What Happens When $4.7T in Real Estate Debt Comes Due?

A wave of properties hit the market for up to 40% less than recent values. AARE is buying these income-producing buildings at a discount for its new REIT, which plans to pay at least 90% of its income to investors. And you can be one of them.

This is a paid advertisement for AARE Regulation CF offering. Please read the offering circular at https://invest.aare.com/

Meraas awarded Al Sahel Contracting an AED 340 million contract to build Riwa at Madinat Jumeirah Living, three 10-storey buildings with 244 premium apartments, scheduled for completion in Q3 2027, reinforcing their long-term partnership and emphasizing high-quality, design-led, community-focused urban living.

Read the full article on Zawya

Dubai Land Department (DLD), in collaboration with Dubai Holding Community Management, has approved the first-ever fixed three-year service fees for the Palm Jumeirah Master community.

Read the full article on Arabian Business

Dubai’s residential market stayed strong in November 2025, with 19,019 sales worth AED64.7bn, up 30% in volume and 50% in value year-on-year. Off-plan led activity; apartment prices rose 14% and villas 30.7% annually, with higher rents and solid yields, and momentum expected to continue into 2026.

Read the full article on Economy Middle East

MANSORY Residences by Amaal is a 60-storey, ultra-luxury, car-inspired tower in Meydan Horizon with bespoke interiors, extensive lifestyle amenities, and smart-home tech. Backed by strong demand, it combines branded living, design-led luxury, sustainability, and an innovative tokenized ownership model to widen access to prime Dubai real estate.

Read the full article on Gulf Today

The Dubai residential real estate market entered a new phase of maturity in 2025, shaped by end-user decision making, globally diverse investor activity and a clear shift toward community-led priorities, according to Banke International Properties’ year-end analysis.

Read the full article on Arabian Business

Dar Global has appointed Edrafor Emirates for enabling and foundation works on the $1bn, 80-floor Trump International Hotel & Tower on Sheikh Zayed Road, due 2030–31. The 574-unit tower will feature Dubai’s highest outdoor pool. Dar Global also recently awarded Trump Tower Jeddah’s $531m main contract.

Read the full article on Zawya

BEYOND Developments has launched SIORA, a 2M sq ft Japanese garden–inspired beachfront masterplan on Dubai Islands, with 2.7M sq ft GFA and over 70% open green space. The pedestrian coastal district emphasizes wellbeing, sustainability, and artful placemaking, reinforcing BEYOND’s AED10bn, design-led growth across Dubai’s coastline.

Read the full article on Zawya

Dubai Islands touted as the ‘new Palm’ as wealthy buyers snap up trophy waterfront homes – developer

Buyers from Europe and the Americas turn to Dubai Islands as island living becomes the city’s most sought-after trophy asset, says Ishan Khwaja of LIV Developers.

Read the full article on Arabian Business

The UAE has launched a fully digital “Release of Property Mortgage After Settlement” service for housing programme beneficiaries, cutting steps, documents, and visits to zero and reducing processing time to one day. Piloted in Ajman, it supports family stability and the We the UAE 2031 digital-government vision.

Read the full article on Zawya

SAAS Properties, the exclusive real estate partner of Abu Dhabi Finance Week 2025, unveiled The Ritz-Carlton Residences on Al Maryah Island. In partnership with Marriott, it expands SAAS’s branded luxury portfolio and opens expressions of interest for high-end buyers and investors.

Read the full article on ADGM

Abu Dhabi developer Modon sold out Bashayer, its first waterfront community on Hudayriyat Island, within a day, generating AED3 billion in sales. The gated project includes 157 villas and 330 premium apartments, underscoring surging demand for the island’s lifestyle-focused communities.

Read the full article on Zawya

Tiger Properties has launched “Tiger Downtown Ajman,” a $10bn, 4.27m sq m fully integrated waterfront city in Aaliya, Ajman, featuring diverse furnished units, 25+ lifestyle amenities, and a lagoon, with phase one completing in 2028 and ownership open to all nationalities.

Read the full article on Gulf Today

Dubai Real Estate Transactions as Reported on the 10th of December 2025

On the 10 December 2025, the total transacted value reached AED 2,187,368,147. Off-plan dominated with AED 1,453,206,680 (66.4%), while Ready accounted for AED 734,161,467 (33.6%).

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 1,162.7 | 515.2 |

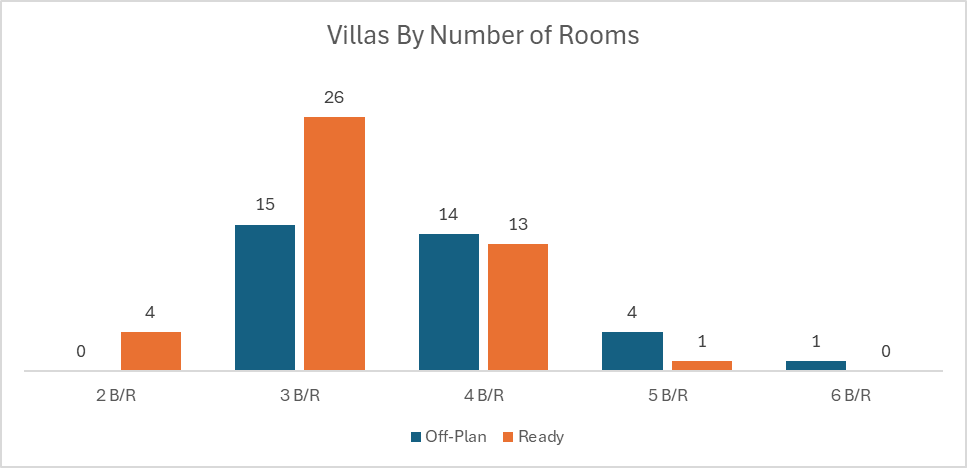

Villas | 179.9 | 152.0 |

Hotel Apts & Rooms | 2.1 | 30.1 |

Commercial | 108.5 | 36.9 |

Total | 1,453.2 | 734.2 |

Off-Plan Market Performance

Total Value: AED 1,453,206,680 (66.4% of daily total)

Flats: AED 1,162,733,790 (80.0%)

Villas: AED 179,890,630 (12.4%)

Hotel Apts & Rooms: AED 2,103,300 (0.1%)

Commercial: AED 108,478,960 (7.5%)

Off-plan activity was heavily concentrated in flats, which captured four-fifths of new project value, with villas and commercial units adding depth to the development pipeline.

Ready Market Performance

Total Value: AED 734,161,467 (33.6% of daily total)

Flats: AED 515,183,191 (70.2%)

Villas: AED 151,964,524 (20.7%)

Hotel Apts & Rooms: AED 30,080,687 (4.1%)

Commercial: AED 36,933,066 (5.0%)

The ready market was similarly led by apartments, while villas maintained a strong share, signalling sustained end-user and investor demand for move-in-ready residential communities.

On The Micro Level

Market Insights & Outlook

The day’s transactions confirm a market still firmly led by off-plan launches, yet underpinned by a healthy flow of ready deals. Apartments dominate both segments, reflecting their role as the core liquidity engine of Dubai’s property market, while villas continue to attract lifestyle-driven and long-term buyers, supporting a balanced and resilient outlook.

Data Source: Dubai Land Department