Looking for unbiased, fact-based news? Join 1440 today.

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

Dubai property stayed active in Aug 2025. Demand is strongest for apartments, especially studios/1-beds. Off-plan surges in Business Bay, Dubai Investment Park, and Dubai South. Resales boom in Wadi Al Safa 4 and Al Barsha South Fourth. Luxury focus: Downtown, Palm Jumeirah, and Dubai Marina.

Read the full article on Gulf News

2025 Power List names 100 GCC developers reshaping the region, from UAE megaprojects to Saudi giga-cities and mixed-use builds. Rankings weigh project value/pipeline, new awards, expansion, ESG/CSR, innovation, and market influence, honoring companies driving resilient, sustainable urban futures.

Read the full article on Construction Week Online

Dubai Aug 2025, 18,564 sales worth AED 50.7bn (+15% volume, +7% value YoY). Off-plan led (+25% volume, +11% value); primary 12,106 deals (91% off-plan). Standouts, Business Bay, Dubai Investment Park; secondary surges in Wadi Al Safa 4, Al Barsha South Fourth. Apartments, especially studios/1-beds, dominate demand.

Read the full article on Zawya

Dubai Holding Asset Management is unifying 40+ malls and lifestyle sites under “Dubai Retail” after integrating Nakheel and Meydan, creating a retail giant with 6,500 retailers across 13m sq ft. Nakheel Mall becomes Palm Jumeirah Mall; new openings include Nad Al Sheba Mall and upcoming Al Khail Avenue.

Read the full article on Gulf News

ANAX launches V-Suites in Business Bay, executive residences from AED 1.6M, handover Q4 2026. Designed by Venetian Enrico with Italian finishes, smart homes, Burj views. 19 floors plus “V Club” co-working, wellness and leisure. Prime access; 30/20/50 payment plan targeting investors and professionals.

Read the full article on Zawya

Built for Managers, Not Engineers

AI isn’t just for developers. The AI Report gives business leaders daily, practical insights you can apply to ops, sales, marketing, and strategy.

No tech jargon. No wasted time. Just actionable tools to help you lead smarter.

Start where it counts.

Zimaya launched Belle Vie in Dubai Silicon Oasis, its third project in a year, with 50%+ reserved on day one. The low-rise offers studios to four-beds with spacious, end-user layouts and amenities, near the upcoming Blue Line station. Zimaya plans further projects in Dubai Islands and Arjan.

Read the full article on Gulf News

UAE MoF’s Ministerial Decision 173/2025 (effective Jan 1, 2025) allows 4% tax depreciation on investment properties held at fair value, on original cost, pro-rata, if firms irrevocably elect the realisation basis on time. Miss the election, lose the deduction. Applies to group/restructuring transfers and may create deferred tax.

Read the full article on Zawya

Amirah Developments’ Dubai Islands residence delivers 31% energy and 24.37% water savings, targeting LEED v3 NC and EHS-Trakhees compliance. With efficient HVAC, smart lighting, low-flow fixtures and reflective roofs, it aligns with UAE Net Zero 2050, prioritizing wellness (fresh-air, low-VOC, non-smoking) and green mobility.

Read the full article on Gulf News

DAMAC launched Capri One at Riverside Views in August; it sold out at the 27 Aug launch. A multi-channel push (OOH, digital, PR, events, CRM) targeted first-time buyers/young couples, stressing affordable luxury, wellness amenities, and proximity to Expo/Al Maktoum. Payment plans start from AED 2,499/month.

Read the full article on Campaign Middle East

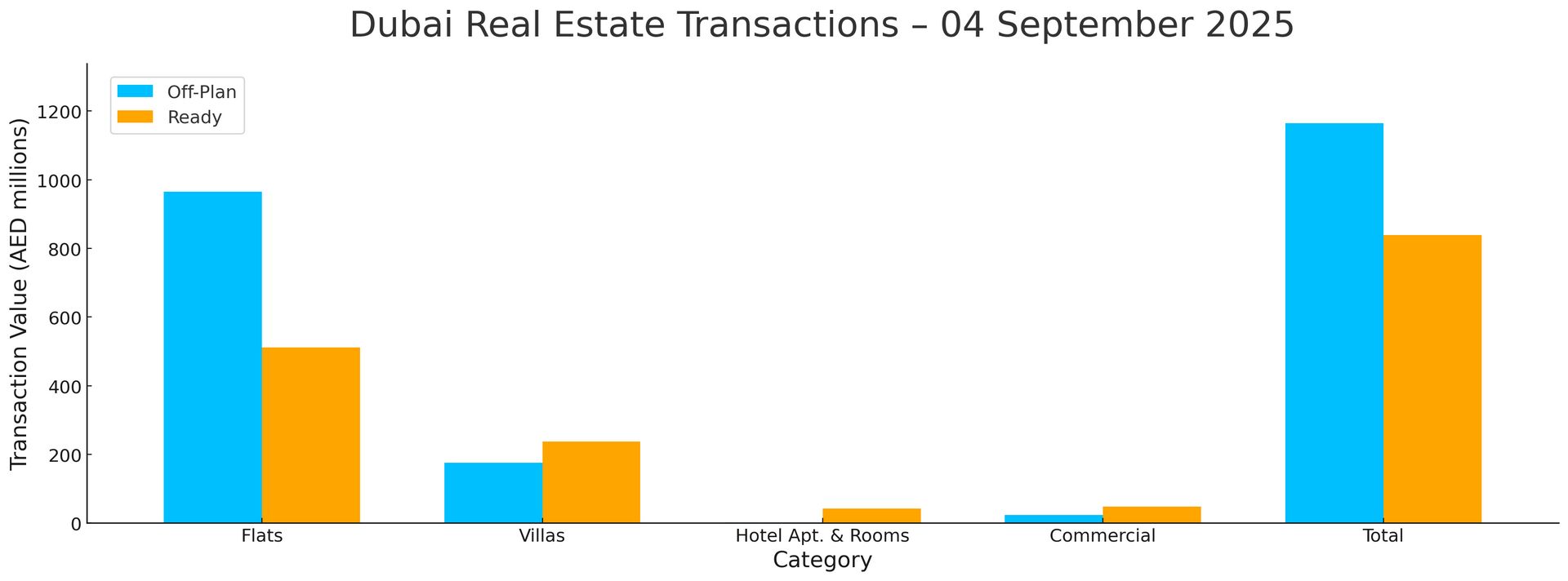

Dubai Real Estate Transactions as Reported on the 4th of September 2025

On the 4th of September, the total transacted value reached AED 2 billion. Off-plan dominated with AED 1.2 billion (58.1%), while Ready accounted for AED 838 million (41.9%).

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 965.2 | 511.9 |

Villas | 174.9 | 236.8 |

Hotel Apt. & Rooms | 1.0 | 41.6 |

Commercial | 23.1 | 47.6 |

Total | 1,164.2 | 837.9 |

Off-Plan Market Performance

Total Value: AED 1,164,161,219

Flats: AED 965,174,018 (82.9% of off-plan)

Villas: AED 174,879,550 (15.0% of off-plan)

Hotel Apts & Rooms: AED 1,026,850 (0.1% of off-plan)

Commercial: AED 23,080,801 (2.0% of off-plan)

Off-plan activity was led decisively by flats, with villas a meaningful secondary driver; commercial and hospitality segments were marginal.

Ready Market Performance

Total Value: AED 837,886,072

Flats: AED 511,857,869 (61.1% of ready)

Villas: AED 236,844,483 (28.3% of ready)

Hotel Apts & Rooms: AED 41,564,477 (5.0% of ready)

Commercial: AED 47,619,243 (5.7% of ready)

Ready sales were anchored by apartments, while villas delivered strong support; hospitality and commercial made up modest shares.

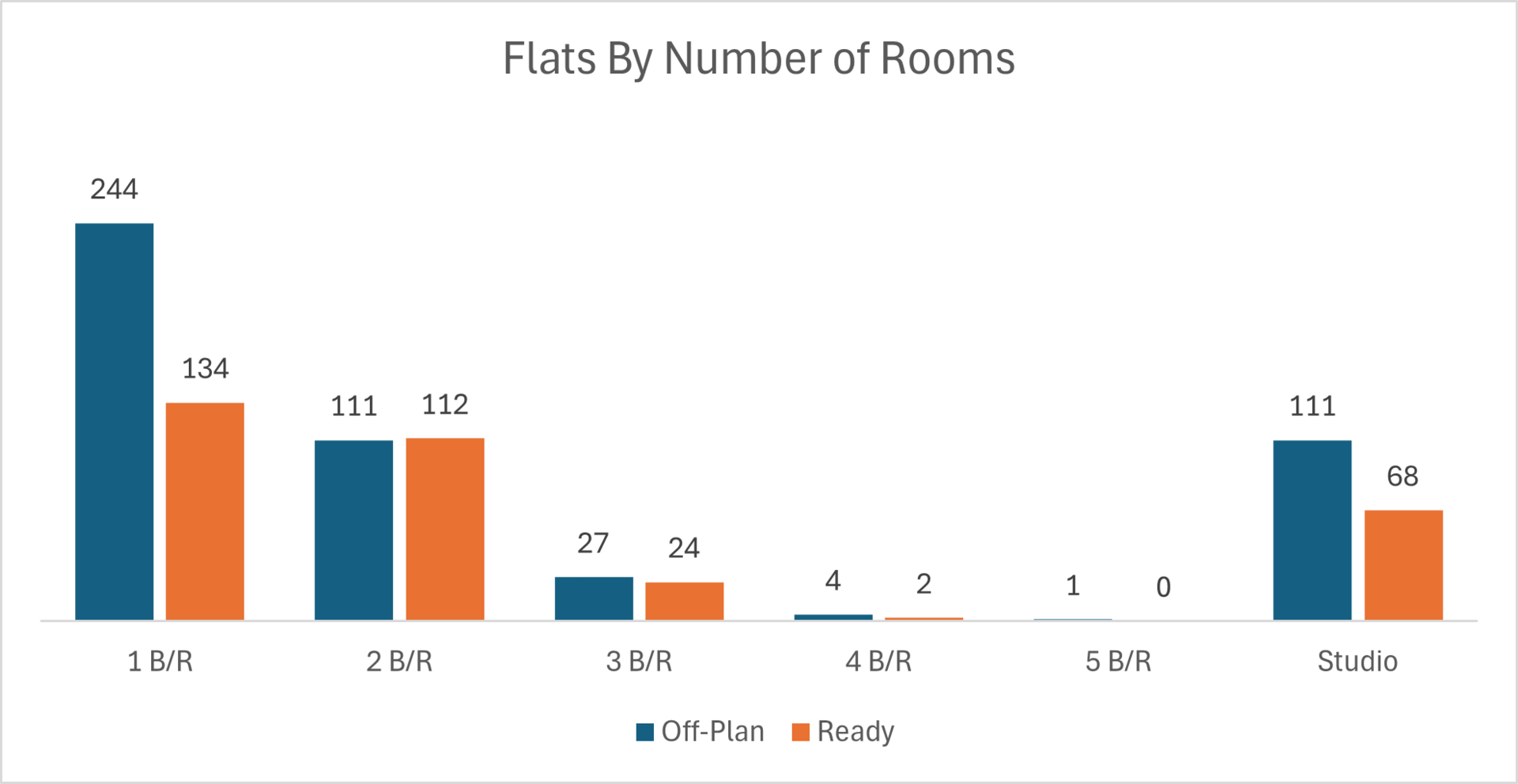

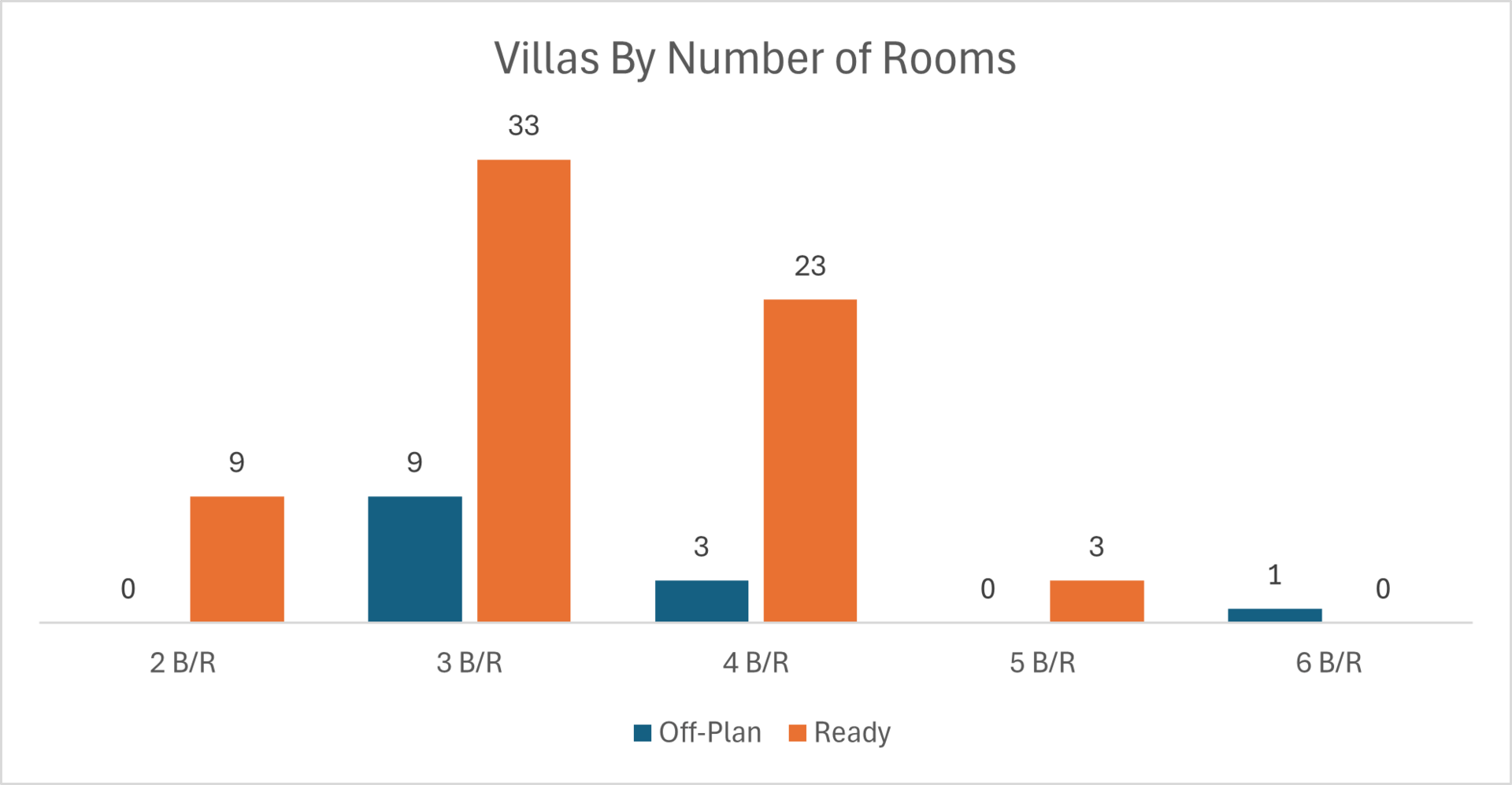

On The Micro Level

Market Insights & Outlook

Momentum remains broad-based with apartments setting the pace across both segments. Villas continue to provide depth—especially in the ready market—while commercial and hospitality play smaller roles. With off-plan leading over 58% of value, near-term sentiment favors new launches, while end-user demand sustains stability in the ready segment.

Data Source: Dubai Land Department