Emaar posted record 2025 results as property and recurring-income businesses surged. Property sales hit AED80.4bn (+16%), revenue reached AED49.6bn (+40%), and profit before tax rose 36% to AED25.7bn. Backlog climbed to AED155bn (+39%); dividends maintained at 100% of share capital.

Read the full article on Construction Week Online

Property Monitor says DIFC’s AED100bn Zabeel District expansion is demand-led, reflecting near-capacity vacancies and high rents. Adding 17.7m sq ft in six phases (public access by 2030, completion by 2040), it doubles DIFC capacity, supports Class A office and premium residential demand, and opens new institutional and individual investment opportunities.

Read the full article on Economy Middle East

YAS Developers plans AED1bn of Dubai projects in 2026, launching Casa Altia in Al Furjan after handing over Altia Residence and Altia One. Casa Altia offers 72 apartments, including six ultra-luxury pool homes, starting from AED1.7m, with completion due Q1 2028.

Read the full article on Zawya

ADGM’s Registration Authority launched a Broker Classification Initiative to boost professionalism in its real estate jurisdiction. Licensed brokers will be ranked in five tiers (General to Platinum) based on sales performance, education, and customer feedback. Introduced at a 10 Feb 2026 workshop, it aims to strengthen trust, service quality, and investor confidence.

Read the full article on Economy Middle East

BCD Global broke ground on its first Dubai project in Warsan: a freehold, mid-market development of one- and two-bedroom apartments targeting long-term investors. The firm cites strong 2025 market momentum and resilient yields, positioning the project for sustained rental demand. More sales and timeline details will follow; it targets Dh300m revenue in Q1 2026.

Read the full article on MENA FN

Beyond Developments launched “Evermore,” a Dh25bn+ flagship on Marjan Beach, Ras Al Khaimah, spanning 7m+ sq ft. Opposite Wynn Al Marjan Island Resort, it will be a fully integrated beachfront destination blending classic French-inspired and contemporary design, aligning with RAK Vision 2030 and Beyond’s 2026 expansion outside Dubai.

Read the full article on Gulf News

H&H partnered with Mubadala to bring its Eden House luxury residential brand to Abu Dhabi, launching a new tower on Al Maryah Island within ADGM. Designed by Dxb Lab, the 60-floor project will offer 200+ high-end units with 3m ceiling heights, aiming to elevate Al Maryah’s live-work residential offering alongside its commercial core.

Read the full article on Zawya

RAK Properties has announced the launch of The Strand, a mixed-use residential destination within the Marjan Beach masterplan, as the developer expands its presence on Ras Al Khaimah’s mainland and responds to rising demand for high-quality housing.

Read the full article on Arabian Business

ENBD REIT reported strong Q4 2025 results: NAV rose to USD257.4m (USD1.03/share), up 6.1% QoQ and 19.4% YoY, driven by portfolio valuation gains. Property value reached USD436m; occupancy was 95%. FFO increased 12.6% YoY to USD9.4m, while net income jumped 61% to USD48.9m; LTV stood at 42%, with DIFC-led offices the main driver.

Read the full article on Zawya

Al Mal Capital REIT appointed xCube as its DFM liquidity provider. xCube will post continuous two-way quotes during trading hours under DFM/CMA rules to support orderly trading, improve day-to-day liquidity, and make the REIT’s units more accessible, helping broaden the investor base over time.

Read the full article on Zawya

Qatar’s January 2026 real estate transactions rose to QAR1.732bn (428 deals) from QAR1.53bn (382) a year earlier. Doha led by value (QAR801.5m). Mortgage activity totaled 99 transactions worth QAR4.9bn, dominated by Doha. Growth was linked to new property laws attracting capital.

Read the full article on Economy Middle East

Dubai Real Estate Transactions as Reported on the 12th of February 2026

On the 12-Feb-2026, the total transacted value reached AED 2.58bn. Off-plan dominated with AED 1.52bn (59.1%), while Ready accounted for AED 1.06bn (40.9%).

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 945.6 | 761.9 |

Villas | 384.1 | 212.8 |

Hotel Apt. & Rooms | 32.9 | 29.2 |

Commercial | 161.1 | 52.0 |

Total | 1,523.7 | 1,056.0 |

Off-Plan Market Performance

Total Value: AED 1.52bn

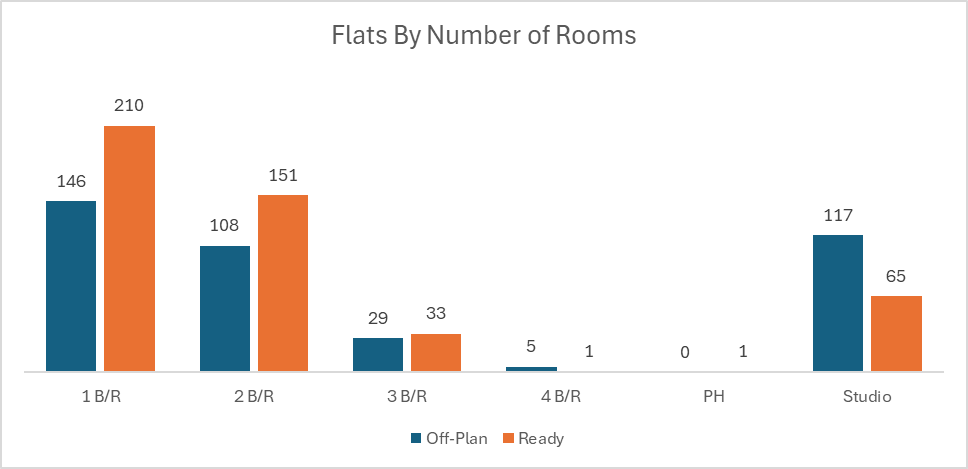

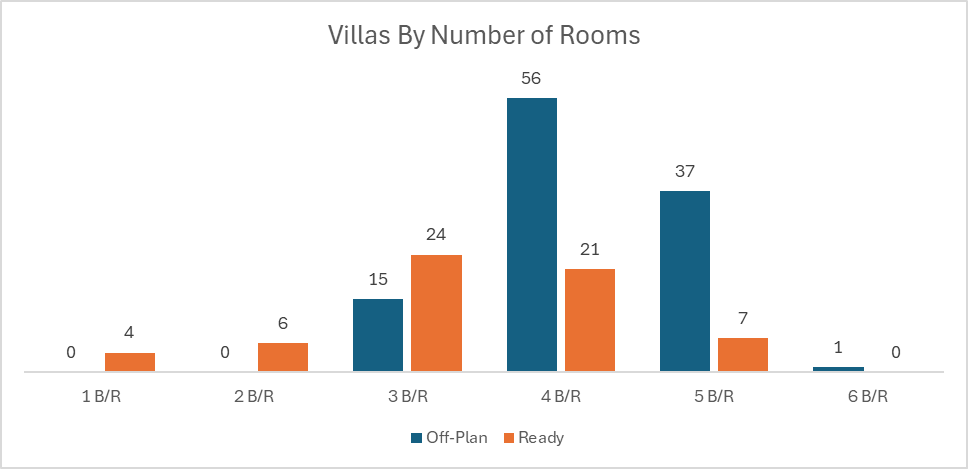

Flats: AED 945.6m (62.1%)

Villas: AED 384.1m (25.2%)

Hotel Apts & Rooms: AED 32.9m (2.2%)

Commercial: AED 161.1m (10.6%)

Off-plan activity was flat-led, with villas providing a solid secondary contribution and commercial adding meaningful depth.

Ready Market Performance

Total Value: AED 1.06bn

Flats: AED 761.9m (72.2%)

Villas: AED 212.8m (20.2%)

Hotel Apts & Rooms: AED 29.2m (2.8%)

Commercial: AED 52.0m (4.9%)

Ready transactions were even more concentrated in flats, pointing to strong end-user/investor demand for completed apartment stock.

On The Micro Level

Market Insights & Outlook

Overall turnover leaned toward off-plan (nearly 60% of value), signalling continued appetite for new launches and forward-priced inventory. At the same time, ready market resilience, driven heavily by flats, suggests stable demand for immediate occupancy assets, while commercial remained a smaller, supportive slice across both segments.

Data Source: Dubai Land Department