You’ve Hit Capacity. Now What?

You built your business by saying yes to everything. Every detail. Every deadline. Every late night.

But now? You’re leading less and managing more.

BELAY’s eBook Delegate to Elevate pulls from over a decade of experience helping thousands of founders and executives hand off work — without losing control. Learn how top leaders reclaim their time, ditch the burnout, and step back into the role only they can fill: visionary.

It’s not just about scaling. It’s about getting back to leading.

The ceiling you’re feeling? Optional.

Dubai Islands, five man-made islands near Deira, are emerging as a resort-style residential hub with beaches, marinas, and villas/townhouses/apartments. Prices: 1BRs ~AED 1.5–2M, townhouses AED 4–6M, villas from AED 8M with 60/40 or 70/30 plans. Targets families, waterfront seekers, investors; early phase suggests appreciation and rental potential.

Read the full article on BBN Times

Mira Developments plans a Dh55bn “small city” between Abu Dhabi and Dubai: 14,000 apartments, 1,700 villas, 1,000 townhouses, mall, offices, hospital, schools, universities, hotels and golf course. Funded via equity and Swiss partners; Dh2.47bn Al Mamoura land secured. Construction within 12 months; completion by 2035.

Read the full article on The National

Dubai Islands recorded AED6.1bn ($1.66bn) in property sales during the first half of 2025, confirming its status as one of Dubai’s fastest-growing waterfront destinations and a key contributor to the emirate’s record-breaking real estate performance.

Read the full article on Arabian Business

Vincitore Realty unveiled Vincitore Wellness Estate in Majan, Dubai, touted as the world’s largest designer wellness residential tower and the GCC’s first certified wellness homes. It offers 65+ wellness amenities across 200,000 sq ft, health-focused features, and flexible payment plans, including construction-linked post-handover and 8% ROI options.

Read the full article on Zawya

Swap Without MEV

Protect your swaps from MEV. CoW Swap stops bots from jumping your order, reducing slippage and failed transactions. Keep more of what you trade with execution you can trust. Trade smarter.

Object 1 launched ELAR1S Sky (43 floors, 402 units) and ELAR1S Rise (24 floors, 198 units) in JVT District 3, unveiled at Atlantis The Royal. With pools, gyms, gardens and smart homes, handover is in 2028. JVT rents rose 20%, yields 6–8%, transactions up 62% in early 2025.

Read the full article on Zawya

The Middle East and North Africa (MENA) region has taken the lead in worldwide branded residential development, accounting for 36 per cent of new global signings, more than any other region.

Read the full article on Arabian Business

Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

Takmeel Developments launched Divine Al Barari in Majan: a US$109m, 291-home project (studios to 3BRs, duplex penthouses) with private balcony pools and 30+ wellness amenities. Strategically located near major highways, it targets Q2 2028 handover. Takmeel also teased a US$408m, 650,000-sq-ft pipeline for 2026.

Read the full article on ME Construction News

NewGenIvf (NASDAQ:NIVF) formed a JV with BNW to develop a Ras Al Khaimah Beach District project. NewGen holds 60%, funds 36% of land; BNW covers construction. Target completion 2028, projected $67m net (272% ROI) on 527,753 sq ft at ~$817/sq ft. Move diversifies amid weak finances.

Read the full article on investing.com

Bada Al Jubail is an ultra-exclusive enclave on Abu Dhabi’s Jubail Island, offering private-beach waterfront mansions amid mangroves, marinas, and elite amenities. Aimed at UHNW families, it blends seclusion with city access, architectural excellence, and multigenerational value, uniting rarity, nature-led living, and long-term investment appeal.

Read the full article on Yahoo Finance

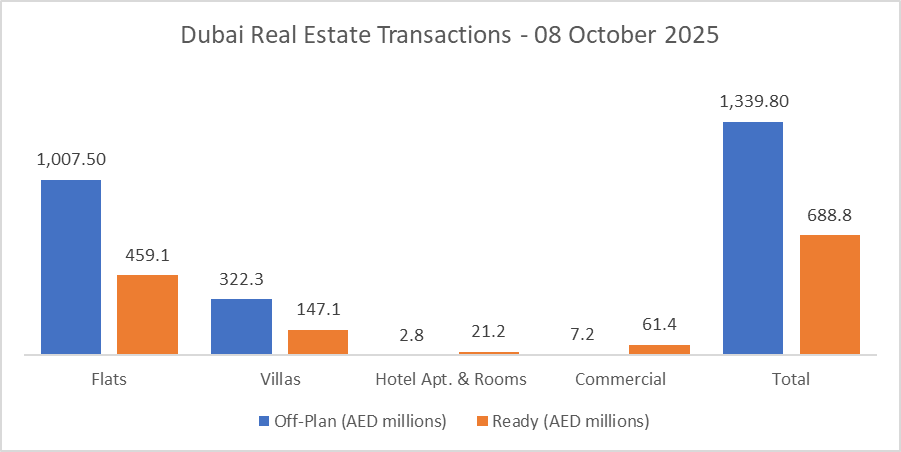

Dubai Real Estate Transactions as Reported on the 8th of October 2025

On 08-Oct-2025, the total transacted value reached AED 2,028,606,857. Off-plan dominated with AED 1,339,781,699 (66.0%), while Ready accounted for AED 688,825,158 (34.0%).

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 1,007.5 | 459.1 |

Villas | 322.3 | 147.1 |

Hotel Apt. & Rooms | 2.8 | 21.2 |

Commercial | 7.2 | 61.4 |

Total | 1,339.8 | 688.8 |

Off-Plan Market Performance

Total Value: AED 1,339,781,699

Flats: AED 1,007,475,011 (75.2%)

Villas: AED 322,310,368 (24.1%)

Hotel Apts & Rooms: AED 2,785,330 (0.2%)

Commercial: AED 7,210,990 (0.5%)

Off-plan activity was led by flats, with villas providing a solid secondary lift; other segments were marginal.

Ready Market Performance

Total Value: AED 688,825,158

Flats: AED 459,081,707 (66.6%)

Villas: AED 147,129,917 (21.4%)

Hotel Apts & Rooms: AED 21,211,061 (3.1%)

Commercial: AED 61,402,473 (8.9%)

Ready sales were driven by flats, villas contributed more than 20%, while commercial contributed nearly one-tenth, signalling healthy end-user and business demand.

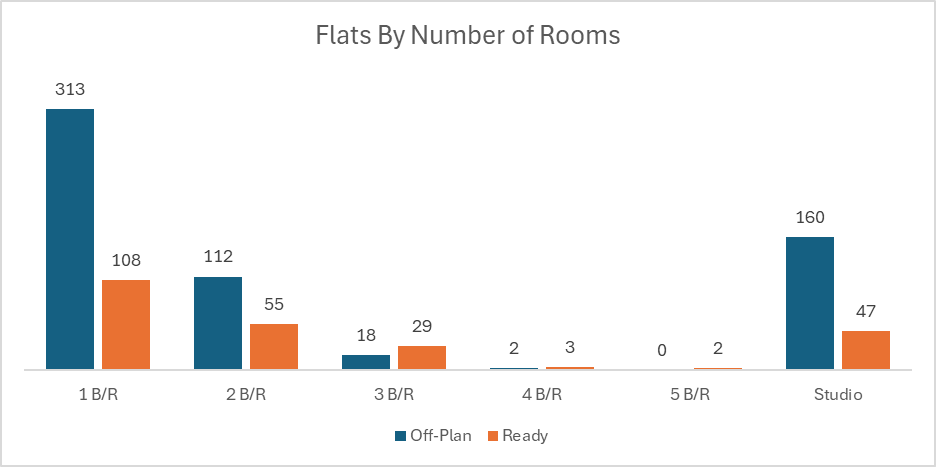

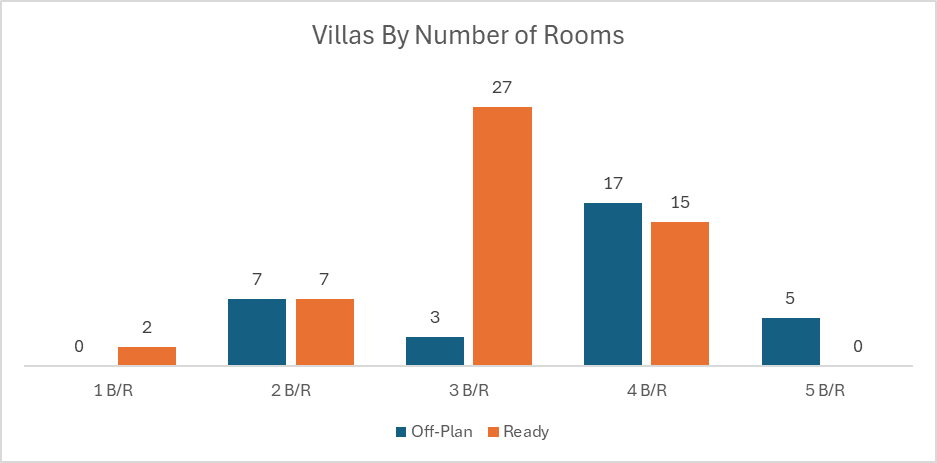

On The Micro Level

Market Insights & Outlook

A two-thirds off-plan share indicates sustained appetite for pipeline projects, while resilient ready transactions, especially flats, reflect consistent end-user demand. The commercial uptick within ready supports confidence in occupier activity; near-term momentum should remain stable barring major launch or macro surprises.

Data Source: Dubai Land Departement