Immersive tech is reshaping UAE real estate by improving design, marketing, and buyer experience. The UAE VR market made ~Dhs366m in 2024 and could reach Dhs1.612bn by 2030 (28% CAGR). VR/AR enable pre-completion walkthroughs, faster approvals, reduced costs, and smoother remote sales.

Read the full article on Gulf Business

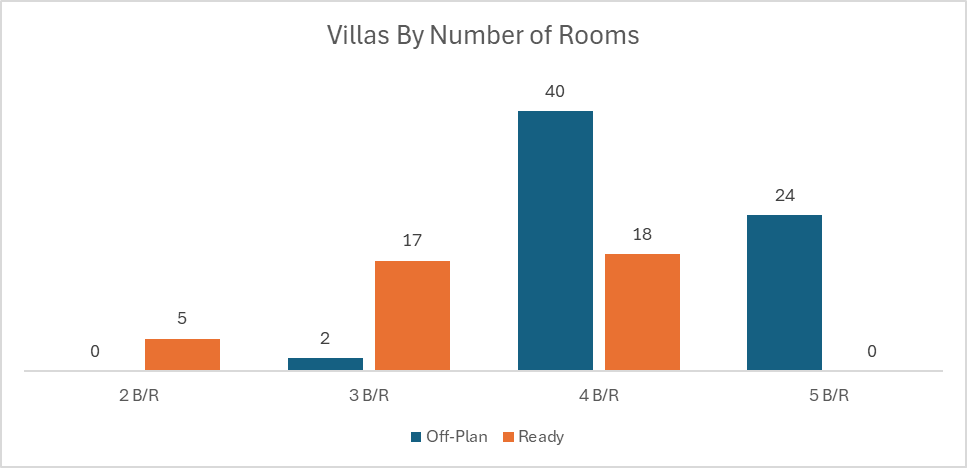

Dubai’s housing market is cooling into a more sustainable phase after years of rapid growth. Analysts say 2026 oversupply fears are exaggerated; risks are concentrated in supply-heavy districts and small apartments. Population growth and strong absorption support prices, while villas remain undersupplied. Off-plan dominates transactions, and delivery delays may curb supply shocks.

Read the full article on Khaleej Times

Abu Dhabi’s 2025 real estate sales jumped from $27bn to nearly $39bn, with transactions up 49%, making the capital ~10–12% of UAE deal value. Rents are leading (strong gains on Reem/Yas/Saadiyat). For 2026, growth is forecast to stay strong but disciplined, with new supply absorbed gradually and rising international demand.

Read the full article on Economy Middle East

Dubai hit a record single-day transaction value on 26 Jan: AED 15.6bn across 1,501 deals, per Dubai Land Department data. Arabian Gulf Properties’ chairman says it signals market maturity, strong local/international confidence, and deep liquidity. Sales alone reached AED 11.4bn, reflecting broad activity and sustainable, regulation-backed growth.

Read the full article on Zawya

Ask anyone who built serious wealth in Dubai real estate over the past two decades, and the story often sounds the same. They knew someone. They heard about a project before the advertisements hit. They had a broker who called them first. They moved fast while others deliberated.

Read the full article on Arabian Business

PRYPCO Mint, a real estate tokenisation platform in the MENA region, has announced the launch of its first marketplace, scheduled to go live on 20 February via the PRYPCO Mint App, as Dubai continues to advance technology-driven property investment models.

Read the full article on Arabian Business

CBRE says UAE branded residences have evolved from a “name on the door” into a strategically important luxury segment, driven by economic confidence and a broader HNW buyer base. Dubai leads in scale (big premiums, off-plan dominance, huge pipeline), Abu Dhabi in scarcity (higher premiums), and Ras Al Khaimah is the fast-growing frontier.

Read the full article on Construction Week Online

Moody’s Ratings expect the blazing pace of growth over the past few years by UAE residential real estate to slow down over the next 12-18 months, but it added that the large developers and banks will remain resilient.

Read the full article on Arabian Business

Royal Development Holding sold out its AED1bn Rotana Residences, Al Reem Island project in Abu Dhabi before launch, highlighting strong demand for premium branded living. The two-tower development includes 439 homes (studios to duplex penthouses), begins construction Q2 2026, completes Q4 2028, and targets a 1 Pearl sustainability rating.

Read the full article on Zawya

Dubai Real Estate Transactions as Reported on the 11th of February 2026

On the 11-Feb-2026, the total transacted value reached AED 1.75bn. Off-plan dominated with AED 1.09bn (62.2%), while Ready accounted for AED 0.66bn (37.8%).

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 767.0 | 423.9 |

Villas | 236.4 | 136.9 |

Hotel Apt. & Rooms | 5.1 | 38.6 |

Commercial | 82.5 | 63.0 |

Total | 1,091.0 | 662.5 |

Off-Plan Market Performance

Total Value: AED 1.09bn

Flats: AED 767.0m (70.3%)

Villas: AED 236.4m (21.7%)

Hotel Apts & Rooms: AED 5.1m (0.5%)

Commercial: AED 82.5m (7.6%)

Off-plan activity was overwhelmingly flat-led, with villas providing a strong secondary layer of demand.

Ready Market Performance

Total Value: AED 662.5m

Flats: AED 423.9m (64.0%)

Villas: AED 136.9m (20.7%)

Hotel Apts & Rooms: AED 38.6m (5.8%)

Commercial: AED 63.0m (9.5%)

In the ready market, flats remained the anchor, while commercial and hotel units added meaningful depth to turnover.

On The Micro Level

Market Insights & Outlook

The day’s performance reflects a clear preference for off-plan exposure, with flats driving the bulk of value across both segments. Ready activity remained solid and more diversified, suggesting steady end-user and investor demand, while off-plan continues to capture momentum through scale and pricing breadth.

Data Source: Dubai Land Department