JLL says MEA will see a $3tn real estate/infrastructure pipeline (2026–2030), with the UAE central: $795bn projected cashflows, including $470bn for real estate (over $300bn in Dubai). Tight office vacancies and a “flight to quality” support rents, logistics investment, and retrofitting/repurposing.

Read the full article on Gulf Business

Dubai’s freehold home prices rose 19.8% YoY in Q4 2025 (ValuStrat), showing slower growth; the index was up 4.3% QoQ. Villas outperformed apartments (25.1% vs 14.2% YoY). Prime also grew but moderated. A record 131,234 units are forecast for 2026; Q4 saw 13,626 ready sales worth AED36bn.

Read the full article on Economy Middle East

The Dubai off-plan residential market delivered its strongest performance on record in 2025, reinforcing its position as the primary engine of the emirate’s real estate growth, according to Betterhomes’ Dubai Residential Real Estate FY 2025 report.

Read the full article on Arabian Business

Arthouse Hills Arjan has entered its official market phase, releasing pricing, unit mix and payment plan details after strong soft-launch interest. The AED550m, wellness-focused Arthouse-branded residences in Arjan target end-users and investors, with studios from AED869,888, 1BR from AED1,307,888 and 2BR from AED1,855,888, handover Q4 2028, and extensive lifestyle amenities.

Read the full article on Zawya

A startup operating in Abu Dhabi and Dubai is pitching itself as a new way for individual homebuyers to access the same discounts typically reserved for institutional investors buying in bulk.

Read the full article on Arabian Gulf Business Insight

Dubai Chamber of Digital Economy has signed an agreement with global visual communication platform Canva to establish the company’s regional headquarters in Dubai and support 250,000 small and medium-sized enterprises (SMEs) and individuals in the digital sector over the next five years.

Read the full article on Arabian Business

Knight Frank says Dubai led global $10m+ home sales in Q4 2025: 143 deals worth $2.5bn (+39% QoQ by count). Across 12 markets, 555 super-prime homes sold (+17% QoQ) totaling $10.3bn. Dubai logged 500 such sales in 2025, over 3x London.

Read the full article on Robb Report

JLL expects MEA’s 2026–2030 pipeline to reshape markets: low vacancies + strong absorption should keep rents and prices supported. Capital is shifting toward cross-border flows and alternative financing, helped by regulatory-driven transparency. In the UAE, occupiers plan office expansion but with a quality/efficiency focus, while industrial/logistics benefits from near-full occupancy and infrastructure-led new hubs.

Read the full article on Zawya

Al Ghurair Development broke ground on The Weave in JVC after a first-phase sell-out, signaling construction is underway. Turner & Townsend was appointed project management consultant. The 2028-completion, design-led project (with architect Joe Adsett) offers 130 1–3BR+ homes (700–2,200 sq ft) from AED 1.2m, with rooftop wellness, infinity pool, cinema, and social spaces.

Read the full article on Zawya

Sky View Development has joined Dubai Land Department’s First-Time Home Buyers (FTHB) Initiative, becoming an approved developer offering preferential pricing, discounts, and dedicated inventory to eligible first-time buyers. Residents qualify via a government platform using Emirates ID and receive a QR code to redeem benefits. Sky View’s upcoming Avion 100 will participate.

Read the full article on Khaleej Times

A UAE traffic expert says Dubai can cut congestion by replacing short 2–5km car trips with new high-speed underground links and driverless last-mile feeders around hotspots like Downtown, DIFC and MoE. He argues most traffic is work-related, and combining mass transit with feeder systems, and automation, can improve road efficiency.

Read the full article on Khaleej Times

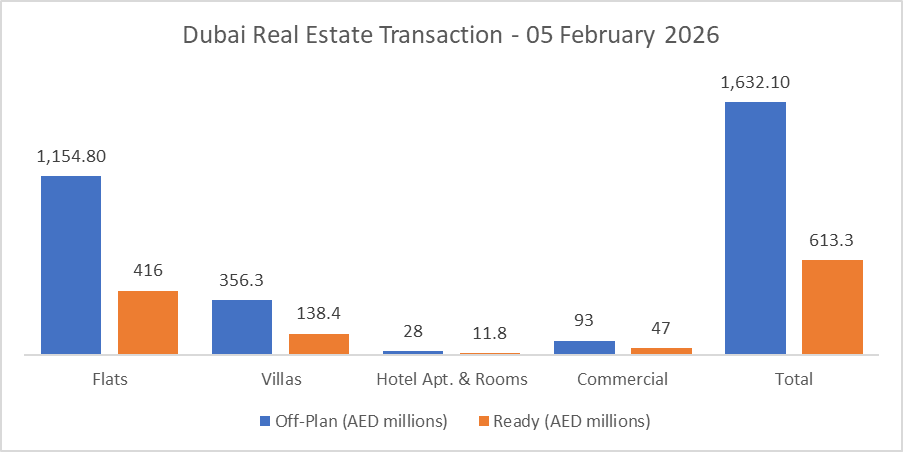

Dubai Real Estate Transactions as Reported on the 5th of February 2026

On the 05-Feb-2026, the total transacted value reached AED 2,245,381,712. Off-plan dominated with AED 1,632,123,761 (72.7%), while Ready accounted for AED 613,257,951 (27.3%).

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 1,154.8 | 416.0 |

Villas | 356.3 | 138.4 |

Hotel Apt. & Rooms | 28.0 | 11.8 |

Commercial | 93.0 | 47.0 |

Total | 1,632.1 | 613.3 |

Off-Plan Market Performance

Total Value: AED 1,632,123,761

Flats: AED 1,154,823,274 (70.8%)

Villas: AED 356,272,236 (21.8%)

Hotel Apts & Rooms: AED 28,006,519 (1.7%)

Commercial: AED 93,021,731 (5.7%)

Off-plan activity was overwhelmingly flat-led, with villas playing a strong secondary role.

Ready Market Performance

Total Value: AED 613,257,951

Flats: AED 416,035,092 (67.8%)

Villas: AED 138,396,721 (22.6%)

Hotel Apts & Rooms: AED 11,802,125 (1.9%)

Commercial: AED 47,024,014 (7.7%)

Ready transactions were also driven by flats, while commercial took a slightly larger share than in off-plan.

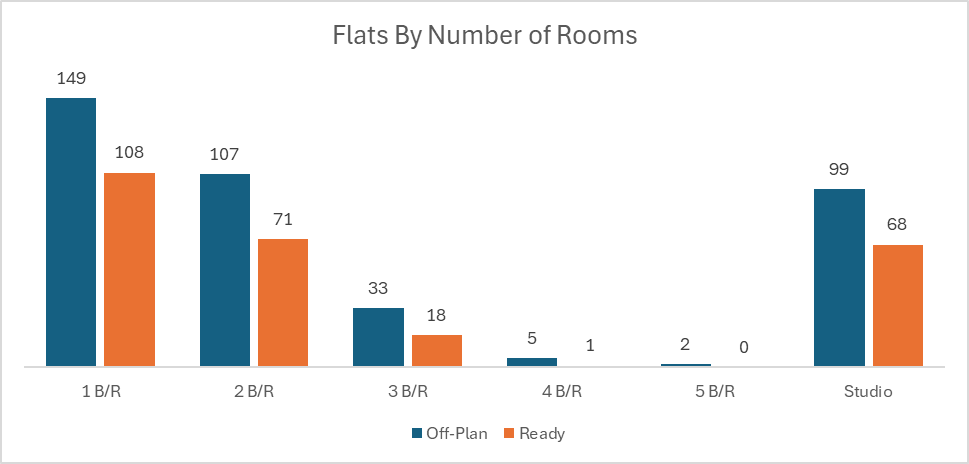

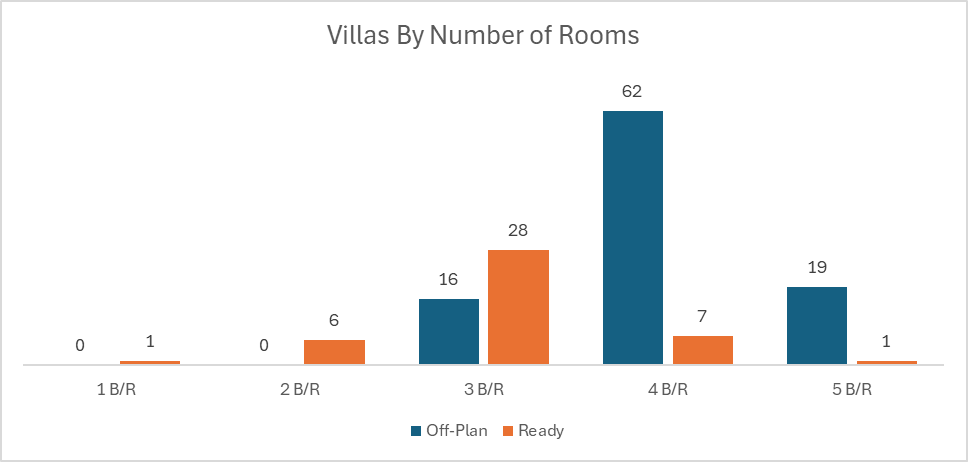

On The Micro Level

Market Insights & Outlook

Today’s market was clearly off-plan-led, contributing nearly three-quarters of total value, with flats dominating both segments. The mix suggests end-user and investor demand remains concentrated in apartment stock, while villas continue to capture a meaningful share, especially off-plan, supporting a barbell dynamic between lifestyle upgrades (villas) and scalable demand (flats).

Data Source: Dubai Land Department