Missed OpenAI? The Clock Is Ticking on RAD Intel’s Round

Ground floor opportunity on predictive AI for ROI-based content.

RAD Intel is already trusted by a who’s-who of Fortune 1000 brands and leading global agencies with recurring seven-figure partnerships in place.

$50M+ raised. 10,000+ investors. Valuation up 4,900% in four years*.

Backed by Adobe and insiders from Google. Shares at $0.81 until Nov 20 — then the price moves. Invest now.

This is a paid advertisement for RAD Intel made pursuant to Regulation A+ offering and involves risk, including the possible loss of principal. The valuation is set by the Company and there is currently no public market for the Company's Common Stock. Nasdaq ticker “RADI” has been reserved by RAD Intel and any potential listing is subject to future regulatory approval and market conditions. Investor references reflect factual individual or institutional participation and do not imply endorsement or sponsorship by the referenced companies. Please read the offering circular and related risks at invest.radintel.ai.

Dubai’s luxury market is ablaze. Brookfield’s Solaya has pre-construction bidding wars, penthouses more than $24m, and AED1m EOI checks. Off-plan is ~70% of deals. Safeguards reduce flipping, but UBS warns of bubble risk. Ultra-prime demand stays strong despite potential macro shocks.

Read the full article on Bloomberg

The Dubai property market remained resilient in October 2025, with a moderate seasonal slowdown offset by continued strength in off-plan and secondary sales, and sustained demand from mid-income mortgage buyers, according to Property Finder.

Read the full article on Arabian Business

Dubai’s market stays resilient despite October cooling. YTD: 177,519 sales worth Dh554.9b. Growth led by mid-income apartment buyers; mortgage volumes up, average values down. Primary ready and secondary off-plan strong; top areas include Al Yelayiss 1, Nad Al Sheba, Al Barsha South Fourth and Burj Khalifa.

Read the full article on Khaleej Times

The Dubai real estate sector recorded AED19.86bn ($5.4bn) of transactions last week, according to data from the Land Department.

Read the full article on Arabian Business

Wall Street’s Morning Edge.

Investing isn’t about chasing headlines — it’s about clarity. In a world of hype and hot takes, The Daily Upside delivers real value: sharp, trustworthy insights on markets, business, and the economy, written by former bankers and seasoned financial journalists.

That’s why over 1 million investors — from Wall Street pros to Main Street portfolio managers — start their day with The Daily Upside.

Invest better. Read The Daily Upside.

Property prices in Ras Al Khaimah have surged past those in Dubai’s most exclusive areas as the northern emirate cements its place as one of the UAE’s fastest-growing real estate markets, public and private data shows.

Read the full article on Arabian Gulf Business Insight

Sobha Realty, the Dubai-based luxury real estate developer, has announced the launch of The Mirage at Sobha Central, the latest addition to its flagship mixed-use master development on Sheikh Zayed Road.

Read the full article on Arabian Business

Shamal Holding unveiled The Dubai Beach EDITION at Dubai Harbour, a luxury resort and residences by RSHP, completing in 2029. It includes 165 beachfront homes and a 185-room hotel with private beach, wellness and dining amenities.

Read the full article on Zawya

Dubai commercial real estate surged in Q3 2025. Dhs30.38bn sales (+31% YoY), led by offices (Business Bay/JLT dominant) and a retail rebound (Dhs1.15bn). Smaller-ticket strata deals grew; off-plan hit Dhs2.4bn. With low vacancies and a 680k sqm pipeline plus towers due 2029–2030, momentum likely extends into 2026.

Read the full article on Gulf Business

The best marketing ideas come from marketers who live it. That’s what The Marketing Millennials delivers: real insights, fresh takes, and no fluff. Written by Daniel Murray, a marketer who knows what works, this newsletter cuts through the noise so you can stop guessing and start winning. Subscribe and level up your marketing game.

Dubai’s Samana Developers reportedly plans to issue a sukuk of nearly $300 million by the end of the first quarter of 2026. The funds will be used to acquire land in prime and waterfront areas for high-end projects, Bloomberg reported, quoting CEO Imran Farooq.

Read the full article on Arabian Gulf Business Insight

Nordic by fäm is reshaping Dubai’s ultra-luxury market with an AED3bn portfolio sold only after completion, emphasizing Scandinavian minimalism over ostentation. Ultra-prime launches topped AED140bn in five years; AED40m+ villa sales rose from 27 (2020) to 242 (2024). A 35,000-sq-ft flagship (AED275m) completes December 2026.

Read the full article on Zawya

Dubai Real Estate Transactions as Reported on the 10th of November 2025

On the 10-Nov-2025, the total transacted value reached AED 3,257,427,223. Off-plan dominated with AED 2,229,038,837 (68.4%), while Ready accounted for AED 1,028,388,386 (31.6%).

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 1,991.2 | 724.0 |

Villas | 161.4 | 204.1 |

Hotel Apt. & Rooms | 3.7 | 55.1 |

Commercial | 72.7 | 45.1 |

Total | 2,229.0 | 1,028.4 |

Off-Plan Market Performance

Total Value: AED 2,229,038,837

Flats: AED 1,991,202,117 (89.3%)

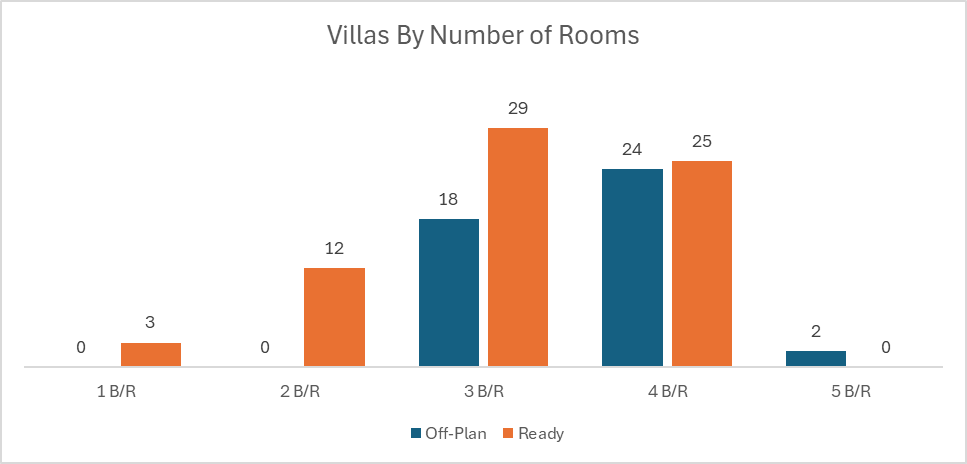

Villas: AED 161,414,972 (7.2%)

Hotel Apts & Rooms: AED 3,675,000 (0.2%)

Commercial: AED 72,746,748 (3.3%)

Off-plan was overwhelmingly driven by flats, with modest contributions from villas and limited activity in commercial and hospitality units.

Ready Market Performance

Total Value: AED 1,028,388,386

Flats: AED 724,020,805 (70.4%)

Villas: AED 204,144,054 (19.9%)

Hotel Apts & Rooms: AED 55,146,742 (5.4%)

Commercial: AED 45,076,785 (4.4%)

Ready transactions were anchored by flats, with villas providing a solid secondary share and moderate hospitality and commercial volumes.

On The Micro Level

Market Insights & Outlook

A strong off-plan skew continues to define daily flows, with flats capturing the bulk of activity across both segments. Ready villas remain resilient, hinting at sustained end-user demand. Barring near-term launch timing effects, breadth across asset types supports stable momentum into mid-November.

Data Source: Dubai Land Department