Busy Isn’t a Badge. It’s a Bottleneck..

Every minute you spend on low-value work costs you opportunities you can’t get back. That is why BELAY exists: to help leaders like you get back to what matters.

Our Delegation Guide + Worksheet gives you a simple system to:

✓ Identify what to delegate

✓ Prioritize what’s costing you most

✓ Hand it off strategically

And when you’re ready, BELAY provides top-tier remote staffing solutions — U.S.-based, highly vetted, and personally matched — to help you put those hours back where they belong: fueling strategy, leadership, and growth.

Real freedom starts with a right partner.

Dubai’s 2025 property market is resilient, led by tourism and investors with off-plan dominance and record luxury sales. Large 2025–26 handovers may prompt 10–15% mid-market corrections, accelerating a flight-to-quality toward prime, branded, sustainable, well-located assets. Rentals stay supported; mixed-use and disciplined developers fare best.

Read the full article on Zawya

Dubai enters 2025/26 resilient: tourism 9.88m H1 (80.6% occupancy), off-plan 69% of Q1 deals; prices +3.7% to AED 1,749/sq ft; $2.6bn super-prime Q2. Heavy 2025–26 handovers may pressure mid-market, but “flight-to-quality” favors prime, branded, sustainable, mixed-use assets; outlook supported by global demand.

Read the full article on TTW

Mashriq Elite handed over Floareá Residence in Arjan (206 apartments), featuring a 5m-tall, 30m-wide waterfall. The developer plans over 1,200 units in two years, with projects in Discovery Gardens, Arjan, JVC, DLRC, Dubai Islands, Meydan D11 and DPC, citing strong demand, rising yields, and on-time delivery.

Read the full article on Zawya

A canal-front Business Bay plot sold for a record Dh362m, underscoring scarce prime land and strong liquidity. Area land prices rose ~16.7% YoY; median now Dh2,434/sq ft (+7.3%), with 10,682 deals (+19.4%). Investor demand, infrastructure upgrades and waterfront scarcity support further growth.

Read the full article on Khaleej Times

Azizi Zain in Al Furjan is ~35% complete, targeting Q1 2026 handover. Structural 98%, blockwork 58%, plaster 41%, MEP 19%, HVAC 18%, finishes 14%. The metro-connected project will feature modern amenities including a gym, pools, kids’ areas, landscaped spaces, BBQ areas, parking, and 24/7 security.

Read the full article on Zawya

OMNIYAT launched LUMENA ALTA: a 380 meter, 73-level ultra-luxury tower on Sheikh Zayed Road, delivering 720,000 sq ft of premium offices by 2030 (GDV > AED5bn). It will link to the Dubai Metro Gold Line, feature a five-star hotel with the world’s tallest infinity pool, and target LEED/WELL/WiredScore.

Read the full article on Economy Middle East

Dar Global began handover of DaVinci Tower, the first Pagani-branded residences on Dubai Water Canal: 80 ultra-luxury homes with custom interiors, smart systems, and Burj Khalifa views. The developer says it sets a benchmark for branded residences, reinforcing Dubai’s status for design-driven living.

Read the full article on Zawya

Best Price, Every Trade.

Want the best price on every swap? CoW Swap evaluates routes across DEXs in real time and settles the most efficient path. Tighter pricing, higher success rates, fewer reverts. Find your best price.

September 2025: Dubai VPI 230.6 (+1.4% MoM, +21.3% YoY). Villas hit 307.5 (+1.8% MoM, +26.4% YoY); apartments +1.1% MoM, +16.1% YoY. Off-plan ~80% of sales; ultra-prime surges. 42k units due in 2025 may temper mid-market; villas/luxury strong; rents seen +5–8%.

Read the full article on Economy Middle East

Dubai Land Department won the 2025 Asia Pacific Enterprise Award (Inspirational Brand) for innovation, governance and sustainable real estate. It pioneered blockchain, hosted global congresses, launched Mollak and Smart Valuation, and earned top transparency rankings and ISO certifications—advancing a transparent, efficient, investor-friendly “happy city” property ecosystem.

Read the full article on Vulcan Post

Marjan unveiled Marjan Beach in Ras Al Khaimah: an 85m sq ft, eight-neighbourhood waterfront town with a 3 km beach, 6.5m sq ft of green space, 22,000 homes and 12,000 hotel rooms for 74k residents. It supports RAK Vision 2030 with sustainable, mixed-use living and strong regional connectivity.

Read the full article on ME Construction News

Sharjah rents cooled in September after sharp YTD rises, signaling a maturing, more balanced market. Demand stays robust on value and yields, aided by family-friendly infrastructure and Dubai proximity. according to Bayut: Al Khan priciest; Al Taawun studio rents +10.7% YoY; Muwailih tops 1BR. Variations reflect location and quality.

Read the full article on Gulf News

Seeking impartial news? Meet 1440.

Every day, 3.5 million readers turn to 1440 for their factual news. We sift through 100+ sources to bring you a complete summary of politics, global events, business, and culture, all in a brief 5-minute email. Enjoy an impartial news experience.

From ultra-luxury coastal residences to smart urban communities and mixed-use destinations, these are 20 of the most notable real estate project launches that made headlines across the Middle East in September 2025

Read the full article on Construction Week Online

The Ajman real estate sector continued its strong growth in September, recording total transactions worth AED2.97bn ($809m), a 53 per cent increase compared to the same month in 2024, according to the latest report from the Department of Land and Real Estate Regulation.

Read the full article on Arabian Business

LIV Developers will deliver AED 2.3bn of homes (640 apartments) in 12 months and has >AED1.5bn in ultra-prime pipeline. LIV Marina handed over early; LIV LUX tops out, completing Dec 2026 (handover Q1 2027). LIV Maritime sold out; CRCC reappointed. Strong foreign demand; Q4-2025 beachfront island launch with wellness focus.

Read the full article on Zawya

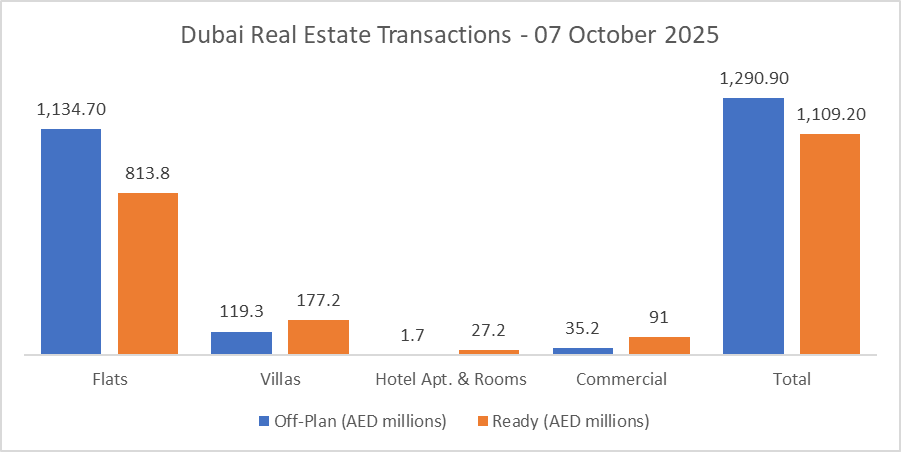

Dubai Real Estate Transactions as Reported on the 7th of October 2025

On 07-Oct-2025, the total transacted value reached AED 2,400,111,418. Off-plan dominated with AED 1,290,925,451 (53.8%), while Ready accounted for AED 1,109,185,968 (46.2%).

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 1,134.7 | 813.8 |

Villas | 119.3 | 177.2 |

Hotel Apt. & Rooms | 1.7 | 27.2 |

Commercial | 35.2 | 91.0 |

Total | 1,290.9 | 1,109.2 |

Off-Plan Market Performance

Total Value: AED 1,290,925,451

Flats: AED 1,134.7 m (87.9%)

Villas: AED 119.3 m (9.2%)

Hotel Apts & Rooms: AED 1.7 m (0.1%)

Commercial: AED 35.2 m (2.7%)

Off-plan activity was led overwhelmingly by flats, with villas a distant second and minimal hotel-apartment/commercial contribution.

Ready Market Performance

Total Value: AED 1,109,185,968

Flats: AED 813.8 m (73.4%)

Villas: AED 177.2 m (16.0%)

Hotel Apts & Rooms: AED 27.2 m (2.4%)

Commercial: AED 91.0 m (8.2%)

Ready transactions were anchored by flats, while commercial assets provided a notable secondary lift after villas.

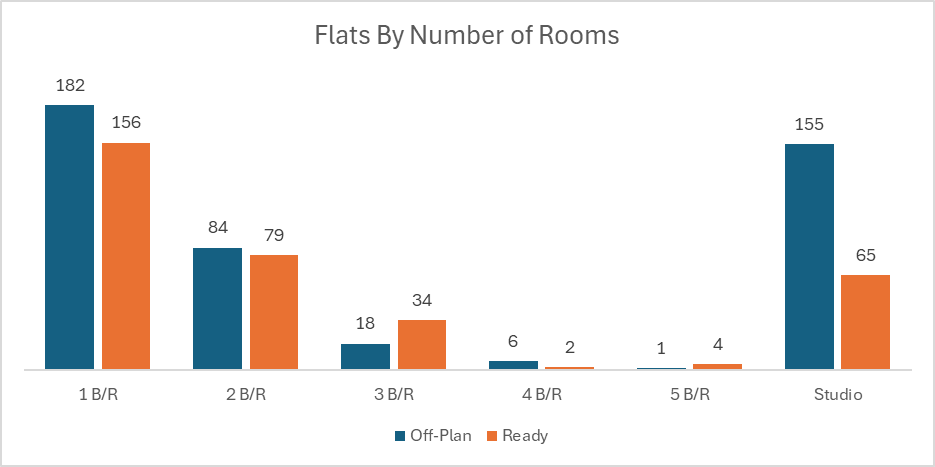

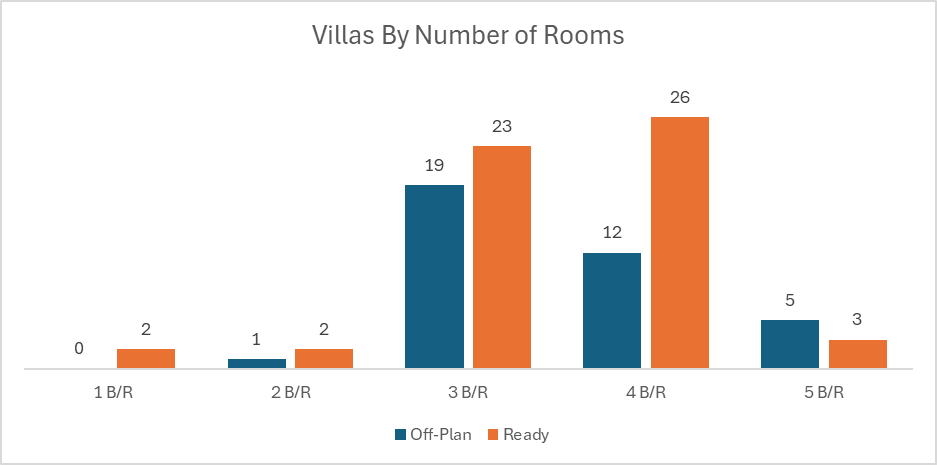

On The Micro Level

Market Insights & Outlook

A balanced split kept momentum firm: off-plan flats continue to set the pace, while ready demand remains solid, especially for flats and income-oriented commercial assets. Watch for sustained developer launches on the off-plan side and selective end-user/investor interest in ready villas and prime commercial.

Data Source: Dubai Land Department