Smart Investors Don’t Guess. They Read The Daily Upside.

Markets are moving faster than ever — but so is the noise. Between clickbait headlines, empty hot takes, and AI-fueled hype cycles, it’s harder than ever to separate what matters from what doesn’t.

That’s where The Daily Upside comes in. Written by former bankers and veteran journalists, it brings sharp, actionable insights on markets, business, and the economy — the stories that actually move money and shape decisions.

That’s why over 1 million readers, including CFOs, portfolio managers, and executives from Wall Street to Main Street, rely on The Daily Upside to cut through the noise.

No fluff. No filler. Just clarity that helps you stay ahead.

Emaar’s 9M 2025: property sales AED61bn (+22%), revenue AED33.1bn (+39%), EBITDA AED16.6bn (+32%), net profit before tax AED16.7bn (+35%); backlog AED150.3bn (+49%). Strong UAE builds, surging international (Egypt, India). Recurring revenue AED7.7bn (+13%); malls 98%+ occupancy, hotels 72%; ratings upgraded.

Read the full article on Economy Middle East

Despite record sales, Dubai’s agency boom is overcrowded. 3,000+ new brokers in Q3 lifted active agents to ~40,000, pushing average commissions to ~AED18,000/month. Many quit within three months; survival favors trained, value-adding brokers with savings amid cut-throat, commission-only competition.

Read the full article on The National

BlackBrick forecasts steady, end-user-led villa price gains in 2025–26, highlighting Al Barari, Arabian Ranches, DAMAC Hills (15–20%), Jumeirah Islands (8–12%), and Jumeirah Golf Estate (7–12%). Demand is driven by livable spaces, land/plots, upgrade potential, community cohesion, and understated, timeless design

Read the full article on Gulf Business

BEYOND Developments launched “31 Above,” the first commercial tower in Dubai Maritime City, targeting regional HQs and innovators. Art-Deco–inspired, human-centric design with terraces, wellness zones, dual cores, and high-speed lifts. Strategically near DIFC/Downtown/Airport; 4,500 sqm amenities. Completion Q1 2029; aims to redefine premium workplaces.

Read the full article on Zawya

The best marketing ideas come from marketers who live it. That’s what The Marketing Millennials delivers: real insights, fresh takes, and no fluff. Written by Daniel Murray, a marketer who knows what works, this newsletter cuts through the noise so you can stop guessing and start winning. Subscribe and level up your marketing game.

Dubai will deliver 44,000 homes in 2025, the most in five years, with 69,000 projected in 2026. Record supply and strong population growth are maturing the market, moderating price and rent gains. Prime villa areas remain resilient; mid-market apartments slow. Q3 2025 prices hit Dh1,871/sqft (+13% YoY).

Read the full article on Khaleej Times

From ultra-luxury coastal residences to smart urban communities and mixed-use destinations, these are 24 of the most notable real estate project launches that made headlines across the Middle East in October 2025.

Read the full article on Construction Week Online

Emirates Developments and Hilton launched Hilton Residences JLT, a 38-storey branded tower in JLT Cluster F. The 396-unit project blends hospitality and luxury design, offering studios to four-bed sky villas plus wellness, pools, retail and kids’ amenities, steps from DMCC Metro and major hubs.

Read the full article on ME Construction News

Dubai rents are easing in mid-range areas as ~30k new homes hit the market; villas hold firm on limited supply. Tenants are negotiating better deals and some are buying, easing demand. Expect further moderation into 2026; use RERA benchmarks, data, timing, and newer communities to save.

Read the full article on Gulf News

Acube handed over Adhara Star in Arjan, its debut 113-unit mixed-use project, completed in under two years and sold out three months post-launch. Green-certified with extensive amenities, it signals strong investor confidence and sets up Acube’s next launches.

Read the full article on Zawya

The best HR advice comes from those in the trenches. That’s what this is: real-world HR insights delivered in a newsletter from Hebba Youssef, a Chief People Officer who’s been there. Practical, real strategies with a dash of humor. Because HR shouldn’t be thankless—and you shouldn’t be alone in it.

DAMAC topped out the 71-storey Cavalli Tower in Dubai Marina, the world’s first Cavalli-branded residential tower. The 436-unit, ultra-luxury project, by architect Shaun Killa with Roberto Cavalli interiors, is on track for handover late next year, adding sky pools, resort amenities, and fashion-led design amid strong demand for branded residences.

Read the full article on Economy Middle East

Expo City Dubai is evolving into a mixed-use “Green Innovation District”. Housing opens from next summer (target ~35,000 residents), offices for ~40,000 professionals, Dubai Exhibition Center expands to 150,000 m² by 2027, plus new hotels, sports facilities, and retained attractions (Vision, Terra, Alif).

Read the full article on Gulf News

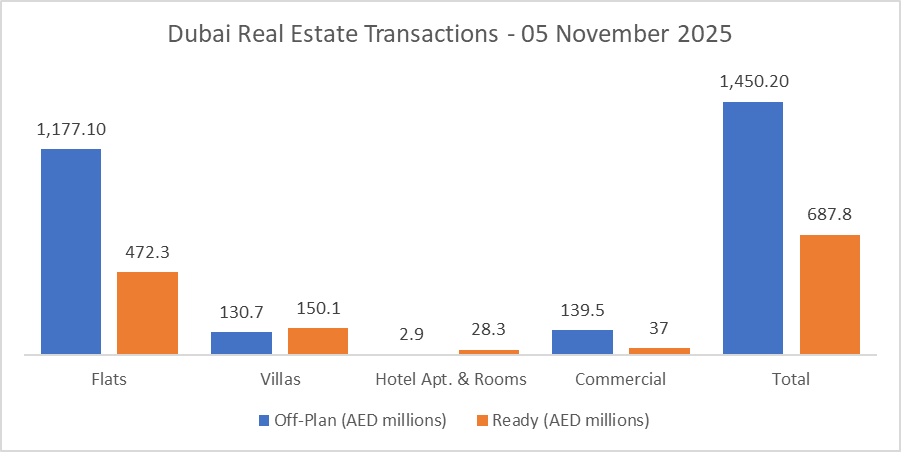

Dubai Real Estate Transactions as Reported on the 6th of November 2025

On the 06-Nov-2025, the total transacted value reached AED 2,137,959,896. Off-plan dominated with AED 1,450,208,618 (67.8%), while Ready accounted for AED 687,751,278 (32.2%).

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 1,177.1 | 472.3 |

Villas | 130.7 | 150.1 |

Hotel Apt. & Rooms | 2.9 | 28.3 |

Commercial | 139.5 | 37.0 |

Total | 1,450.2 | 687.8 |

Off-Plan Market Performance

Total Value: AED 1,450,208,618

Flats: AED 1,177,107,886 (81.2%)

Villas: AED 130,715,642 (9.0%)

Hotel Apts & Rooms: AED 2,927,000 (0.2%)

Commercial: AED 139,458,090 (9.6%)

Off-plan activity was led by flats (four-fifths of value), with balanced contributions from villas and commercial; hotel units were minimal.

Ready Market Performance

Total Value: AED 687,751,278

Flats: AED 472,306,452 (68.7%)

Villas: AED 150,129,011 (21.8%)

Hotel Apts & Rooms: AED 28,340,318 (4.1%)

Commercial: AED 36,975,498 (5.4%)

Ready volumes were driven by flats, with villas providing a strong secondary share; hospitality and commercial were modest.

On The Micro Level

Market Insights & Outlook

A two-thirds off-plan skew underscores robust launch absorption, while ready demand remains anchored in flats with healthy villa participation. Watch for pricing discipline in off-plan villas and commercial as supply pipelines normalize; ready apartment momentum should continue in well-located, quality stock.

Data Source: Dubai Land Department