|

|

Do You Want To Be Featured As An Area Expert? Click Here |

|

AboutTheUAE is your definitive guide to Dubai – discover top Real Estate, schools, visa requirements, housing insights, transport tips, shopping hotspots, entertainment and more. |

Dubai’s property market is facing a shift as new digital platforms allowing direct buyer-seller connections threaten to make traditional real estate brokers obsolete, experts told Arabian Business.

Read the full article on Arabian Business

From January 2026, Saudi Arabia will allow foreign individuals and companies to purchase property in approved zones (e.g., Riyadh, Jeddah), with special restrictions for holy cities, as part of Vision 2030. Detailed rules and locations will be published on the Istitaa platform for public feedback.

Read the full article on Gulf News

Russians, British, Indians and other Europeans are leading buyers of Dubai luxury properties worth Dh20 million+, with transactions up 110% year-on-year and 70% from H2 2024. Dirham weakness, migration and tax shifts drive demand. UAE expects 9,800 millionaires in 2025, attracting Dh231 billion; Emirates Hills tops sales.

Read the full article on Khaleej Times

Egyptian proptech leader Nawy has acquired a majority stake in Dubai’s fractional investment platform SmartCrowd, marking its GCC debut after a $52 million Series A. The deal broadens Nawy’s full-stack real estate offerings across MENA, following its ROA acquisition.

Read the full article on The Condia

Centurion Properties has signed an MoU with China’s CITIC Construction to co-develop over 10 million sq ft of luxury residential and commercial projects across Dubai, worth Dh10.5 billion, with construction set to begin in Q3 2025, combining local expertise and global engineering prowess.

Read the full article on Khaleej Times

Sharjah’s Real Estate Registration Department relaunched its portal, enabling developers to register projects, certify sales contracts and form homeowners’ associations. Investors can manage association registrations, fee declarations and complaints. Government users access ownership reports; individuals handle title deeds, valuations and data updates. Banks gain mortgage registration and amendment services.

Read the full article on Gulf News

Villa prices led Dubai’s H1 2025 rally, rising over 10 percent in Dubailand and up to 11 percent across affordable segments. Apartment prices climbed up to 7 percent (affordable) and 4 percent (luxury). Demand remains strong but price growth is stabilizing.

Read the full article on Khaleej Times

Dubai South Properties has sold out the first two phases of its Hayat by Dubai South community within hours of launch, generating sales that exceeded AED 1.2 billion.

Read the full article on Arabian Business

A Dh150 million seven-bedroom mansion in Dubai Hills sold near asking price, underscoring the estate’s ultra-luxury appeal. From January to May 2025, villa transactions rose 12.2% while prices jumped 14.1%, highlighting Dubai Hills Estate’s draw for HNW/UHNW investors.

Read the full article on Khaleej Times

Dubai Real Estate Transactions as Reported on the 9th of July 2025

On 09 July 2025, Dubai’s total real estate transaction value reached AED 2.309 billion. Off-plan properties accounted for 72.6% (AED 1.677 billion), while ready assets contributed 27.4% (AED 632.2 million) of the total volume.

Category | Off-Plan (AED million) | Ready (AED million) |

|---|---|---|

Flats | 1,529.1 | 453.7 |

Villas | 54.0 | 103.5 |

Hotel Apt. & Rooms | 22.3 | 32.7 |

Commercial | 71.8 | 42.2 |

Total | 1,677.2 | 632.2 |

Off-Plan Market Performance

Total Value: AED 1.677 billion

Share of Total Transactions: 72.6%

Subcategory | Value (AED) | % of Off-Plan |

|---|---|---|

Flats | 1,529,069,081 | 91.2% |

Villas | 53,999,908 | 3.2% |

Hotel Apartments & Rooms | 22,294,176 | 1.3% |

Commercial | 71,846,214 | 4.3% |

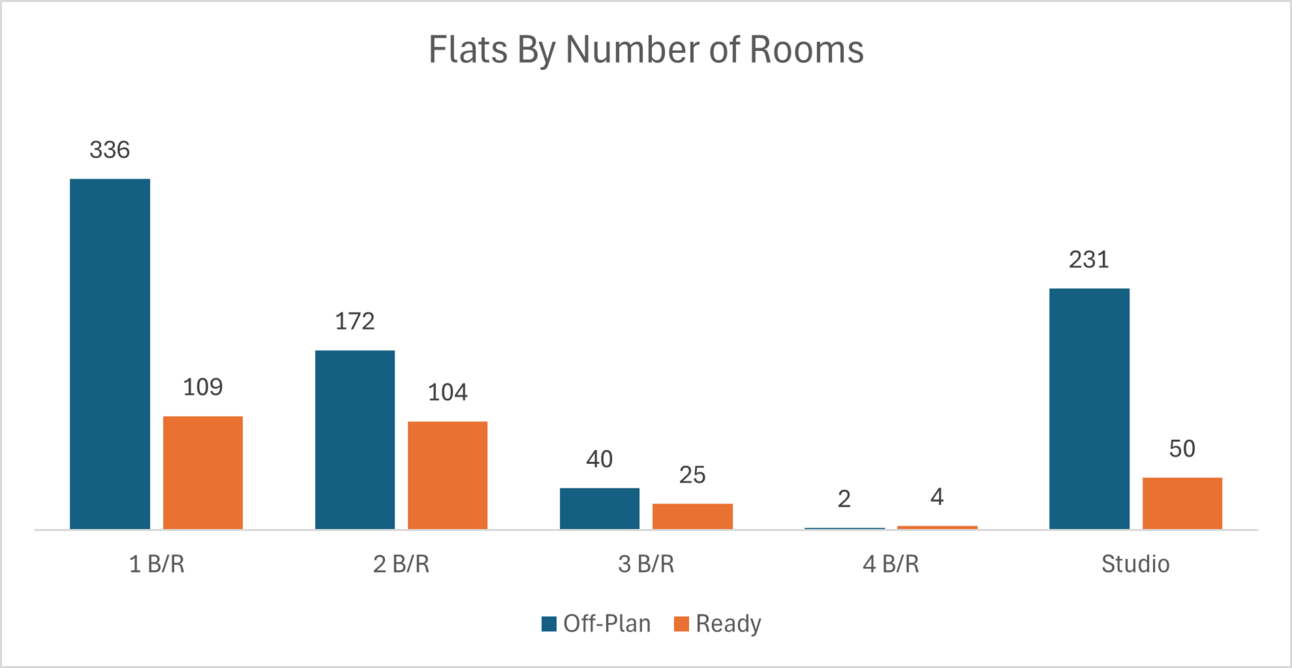

Flats overwhelmingly dominated the off-plan segment, comprising over nine-tenths of its value.

Ready Market Performance

Total Value: AED 632.2 million

Share of Total Transactions: 27.4%

Subcategory | Value (AED) | % of Ready |

|---|---|---|

Flats | 453,745,734 | 71.8% |

Villas | 103,465,990 | 16.4% |

Hotel Apartments & Rooms | 32,732,889 | 5.2% |

Commercial | 42,241,824 | 6.7% |

Flats led the ready sector as well, accounting for nearly three-quarters of its value.

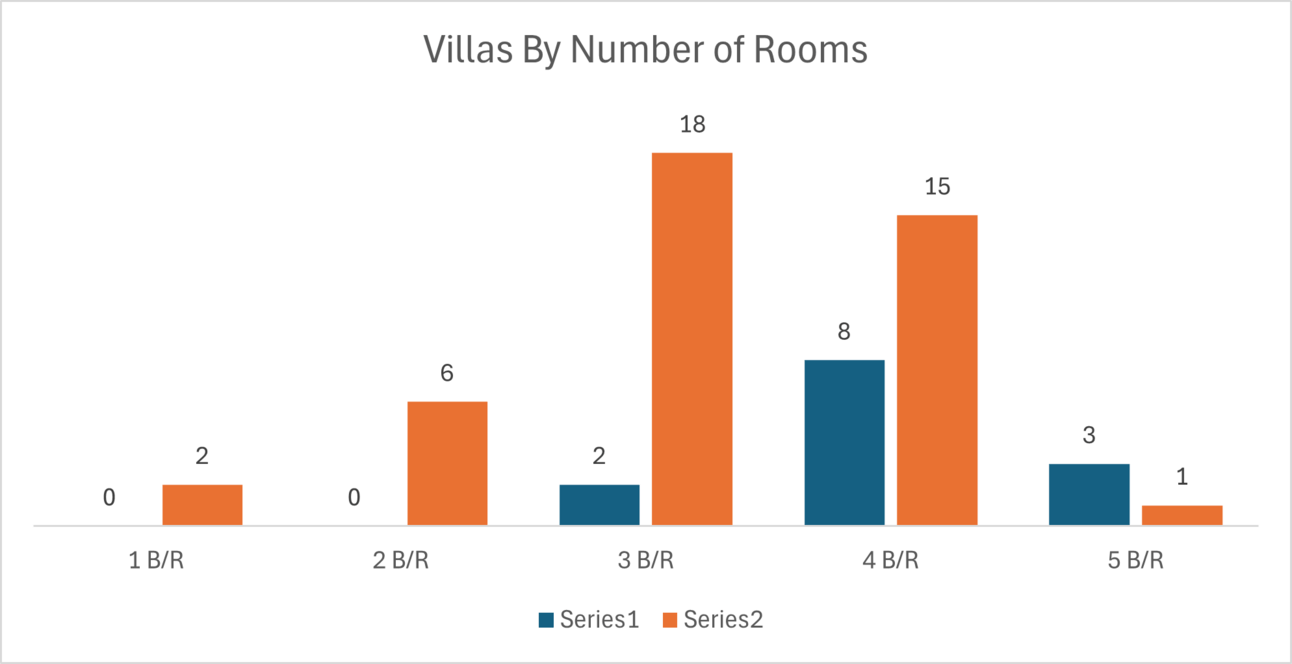

On The Micro Level

Market Insights

Strong demand for flats continues to drive both off-plan and ready-market activity, reflecting investor confidence in Dubai’s residential offerings. The pronounced off-plan dominance suggests developers should prioritize new flat launches, while niche villa and commercial projects can cater to growing diversification needs. As both segments perform robustly, the market outlook remains buoyant, with opportunities for balanced growth across asset classes.

Data Source: Dubai Land Department