This Spring, Grow with the Help of a Therapist

Your mental wellness deserves to bloom. For Mental Health Awareness Month, BetterHelp is offering your first week of therapy free, no strings attached. Whether you’re facing stress, burnout, or relationship challenges, therapy can help you grow through what you’re going through.

You’ll be matched in under 24 hours, and you can message, chat, or video call your therapist anytime, anywhere. 94% of users report improvement, and 80% see symptom relief within just a few sessions.

It’s time to invest in yourself: try therapy with no risk today.

With over 72,000 green buildings and growing sustainability goals, Dubai’s property sector needs agents to drive eco-conscious development and investor awareness.

Read the full article on Arabian Business

Dubai real estate prices could double in five years, says Driven Properties CEO, citing strong fundamentals, high cap rates, and global undervaluation compared to cities like New York and Singapore. A new report ranks Dubai as a rising Tier-1 city with strong infrastructure, safety, and transaction depth.

Read the full article on Gulf Business

DAMAC has launched Chelsea Residences in Dubai Maritime City, a luxury waterfront project in partnership with Chelsea F.C., offering over 1,400 branded apartments, world-class wellness facilities, and immersive Chelsea-themed experiences. Prices start at AED 2.17M, marking a unique fusion of sports, design, and premium waterfront living.

Read the full article on Emirates 24/7

Dubai’s office market is booming, with rents up 45% year-on-year in Q1 2025, vacancy rates falling, and demand rising—especially in prime areas like DIFC. The city now ranks 8th globally in office occupancy costs, reflecting strong business confidence, limited Grade A supply, and growing interest from global firms.

Read the full article on Economy Middle East

Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

Gulf House Real Estate has launched Olaia Residences on Palm Jumeirah, a luxury project with private beach access, rooftop pools, and duplexes starting at AED 11M. With strong demand and limited new supply, 20% of units sold pre-launch. Completion is expected by Q4 2027.

Read the full article on Arabian Gulf Business Insight

DMCC has appointed Ali & Sons Contracting to lead Phase 2 of Uptown Dubai, featuring two Grade A commercial towers linked to Uptown Tower. The project emphasizes innovation, sustainability, and advanced construction techniques, reinforcing Uptown Dubai’s status as a premier urban destination.

Read the full article on Economy Middle East

Property Finder has launched registration for the third edition of its SheForShe programme, empowering 300 women in UAE real estate through mentorship, training, and workshops. Partnering with Women Choice, the initiative aims to promote leadership, inclusion, and professional growth for aspiring female professionals starting September 2025.

Reaad the full article on Construction Business News

Disney will open its seventh theme park on Yas Island, Abu Dhabi, in partnership with Miral. Disney will design and manage the park, while Miral funds and operates it. Targeting 120 million annual UAE airline passengers, the resort expands Abu Dhabi’s growing entertainment hub. No opening date has been announced.

Read the full article on Yahoo News

SAAS Properties has launched The St. Regis Residences on Al Maryah Island, a 38-storey luxury tower with 161 residences in partnership with Marriott. Featuring high-end finishes, smart-home tech, and exclusive amenities, the project blends elegance with functionality and strengthens Al Maryah’s position as Abu Dhabi’s premier lifestyle destination.

Read the full article on The National

The Luxe Developers' flagship project Oceano on Al Marjan Island is officially sold out, driven by record-breaking AED180M Sky Villa sales. The ultra-luxury twin-tower project redefines Ras Al Khaimah’s high-end market, showcasing global demand for private, design-driven living and setting new benchmarks for the emirate’s real estate appeal.

Read the full article on Zawya

Object 1 reported a 220% surge in sales value and 140% rise in volume in Q1 2025, driven by strong performance in JVC, JVT, and Jumeirah Garden City. With 12 active projects and 9 in development, the developer is expanding into Abu Dhabi, targeting international investors with tech-integrated, sustainable homes.

Read the full article on MENA FN

Photo by Moussa Idrissi

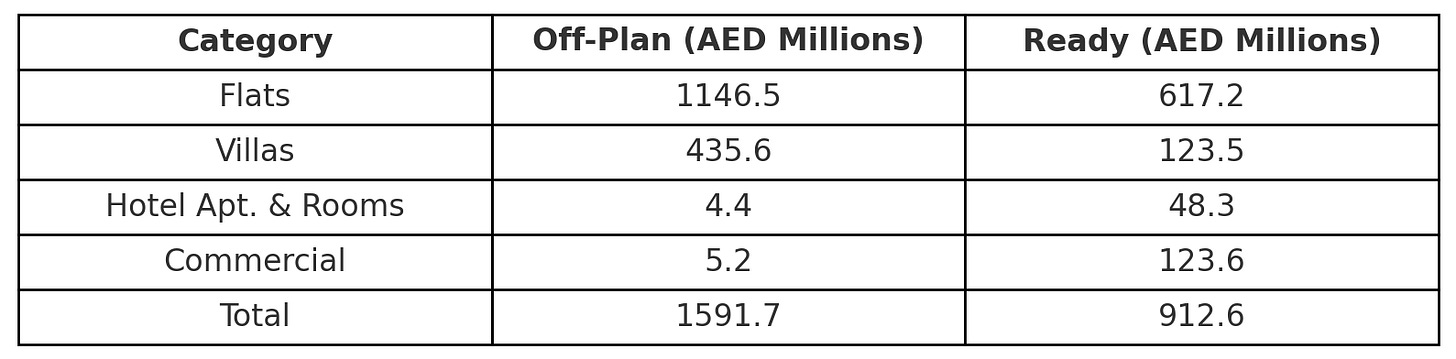

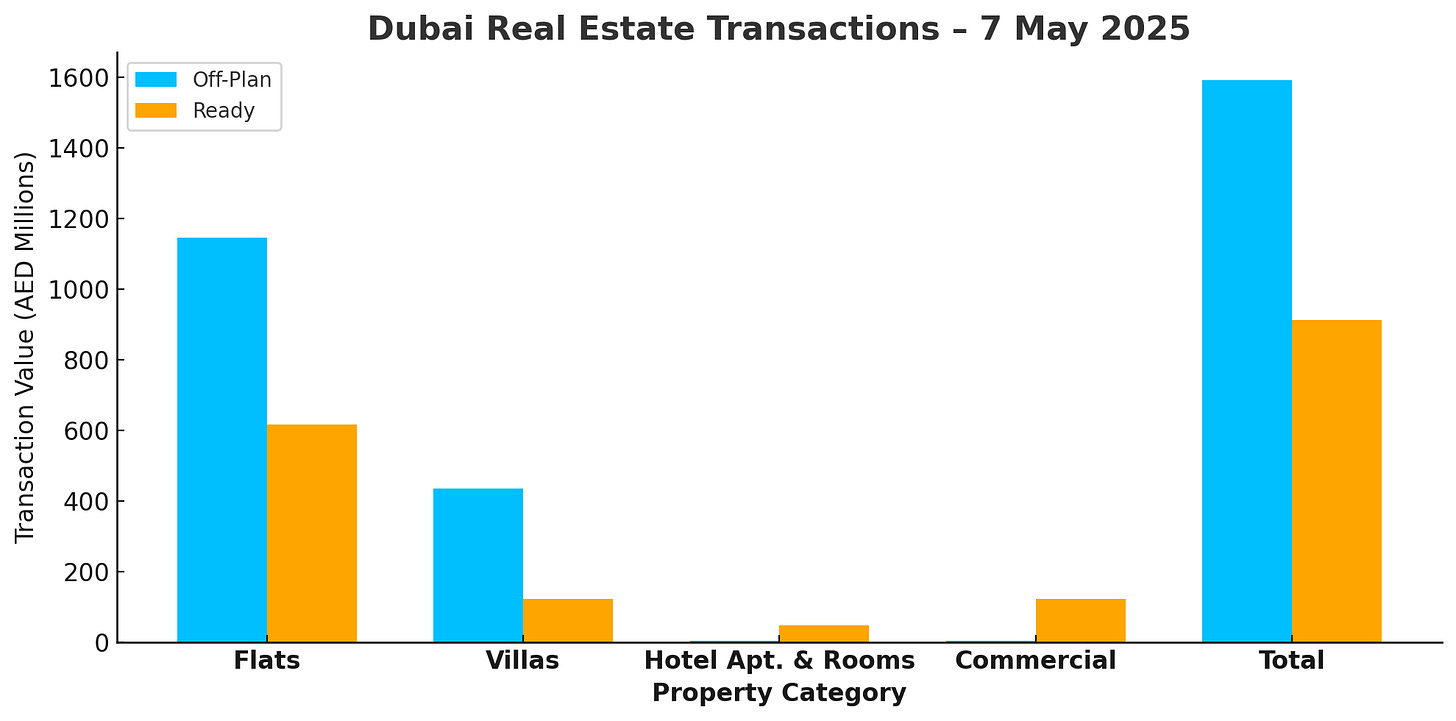

Dubai Real Estate Transactions as Reported on the 7th of May 2025

On 7 May 2025, the Dubai real estate market recorded a total transaction value of AED 2.50 billion, driven predominantly by off-plan activity. Off-plan transactions accounted for AED 1.59 billion, contributing 63.5% of the day’s total. Ready property transactions followed with AED 912.6 million, representing the remaining 36.5%. This continues the trend of strong developer-led sales, as investor interest remains high in off-plan opportunities.

Off-Plan Market Performance

The off-plan segment recorded AED 1.6 billion in total sales, securing the majority share (63.5%) of the day’s transactions. Within this category:

Flats led the market, contributing 72.0% (AED 1,146.5 million) to the off-plan segment.

Villas accounted for 27.4% (AED 435.6 million), reflecting high activity in the family homes, could be due to new launches or maturing Off-Plan projects.

Commercial properties made up 0.3% (AED 5.2 million), indicating continued interest in business-oriented investments.

Hotel apartments & rooms represented 0.3% (AED 4.4 million), showing niche investment appeal in hospitality assets.

Off-plan flats continue to dominate this segment, comprising nearly three-quarters of all off-plan activity. The strength in off-plan villa sales also highlights sustained interest in suburban and branded villa communities.

Ready Market Performance

The ready property market totaled AED 912.6 million, accounting for 36.5% of overall transactions. Key highlights include:

Flats remained dominant, making up 67.6% (AED 617.2 million), showing continued demand for immediate occupancy.

Villas followed with 13.5% (AED 123.5 million), reflecting buyer preference for established residential communities.

Hotel apartments & rooms contributed 5.3% (AED 48.3 million).

Commercial properties made up 13.6% (AED 123.6 million).

Ready flats remained the backbone of secondary market activity. Notably, commercial properties matched villas in transaction value, suggesting renewed interest in income-generating assets such as offices and retail spaces.

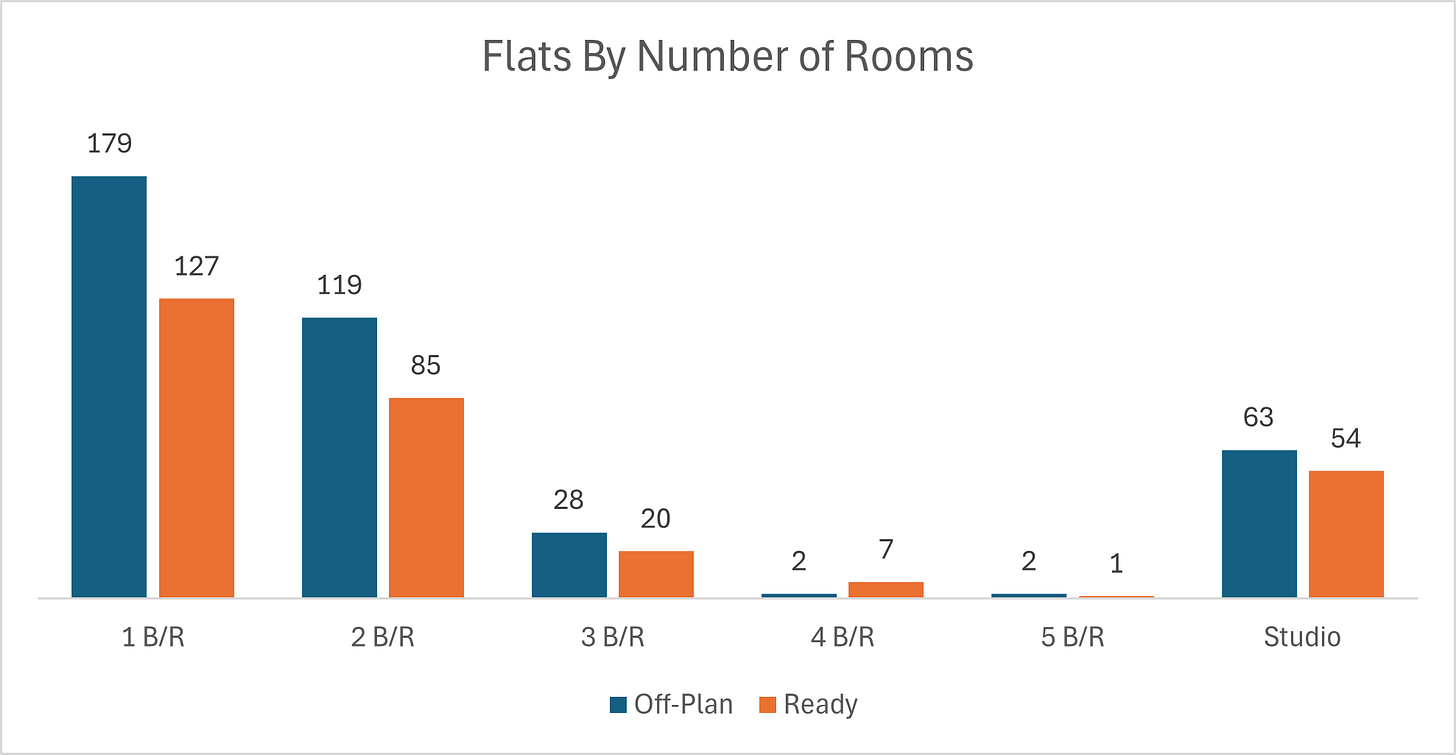

On The Micro Level

Market Insights & Outlook

Investor appetite in Dubai remains buoyant, with off-plan activity maintaining a significant lead. The high proportion of flat transactions—both off-plan and ready—points to continued confidence in residential rental yields and capital appreciation. Commercial activity, though lower in absolute terms, showed balanced interest across new and existing stock.

As summer approaches, developers may increase promotions and incentives, which could further accelerate off-plan uptake. Meanwhile, the ready market’s stability signals end-user confidence and the ongoing absorption of completed inventory.

Data Source: Dubai Land Department