Starting January 1, 2025, UAE investors in REITs exempt from corporate tax will be taxed on 80% of property income unless dividends are distributed within nine months. Clarifications also cover profit distributions, expenses, disposals, and non-resident investor obligations.

Read the full article on Gulf News

Jumeirah Residences Asora Bay by Meraas apartments in Dubai’s La Mer sold for combined $63.7m.

Read the full article on Arabian Business

Dubailand recorded AED 26.2 billion in off-plan sales across 9,000+ units in 12 months, driven by strong demand, central location, lifestyle appeal, and upcoming projects like LEOS Developments’ new Weybridge Gardens launch.

Read the full article on Zawya

Some UAE banks are now offering mortgages below 4% and making it easier for buyers to finance homes under 70-30 and 80-20 payment plans.

Read the full article on Arabian Business

Dubai property market hit a record AED 62.1 billion in April, up 94% YoY, driven by high-value sales in Palm Jebel Ali and The Oasis, with off-plan deals dominating and secondary sales also surging.

Read the full article on Gulf News

Dubai is nearing tier-1 global city status, ranking 5th in a new index due to strong infrastructure, safety, and quality of life. While short-term real estate prices may stabilize, long-term growth remains positive, with high rental demand, rising institutional investment, and strong opportunities in waterfront and mid-income housing.

Read the full article on Economy Middle East

Modon has launched Nawayef Village, the first townhouse community on Hudayriyat Island in Abu Dhabi. The gated, Tuscany-inspired freehold project offers 378 units with lush landscaping, premium amenities, and scenic views, marking a new benchmark in community living and responding to rising demand for townhouses in the capital.

Read the full article on Zawya

Dubai Land Department partnered with MIE Events to promote Dubai’s real estate sector at the America Property Exhibition in Miami, aiming to attract foreign investment. The initiative supports the Dubai Real Estate Strategy 2033 by enhancing global engagement, streamlining processes, and positioning Dubai as a top-tier property investment hub.

Read the full article on Economy Middle East

Bloom Holding, a leading UAE real estate development company, announced the launch of the second phase of ‘Granada’, its premium community living apartments in Abu Dhabi.

Read the full article on Arabian Business

Photo by You Know What Blog

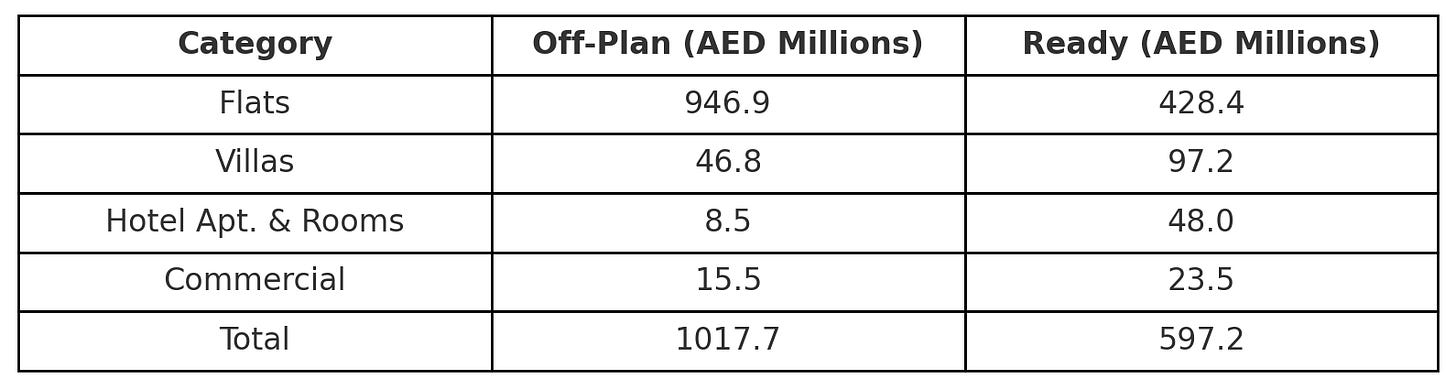

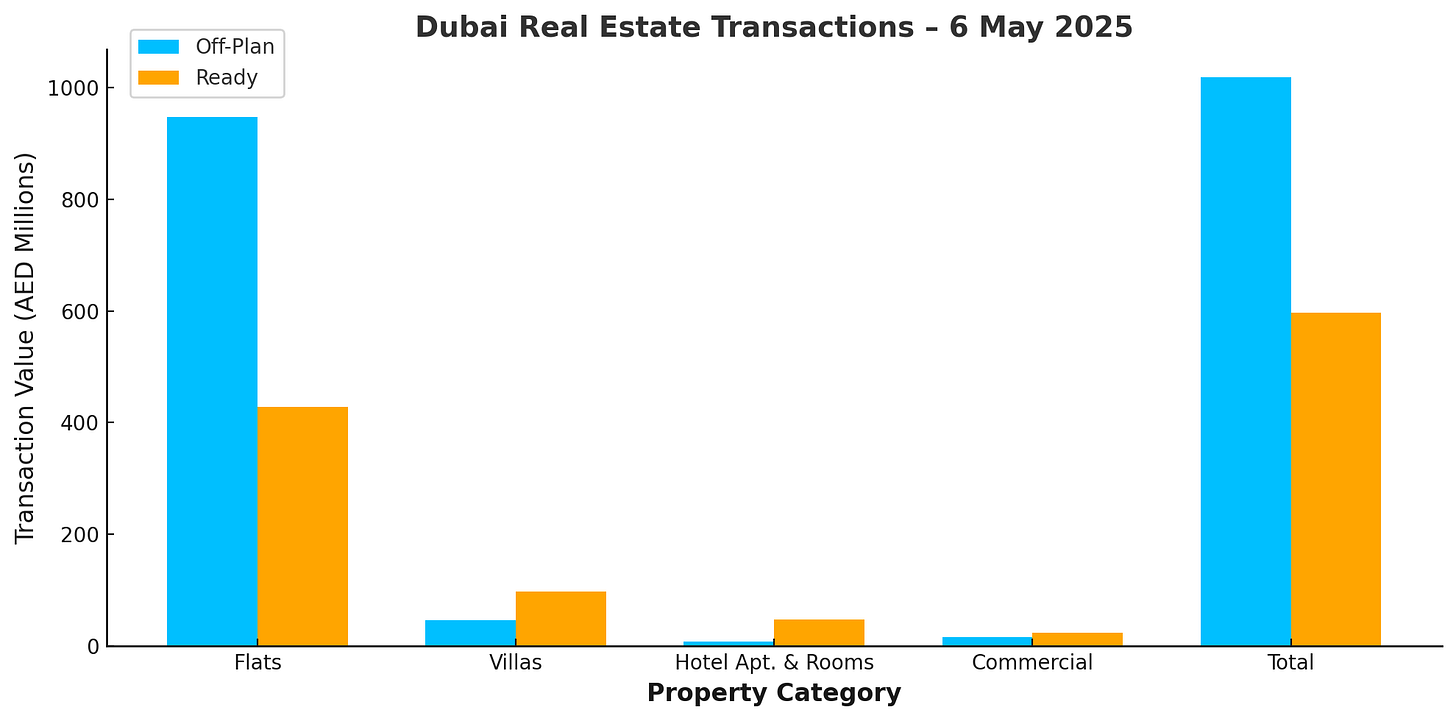

Dubai Real Estate Transactions as Reported on the 6th of May 2025

Dubai’s real estate market continues to demonstrate robust performance, with total property transactions reaching AED 1.61 billion on May 6, 2025. The off-plan segment accounted for 63% of the total transaction value, while ready properties made up 37%. This distribution highlights the sustained momentum in new project launches and investor appetite for off-plan developments.

Off-Plan Market Performance

The off-plan segment recorded AED 1.02 billion in total sales, securing the majority share (63%) of the day’s transactions. Within this category:

Flats led the market, contributing 93.0% (AED 946.9 million) to the off-plan segment.

Villas accounted for 4.6% (AED 46.8 million), reflecting selective interest in upcoming family homes.

Commercial properties made up 1.5% (AED 15.5 million), indicating continued interest in business-oriented investments.

Hotel apartments & rooms represented 0.8% (AED 8.5 million), showing niche investment appeal in hospitality assets.

The overwhelming dominance of off-plan flats underscores strong buyer confidence in future inventory and the appeal of flexible developer-led payment plans.

Ready Market Performance

The ready property market totaled AED 597.2 million, accounting for 37% of overall transactions. Key highlights include:

Flats remained dominant, making up 71.7% (AED 428.4 million), showing continued demand for immediate occupancy.

Villas followed with 16.3% (AED 97.2 million), reflecting buyer preference for established residential communities.

Hotel apartments & rooms contributed 8.0% (AED 48.0 million), signaling healthy interest in income-generating rental units.

Commercial properties made up 3.9% (AED 23.5 million), suggesting moderate business activity in the resale market.

The ready segment remained resilient, driven largely by residential demand and a growing rental market.

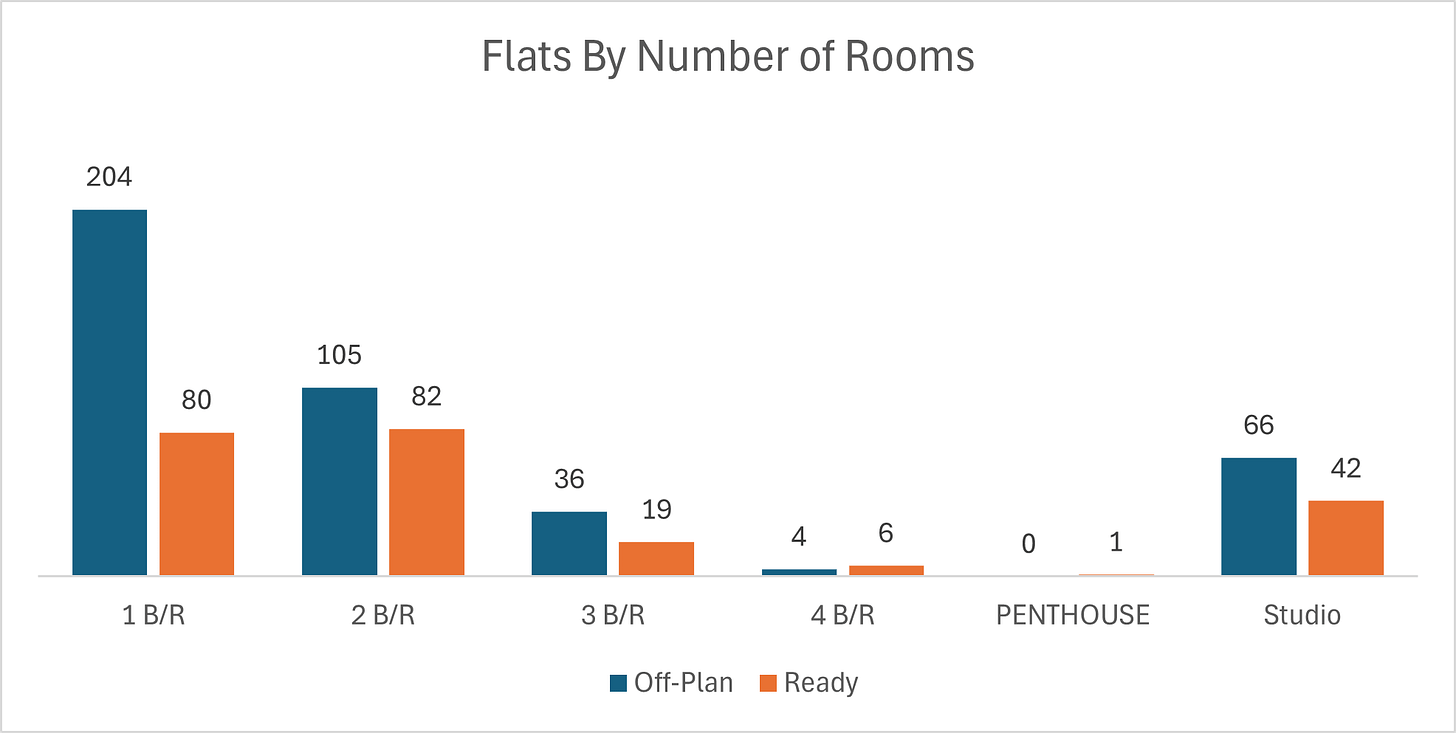

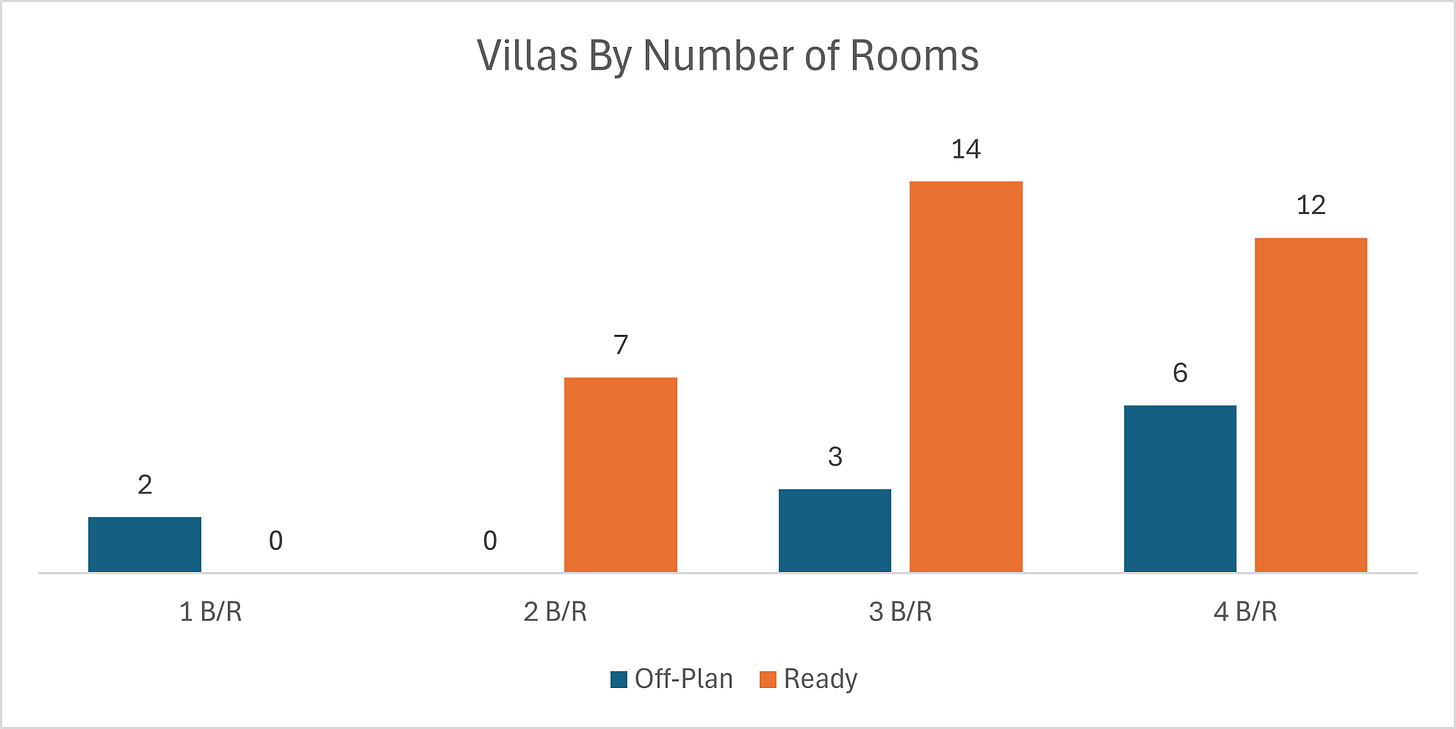

On The Micro Level

Market Insights & Outlook

Dubai’s real estate market remains well-balanced, with off-plan developments driving momentum and ready properties providing stability. The high proportion of transactions in off-plan flats illustrates investor confidence in the city’s long-term growth, while the ready market’s strong showing highlights consistent end-user demand.

With diverse offerings across residential, commercial, and hospitality assets, Dubai continues to strengthen its position as a global investment hub. As infrastructure projects advance and population growth sustains demand, the outlook for 2025 remains optimistic across all segments of the market.

Data Source: Dubai Land Department