Dubai Real Estate Market Review 09-May-2025

Dubai’s real estate market is set to double in value within five years. Emaar Development backlog crosses AED100bn. Real Estate and Construction now lead UAE graduate hiring.

Dubai Property Market Eyes Doubling in Value by 2030 Amid Strategic Growth

Dubai’s real estate market is set to double in value within five years, driven by strong demand, foreign investment, urban planning, and luxury development, despite potential global risks.

Read the full article on MSN

Can’t afford a whole property in Dubai? Buying a piece of one just got easier!

Real estate tokenisation lets UAE residents invest in Dubai property from as little as AED 500, offering secure, regulated, and fractional ownership through blockchain—making property investment accessible, transparent, and affordable for all.

Read the full article on Gulf News

Emaar Development backlog crosses AED100bn as Q1 sales jump 28% to $4.5bn

Revenue increases by 43% to $1.4bn; EBITDA grows 48% to $683mn; Net Profit before tax jumps 49% to $753mn.

Read the full article on Arabian Business

Engel & Völkers Highlights Record-Breaking April In Dubai’s Real Estate Market

Dubai’s real estate saw 17,447 residential sales in April—a 61% year-on-year surge—while commercial rents rose sharply: office rents +22.4% and warehouse rates +40.8%, reflecting strong demand, international investment, and market resilience amid global economic uncertainty.

Read the full article on Construction Business News

A.R.M. Holding, BIG announce 5 sq km Dubai masterplan at Jebel Ali

A.R.M. Holding, a UAE-based investment firm, has formed a partnership with BIG-Bjarke Ingels Group to develop a 5 sq. km. masterplan around the Jebel Ali Racecourse in Dubai.

Read the full article on Arabian Business

Union Properties slashes more debt, eyes new projects after strong Q1

In Q1 2025, Union Properties’ revenue rose 18.2% to Dh163 million and gross profit climbed 25.3% to Dh42.8 million, alongside Dh179 million in debt repayments. Supported by Dh1.3 billion in land sales, the developer has relaunched off-plan projects with Takaya and is enhancing liquidity for future launches.

Read the full article on Gulf News

Dubai Land Department recognised under ‘Best Practices – Anti-Fraud Category’ by UAE Internal Auditors Association

The Dubai Land Department won the ‘Best Practices – Anti-Fraud’ award from the UAE Internal Auditors Association for its integrated fraud risk management system, proactive use of data analytics and whistleblowing platforms, and alignment with ACFE standards—reinforcing transparency, integrity, and stakeholder trust in Dubai’s real estate sector.

Read the full article on MSN

UAE jobs: Real estate top draw for graduates - but there are surprises too

LinkedIn data shows real estate and construction now lead UAE graduate hiring, with equipment rental also offering entry roles. Despite 76% of HR pros seeing more applications, tech, government admin, and support services remain strong. Fastest-growing roles include AI engineers, planning engineers, and full-stack engineers.

Read the full article on Gulf News

New Dubai airport expansion to drive a million jobs and housing

Contracts worth Dh1.075 billion—including Dh1 billion for a second runway and Dh75 million for enabling works—have been awarded for Al Maktoum Airport’s $35 billion expansion. Phase 1, due by 2032, will boost capacity to 150 million passengers, create up to one million jobs, and feature AI-driven, robotics-enabled borderless processing.

Read the full article on The National

Abu Dhabi property prices to surge following Disney theme park announcement

Disneyland ‘a gamechanger for Abu Dhabi,’ says real estate expert as Yas Island and surrounding areas are expected to see a rise in property prices.

Read the full article on Arabian Business

Ohana Development Partners with Jacob & Co. to Launch AED 4.7 Billion Beachfront Living Project in Al Jurf

Ohana Development and Jacob & Co. launch a AED 4.7 billion beachfront project in Al Jurf featuring branded villas, apartments, and mansions within a natural reserve, plus exclusive amenities like a beach club, cigar lounge, and wellness center. Completion is set for Q2 2028.

Read the full article on ABC

Ras Al Khaimah real estate: RAK Properties reports $101m Q1 revenue amid record sales

Ras Al Khaimah real estate developer RAK Properties reported revenue of AED370m ($101m) in Q1 2025, reflecting an increase of 28 per cent compared to the same period in 2024.

Read the full article on Arabian Business

Dubai Real Estate Transactions as Reported on the 8th of May 2025

On 8 May 2025, the Dubai real estate market recorded a total transaction value of AED 2.04 billion, driven predominantly by off-plan activity. Off-plan transactions accounted for AED 1.25 billion, contributing 61.1% of the day’s total. Ready property transactions followed with AED 796 million, representing the remaining 38.9%. This continues the trend of strong developer-led sales, as investor interest remains high in off-plan opportunities.

Off-Plan Market Performance

The off-plan segment recorded AED 1.25 billion in total sales, securing the majority share (61.1%) of the day’s transactions. Within this category:

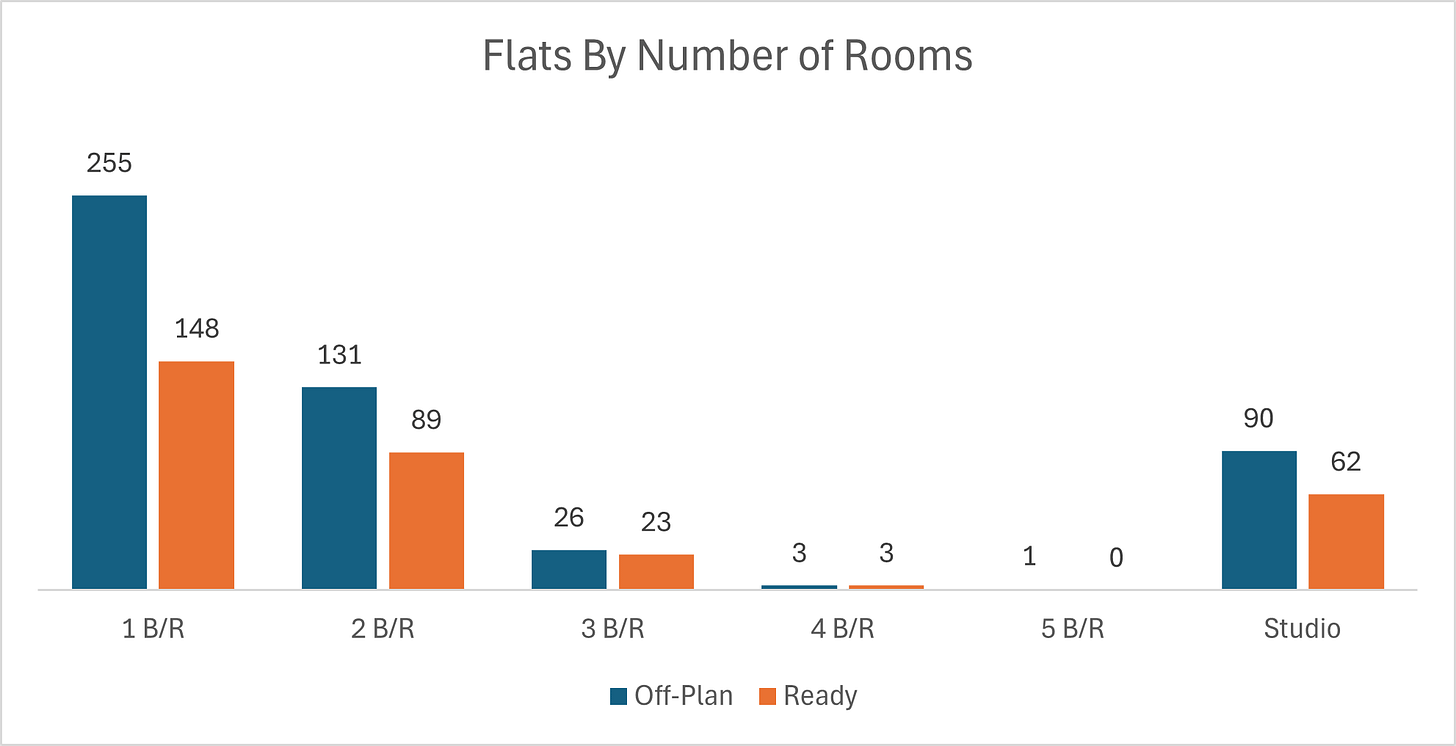

Flats led the market, contributing 89.2% (AED 1,114.9 million) to the off-plan segment.

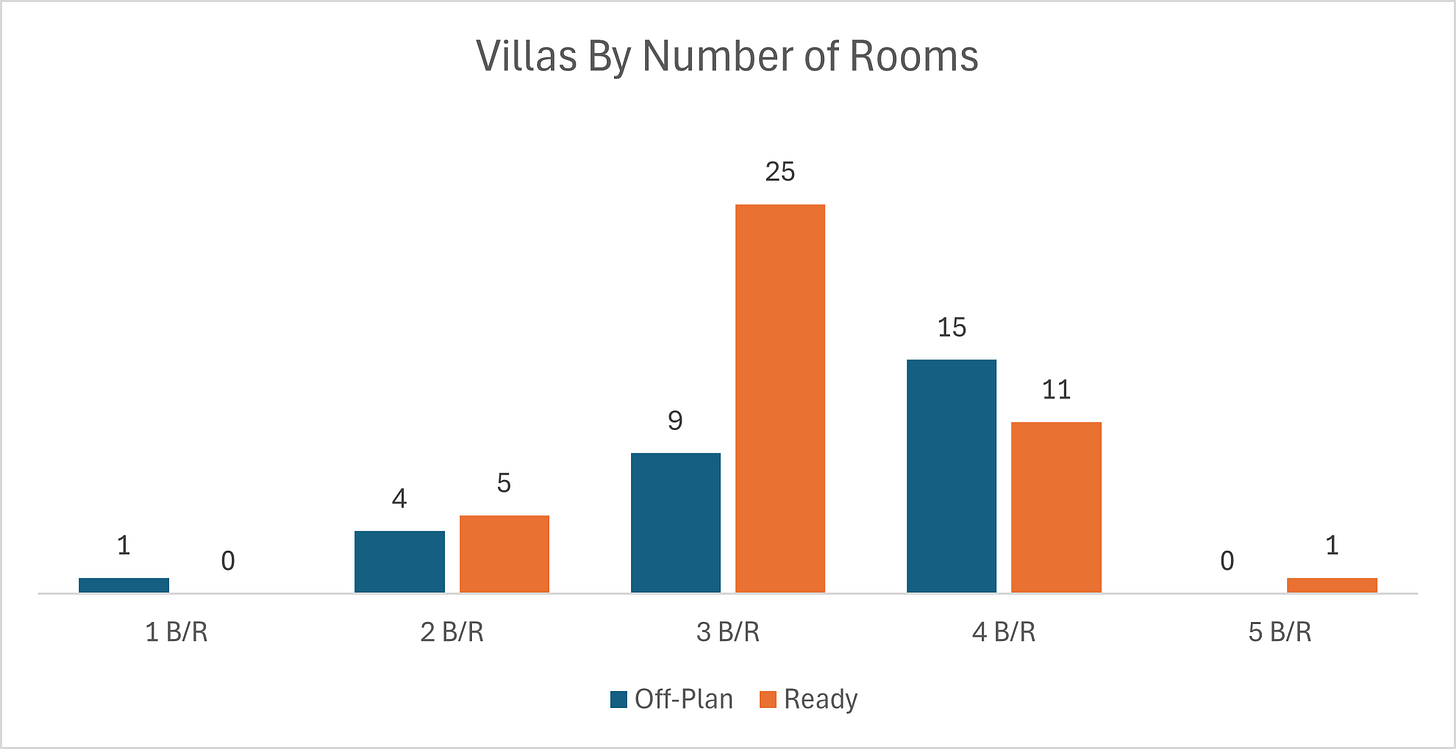

Villas accounted for 8.5% (AED 105.5 million), reflecting high activity in the family homes.

Commercial properties made up 0.3% (AED 4.2 million), indicating continued interest in business-oriented investments.

Hotel apartments & rooms represented 1.9% (AED 24.2 million), showing niche investment appeal in hospitality assets.

Off-plan flats continue to dominate this segment, comprising nearly 90% of all off-plan activity. The strength in off-plan villa sales also highlights sustained interest in suburban and branded villa communities.

Ready Market Performance

The ready property market totaled AED 796 million, accounting for 38.9% of overall transactions. Key highlights include:

Flats remained dominant, making up 62.9% (AED 500.4 million), showing continued demand for immediate occupancy.

Villas followed with 14.6% (AED 116.0 million), reflecting buyer preference for established residential communities.

Hotel apartments & rooms contributed 9.1% (AED 72.6 million).

Commercial properties made up 8.8% (AED 70.4 million).

Ready flats remained the backbone of secondary market activity. Villas remain strong, reflecting the interest in family living and larger spaces.

On The Micro Level

Market Insights & Outlook

Flats dominate both off-plan (89.2%) and ready (62.9%) segments, reflecting sustained demand for apartment living.

Villas and hospitality units are gaining traction in the ready market (combined 23.7%), signalling growing interest in higher-end lifestyles and tourism-linked assets.

Commercial volumes remain modest, particularly off-plan (0.3%), suggesting developers are prioritising residential launches.

Outlook: With off-plan accounting for over 60% of activity, developers may continue focusing on new residential supply, while mature ready communities could see steady absorption—especially in mixed-use and hospitality-oriented projects.

Data Source: Dubai Land Department