|

Marriott expands EMEA branded residences, operating 33 with 50+ in pipeline across 18 countries. New projects in Dubai, Abu Dhabi, London, Budapest; highlights include Dubai Beach EDITION, Ritz-Carlton Al Maryah, St. Regis Bodrum, JW on Dubai Islands. Strong demand (e.g., Dubai’s Affini sold out), rich amenities, Bonvoy benefits, sustainability focus.

Read the full article on Tour Travel World

Casa Vista Development launched Aquora, a AED 350m luxury waterfront project on Dubai Islands: 105 homes (1–3 beds), plus six retail units. Completing Q1 2028, prices start at AED 1.9m. Amenities include a 22m rooftop infinity pool, dog park, cinema, and full wellness club; aligned with Dubai 2040.

Read the full article on Zawya

The AI Race Just Went Nuclear — Own the Rails.

Meta, Google, and Microsoft just reported record profits — and record AI infrastructure spending:

Meta boosted its AI budget to as much as $72 billion this year.

Google raised its estimate to $93 billion for 2025.

Microsoft is following suit, investing heavily in AI data centers and decision layers.

While Wall Street reacts, the message is clear: AI infrastructure is the next trillion-dollar frontier.

RAD Intel already builds that infrastructure — the AI decision layer powering marketing performance for Fortune 1000 brands. Backed by Adobe, Fidelity Ventures, and insiders from Google, Meta, and Amazon, the company has raised $50M+, grown valuation 4,900%, and doubled sales contracts in 2025 with seven-figure contracts secured.

Shares remain $0.81 until Nov 20, then the price changes.

👉 Invest in RAD Intel before the next share-price move.

This is a paid advertisement for RAD Intel made pursuant to Regulation A+ offering and involves risk, including the possible loss of principal. The valuation is set by the Company and there is currently no public market for the Company's Common Stock. Nasdaq ticker “RADI” has been reserved by RAD Intel and any potential listing is subject to future regulatory approval and market conditions. Investor references reflect factual individual or institutional participation and do not imply endorsement or sponsorship by the referenced companies. Please read the offering circular and related risks at invest.radintel.ai.

Sharafi Development launched Marea Residences on Dubai Islands, a G+2+12 waterfront project with 1–2BR homes and penthouses, sea views and resort-style amenities (infinity pool, spa, gym, concierge). Metropolitan Premium Properties is exclusive sales partner. Prices from AED 2.6m, 40/30/30 plan, two years management, one year maintenance.

Read the full article on Khaleej Times

SmartCrowd launched Abu Dhabi’s first crowdfunded property, a AED 1.2m Yas Island studio, marking expansion beyond Dubai. The regulated platform, with entry from AED 500 and AED 290m invested to date, offers options like SmartCrowd Flip and plans listings across other emirates to help investor diversification.

Read the full article on Zawya

Mashriq Elite began building Floarea Skies in JVC. 23 floors, 192 units (42 studios, 134 1BR, 16 2BR), completing Q4 2027. Prices start AED 666k–1.499m. JVC leads sales; Purple Line to boost appeal. Extensive amenities; prime access. Developer plans 1,200 more units.

Read the full article on Khaleej Times

If you need evidence that Dubai’s real estate market is flourishing, consider this: from January to October, a property was sold about every two minutes on average, according to government data.

Read the full article on Arabian Gulf Business Insight

Wall Street’s Morning Edge.

Investing isn’t about chasing headlines — it’s about clarity. In a world of hype and hot takes, The Daily Upside delivers real value: sharp, trustworthy insights on markets, business, and the economy, written by former bankers and seasoned financial journalists.

That’s why over 1 million investors — from Wall Street pros to Main Street portfolio managers — start their day with The Daily Upside.

Invest better. Read The Daily Upside.

Orlinski Realty Group, co-founded with artist Richard Orlinski, launches in Dubai to create art-led hotels and branded residences “sculpted” and authenticated as part of his legacy. Leveraging the UAE’s booming market, ORG seeks developer partners; globally, branded residences command 30–35% price premiums.

Read the full article on Zawya

Dubai’s Solaya waterfront project by Brookfield Properties and Dubai Holding is courting ultra-wealthy buyers via a deposit-based bidding for limited units, including $24m+ penthouses. Despite pre-construction, demand is intense, signaling Dubai’s shift toward hyper-exclusive, ultra-luxury real estate sales.

Read the full article on MENA FN

PACE, a Pakistan-listed firm in First Capital Group, will create a Dubai subsidiary to execute a new project, per a PSX filing. The CEO is empowered to complete formalities. It reflects a broader shift of Pakistani companies to the UAE for smoother payments, contract enforcement, and business climate.

Read the full article on Business Recorder

The best marketing ideas come from marketers who live it. That’s what The Marketing Millennials delivers: real insights, fresh takes, and no fluff. Written by Daniel Murray, a marketer who knows what works, this newsletter cuts through the noise so you can stop guessing and start winning. Subscribe and level up your marketing game.

Dubai’s expat influx fuels rising demand for ready, furnished homes, prized for convenience and flexibility. Q3 2025 saw ~59,000 deals worth AED169bn: ready 18,500 (AED86.4bn), off-plan 39,000+ (AED82.8bn). Furnished units cut setup hassle, suit short contracts, often include utilities, and are moderating mid-market price/rent growth.

Read the full article on Khaleej Times

Missoni and Octa Development launched “Octa Isle Interiors by Missoni” on Dubai Islands (Island A): 2–5BR apartments with resort amenities, encircling river, urban beach pool, sports courts and a Wellness Bay (Turkish bath, sauna, spa). Missoni interiors; Octa cites 8,000+ units sold, AED16bn transactions, and global brand partnerships.

Read the full article on Fashion Network

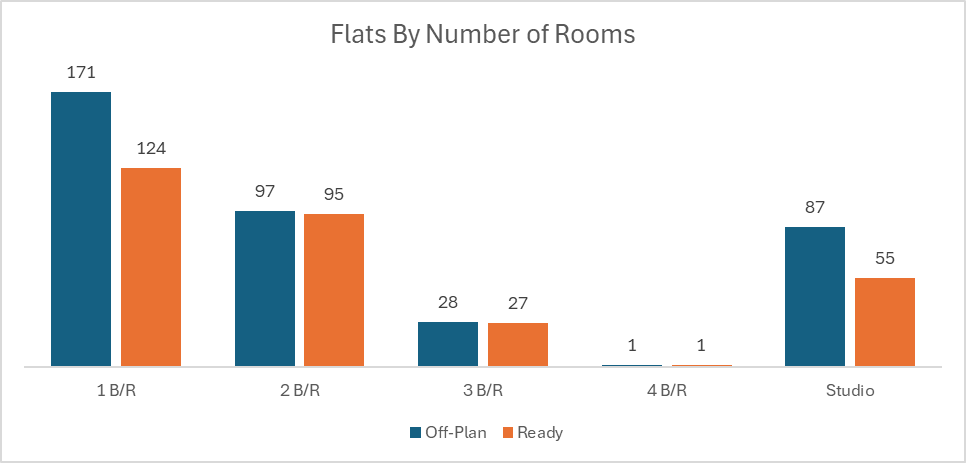

Dubai Real Estate Transactions as Reported on the 11th of November 2025

On the 11-Nov-2025, the total transacted value reached AED 1,841,978,763. Off-plan dominated with AED 1,104,250,831 (59.9%), while Ready accounted for AED 737,727,932 (40.1%).

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 848.6 | 450.0 |

Villas | 163.9 | 186.5 |

Hotel Apt. & Rooms | 5.9 | 39.1 |

Commercial | 85.8 | 62.1 |

Total | 1,104.3 | 737.7 |

Off-Plan Market Performance

Total Value: AED 1,104,250,831

Flats: AED 848,583,460 (76.8%)

Villas: AED 163,888,809 (14.8%)

Hotel Apts & Rooms: AED 5,935,111 (0.5%)

Commercial: AED 85,843,451 (7.8%)

Off-plan activity was led by flats, which captured over three-quarters of segment value, with villas a distant second.

Ready Market Performance

Total Value: AED 737,727,932

Flats: AED 450,044,327 (61.0%)

Villas: AED 186,543,455 (25.3%)

Hotel Apts & Rooms: AED 39,074,467 (5.3%)

Commercial: AED 62,065,684 (8.4%)

Ready demand was flat-driven, though villas provided a strong quarter share of value.

On The Micro Level

Market Insights & Outlook

The day’s mix skews toward apartments across both segments, signaling liquidity concentration in smaller ticket sizes while villas remain a meaningful secondary driver. If this balance holds, expect steady velocity in mid-market communities, with selective premium assets supporting villa values.

Data Source: Dubai Land Department