|

|

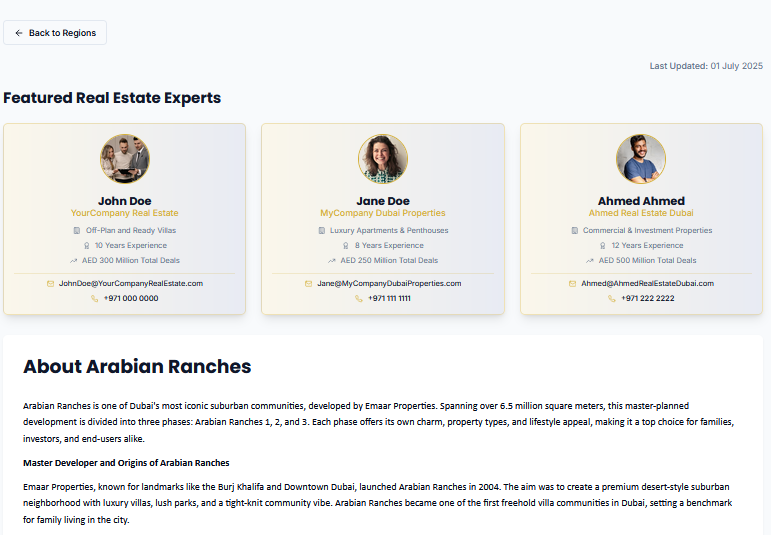

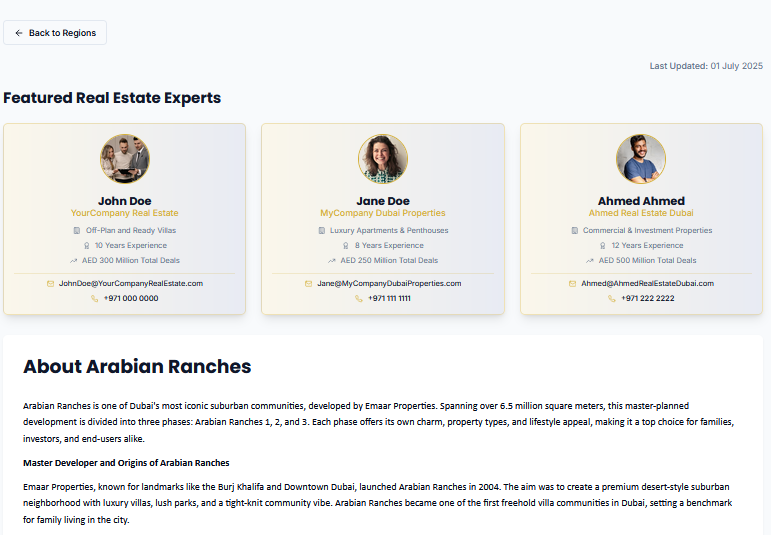

Do You Want To Be Featured As An Area Expert? Click Here |

|

AboutTheUAE is your definitive guide to Dubai – discover top Real Estate, schools, visa requirements, housing insights, transport tips, shopping hotspots, entertainment and more. |

Dubai Residential REIT, managed by DHAM Investments, grew H1 2025 net profit 10 % to AED 622 m on revenue of AED 958 m (+10 %) and EBITDA of AED 718 m (+11 %). Occupancy averaged 98 %. A AED 550 m interim dividend will be paid in September.

Read the full article on Zawya

Chestertons says JVC, Damac Island, Downtown, Dubai Marina, Meydan City and Dubai South lead Dubai’s 2025 residential surge, with rental yields up to 7.39 %. Strategic planning, investor-friendly policies and infrastructure pushed sales up 25.8 %, boosted off-plan demand and kept occupancy and rents rising.

Read the full article on MSN

Dubai’s post-COVID boom is rooted in policy and fundamentals: rapid population growth (+89k Q1 2025), tax-free stability, 6-8 % net yields, home prices up 26 % YoY, and AED 70.8 bn H1 deals. Guided by the 2040 Master Plan, 170k units are underway, shifting the market toward long-term, value-driven growth.

Read the full article on Gulf Business

Amirah Developments’ debut project, Bonds Avenue Residences on Dubai Islands, helped lift Dubai real-estate transactions 25 % YoY to AED 431 bn (125,538 deals) in H1 2025. Quarterly volumes climbed from AED 142.7 bn to AED 184 bn, underscoring market resilience and luxury demand as 9,800 new millionaires arrive.

Read the full article on Zawya

Ajman’s real estate market saw significant growth in July 2025, recording 1,920 transactions worth AED 3.25 billion ($885m), a 62.5 per cent increase in value compared to July 2024, according to the Department of Land and Real Estate Regulation.

Read the full article on Arabian Business

Dubai’s H1 2025 property market logged 96 k deals worth AED 322 bn, 45 % off-plan. Apartment prices rose 13 %, villas 25 %. Mid-tier areas yield 7-11 %. Growth is fueled by end-users, transparent policies, Golden Visas, proptech, and disciplined, demand-led development.

Read the full article on Gulf News

|

|

Do You Want To Be Featured As An Area Expert? Click Here |

|

AboutTheUAE is your definitive guide to Dubai – discover top Real Estate, schools, visa requirements, housing insights, transport tips, shopping hotspots, entertainment and more. |

Henley’s 2025 Wealth Migration Report says UAE will gain 9,800 millionaires in 2025, leading global inflows for a third year. Tax-free income, Golden Visas and stability will attract $63 bn to Dubai real estate, while the UK is expected to lose 16,500 millionaires.

Read the full article on Gulf Today

Reem Island, Al Reef, and Yas Island developments lead Abu Dhabi real estate gains as nearly all communities post double-digit growth.

Read the full article on Arabian Business

Dubai crypto exchange UnitedCoin partners with a top real-estate agency to let investors convert USDT to AED for luxury property purchases, streamlining fully compliant crypto-to-property deals and underscoring Dubai’s pro-blockchain stance and rising demand from global high-net-worth buyers.

Read the full article on Gulf News

Dubai’s 2025 housing market pivots to suburban hubs, JVC, DAMAC Island, Dubai South, Meydan, Marina, Downtown, yielding 6-7%+. Zone 6 alone drives 55 % of transactions. Apartments still lead (76 %) yet demand for larger homes grows. Government incentives and new infrastructure back 28.6 k launches and sustained investor interest.

Read the full article on Gulf Business

Jebel Ali Free Zone expansion and the planned Al Maktoum International Airport are driving demand in Downtown Jebel Ali and Dubai South. Off-plan units start at Dh800–1,400 /sq ft (Azizi Abraham) versus Dh1,550 JAFZA average; Dubai South averages Dh950–1,300. Prices rose 15–20 % YoY, indicating early-stage growth.

Read the full article on Gulf News

Dubai’s June crackdown on illegally partitioned flats displaced tenants to Al Nahda and Sharjah, boosting studio and one-bed rents 10-20%. Fewer shared units and landlords recouping renovation costs drive prices, while authorities say the cleanup enhances safety and rental transparency.

Read the full article on The Global Filipino Magazine

Dubai Real Estate Transactions as Reported on the 7th of August 2025

On 7 August 2025, Dubai’s property market recorded total transactions worth AED 2.03 billion. Off-plan sales remained the main engine, contributing AED 1.23 billion (60.6 %), while ready properties accounted for AED 0.80 billion (39.4 %).

Category | Off-Plan (AED m) | Ready (AED m) |

|---|---|---|

Flats | 1,138.8 | 398.9 |

Villas | 63.1 | 129.1 |

Hotel Apt. & Rooms | 11.9 | 239.3 |

Commercial | 18.0 | 32.3 |

Total | 1,231.8 | 799.5 |

Off-Plan Market Performance

Sub-category | Value (AED m) | % of Off-Plan |

|---|---|---|

Flats | 1,138.8 | 92.5 % |

Villas | 63.1 | 5.1 % |

Hotel Apts. & Rooms | 11.9 | 1.0 % |

Commercial | 18.0 | 1.5 % |

Flats clearly dominated off-plan activity, capturing more than nine-tenths of the segment’s value.

Ready Market Performance

Sub-category | Value (AED m) | % of Ready |

|---|---|---|

Flats | 398.9 | 49.9 % |

Villas | 129.1 | 16.1 % |

Hotel Apts. & Rooms | 239.3 | 29.9 % |

Commercial | 32.3 | 4.0 % |

Ready transactions were more balanced, with flats just under half of the total and hotel-type assets rising to nearly 30 %.

On The Micro Level

Market Insights & Outlook

Off-plan momentum endures: Developers continue to capture buyers early in the cycle, with apartments the clear favourite.

Ready segment diversifies: Higher ticket sizes in hotel apartments indicate institutional and hospitality-focused demand alongside end-user purchases.

Yield focus: Investors are gravitating toward assets offering stable rental returns, reinforcing demand for both mid-market flats and serviced residences.

Pipeline watch: With a robust delivery schedule through 2026-27, supply will test pricing power; however, sustained population inflows and policy support should keep fundamentals resilient.

Overall, the day’s figures highlight a market still driven by off-plan apartment sales yet increasingly supported by diversified ready-asset demand—an encouraging sign of depth and maturity in Dubai’s real estate landscape.

Data Source: Dubai Land Department