Dubai’s off-plan resale market is slowing as most owners hold for higher returns; only 10–20% are reselling, Cavendish Maxwell says. Despite slight recent price easing, 2025 hit records (200k+ deals, Dh541.5bn). With more supply coming, 2026 may normalise and hinge on absorption and sentiment.

Read the full article on Khaleej Times

Dubai-based artificial intelligence startup Smart Bricks has raised $5 million in a pre-seed funding round led by Andreessen Horowitz, as investors look to back technology aimed at automating and speeding up global real estate investment decisions.

Read the full article on Arabian Business

Sheikh Mohammed bin Rashid Al Maktoum, Vice President and Prime Minister of the UAE and Ruler of Dubai, approved the Al Layan Oasis development project, a new environmental and recreational destination designed to showcase the desert environment while enhancing sustainability and quality of life.

Read the full article on Arabian Business

Moody’s expects UAE property growth to cool over the next 12–18 months as new supply comes online, with possible modest apartment price declines. Big developers and banks should handle a moderate slowdown thanks to strong backlogs, balance sheets, and regulatory buffers. Smaller developers face higher funding and execution risks.

Read the full article on The National

Dubai’s branded residences boomed in 2025: 34 new projects added 8,607 units, reaching 166 projects and 51,692 units. Transaction value jumped 38% to AED79.1bn while volume rose 2.1%. Off-plan dominated (82%). Trophy deals (AED100m+) doubled to 22, including a AED550m Bugatti penthouse sale. Prices rose ~15%.

Read the full article on Economy Middle East

Ellington Properties launched The Meriva Collection on Dubai Islands (Island B), its first hospitality-led beachfront project. It includes five residential buildings, a signature beachfront residence, and a hotel with direct beach access, plus extensive wellness and social amenities. Betterhomes says Dubai Islands saw AED6.1bn sales in H1 2025.

Read the full article on Zawya

Aldar launched Baccarat Residences Saadiyat, a 77-home luxury project in Abu Dhabi’s Saadiyat Cultural District overlooking Louvre Abu Dhabi and the future Guggenheim. Prices aren’t final but demand is high. Designed by Japanese architect Sou Fujimoto, it features two buildings inspired by Saadiyat’s shoreline.

Read the full article on Khaleej Times

Dubai developer Binghatti Holding has raised $500 million through a five-year sukuk, as it aims to expand its development pipeline. The issuance was oversubscribed 4.4 times, attracting demand of $2.5 billion, it said in a statement. International investors accounted for half of the order book. The sukuk, part of the developer’s $1.5 billion debt-raising programme, was priced at a profit rate of 8.375 percent, or 461 basis points over the five-year US treasury yield.

Read the full article on Arabian Gulf Business Insight

NORD Real Estate Development launched NOVAYAS on Yas Island, a ~$81.7m project with 96 homes and retail space near major attractions and the planned Disneyland site. The development features contemporary design, balconies and glazing, landscaped access, and amenities like pools, gym, outdoor cinema, kids’ areas, and EV charging.

Read the full article on Middle East Construction News

AGN Skyline Developers launched Casa Aura in Dubai South, starting construction before sales to boost buyer confidence. The five-storey project offers smart-home apartments with European finishes, extensive amenities, and strong connectivity near Al Maktoum Airport and Expo City. A construction-linked plan spans 20 months, with 40% due on completion.

Read the full article on Gulf News

Dubai Real Estate Transactions as Reported on the 10th of February 2026

On the 10-Feb-2026, the total transacted value reached AED 2.18bn. Off-plan dominated with AED 1.52bn (69.9%), while Ready accounted for AED 0.66bn (30.1%).

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 1,106.2 | 479.7 |

Villas | 291.4 | 116.7 |

Hotel Apt. & Rooms | 28.2 | 11.1 |

Commercial | 99.1 | 50.5 |

Total | 1,524.9 | 658.0 |

Off-Plan Market Performance

Total Value: AED 1,524.9m

Flats: AED 1,106.2m (72.5%)

Villas: AED 291.4m (19.1%)

Hotel Apt. & Rooms: AED 28.2m (1.8%)

Commercial: AED 99.1m (6.5%)

Off-plan activity was overwhelmingly flat-led, with villas providing a meaningful secondary pillar and limited contribution from hospitality and commercial stock.

Ready Market Performance

Total Value: AED 658.0m

Flats: AED 479.7m (72.9%)

Villas: AED 116.7m (17.7%)

Hotel Apt. & Rooms: AED 11.1m (1.7%)

Commercial: AED 50.5m (7.7%)

The ready market mirrored off-plan structure, flats anchored demand, while commercial outperformed its off-plan share, signalling selective appetite for income-oriented assets.

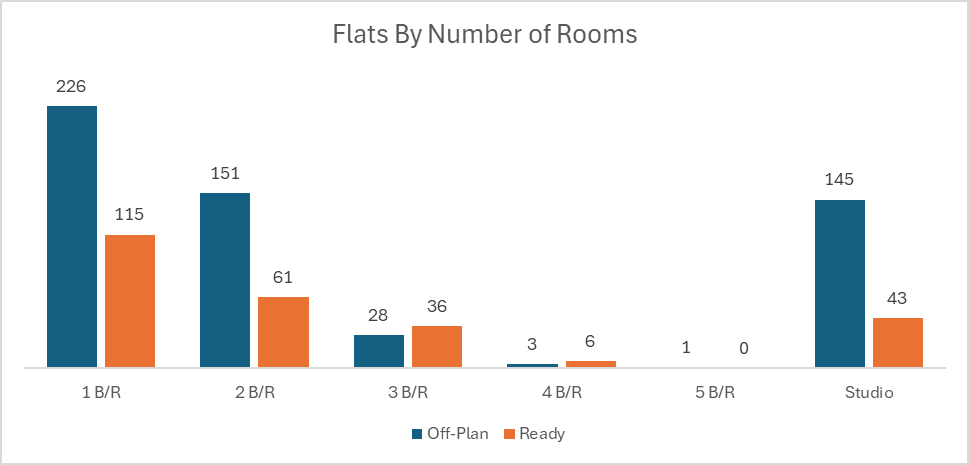

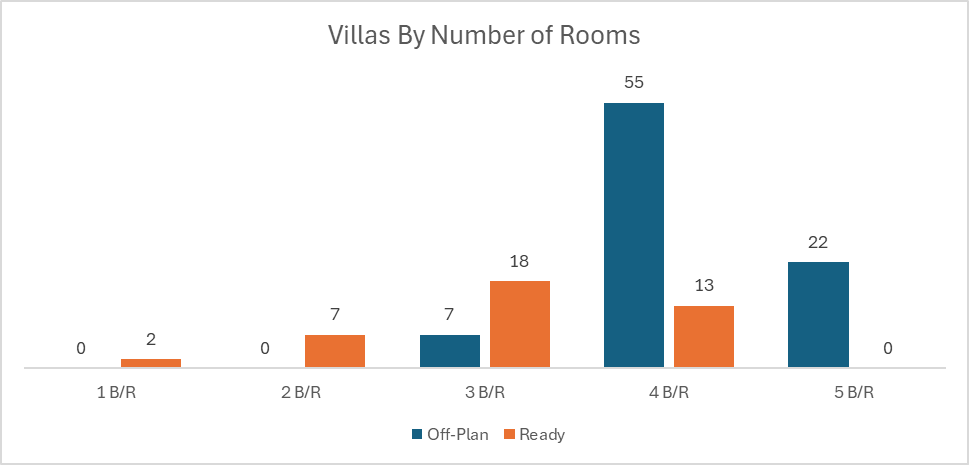

On The Micro Level

Market Insights & Outlook

The day’s distribution highlights a market still driven by off-plan liquidity, where flats remain the primary capital sink for both end users and investors. Meanwhile, the ready segment’s steadier 30% share, and slightly higher commercial contribution, suggests targeted positioning in established, usable assets. If this mix persists, expect developers’ flat launches to keep absorbing most demand, while ready commercial stays opportunistically supported by yield-seeking buyers.

Data Source: Dubai Land Department