Looking for unbiased, fact-based news? Join 1440 today.

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

Dubai logged a record 99 k property deals in H1 2025, reflecting rising investor confidence and a shift toward long-term living. Diverse buyers seek lifestyle and Grade-A commercial space; modest price corrections may affect weaker areas. New first-time buyer incentives further bolster accessibility and market resilience.

Read the full article on Gulf Business

Shamal Holding unveils Naïa Island Dubai, an ultra-luxury private estate off Jumeirah with the region’s first Cheval Blanc maison, limited beachfront homes and plots, marina, and wellness and dining venues. Low-rise design maximises landmark views; construction has already started.

Read the full article on Zawya

H1 2025 Dubai residential real estate recorded 91.9 k deals worth AED 262 bn (+23 % volume, +36 % value YoY). Q2 rebound lifted prices 7.8 % versus H2 2024 while rents plateaued. 17.2 k units delivered but big pipeline risks delays. Luxury transactions jumped 82 %; JVC and DAMAC Islands dominated activity.

Read the full article on Economy Middle East

Dubai property sales hit AED 63.6 bn, up 27 % YoY on 24 % higher volumes. Off-plan secondary deals surged 123 %, while ready sales climbed 56 %. A new tax rule allowing fair-value depreciation boosts returns, sustaining investor appetite as apartments dominate demand and solid economic growth supports outlook.

Read the full article on Khaleej Times

Dubai closed 91.9 k residential deals worth AED 262 bn (+23 % YoY). Off-plan remains 70 %, but ready sales hit records as villa/townhouse demand grows. Only 21 % of 2025 projects are 75 % complete, foreshadowing delays. Rentals moderate; Emaar, Damac, Sobha dominate launches.

Read the full article on Zawya

Emaar Properties’ H1 2025 net profit jumped 34 % YoY to AED 10.4 bn on revenue up 38 % to AED 19.8 bn. Record property sales hit AED 46 bn, lifting backlog to AED 146 bn. Emaar Development, malls, hospitality and international operations all reported strong growth.

Read the full article on The National

Dubai Municipality processed 30 k building permits (+20 % YoY) in H1 2025, covering 5.5 m m²—1 m m² in July alone. Multi-storey commercial projects led (45 %), villas 40 %. Digital “Build in Dubai” platform and BIM audits sped approvals, reinforcing Dubai’s construction boom and sustainable, smart-city goals.

Read the full article on Economy Middle East

Dubai’s property market defied the usual summer slowdown in July, with rental activity jumping as families and professionals moved to the emirate ahead of the new academic year, data from the Dubai Land Department (DLD) showed.

Read the full article on Arabian Business

325 projects launched 87.9 k units (~490/day) in H1 2025; apartments dominated 86 %. Only 17.3 k units completed, mainly in JVC, Sobha Hartland and MBR City. With 61.8 k units still due in 2025 and 100 k+ in 2026-27, low progress (21 %) signals likely delivery delays.

Read the full article on MENA FN

Dubai-based real estate developer, Ellington Properties, has announced the launch of Eaton Square, its first-ever commercial development. Located in Mohammed Bin Rashid City (MBR City), this project marks a new chapter for the developer, marking its entry into the commercial real estate sector.

Read the full article on Arabian Business

Azizi Developments has launched Azizi Abraham, a rare freehold residential project inside Jebel Ali Free Zone, giving investors ownership opportunities within the UAE’s flagship business hub, adjacent to the region’s largest port and well connected to Dubai’s key destinations.

Read the full article on Arabian Business

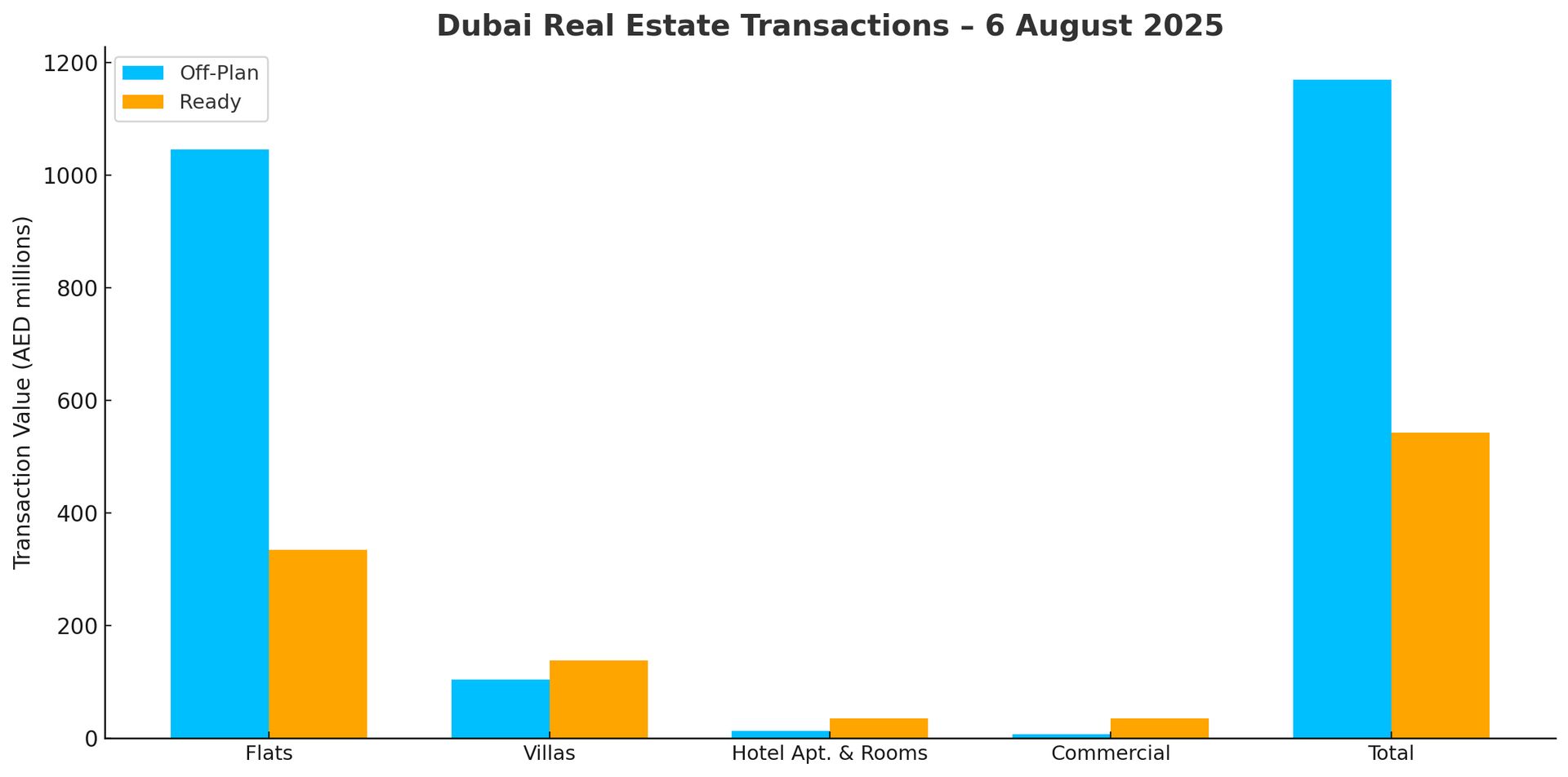

Dubai Real Estate Transactions as Reported on the 6th of August 2025

On 6 August 2025, Dubai’s property market recorded total transactions worth AED 1.71 billion. Off-plan deals contributed AED 1.17 billion (68.3 %), while ready properties added AED 0.54 billion (31.7 %).

Category | Off-Plan (AED million) | Ready (AED million) |

|---|---|---|

Flats | 1,045.6 | 334.5 |

Villas | 104.0 | 137.9 |

Hotel Apt. & Rooms | 12.9 | 35.1 |

Commercial | 6.9 | 35.3 |

Total | 1,169.4 | 542.7 |

Off-Plan Market Performance

Flats: AED 1,045.6 m (89.4 %)

Villas: AED 104.0 m (8.9 %)

Hotel Apartments & Rooms: AED 12.9 m (1.1 %)

Commercial: AED 6.9 m (0.6 %)

Flats dominated, accounting for almost nine-tenths of all off-plan spending.

Ready Market Performance

Flats: AED 334.5 m (61.6 %)

Villas: AED 137.9 m (25.4 %)

Hotel Apartments & Rooms: AED 35.1 m (6.5 %)

Commercial: AED 35.3 m (6.5 %)

Flats led the ready segment, while villas secured a solid quarter share.

On The Micro Level

Market Insights & Outlook

Off-plan resilience: A two-thirds share underscores sustained confidence in pipeline projects and developer delivery.

Apartment appetite unshaken: Across both segments, flats absorbed 80 % of total spend, reflecting strong investor and end-user demand for high-density living.

Family-oriented villa pull: Ready and off-plan villa sales highlight ongoing lifestyle-driven purchases in master-planned communities.

Broader diversification: Commercial and hotel assets, though smaller, signal healthy mixed-use activity supporting Dubai’s growth narrative.

With buoyant sales, supportive financing and continued international interest, Dubai’s real-estate momentum is set to carry through Q3, reinforced by a steady launch pipeline and robust economic fundamentals.

Data Source: Dubai Land Department