|

|

Do You Want To Be Featured As An Area Expert? Click Here |

|

AboutTheUAE is your definitive guide to Dubai – discover top Real Estate, schools, visa requirements, housing insights, transport tips, shopping hotspots, entertainment and more. |

Dubai is pioneering blockchain-powered real estate tokenisation, splitting properties into digital tokens for fractional ownership. Its DLD pilot sold out in under two minutes, attracting investors from over 30 countries. Tokenisation broadens market access, speeds transactions, and combines regulatory innovation with mainstream property fundamentals to redefine property investment.

Read the full article on Khaleej Times

Azizi Developments reports Azizi Central in Al Furjan is 57% complete, with Q4 handover. Structure is finished; blockwork and plastering near 97%/95%; tiling 18%; HVAC/MEP 64%/53%; façade 50%; elevators 22%; finishes 37%. The development features one- to three-bedroom apartments and extensive amenities.

Read the full article on Zawya

Dubai’s real estate market hit a record H1 2025 with AED 326.7 billion in nearly 99 000 residential transactions. Soaring population (+90 000 new residents), limited supply (12 000 homes) drove prices and rents higher, led by off-plan sales (two-thirds of volume) and villa segments in prime areas. Growth remains positive into Q4.

Read the full article on Construction Business News

Dubai’s real estate market hit a record H1 2025 with AED 326.7 billion in nearly 99 000 residential sales, driven by 90 000 new residents and limited supply (12 000 homes). Villa segments in prime areas saw the greatest capital gains, while off-plan transactions comprised over two-thirds of activity.

Read the full article on Economy Middle East

The project marks the company’s second development following Mayfair Gardens in Jumeirah Garden City in Dubai.

Read the full article on Arabian Business

Dubai’s rental market is stabilizing: long-term rents show measured shifts, affordable up 7%, luxury down 1–5%, mid-tier and villa segments mixed, as new inventory eases pressure. Meanwhile, short-term rentals remain robust across luxury, mid-tier, and budget segments, offering tenants greater choice and flexibility.

Read the full article on Economy Middle East

Branded residences blend luxury living with prestigious brand appeal, offering exclusive amenities, prime locations, and smart, sustainable design. Attracting global, affluent investors, these developments, from Cavalli Couture to Bulgari Residences, deliver status, robust ROI, and strong market performance, cementing branded real estate as a highly desirable, premium asset.

Read the full article on Property Investor Today

Amirah Developments will launch five luxury and mid-luxury projects in Dubai and Ras Al Khaimah worth AED 1.8 billion, including the AED 100 million Bonds Avenue Residences on Dubai Islands (handover Q1 2027). Self-funded and eco-focused, projects feature branded residences, wellness communities, and resort-style design.

Read the full article on Zawya

UAE job growth in Q2 surged 4%, surpassing Saudi Arabia’s 2%, driven by real estate, finance, and tech, aided by digital work permits. GCC hiring rose 1% (Oman +2%, Bahrain +1%), while Qatar (-3%) and Kuwait (-4%) dipped. Senior finance, compliance, and public sector roles saw strongest demand.

Read the full article on The National

Dubai Real Estate Transactions as Reported on the 10th of July 2025

On 10 July 2025, Dubai’s total real estate transaction value reached AED 2.95 billion, with off-plan properties accounting for 74.9% and ready assets contributing 25.1% of the total volume.

Category | Off-Plan (AED million) | Ready (AED million) |

|---|---|---|

Flats | 1543.1 | 484.4 |

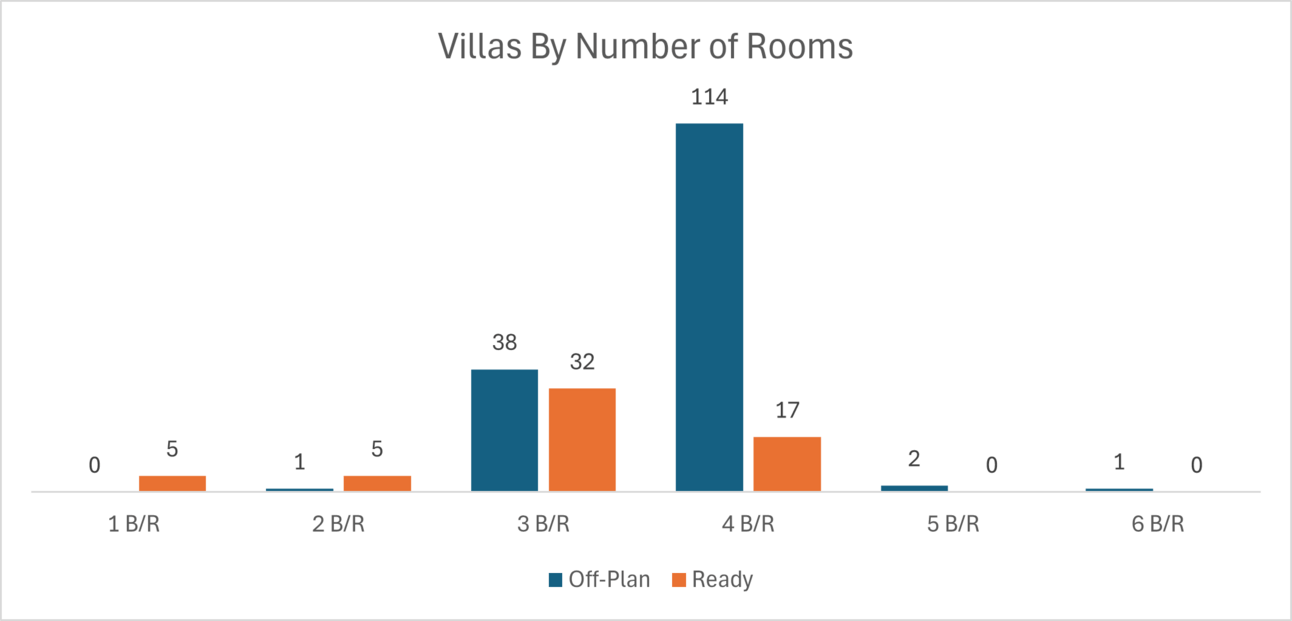

Villas | 628.0 | 149.6 |

Hotel Apt. & Rooms | 15.1 | 32.4 |

Commercial | 27.0 | 75.5 |

Total | 2213.1 | 741.8 |

Off-Plan Market Performance

Total Value: AED 2.21 billion

Share of Total Transactions: 74.9%

Subcategory Breakdown:

Flats: AED 1.54 billion (69.7% of off-plan)

Villas: AED 0.63 billion (28.4%)

Hotel Apartments & Rooms: AED 0.015 billion (0.7%)

Commercial: AED 0.027 billion (1.2%)

Flats had the biggest share of off-plan segment, while villas showed strong demand with 28% of the off-plan value.

Ready Market Performance

Total Value: AED 0.74 billion

Share of Total Transactions: 25.1%

Subcategory Breakdown:

Flats: AED 0.48 billion (65.3% of ready)

Villas: AED 0.15 billion (20.2%)

Hotel Apartments & Rooms: AED 0.032 billion (4.4%)

Commercial: AED 0.075 billion (10.2%)

On The Micro Level

Market Insights

Off-plan offerings remain the market’s driving force, led by flat sales that continue to dominate investor interest. Villas hold a healthy 28.4% share of off-plan volume, reflecting strong demand for larger units. Ready properties, while smaller in overall volume, see flats and villas together representing over 85% of their segment, catering to buyers seeking immediate occupancy.

Data Source: