The UAE real estate sector is booming and tech-driven, set to grow from AED 302.65bn in 2024 to AED 486.2bn by 2030. Rising investor demand, supportive policies, and PropTech tools like AR/VR are reshaping how projects are designed, marketed, and sold.

Read the full article on MENA FN

Nakheel has awarded a AED 400m contract to Shapoorji Pallonji Mideast to build 38 ultra-luxury Crown Garden Villas on Palm Jumeirah, offering five- and six-bedroom waterfront homes with private beach access, resort-style amenities, and contemporary indoor–outdoor design.

Read the full article on Zawya

Tomorrow World Group has announced a self-funded Dh8 billion development pipeline for 20+ luxury waterfront and commercial projects between 2026–2028, aligning with Dubai’s 2040 plan. The move rides record 2025 sales and strong demand for high-end, lifestyle-led communities amid rising prices and limited premium supply.

Read the full article on Khaleej Times

The Dubai real estate sector recorded AED10.7bn ($2.9bn) of transactions last week, according to data from the Land Department.

Read the full article on Arabian Business

Sheikh Maktoum reviewed Wasl Group’s 2025 performance, praising real estate’s role in Dubai’s economy and competitiveness. He urged Wasl to deliver innovative, high-quality projects, expand affordable housing beyond its current 45,000 units, advance digital transformation, and support D33 and Dubai 2040 goals of a top-three global urban economy.

Read the full article on Emirates 24/7

DHG Properties has launched Helvetia Marine, a new premium residential development on Dubai Islands, strengthening the Swiss developer’s growing footprint in the UAE market.

Read the full article on Arabian Business

A new report says about 54% of Dubai’s property deals in H2 2025 were cash-based, insulating the market from global rate swings. With easing borrowing costs, strong regulation, digital systems, and rising institutional interest, Dubai is set for disciplined, confidence-led growth rather than speculative, leverage-driven cycles.

Read the full article on Zawya

The development comprises 157 four and five bedroom villas in a gated neighbourhood anchored by a clubhouse with a rooftop infinity pool.

Read the full article on Arabian Business

Ras Al Khaimah is emerging as a major investment hotspot, with freehold prices up 14.9% YoY, off-plan sales forming 84% of Dh9.1bn deals, solid 5.4% rental yields, and rising FDI and company formations supporting strong forecast GDP growth.

Read the full article on Gulf News

The UAE property market is expected to end 2025 at record highs but enters 2026 in a more balanced phase, with strong population and wealth inflows, rising supply and moderating rents. Dubai moves toward equilibrium, Abu Dhabi strengthens, and the Northern Emirates surge, pointing to a soft landing and sustained, disciplined growth.

Read the full article on Khaleej Times

Azizi Developments says Beachfront I at Azizi Riviera in MBR City is 94% complete. The three-tower, 555-unit lagoon-front project with extensive amenities is on track for year-end delivery, with most structural, MEP, façade and finishing works nearly done.

Read the full article on Trade Arabia

Abu Dhabi is set for one of the biggest real estate expansions in its history as Mubadala Investment Company and Aldar announce a landmark joint venture to develop the final major landbank on Al Maryah Island with a gross value of more than AED60 billion.

Read the full article on Arabian Business

Sheikh Hamdan approved policies to reshape Dubai’s residential planning and digital infrastructure, including family-centric community models, a Digital Resilience Policy and the 2026 Executive Council Agenda. Plans add parks, green corridors, walking and cycling paths, and key services in Madinat Latifa and Al Yalayis, advancing Dubai Urban Plan 2040.

Read the full article on Trade Arabia

The AED1.2 billion development will be delivered by Royal Development Holding in collaboration with Radisson Hotel Group, adding to the capital’s growing branded residential pipeline

Read the full article on Arabian Business

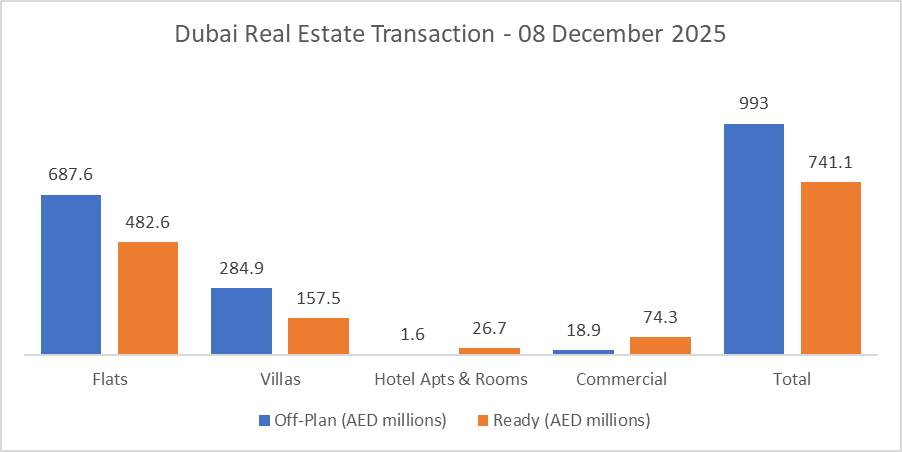

Dubai Real Estate Transactions as Reported on the 8th of December 2025

On the 08-Dec-2025, the total transacted value reached AED 1,734,064,726. Off-plan dominated with AED 992,993,024 (57.3%), while Ready accounted for AED 741,071,701 (42.7%).

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 687.6 | 482.6 |

Villas | 284.9 | 157.5 |

Hotel Apts & Rooms | 1.6 | 26.7 |

Commercial | 18.9 | 74.3 |

Total | 993.0 | 741.1 |

Off-Plan Market Performance

Total Value: AED 993 million (57.3% of daily total)

Flats: AED 687,561,900 (69.2% of Off-Plan)

Villas: AED 284,914,153 (28.7% of Off-Plan)

Hotel Apts & Rooms: AED 1,611,650 (0.2% of Off-Plan)

Commercial: AED 18,905,321 (1.9% of Off-Plan)

Off-plan activity was clearly apartment-led, with nearly seven out of every ten dirhams flowing into flats, while villas captured a strong secondary share. Commercial and hospitality assets remained a very small, more specialised slice of the off-plan market for the day.

Ready Market Performance

Total Value: AED 741 million (42.7% of daily total)

Flats: AED 482,600,872 (65.1% of Ready)

Villas: AED 157,523,697 (21.3% of Ready)

Hotel Apts & Rooms: AED 26,665,000 (3.6% of Ready)

Commercial: AED 74,282,132 (10.0% of Ready)

In the ready segment, end-user and investor demand continued to concentrate on completed flats, with more than two-thirds of ready value split between apartments and villas. Ready commercial and hospitality assets together contributed just over 13% of the day’s ready transactions, reflecting selective but healthy demand for income-generating stock.

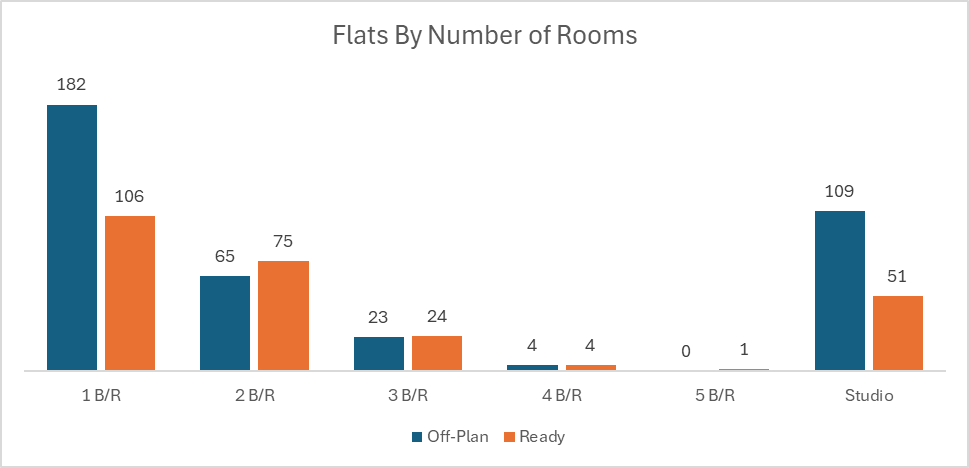

On The Micro Level

Market Insights & Outlook

The 08-Dec-2025 figures show a balanced but off-plan–tilted market, with strong appetite for future-ready apartments and villas complemented by solid trading in completed homes. The relatively modest role of commercial and hospitality deals suggests investors remain focused on core residential exposure, while the near 60/40 split between off-plan and ready points to a market that is still in an expansionary yet broadly orderly phase.

Data Source: Dubai Land Department