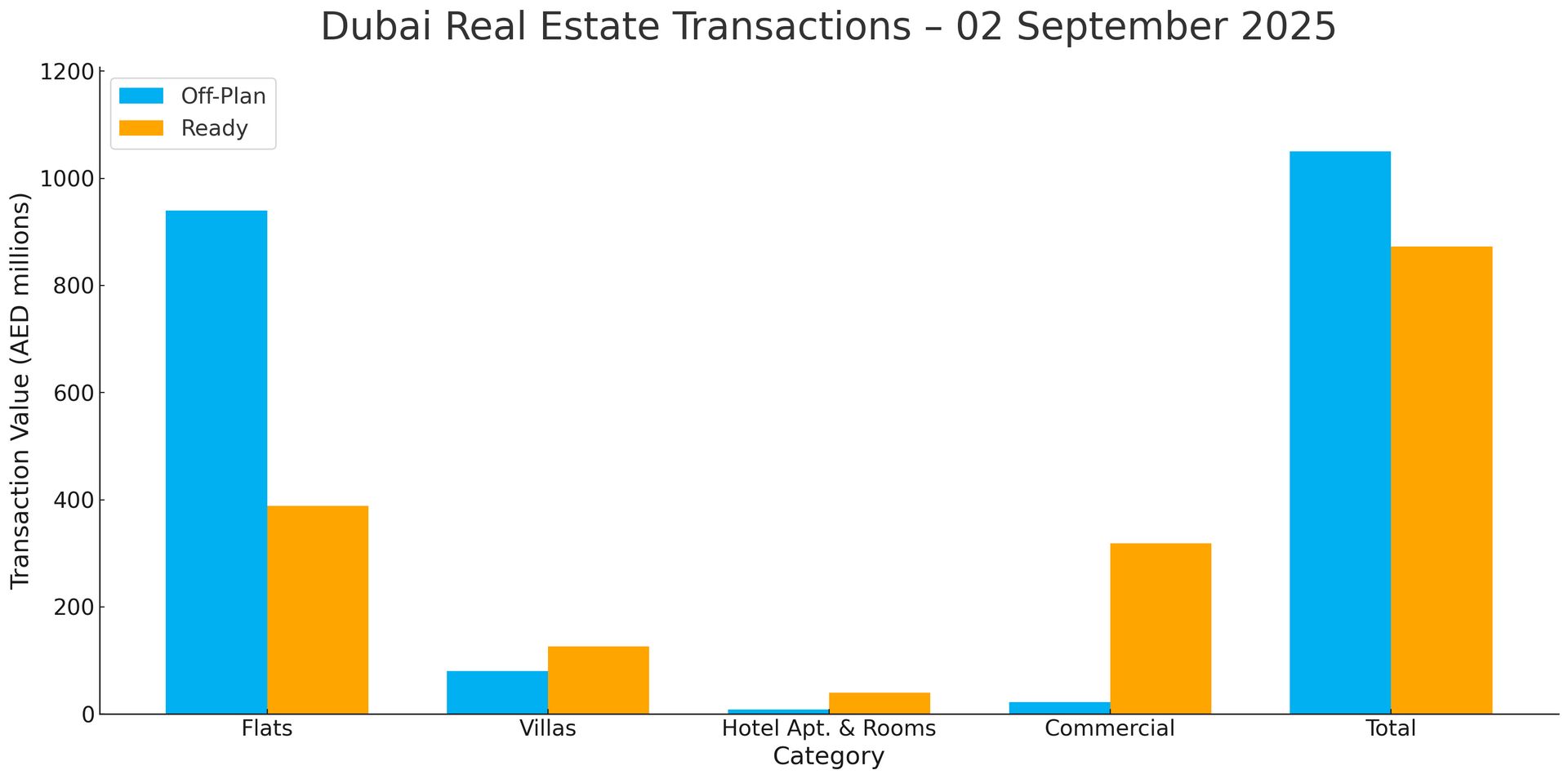

Dubai Real Estate Transactions as Reported on the 2nd of September 2025

Total transacted value reached AED 1,923,248,922. Off-plan dominated with AED 1,050,375,728 (54.6%), while Ready accounted for AED 872,873,194 (45.4%).

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 939.9 | 388.4 |

Villas | 80.2 | 126.2 |

Hotel Apt. & Rooms | 8.0 | 40.0 |

Commercial | 22.3 | 318.3 |

Total | 1,050.4 | 872.9 |

Off-Plan Market Performance

Total Value: AED 1,050,375,728

Flats: AED 939,870,088 (89.5%)

Villas: AED 80,153,054 (7.6%)

Hotel Apts & Rooms: AED 8,028,729 (0.8%)

Commercial: AED 22,323,856 (2.1%)

Off-plan activity was overwhelmingly led by flats (~90% of value), with villas a distant second and limited commercial/hotel volumes.

Ready Market Performance

Total Value: AED 872,873,194

Flats: AED 388,443,681 (44.5%)

Villas: AED 126,153,317 (14.5%)

Hotel Apts & Rooms: AED 40,006,373 (4.6%)

Commercial: AED 318,269,823 (36.5%)

Ready transactions were more balanced, with strong commercial deals (over one-third of value) alongside active flat sales.

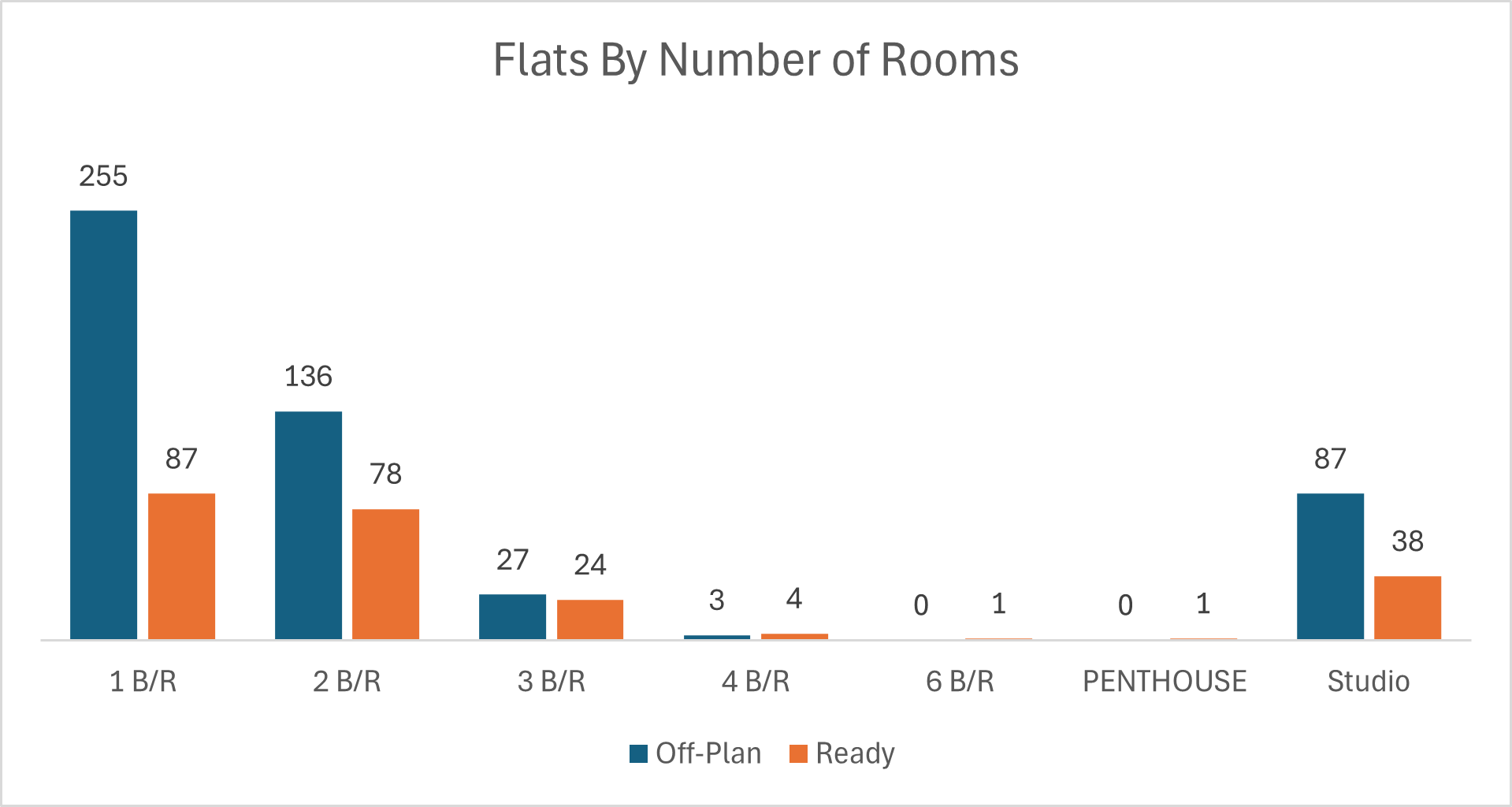

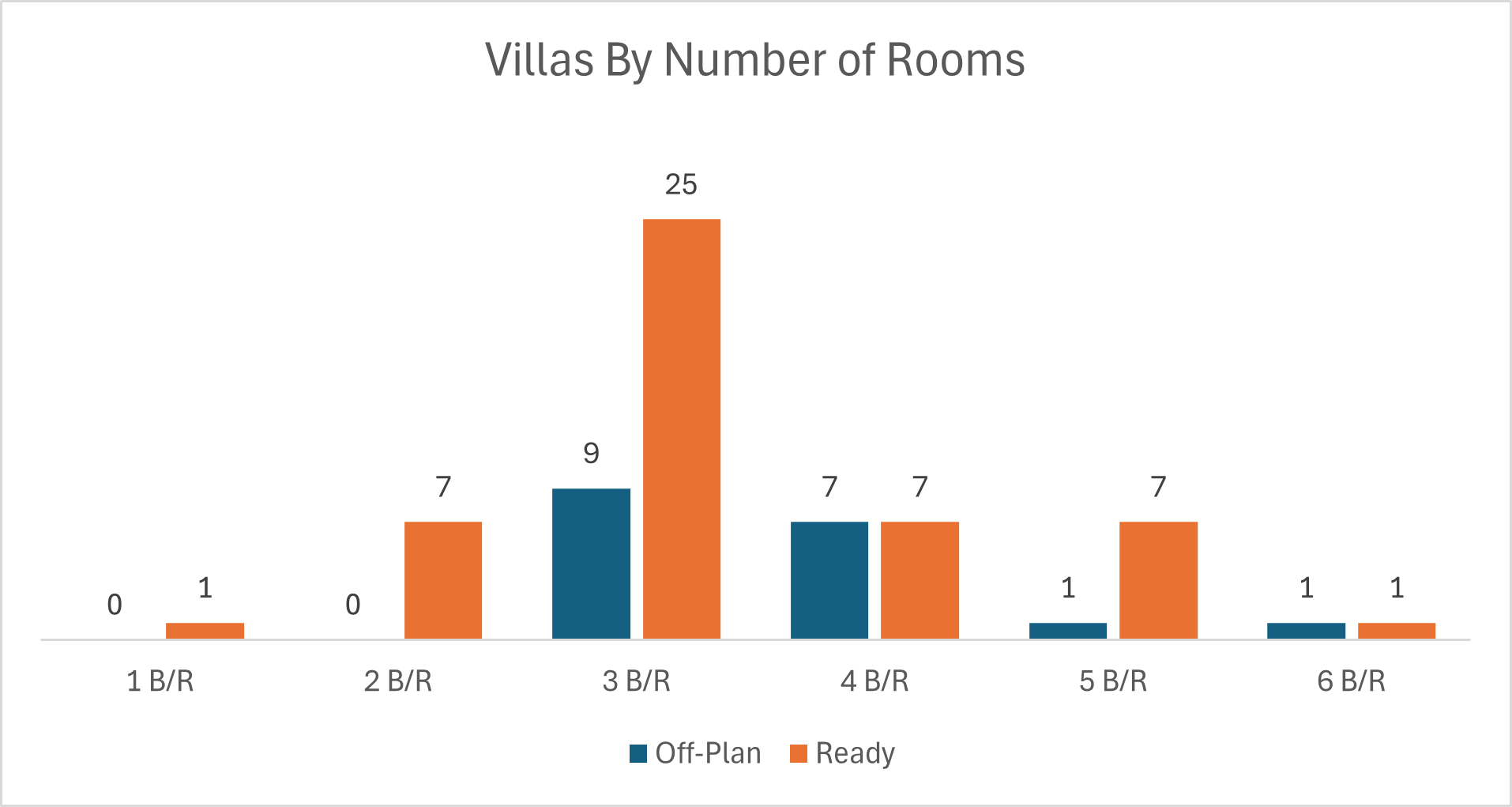

On The Micro Level

Market Insights & Outlook

Off-plan momentum continues to set the tone, powered by flat-led launches, while the secondary market’s commercial strength signals end-user and investor confidence in income-producing assets. Expect near-term stability with selective upside where new inventory aligns with affordability and location.

Data Source: Dubai Land Department