Keep This Stock Ticker on Your Watchlist

They’re a private company, but Pacaso just reserved the Nasdaq ticker “$PCSO.”

No surprise the same firms that backed Uber, eBay, and Venmo already invested in Pacaso. What is unique is Pacaso is giving the same opportunity to everyday investors. And 10,000+ people have already joined them.

Created a former Zillow exec who sold his first venture for $120M, Pacaso brings co-ownership to the $1.3T vacation home industry.

They’ve generated $1B+ worth of luxury home transactions across 2,000+ owners. That’s good for more than $110M in gross profit since inception, including 41% YoY growth last year alone.

And you can join them today for just $2.90/share. But don’t wait too long. Invest in Pacaso before the opportunity ends September 18.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

Saudi Arabia’s office market is undergoing rapid expansion, marked by exceptionally tight supply and strong rental growth in Riyadh and Jeddah, according to JLL’s KSA Office Market Dynamics report for Q2 2025.

Read the full article on Arabian Business

Dubai Islands (ex-Palm Deira) is surging. May 2025 sales near AED 3.5bn amid Dubai’s record Q2 2025 AED 151.8bn (+46% YoY). With strong connectivity and DHG’s AED 260m launch, it’s positioned for sustainable, long-term value under Dubai’s 2040 Master Plan.

Read the full article on Zawya

Dubai logged AED 40.45bn in August sales, 22% below July but 6% higher YoY. Apartments led (89% volume, 71% value); prices averaged AED1.9m (DLD) to AED2.6m (A&A), with sub-AED1m deals up 25% MoM. Rentals surged (+43% value, +48% transactions). Population hit 4m, sustaining demand.

Read the full article on Allsopp & Allsopp

Built for Managers, Not Engineers

AI isn’t just for developers. The AI Report gives business leaders daily, practical insights you can apply to ops, sales, marketing, and strategy.

No tech jargon. No wasted time. Just actionable tools to help you lead smarter.

Start where it counts.

Knight Frank will lead sales for SHA Residences Emirates Island at Al Jurf, the world’s first longevity-focused private island by Imkan. The 2027-delivery project offers apartments and villas with access to SHA health services; prices AED 9m–130m. Between Dubai and Abu Dhabi, it targets wellness tourism.

Read the full article on Zawya

Dubai approved 2,971 Emirati homes in 2025, allocating over Dh2bn via the Zayed Housing Programme. H1 delivered Dh1.725bn support to 3,027 beneficiaries. Backed by Real Estate Strategy 2033, targeting Dh1tn transactions, +70% activity, Dh73bn GDP impact, housing remains a national priority for stability, transparency and AI-enabled quality.

Read the full article on The National

The Hillgate by Ellington launches in Dubai Silicon Oasis, a design-led, wellness-focused community spanning studios to four-bed homes with rich amenities. On the future Blue Line, it joins the First-Time Home Buyer Programme (cap AED 5m). Completion Q4 2027, targeting livability, connectivity, and long-term value.

Read the full article on Zawya

Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

Aldar has announced the launch of 450 townhomes exclusively for UAE nationals at the family-oriented Al Deem community, located northeast of Yas Island in Abu Dhabi.

Read the full article on Arabian Business

Saudi plans the 2 km Rise Tower in Riyadh and has resumed the >1 km Jeddah Tower (target 2028); Dubai’s Burj Azizi (725 m, possibly taller) targets 2027–28. Together, these projects aim to eclipse Burj Khalifa and spur investment with record-breaking mixed-use skyscrapers.

Read the full article on Gulf News

Buyers from South Korea, South Africa, Australia and Canada helped drive demand for apartments, which accounted for nearly nine in ten property transactions last month.

Read the full article on Arabian Business

Dubai tops Savills’ 2025 Executive Nomad Index for a third year, with Abu Dhabi second. Dubai leads on flight connectivity; Abu Dhabi on internet speed. Top five unchanged (Malaga, Miami, Lisbon). The 30-city index targets remote workers; new entrants include Auckland, Tokyo, Crete, Vancouver and Berlin.

Read the full article on Zawya

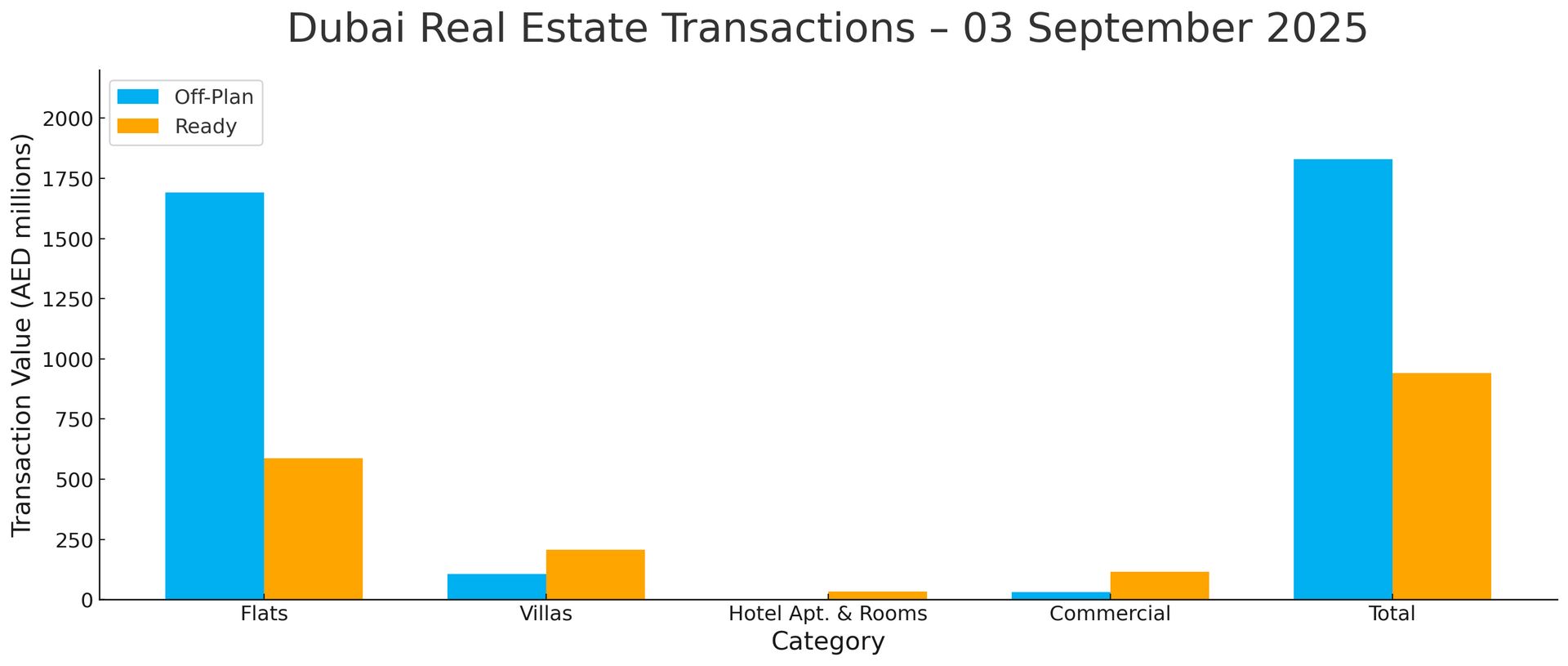

Dubai Real Estate Transactions as Reported on the 3rd of September 2025

On the 3rd of September 2025, the total transacted value reached AED 2,769,972,851. Off-plan dominated with AED 1,829,290,309 (66.04%), while Ready accounted for AED 940,682,541 (33.96%).

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 1,692.24 | 586.37 |

Villas | 104.89 | 205.78 |

Hotel Apt. & Rooms | 0.99 | 33.94 |

Commercial | 31.17 | 114.60 |

Total | 1,829.29 | 940.68 |

Off-Plan Market Performance

Total Value: AED 1,829,290,309

Flats: AED 1,692,242,196 (92.51%)

Villas: AED 104,886,762 (5.73%)

Hotel Apts & Rooms: AED 988,623 (0.05%)

Commercial: AED 31,172,728 (1.70%)

Off-plan activity was overwhelmingly flat-led, with villas a distant second and minimal commercial/hospitality volumes.

Ready Market Performance

Total Value: AED 940,682,541

Flats: AED 586,369,381 (62.33%)

Villas: AED 205,776,857 (21.88%)

Hotel Apts & Rooms: AED 33,938,872 (3.61%)

Commercial: AED 114,597,431 (12.18%)

Ready sales were broad-based but still flat-centric, supported by solid villa trading and meaningful commercial deals.

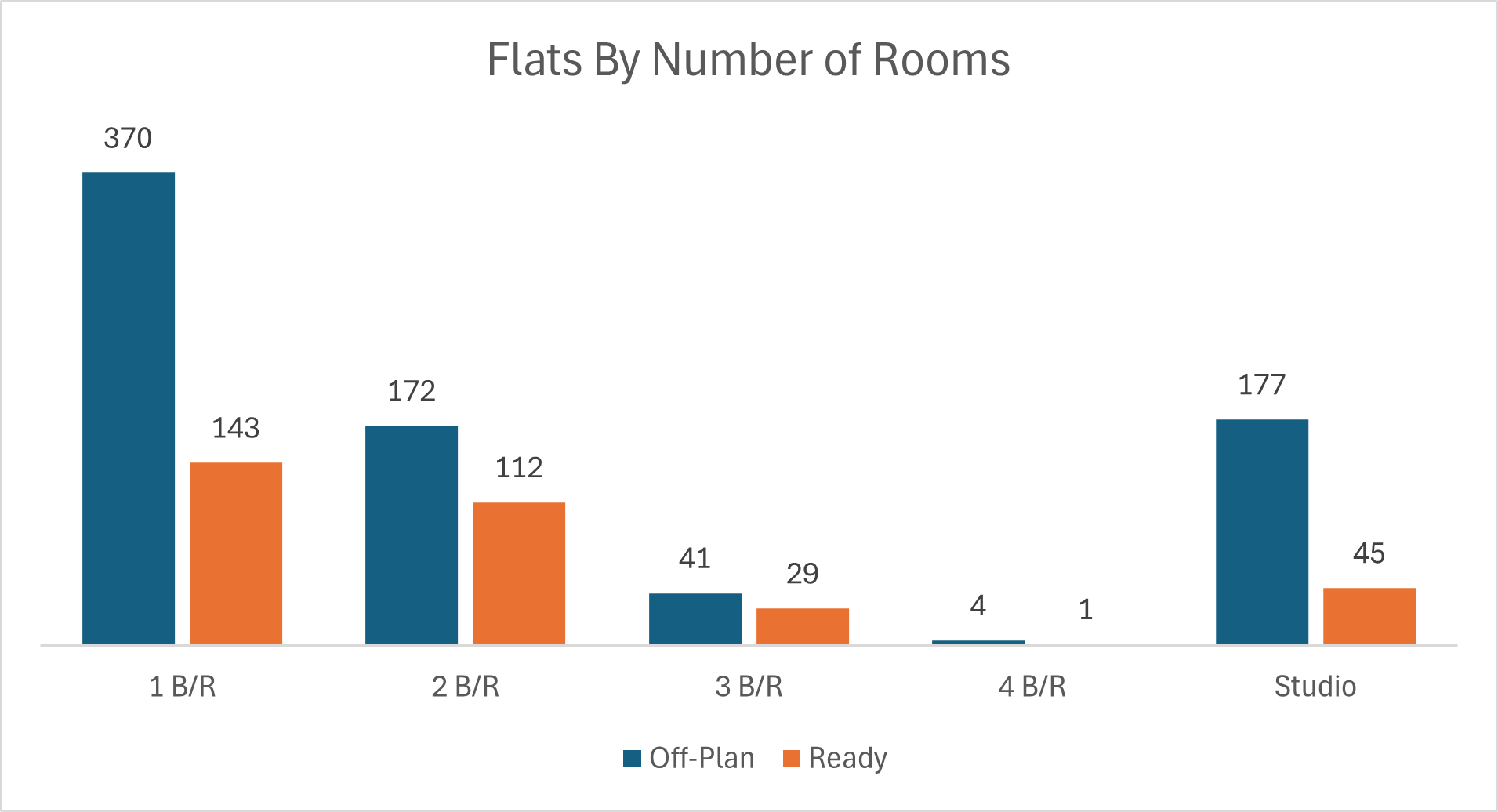

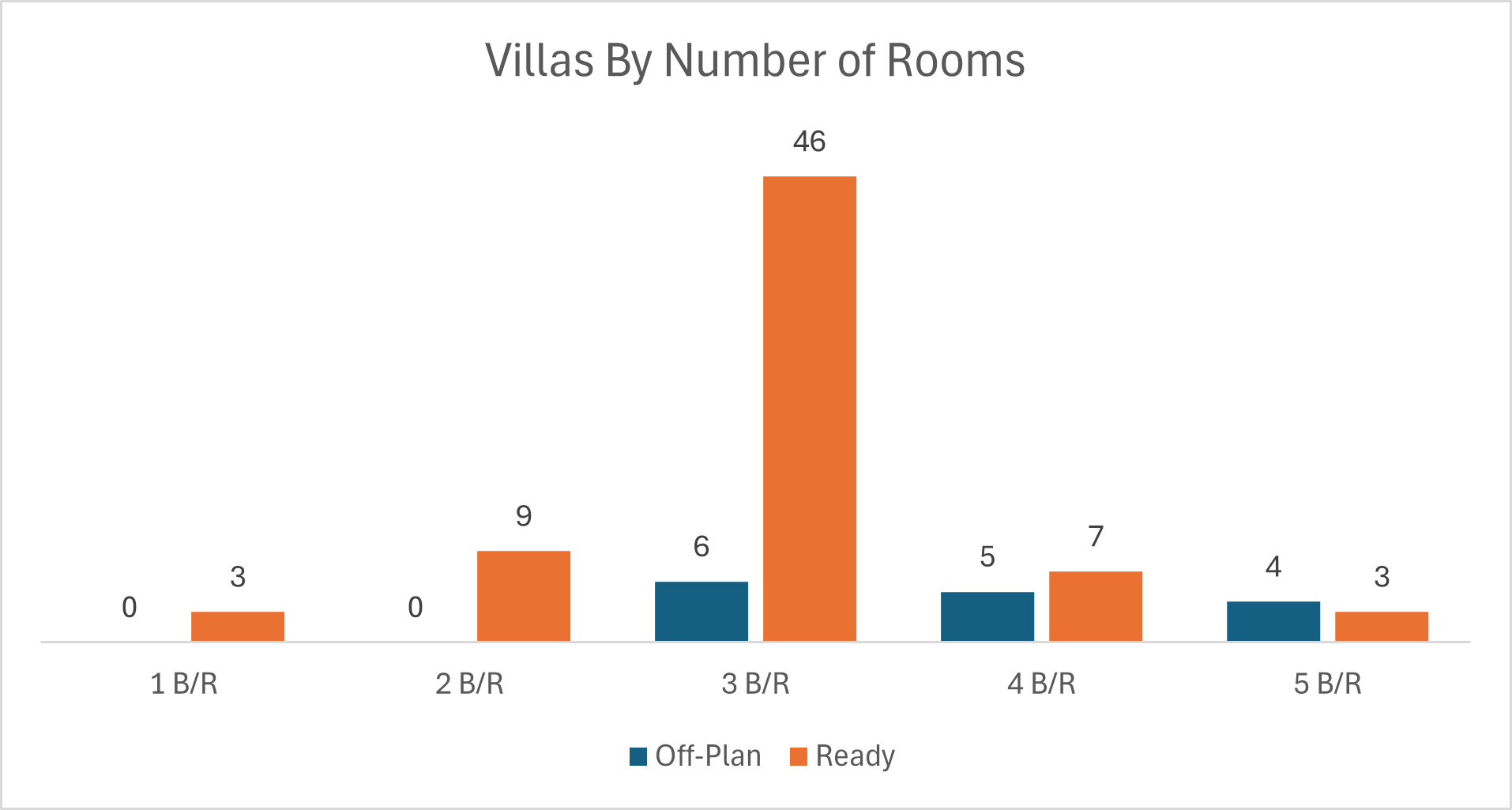

On The Micro Level

Market Insights & Outlook

With two-thirds of value in off-plan, demand skews toward new launches and longer-term investment horizons, while the ready segment reflects steady end-user and rental-driven appetite. Expect momentum to track upcoming project releases, financing conditions, and affordability tiers, particularly mid-market flats.

Data Source: Dubai Land Department