Big investors are buying this “unlisted” stock

When the founder who sold his last company to Zillow for $120M starts a new venture, people notice. That’s why the same VCs who backed Uber, Venmo, and eBay also invested in Pacaso.

Disrupting the real estate industry once again, Pacaso’s streamlined platform offers co-ownership of premier properties, revamping the $1.3T vacation home market.

And it works. By handing keys to 2,000+ happy homeowners, Pacaso has already made $110M+ in gross profits in their operating history.

Now, after 41% YoY gross profit growth last year alone, they recently reserved the Nasdaq ticker PCSO.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

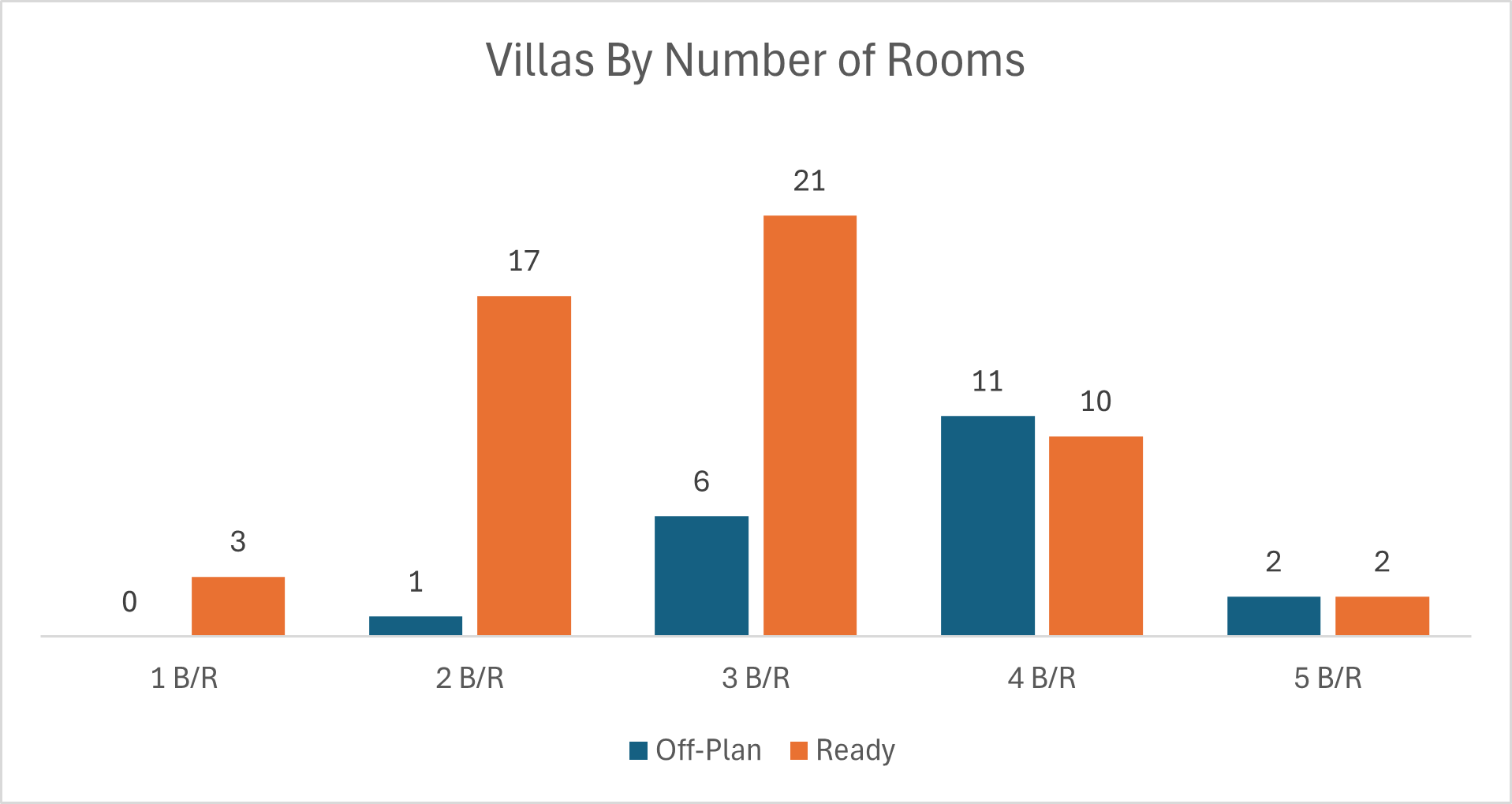

Dubai rents fell 0.6% in H1 2025 vs H2 2024 but remain up 9.9% YoY as new supply boosts tenant leverage. H1 saw 17,300 completions; 61,800 under construction and 100k+ projected for 2026–27. Renewals were 66.8% of 244k contracts. Yields: 7.2% (apartments), 5% (villas).

Read the full article on Khaleej Times

Dubai’s residential real estate market continued its upward trajectory in July 2025, with Betterhomes reporting strong growth in both sales and leasing, driven by robust off-plan demand and an influx of new tenants.

Read the full article on Arabian Business

Renting stays strong, transactions +3.4% MoM, new leases 40%; average annual rents AED 72k (apartments), 172k (townhouses), 255k (villas). Sales surge: 18,816 deals (+20.5%) worth AED 51.3b; prices +3.3% MoM to AED 1,893 psf, with off-plan 65%. Rent for flexibility; buy for long-term equity.

Read the full article on Gulf News

The best HR advice comes from those in the trenches. That’s what this is: real-world HR insights delivered in a newsletter from Hebba Youssef, a Chief People Officer who’s been there. Practical, real strategies with a dash of humor. Because HR shouldn’t be thankless—and you shouldn’t be alone in it.

Dubai logged 4,049 new real estate registrations in H1 2025, signaling investor confidence. DLD digitisation and reforms, long-term visas, and 100% foreign ownership attract capital. Diversifying projects and infrastructure plans expand supply, while a stable macro environment sustains demand across residential, commercial, and smart-city assets.

Read the full article on MENA FN

TownX named Ocean Stone main contractor for AED 662m Ashley Hills in Arjan, 616 units, 400k sq ft saleable. Handover will be phased (timelines TBC). EOIs now open. Since 2017, TownX has delivered 1,774 units, has 2,125 underway; portfolio AED 4bn.

Read the full article on Zawya

Dubai Real Estate Court ended a January 2025 AED21m deal after buyer defaulted, ordering AED1.68m (80% of a AED2.1m deposit) plus 5% annual interest. Ruling cited the withdrawal-penalty clause and Civil Transactions Law. The broker’s 20% share of the penalty wasn’t claimed.

Read the full article on Gulf News

Vincitore Realty awarded Luxridge a AED 2bn contract to build four sold-out projects in Arjan and Dubai Science Park, delivering from 2026 at ~1m sq ft/year. Funded via internal accruals/escrow, Vincitore holds 4m+ sq ft landbank and 3,367 units delivered; exploring wider UAE/GCC as off-plan demand stays strong.

Read the full article on Zawya

Barco Developers entered the UAE market, planning over 2m sq ft of low- to mid-rise housing across Dubai and Ras Al Khaimah. First launches start in Dubai South, with Arjan, DLRC and Jebel Ali Hills to follow. Targeting mid-income end users, Barco promises smart, sustainable, value-priced communities.

Read the full article on Middle East Construction News

Dubai Real Estate Transactions as Reported on the 11th of August 2025

On 11 Aug 2025, Dubai’s property market recorded AED 2.424 billion in transactions. Off-plan deals contributed AED 1.625 billion (67.0%), while ready properties added AED 0.800 billion (33.0%).

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 1530.4 | 591.8 |

Villas | 67.2 | 156.4 |

Hotel Apt. & Rooms | 4.7 | 18.1 |

Commercial | 22.6 | 33.2 |

Total | 1625.0 | 799.5 |

Off-Plan Market Performance

Flats: AED 1,530.4 m (94.2% of off-plan)

Villas: AED 67.2 m (4.1%)

Hotel Apartments & Rooms: AED 4.7 m (0.3%)

Commercial: AED 22.6 m (1.4%)

Ready Market Performance

Flats: AED 591.8 m (74.0% of ready)

Villas: AED 156.4 m (19.6%)

Hotel Apartments & Rooms: AED 18.1 m (2.3%)

Commercial: AED 33.2 m (4.2%)

On The Micro Level

Market Insights & Outlook

Off-plan dominated activity, led overwhelmingly by flats, signalling continued end-user and investor appetite for new launches. In the ready segment, flats remained the workhorse, with villas providing a solid fifth of value. The narrow commercial shares in both categories suggest a residential-led session, consistent with 2025 demand patterns.

Data Source: Dubai Land Department