IREX 2026 Dubai runs 7–8 February at Anantara Downtown, bringing real estate, Golden Visa and immigration-by-investment firms from 10+ countries. It highlights the US EB-5 program ($800k minimum, 10 jobs), plus panels and global residency/citizenship options for affluent investors.

Read the full article on Gulf News

Dubai and Abu Dhabi enter 2026 with strong momentum after record 2025 sales (Dubai: 270k+ deals worth AED917bn; Abu Dhabi: AED164bn+). Property Finder highlights shifts from renting to buying, rising demand for larger/premium homes, apartments dominating volumes, villas leading price growth, studios strong for yields, and sustained interest in established and select off-plan communities.

Read the full article on Economy Middle East

Springfield reports Dubai’s residential market hit AED55.18bn across 15,756 January 2026 sales (+43.9% value, +19.1% volume YoY). Off-plan dominated (71.27%, AED39.33bn/11,229 deals). Prices were broadly stable (AED1,924/sqft), with most demand in AED1–3m homes.

Read the full article on Zawya

World Realty Congress 2025 wrapped up in Dubai with awards honoring leadership in customer experience, asset/facilities management, sustainability, community engagement and people-first practices. Key winners included Dubai Residential (double Gold), Asteco, Colliers, LOAMS, Wadan Developments, Ejadah, and Acube/Adara Star. Over 260 entries from 90+ organisations were judged by a 40-member international jury.

Read the full article on Albawaba

Dubai’s first-time homebuyer scheme is billed as a boost for affordability, but early details suggest the headline incentives offer little new for borrowers navigating the emirate’s mortgage market.

Read the full article on Arabian Gulf Business Insight

Dubai’s population growth is boosting housing demand, especially in established communities, even as supply concerns persist. Analysts expect studio and one-bedroom prices/rents to soften in JVC/JVT, Dubai South, MBR City, Business Bay and Dubailand Residence Complex. With 400k+ units planned for 2026–2030, oversupply risk is seen as segment-specific.

Read the full article on Construction Week Online

SHG is expanding its Myriad student-living brand across the UAE and Saudi Arabia. Myriad Dubai houses 2,300 students; Myriad Muscat (AED400m) houses 2,700. In Saudi, it targets 3,000–4,000-room sites near universities, citing 100,000+ bed demand. Longer-term expansion: Africa, Malaysia, and Europe.

Read the full article on Zawya

First phase of Dubai Loop project with Musk's Boring Company to start immediately, UAE official says

Dubai will launch Phase 1 of the “Dubai Loop,” a 24km underground high-speed transport network to be built by Elon Musk’s Boring Company. Phase 1 covers 6km, funded by AED600m as part of a ~AED2.5bn total cost, and is targeted for completion within two years.

Read the full article on Zawya

Dubai has unveiled a long-term roadmap to significantly expand green and blue infrastructure across the emirate, with projects valued at more than AED4bn ($1.09bn), as part of a strategy to enhance quality of life, urban sustainability and climate resilience by 2030.

Read the full article on Arabian Business

Abu Dhabi’s DMT launched a study to redevelop Mussafah to strengthen it as an industrial and investment hub. Phase one targets waterfront revitalisation with green spaces and upgraded public facilities, plus roadworks (E30 and Street 8). DMT also stepped up inspections to improve compliance, cleanliness, and reduce overoccupancy.

Read the full article on Zawya

Aldar has announced the award of AED66bn ($18bn) in development contracts during 2025, spanning a wide portfolio of residential, commercial, infrastructure and logistics projects across the UAE.

Read the full article on Arabian Business

The UAE is forecast to lead regional economic performance in 2026, with real GDP growth projected at around 5.6 per cent, as global growth diverges and capital allocation enters a new phase, according to a new outlook from First Abu Dhabi Bank.

Read the full article on Arabian Business

Savills says Abu Dhabi had its strongest residential year in 2025: 20,000+ transactions (+58% YoY), with Q4 a record 7,500+. Apartments were 67% of deals; villas/townhouses surged in Q4. Off-plan drove 70% of activity (80% in Q4). Prices rose 15% to AED17,145/sqm, with 700+ AED10m+ deals.

Read the full article on Zawya

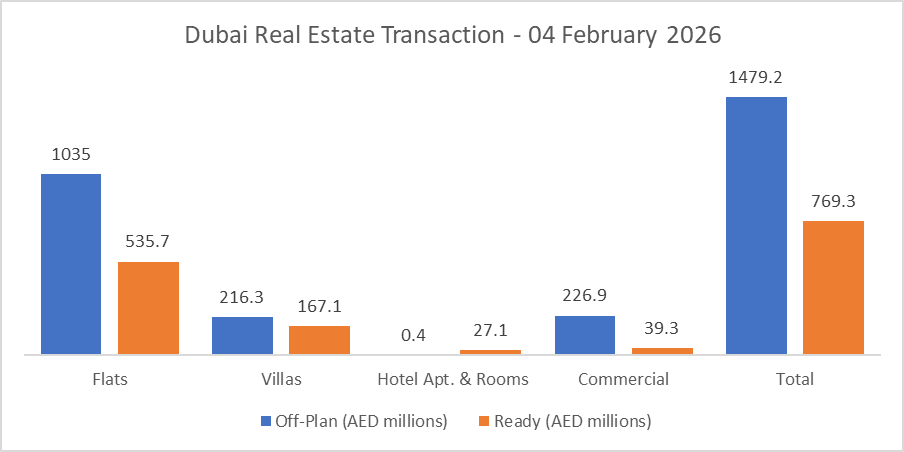

Dubai Real Estate Transactions as Reported on the 4th of February 2026

On the 04-Feb-2026, the total transacted value reached AED2,248,454,139. Off-plan dominated with AED1,479,193,110 (65.8%), while Ready accounted for AED769,261,029 (34.2%).

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 1035.0 | 535.7 |

Villas | 216.3 | 167.1 |

Hotel Apt. & Rooms | 0.4 | 27.1 |

Commercial | 226.9 | 39.3 |

Total | 1479.2 | 769.3 |

Off-Plan Market Performance

Total Value: AED 1.48B

Flats: AED 1.04B (70.0%)

Villas: AED 216.3M (14.6%)

Hotel Apts & Rooms: AED 0.4M (0.0%)

Commercial: AED 226.9M (15.3%)

Off-plan activity was overwhelmingly flat-led, with commercial and villas sharing most of the remaining value.

Ready Market Performance

Total Value: AED 769.3M

Flats: AED 535.7M (69.6%)

Villas: AED 167.1M (21.7%)

Hotel Apt. & Rooms: AED 27.1M (3.5%)

Commercial: AED 39.3M (5.1%)

Ready transactions also skewed strongly toward flats, while villas provided a meaningful second pillar of demand.

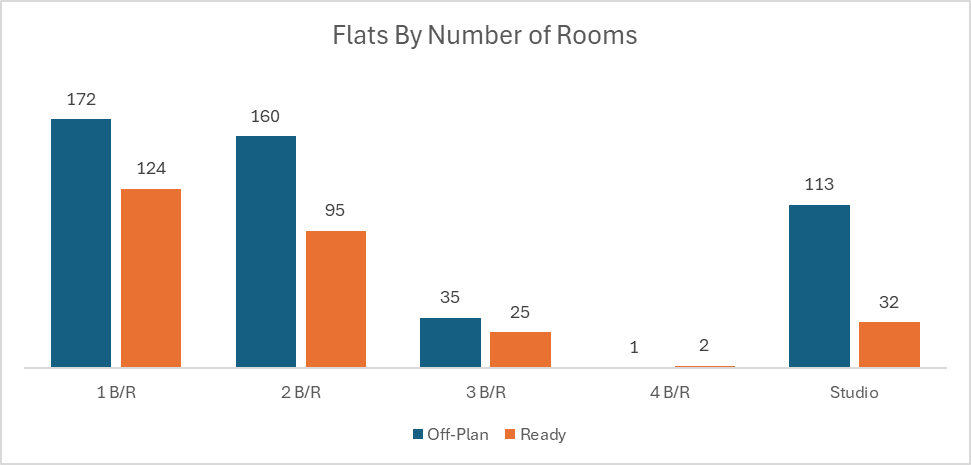

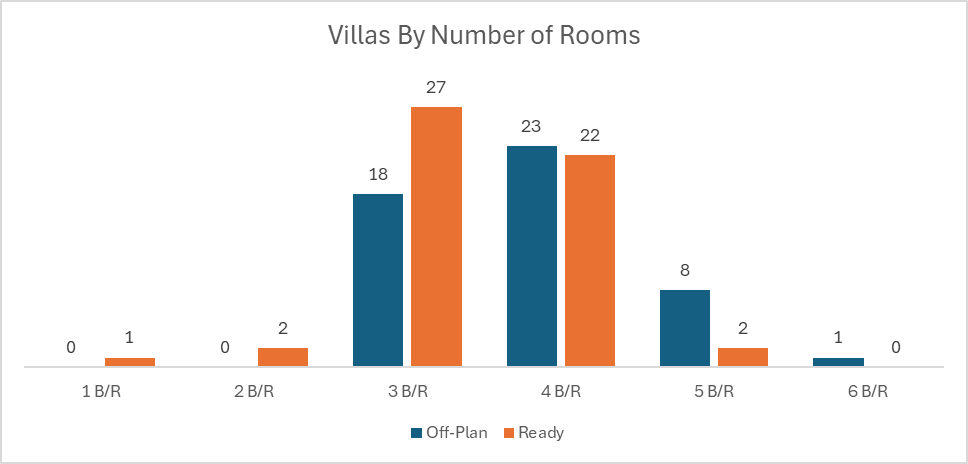

On The Micro Level

Market Insights & Outlook

The day’s market was tilted toward off-plan (nearly two-thirds of total value), signalling continued buyer preference for new supply and developer-led offerings. Across both segments, flats were the clear engine of turnover, while the ready villa share stood out as the strongest non-flat contributor, consistent with end-user appetite for space when available at the right price.

Data Source: Dubai Land Department