Emaar and DWTC launched Terra Gardens at Expo City Dubai, the next phase of Expo Living. The 451,295 m² masterplan has five communities totaling 3,555 homes; Terra Gardens adds 560 units near Expo Mall, with parks, jogging tracks and sports/wellness amenities for a connected, sustainable community.

Read the full article on Zawya

Dubai real estate hit AED559.4bn YTD in 2025, already surpassing 2024’s record. October logged 19,875 deals worth AED59.4bn: apartments led (16,238; AED31bn), villa volumes fell 36.8%, land sales rose 23.9% (AED11bn), commercial volumes +61.7% (AED1.9bn). Average price hit AED1,692/sq ft; first sales dominated (AED38.7bn).

Read the full article on Economy Middle East

Refine has announced a new Dubai real estate pipeline worth more than AED18bn ($4.9bn), featuring more than 3,000 residential units across eight projects and a landmark commercial development in Business Bay.

Read the full article on Arabian Business

Reddit’s Top Stocks Beat the S&P by 40%

Buffett-era investing was all about company performance. The new era is about investor behavior.

Sure, you can still make good returns investing in solid businesses over 10-20 years.

But in the meantime, you might miss out on 224.29% gainers like Robinhood (the #6 most-mentioned stock on Reddit over the past 6 months).

Reddit's top 15 stocks gained 60% in six months. The S&P 500? 18.7%.

AltIndex's AI processes 100,000s of Reddit comments and factors them into its stock ratings.

We've teamed up with AltIndex to get our readers free access to their app for a limited time.

The market constantly signals which stocks might pop off next. Will you look in the right places this time?

Past performance does not guarantee future results. Investing involves risk including possible loss of principal.

LEOS launches a AED5bn+ master community in Wadi Al Safa 5 with Dubai Holding: 800+ wellness-focused homes amid 16,000 trees and lagoons. First phase, Regent’s Park, offers 3–7BR townhouses/villas from AED1,600/sq ft with 5% down, plus smart, sustainable amenities near Dubai Outlet Mall.

Read the full article on Zawya

OMNIYAT marks 20 years with an anniversary campaign culminating Jan 2026. Founder Mahdi Amjad reflects on shaping Dubai through icons like The Opus, One at Palm Jumeirah and The Lana. 2025 milestones include $900m sukuks and $10m+ segment leadership. Next: Marasi Bay and AVA at Palm Jumeirah (handover Q2 2026).

Read the full article on Gulf News

Industry reports say dynamic pricing can lift developers’ revenue 15–30% and profit 10–20%, yet UAE developers largely haven’t adopted it. Startup DPrice launches in the Gulf, offering AI-driven pricing to maximize sales amid record UAE transactions, arguing real-time, predictive pricing beats fixed increments and slow, target-based strategies.

Read the full article on Khaleej Times

Sticking with the same home insurance could cost you

Home insurance costs are rising fast, up nearly 40% nationwide in just the past few years. With premiums changing constantly, sticking with the same provider could mean overpaying by hundreds of dollars. Shopping around and comparing multiple insurers can help lock in better rates without losing the protection your home needs. Check out Money’s home insurance tool to shop around and see if you can save.

Report says Abu Dhabi’s Yas Island “Disney-model” and RAK’s $5.1bn Wynn “Macau-model” create dual growth engines. Dubai, positioned between them, should capture both family and luxury gaming demand, offering the most balanced, resilient investment versus higher-growth RAK and longer-horizon Abu Dhabi.

Read the full article on OpenPR

H-1B costs and lottery uncertainty are pushing global talent toward the UAE. Golden/Green visas, tax-free incomes, and high quality of life attract professionals, boosting Dubai real-estate demand. Firms like NOVVI help newcomers, turning the “Dubai dream” into a stable, investable alternative.

Read the full article on Zawya

Dar Global says its GDV has topped $19bn, driven by expansion in Saudi and a GCC pipeline exceeding $19bn. With Saudi’s property market opening to expatriates in Jan 2026, the Dubai-based developer positions itself to channel global capital into the kingdom’s next growth phase.

Read the full article on Share Cast

Coinvesting Capital (DFSA-regulated, DIFC) launched the COINVESTING BREAD REAL ESTATE FUND with a parallel Luxembourg SCSp, touted as the first DIFC–Luxembourg regulated route into UAE real estate. Backed by Bread Capital directors, it targets institutional capital with governance aligned to international standards.

Read the full article on FinTech Magazine

The best HR advice comes from those in the trenches. That’s what this is: real-world HR insights delivered in a newsletter from Hebba Youssef, a Chief People Officer who’s been there. Practical, real strategies with a dash of humor. Because HR shouldn’t be thankless—and you shouldn’t be alone in it.

Skyloov, a UAE proptech portal, reports rapid year-one traction: 17m property seekers, 25m visits, 511m views, hundreds of thousands of verified leads, 1,300+ agents and 130k active listings. It launched Silvia, an AI voice search assistant, advancing a transparent, data-driven ecosystem for searching, listing, and closing real-estate transactions.

Read the full article on Gulf News

Al Marwan unveiled “District 11,” the UAE’s first AI-designed smart work resort in Sharjah, 3.5m sq ft across 11 buildings, a 368-unit hotel and ~3,000 parking spaces on E311. AI powers dynamic pricing, predictive maintenance and energy optimisation to spur investment and economic diversification.

Read the full article on Gulf News

Dubai Real Estate Transactions as Reported on the 3rd of November 2025

On 03-Nov-2025, the total transacted value reached AED 2,655,480,786. Off-plan dominated with AED 1,712,062,013 (64.5%), while Ready accounted for AED 943,418,773 (35.5%).

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 1,430.2 | 660.5 |

Villas | 125.0 | 144.0 |

Hotel Apt. & Rooms | 2.5 | 67.8 |

Commercial | 154.3 | 71.0 |

Total | 1,712.1 | 943.4 |

Off-Plan Market Performance

Total Value: AED 1,712,062,013

Flats: AED 1,430,202,746 (83.5%)

Villas: AED 125,006,357 (7.3%)

Hotel Apts & Rooms: AED 2,540,135 (0.1%)

Commercial: AED 154,312,775 (9.0%)

Off-plan activity was overwhelmingly led by flats, with meaningful support from commercial deals; villas were steady and hospitality negligible.

Ready Market Performance

Total Value: AED 943,418,773

Flats: AED 660,512,562 (70.0%)

Villas: AED 144,029,650 (15.3%)

Hotel Apts & Rooms: AED 67,841,766 (7.2%)

Commercial: AED 71,034,794 (7.5%)

Ready transactions were flat driven, with balanced contributions from commercial and hospitality alongside villas.

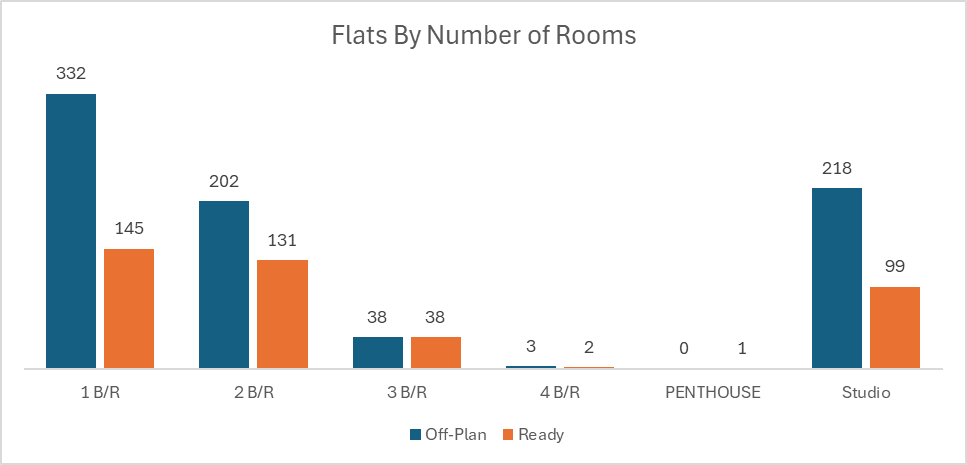

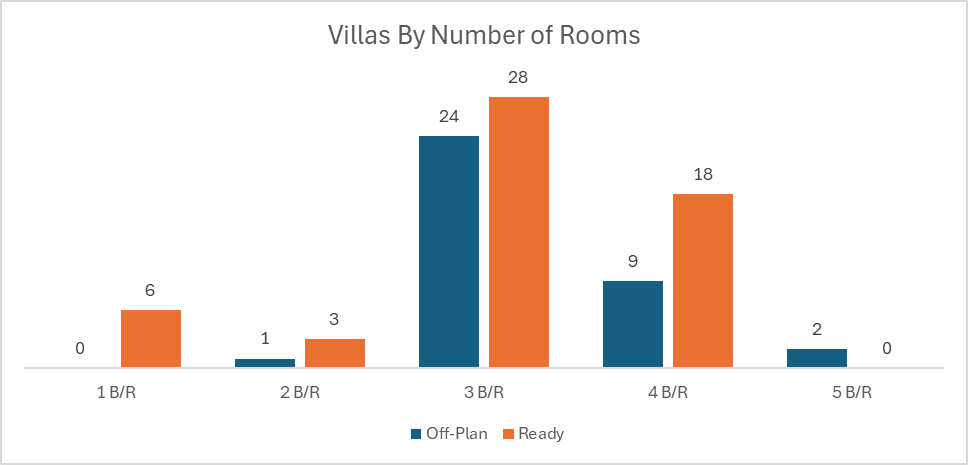

On The Micro Level

Market Insights & Outlook

A strong flat-led day on both off-plan and ready sides underscores depth in apartment demand, while commercial volumes remain supportive. Barring one-off launches, expect apartments to continue anchoring daily turnover with villas providing secondary lift.

Data Source: Dubai Land Department