Your career will thank you.

Over 4 million professionals start their day with Morning Brew—because business news doesn’t have to be boring.

Each daily email breaks down the biggest stories in business, tech, and finance with clarity, wit, and relevance—so you're not just informed, you're actually interested.

Whether you’re leading meetings or just trying to keep up, Morning Brew helps you talk the talk without digging through social media or jargon-packed articles. And odds are, it’s already sitting in your coworker’s inbox—so you’ll have plenty to chat about.

It’s 100% free and takes less than 15 seconds to sign up, so try it today and see how Morning Brew is transforming business media for the better.

The Dubai real estate market continued its strong momentum in the third quarter of 2025, with both office and residential sectors showing sustained growth driven by population gains, robust economic activity, and rising investor confidence, according to Savills’ latest Dubai Market in Minutes report.

Read the full article on Arabian Business

Provident Estate opened its first “Provident Boutique” at Dubai World Trade Centre, a permanent real-estate exhibition hub on Sheikh Zayed Road. It features interactive developer displays and consultation zones, giving investors year-round access to top off-plan and ready projects, blending tech with tailored guidance.

Read the full article on Zawya

Deyaar Development’s Chief Executive Officer said the company’s early public listing in 2007 demonstrated the long-term benefits of transparency and governance for Dubai’s property sector, as the city sees renewed momentum in IPOs and real estate investment trusts.

Read the full article on Arabian Business

Choose the Right AI Tools

With thousands of AI tools available, how do you know which ones are worth your money? Subscribe to Mindstream and get our expert guide comparing 40+ popular AI tools. Discover which free options rival paid versions and when upgrading is essential. Stop overspending on tools you don't need and find the perfect AI stack for your workflow.

Sharjah Ruler H.H. Sheikh Dr Sultan tasked the municipality to modernise older districts, upgrading roads, sewage, greenery, parks, and regulate abandoned properties, fully government-funded. Works cover Al Ghwair, Yarmouk, Al Qadisiyah and Al Jazat with drainage fixes. He also promotes free tree-planting for environmental and wellbeing benefits.

Read the full article on Zawya

CEO Saeed Al Qatami tells Arabian Business the company has seen “great interest” in Dubai’s affordable housing market as it posts a 24% rise in net profit and plans to hand over 2,000 new units by early 2026

Read the full article on Arabian Business

UAE property market: Top off-plan locations emerge in Dubai and Abu Dhabi as investor appetite grows

UAE property stayed strong in Q3 2025. Dubai and Abu Dhabi saw robust ready and off-plan demand, supported by pro-ownership policies, tokenisation and data-driven platforms. Top areas included Dubai Marina, JVC, Dubai Hills, Yas and Saadiyat. Prices and ROIs climbed, with off-plan launches attracting heavy investor interest.

Read the full article on Economy Middle East

Savills reports Dubai real estate remained robust in Q3 2025: office rents hit AED 233/sq ft (+4.5% QoQ, +35% YoY) amid strong leasing; residential saw over 50k deals with 69% off-plan, 1,500 prime sales (>AED 10m, 73% villas), 8,500 units delivered (~30k YTD). Outlook: continued growth.

Read the full article on Zawya

The best marketing ideas come from marketers who live it. That’s what The Marketing Millennials delivers: real insights, fresh takes, and no fluff. Written by Daniel Murray, a marketer who knows what works, this newsletter cuts through the noise so you can stop guessing and start winning. Subscribe and level up your marketing game.

BCC Group International acquired a 51% stake in Ajad Real Estate, expanding its UAE property presence. Chairman Amjad Sithara launched a region-first 100% commission model to attract top agents. The partnership combines BCC’s scale with Ajad’s management and sales expertise to boost UAE real estate services.

Read the full article on Khaleej Times

Sankari broke ground on Regent Residences Dubai – Sankari Place at Marasi Marina, the world’s first standalone Regent-branded residence. ABM won a near AED 1bn contract; completion in 34 months. Designed by Foster + Partners: 63 full-floor homes with private pools, 10 floating homes, and extensive luxury amenities.

Read the full article on Zawya

Dubai approved six initiatives: a AED 18.3bn parks/greenery plan (310 new parks, tripled trees, 95m visits, recycled irrigation); Aviation Talent 33 (15k jobs, 4k trainings); 60 affordable schools (120k seats); Sports Plan 2033; a Financial Restructuring & Insolvency Court; and expanded early-detection healthcare with screening, vaccination, and wait-time targets.

Read the full article on Trade Arabia

Dubai Real Estate Transactions as Reported on the 5th of November 2025

On the 05-Nov-2025, the total transacted value reached AED 1,960,741,613. Off-plan dominated with AED 1,195,474,971 (61.0%), while Ready accounted for AED 765,266,642 (39.0%).

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 972.6 | 438.4 |

Villas | 169.0 | 172.7 |

Hotel Apt. & Rooms | 0.6 | 48.1 |

Commercial | 53.3 | 106.0 |

Total | 1,195.5 | 765.3 |

Off-Plan Market Performance

Total Value: AED 1,195,474,971

Flats: AED 972,622,369 (81.4%)

Villas: AED 168,953,002 (14.1%)

Hotel Apts & Rooms: AED 625,000 (0.1%)

Commercial: AED 53,274,600 (4.5%)

Off-plan activity was led decisively by flats, with villas providing a meaningful secondary lift and limited commercial/serviced-apartment contributions.

Ready Market Performance

Total Value: AED 765,266,642

Flats: AED 438,446,898 (57.3%)

Villas: AED 172,672,149 (22.6%)

Hotel Apts & Rooms: AED 48,129,660 (6.3%)

Commercial: AED 106,017,934 (13.9%)

Ready transactions skewed to flats, while commercial deals formed a sizable share and villas remained a solid second pillar.

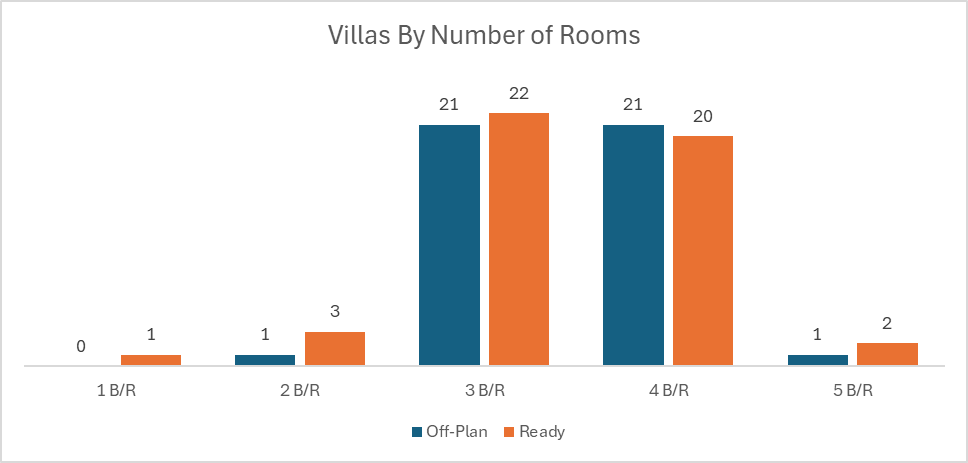

On The Micro Level

Market Insights & Outlook

A balanced day with a clear off-plan lead driven by apartments. Ready market breadth, especially in commercial, signals ongoing occupier/investor confidence. Expect sustained momentum near term as launches pipeline stays active and year-end deal-making supports liquidity.

Data Source: Dubai Land Department