Looking for unbiased, fact-based news? Join 1440 today.

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

Dubai's Land Department and VARA warned against unauthorized promotion of the Real Estate Tokenisation Project, which enables blockchain-based fractional property ownership. The initiative aims to boost innovation, attract global investors, and reach AED 60B in tokenised real estate by 2033.

Read the full article on MSN

Dubai Holding will list 12.5% of its Dubai Residential REIT on the DFM by month’s end, selling 1.63 billion shares. Managing AED 21 billion across 35,700 units, it’s the first 2025 IPO on Dubai’s exchange and the GCC’s largest REIT, despite regional investor scepticism.

Read the full article on Arabian Gulf Business Insight

Samana Developers CEO Imran Farooq has driven 229% annual growth over five years, propelling the firm to the “7th largest developer” in Dubai. He credits the emirate’s global appeal, supply shortages, and rising demand across residential and office markets, while expanding into Grade A offices and a Maldives resort project.

Read the full article on Gulf Business

Discovery Dunes, Discovery Land Company's first Middle Eastern venture, is a 340-residence private community across 26.1 million sq ft in Dubai South’s Golf District. Since its soft launch, prices rose 25% and 60% sold. It features a private golf course and ultra-luxury amenities.

Read the full article on Arabian Business

Dubai’s rapid population surge—3.92 million by March 2025—has outpaced housing supply (only 58% of projected homes delivered), driving a 27% spike in property values, sharp rent hikes, booming off-plan sales, scarce luxury listings, and rising sustainability concerns.

Read the full article on MSN

Capital Investment Holding, Fasset and Zand Bank launched ForteXchain, a blockchain-powered platform enabling fractional real estate investment from $1. It tokenizes properties, streamlines global access and regulatory compliance, with initial assets in Spain, the UAE and Malaysia, and plans for broader institutional and retail participation.

Read the full article on Zawya

As construction progresses, Azizi Developments continues to make strides in delivering a French Mediterranean-inspired waterfront community in MBR City, advancing luxury waterfront living

Read the full article on Arabian Business

April’s real estate transactions reached AED 46.18 billion—a 77.4% year-on-year surge—driven by off-plan launches, regulatory clarity and population growth to 3.93 million. Robust secondary sales and rental activity underscore a maturing, resilient Dubai property market.

Read the full article on Zawya

The Dubai real estate sector recorded AED22.16bn ($6bn) of transactions last week, according to data from the Land Department.

Read the full article on Arabian Business

With US tariff hikes ahead, investors are diverting funds into UAE real estate—AED 761 bn in 2024 sales, 19% rent growth, and 6.7% yields—leveraging its dollar peg, tax-free regime, and Golden Visa to act as a geopolitical “shock absorber” despite mid-tier cyclical risks.

Read the full article on Arabian Gulf Business Insight

RAK Properties has opened sales for Anantara Mina Residences on Hayat Island—84 waterfront apartments and 19 villas with private jetties, beach access, five-star Anantara services, premium amenities, and flexible rental-income options—reinforcing Ras Al Khaimah’s luxury real estate appeal.

Read the full article on Zawya

Dubai Real Estate Transactions as Reported on the 5th of May 2025

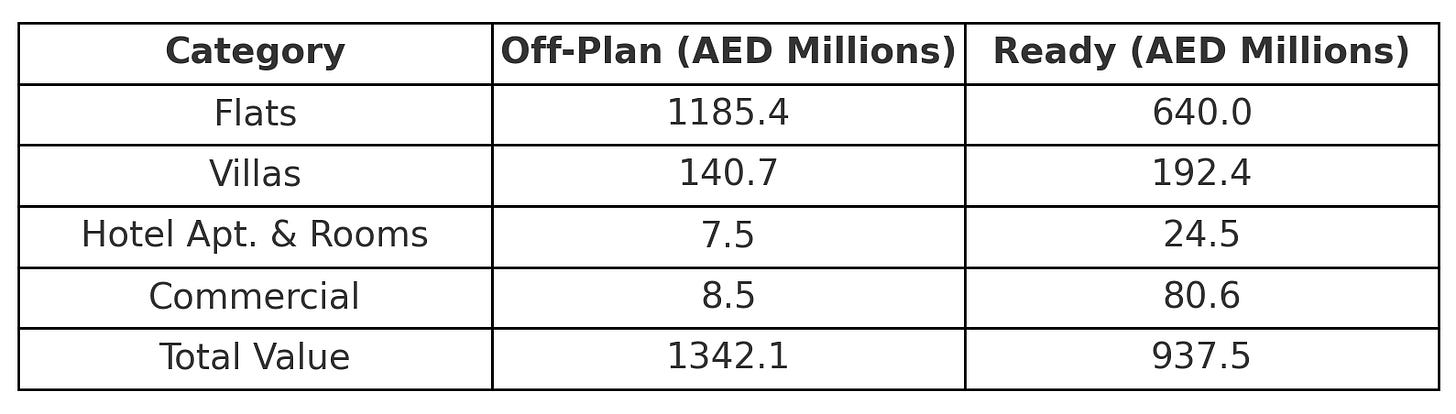

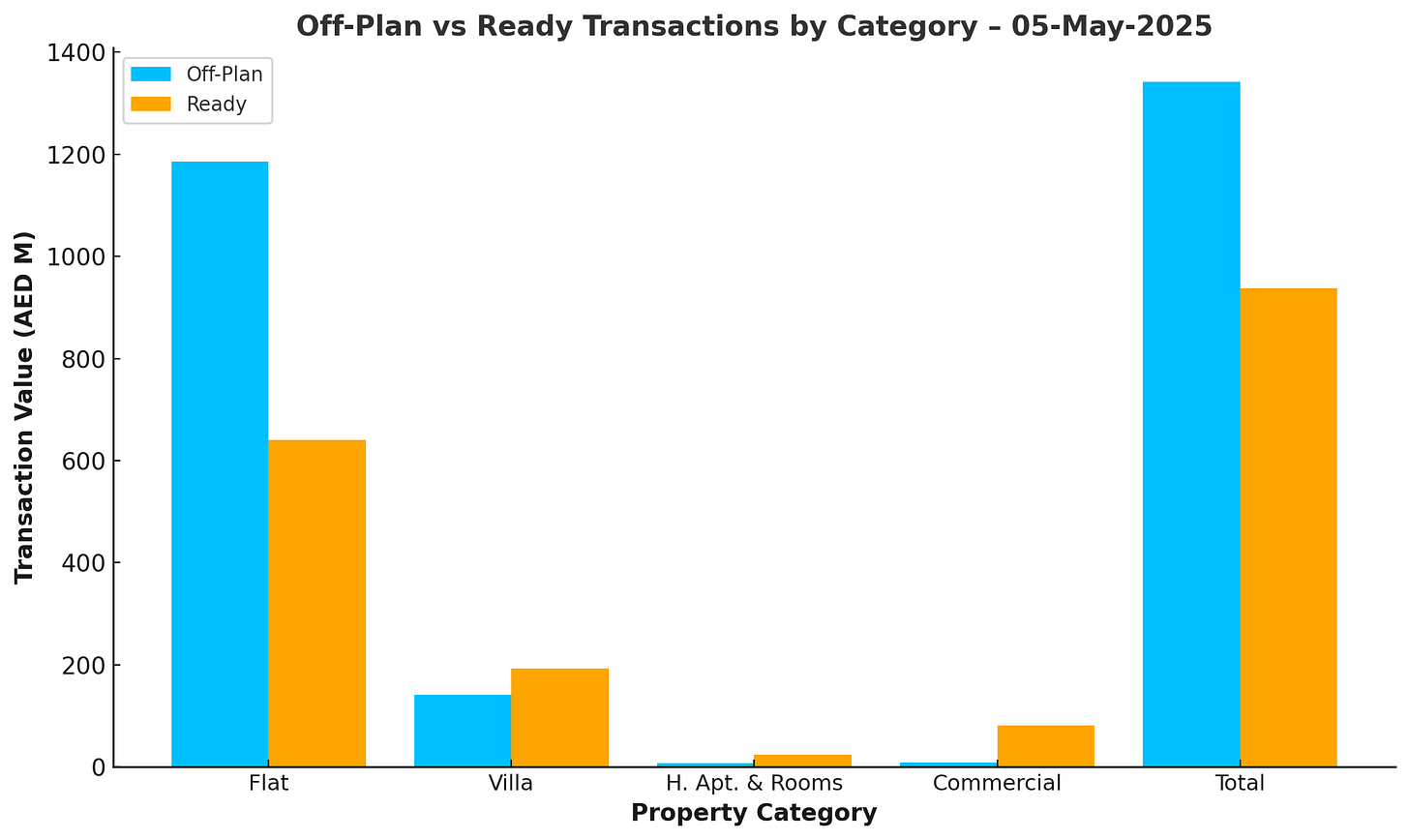

Dubai’s real estate market continues to demonstrate robust performance, with total property transactions reaching AED 2.28 billion on May 6, 2025. The off-plan segment accounted for 58.9% of the total transaction value, while ready properties made up 41.1%. This distribution highlights the continued demand for new developments and investment in off-plan properties, reflecting confidence in Dubai’s long-term growth.

Off-Plan Market Performance

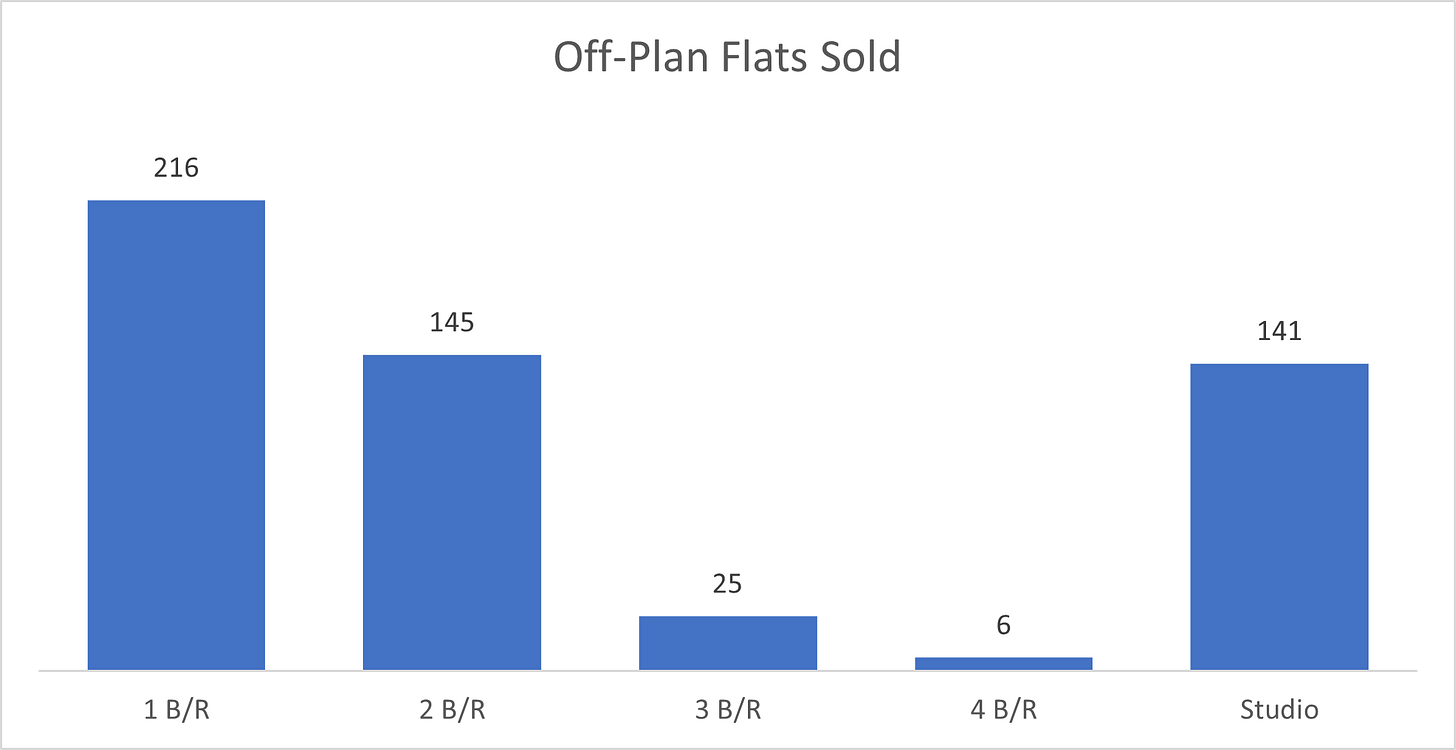

The off-plan segment recorded AED 1.34 billion in total sales, securing the larger share (58.9%) of the day’s transactions. Within this category:

Flats led the market, contributing 88.3% (AED 1,185.4 million) to the off-plan segment.

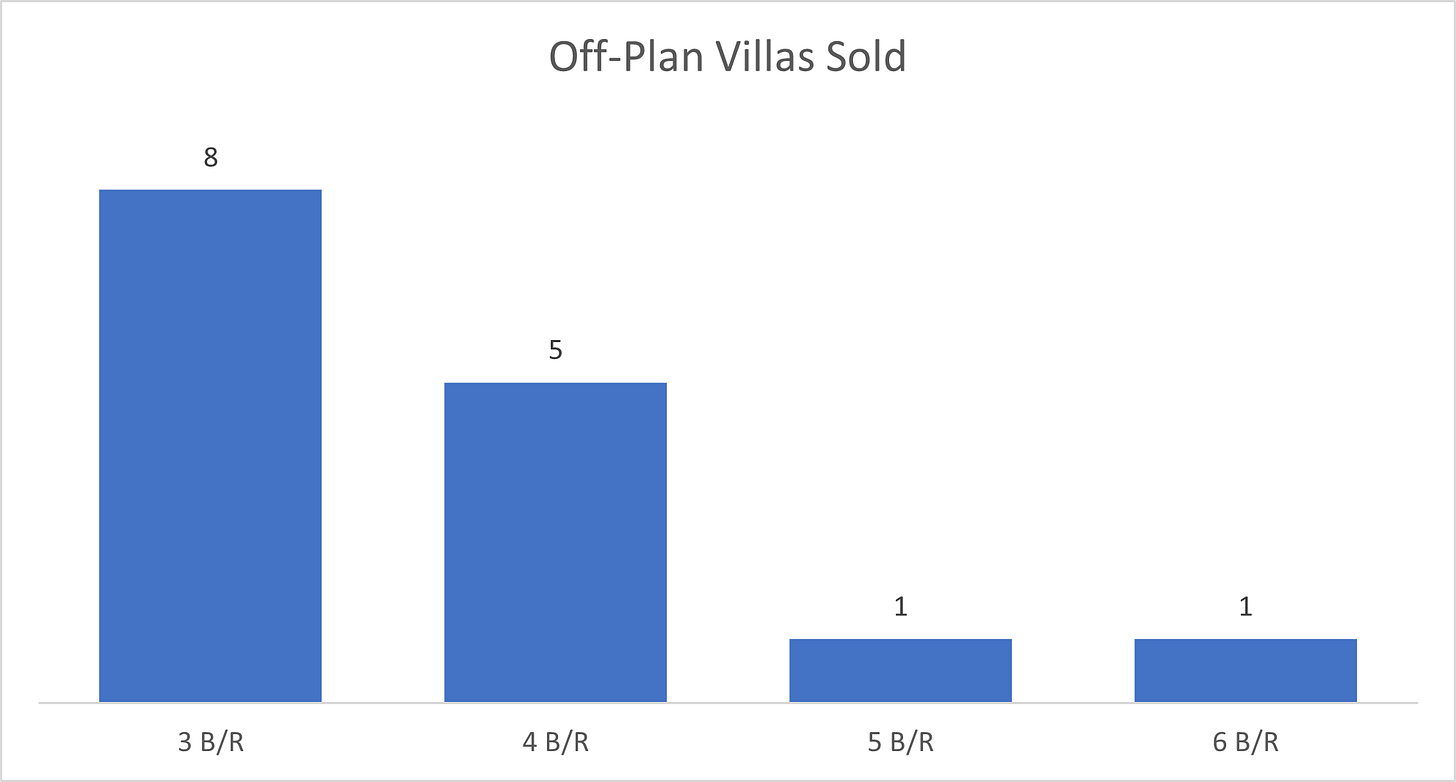

Villas accounted for 10.5% (AED 140.7 million), reflecting sustained interest in family-oriented properties.

Commercial properties contributed 0.6% (AED 8.5 million), indicating steady demand for office and retail spaces.

Hotel apartments & rooms made up 0.6% (AED 7.5 million), a sign of ongoing investment in Dubai’s hospitality sector.

The dominance of off-plan flats suggests that buyers are capitalizing on flexible payment plans and attractive pricing in emerging developments.

Ready Market Performance

The ready property market totaled AED 937.5 million, accounting for 41.1% of overall transactions. Key highlights include:

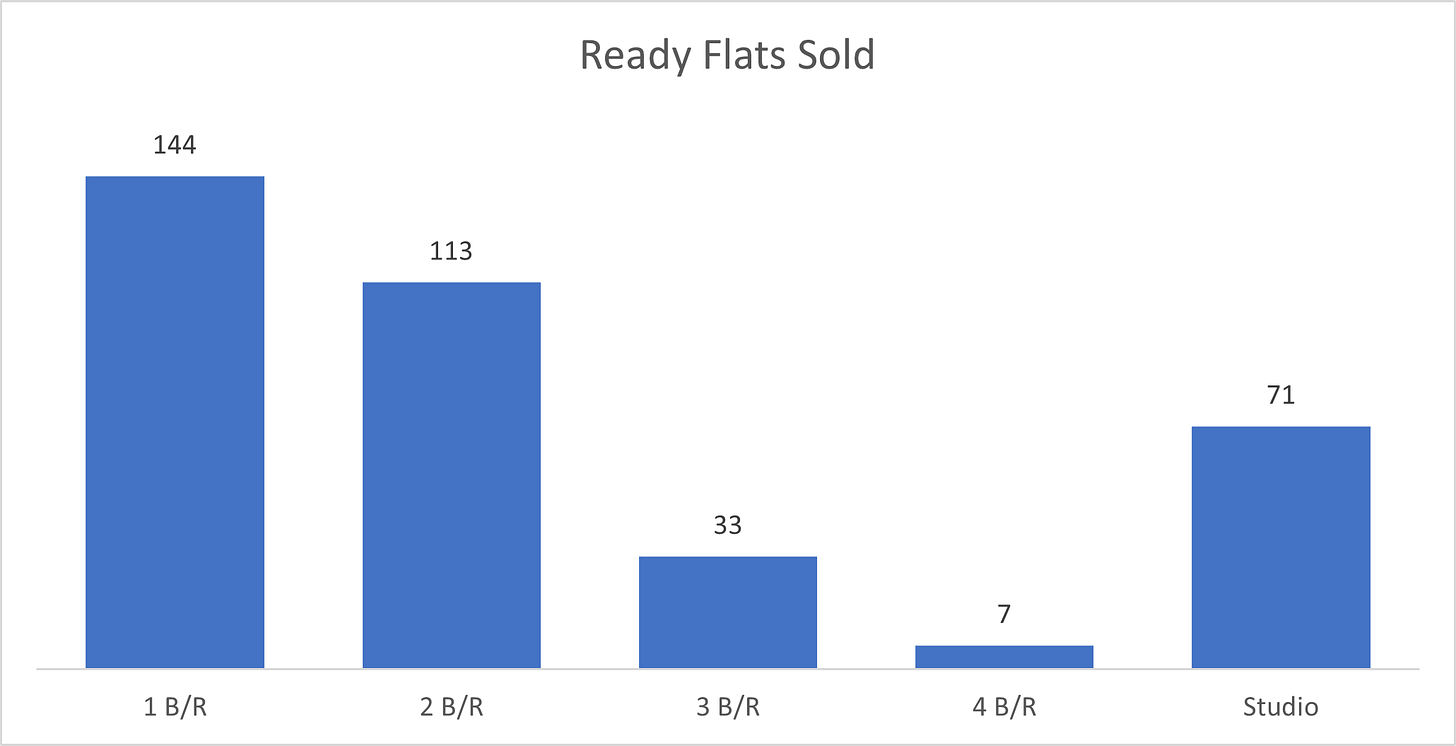

Flats led the segment, making up 68.3% (AED 640.0 million), showing strong demand for immediate occupancy.

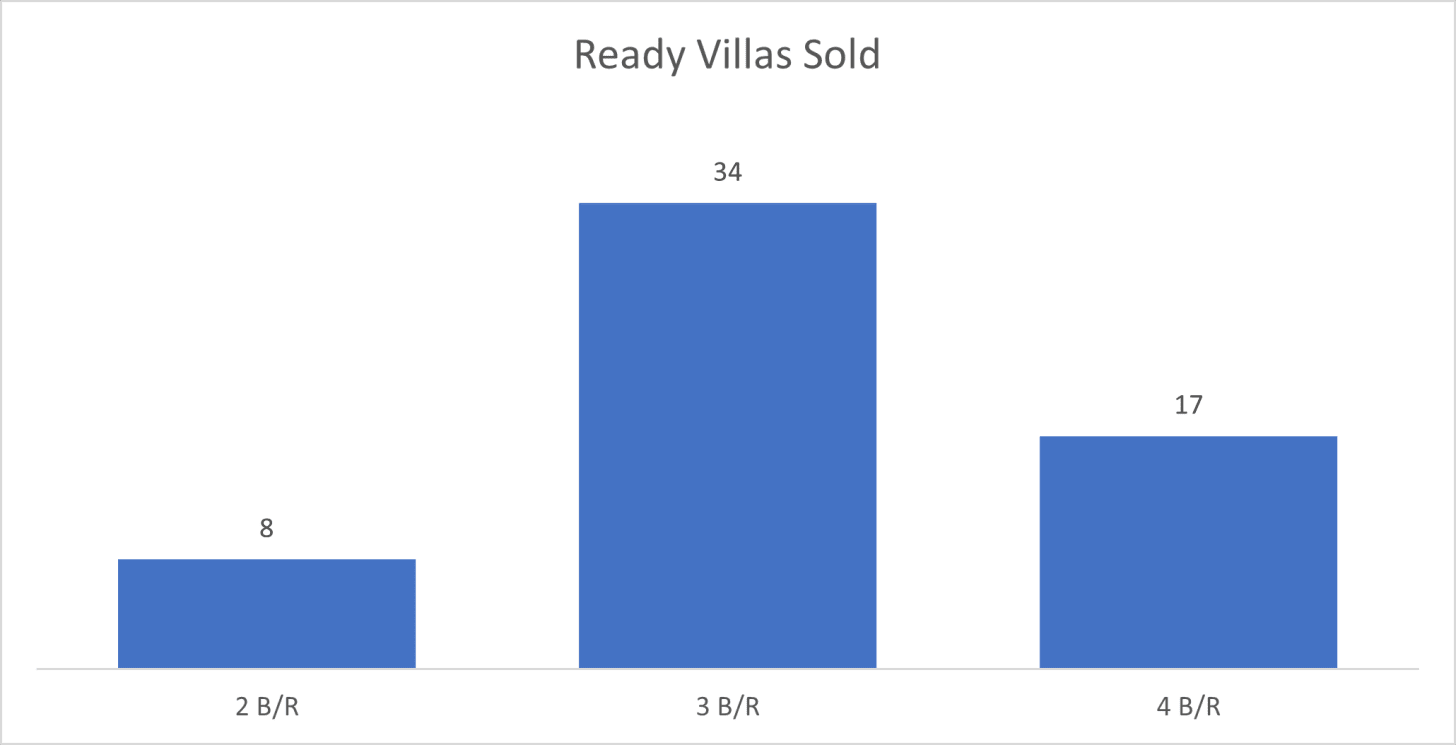

Villas followed with 20.5% (AED 192.4 million), reinforcing the appeal of established communities.

Commercial properties represented 8.6% (AED 80.6 million), reflecting business expansion and retail investments.

Hotel apartments & rooms contributed 2.6% (AED 24.5 million), continuing the trend of short-term rental investment.

The steady performance of ready flats indicates ongoing demand for move-in-ready units, particularly in established areas.

Market Insights & Outlook

Dubai’s real estate market remains dynamic, with off-plan properties continuing to drive transaction volumes, indicating investor confidence in future developments. Meanwhile, the ready property segment remains robust, especially in high-demand residential areas.

The sustained demand across all asset classes, including commercial and hospitality properties, underscores Dubai’s position as a leading global real estate investment hub. With ongoing infrastructure projects and supportive economic policies, the market is expected to maintain momentum throughout 2025.

This data signals a balanced real estate ecosystem, catering to both long-term investors and immediate homebuyers, solidifying Dubai’s reputation as a premier real estate destination.

Data Source: Dubai Land Department