A New Chapter in Home Construction

What if new-home construction were nearly as easy as opening a book? That’s the story with BOXABL.

How? By using assembly lines to condense homebuilding from 7+ months to hours, BOXABL ships readymade houses to their final destination. Then, they’re unfolded and immediately livable.

They’ve already built 700+. But the real transformation’s still coming.

BOXABL’s currently preparing for Phase 2 – combining modules into larger townhomes, single-family homes, and apartments. And until 6/24, you can join as an investor for just $0.80/share.

They already fully maxed out a $75M investment campaign once, so don’t wait around.

*This is a paid advertisement for Boxabl’s Regulation A offering. Please read the offering circular at https://invest.boxabl.com/#circular

Injaz Real Estate Trustee and Dubai Land Department have added remote Ejari registration to AQARI, enabling fully online lease registration via WhatsApp. This digital update eliminates in-person visits, boosts efficiency, and aligns with Dubai’s smart city vision by offering secure, government-linked real estate services globally.

Read the full article on Zawya

Dubai real estate transaction value up almost 40 per cent in May as off-plan sales dominate.

Read the full article on Arabian Business

UAE real estate, especially Dubai post-COVID, continues growing though Fitch predicts up to a 15% price drop in late 2025. Some experts disagree. Development changes’ impact on the market is discussed with Haider Tuaima of ValuStrat and reporter Fareed Rahman.

Listen to the podcast on The National

From January 1 to May 31, 2025, Dubai’s property transaction value hit AED 272.41 billion across 74,221 deals. May saw peak sales: AED 6.306 billion in one day (AED 4.818 billion ready, AED 1.488 billion off-plan). Strong demand is driven by international interest, luxury developments, and Dubai’s investment appeal.

Read the full article on The News

Dubai leads Middle East real estate tokenisation, with DLD projecting transactions to reach Dh60 billion by 2033. Nisus Finance and Xchain (Toyow) signed a MoU to tokenise $500 million in assets via an STO on Toyow, enabling fractional ownership and trading through TTN tokens.

Read the full article on Khaleej Times

Fitch warns Dubai’s residential property surge (up 60% since 2021) may face a “natural” correction of up to 15% over 18 months as new supply (2025–2026) outpaces demand. Rental growth is cooling, but no crash is expected, prices will remain above pre-pandemic levels.

Read the full article on TradingView

Filipino Homes founder Anthony Leuterio becomes licensed Dubai broker, enabling platform to facilitate Dubai property transactions. Philippine brokers can market Dubai listings, and Dubai brokers can list via FHI Global Properties, expanding opportunities for OFWs. The company organizes ARES 2025 summit in Bangkok with 30 developers and 1,000 professionals.

Read the full article on MSN

Dubai villa and townhouse sellers are renovating older properties as prices have surged 92% since May 2022 to Dh6.68 m, driven by strong demand and limited supply. May sales reached Dh54 billion (+11%). Asteco forecasts 14,600 villa handovers by end-2025, further boosting renovations and investor confidence.

Read the full article on Khaleej Times

Buyers continue to view Dubai as a destination for capital appreciation and long-term investment, driven by the city’s growth, new businesses, tourism appeal, and residential attraction.

Read the full article on Arabian Business

Dubai sees repeat foreign investors from Asia, Europe, and the US re-entering market after 40–50% gains. Tourist‐to‐resident conversions drive population to 3.9 m. Real estate transactions reached ~Dh2 trillion over three years, with April 2025 sales hitting Dh62 b despite a global downturn.

Read the full article on Khaleej Times

Watch the Video on CNBC YouTube

Dubai’s residential real estate is stabilizing after a 60% price surge (2022–2025); January 2025 saw a 0.57% price dip. February 2025 transactions rose 32% by volume and 37% by value. Mid‐market housing demand grows while off‐plan deals spike 38% in volume. Fitch warns of a 15% correction amid booming supply.

Read the full article on The National

Dubai’s residential market saw AED 54.4 billion in May 2025 over 17,475 deals (+39% YoY). Off-plan comprised 60.2%, secondary 39.8%. JVC led with 1,800 transactions (AED 1.07 m avg); Palm Jumeirah and Downtown drove luxury sales. Stable pricing, sub-4% mortgages, and a 3.95 m population supported continued demand.

Read the full article on Zawya

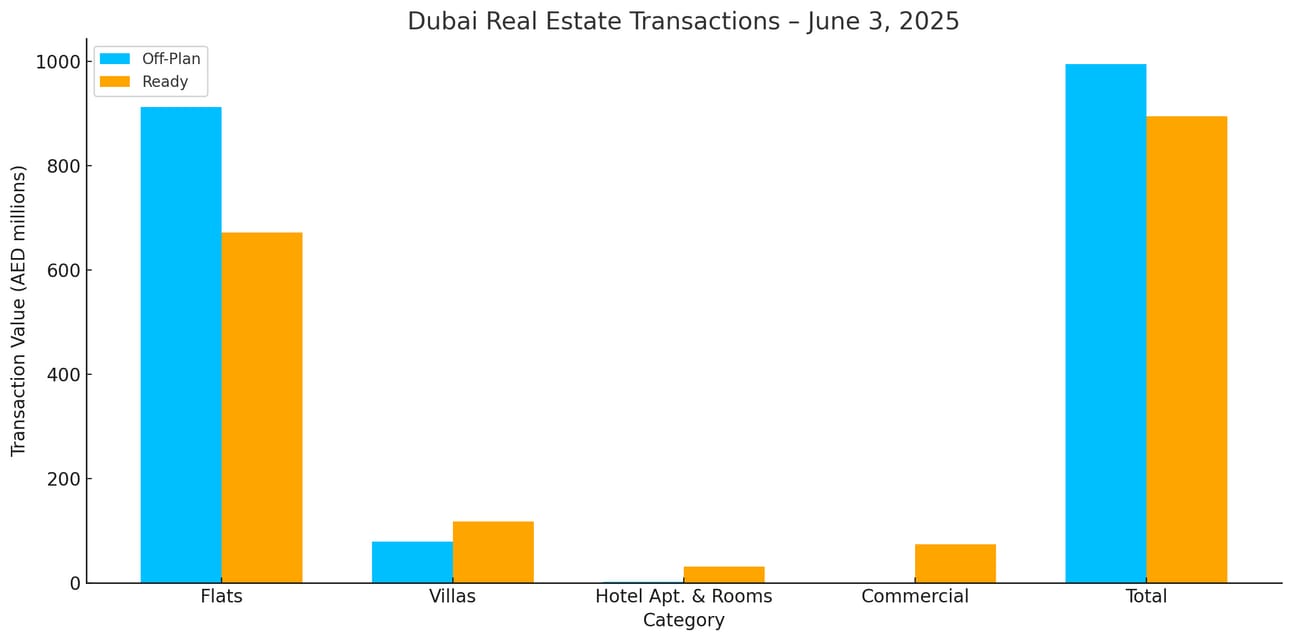

Dubai Real Estate Transactions as Reported on the 3rd of June 2025

On June 3, 2025, Dubai’s total property transaction value reached AED 1.889 billion. Off-plan deals accounted for AED 994.6 million (52.7% of the day’s volume), while ready properties contributed AED 894.8 million (47.3%). This near-balanced split underscores robust activity in both segments.

Property Type | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 913.0 | 671.9 |

Villas | 79.5 | 117.6 |

Hotel Apartments & Rooms | 2.1 | 31.4 |

Commercial | 0.0 | 73.9 |

Total | 994.6 | 894.8 |

Off-Plan Market Performance

Flats: AED 913.0 million (91.8% of off-plan)

Villas: AED 79.5 million (8.0% of off-plan)

Hotel Apartments & Rooms: AED 2.1 million (0.2% of off-plan)

Commercial: AED 0.0 million (0.0% of off-plan)

Flats overwhelmingly dominate the off-plan segment, accounting for nearly 92% of off-plan sales, reflecting continued investor confidence in apartment projects. Villas make up only 8%, signaling modest uptake for under-construction standalone homes. There was virtually no off-plan commercial activity on this date, and hotel apartments recorded minimal transactions.

Ready Market Performance

Flats: AED 671.9 million (75.1% of ready)

Villas: AED 117.6 million (13.1% of ready)

Hotel Apartments & Rooms: AED 31.4 million (3.5% of ready)

Commercial: AED 73.9 million (8.3% of ready)

Within the ready segment, flats again lead, comprising three-quarters of ready sales, driven by strong end-user demand in established communities. Villas capture 13.1%, indicating sustained interest in move-in-ready homes. Ready commercial properties account for 8.3%, showing steady investor appetite for completed retail and office space. Hotel apartments and rooms represent a smaller 3.5%, reflecting limited but present interest in hospitality-linked assets.

On The Micro Level

Market Insights & Outlook

Apartment-Centric Activity: Both off-plan and ready markets are heavily skewed toward flats (91.8% and 75.1%, respectively). This suggests that mid- to high-rise residential projects remain the primary driver of daily volumes.

Villa Market Niche: Villas amount to just 8.0% off-plan and 13.1% ready, indicating that larger, standalone homes continue to attract a smaller, but stable, buyer base.

Commercial and Hospitality Trends: The absence of off-plan commercial deals on June 3, coupled with an 8.3% share for ready commercial, points to a cooling of new commercial launches. Meanwhile, the 3.5% hotel apartment share in ready stock suggests select investor interest in short-stay assets.

Balanced Supply and Demand: The nearly even split between off-plan (52.7%) and ready (47.3%) activity highlights a healthy market balance. Developers are keeping pace with end-user demand for completed units, while investors remain confident in buying under construction.

Overall, June 3’s data reflects a market where apartments continue to rule in both under-construction and turnkey segments. As Dubai’s real estate cycle matures, homebuyers and investors can expect sustained depth across flats, with villas and commercial assets playing smaller, complementary roles.

Data Source: Dubai Land Department