Former Zillow exec targets $1.3T market

The wealthiest companies tend to target the biggest markets. For example, NVIDIA skyrocketed nearly 200% higher in the last year with the $214B AI market’s tailwind.

That’s why investors are so excited about Pacaso.

Created by a former Zillow exec, Pacaso brings co-ownership to a $1.3 trillion real estate market. And by handing keys to 2,000+ happy homeowners, they’ve made $110M+ in gross profit to date. They even reserved the Nasdaq ticker PCSO.

No wonder the same VCs behind Uber, Venmo, and eBay also invested in Pacaso. And for just $2.90/share, you can join them as an early-stage Pacaso investor today.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

EBG Realty partnered with Dubai’s Alba Homes to channel rising Indian investment into Dubai, where Indians account for 22% of foreign buys (AED 35B in 2024). The tie-up offers advisory-led access, exclusive listings, and full-service support, with showcases across India to ease cross-border purchases.

Read the full article on Construction Week Online

UAE’s PropTech market, AED 2.24B in 2024, is forecast to reach AED 5.69B by 2030 (17.5% CAGR), driven by AI, blockchain, IoT, VR/AR. July 2025’s Dubai PropTech Hub targets AED 4.5B locally, 200 startups, AED 1B investment. Sector leads MENA, emphasizing sustainability and smart, efficient development.

Read the full article on Economy Middle East

NiFCO Dubai partnered with BNW Developments, launching a DIFC-registered fund that acquired “Esplora” in JVC (143 units). A new JV will market ready homes for mid-income buyers, aiming for faster, transparent delivery, stronger secondary sales, and a $1bn pipeline, with $200m in assets under evaluation.

Read the full article on Gulf News

Despite talk of cooling rents in Dubai, fresh data shows more of a moderation in prices rather than impending collapse.

Read the full article on Arabian Gulf Business Insight

High-value deals, surging rents and a major development pipeline point to strong investor confidence across Dubai and Abu Dhabi.

Read the full article on Arabian Business

Taraf (Yas Holding) broke ground on KARL LAGERFELD VILLAS in Meydan: 51 five-to-seven-bedroom waterfront homes marking the brand’s Middle East residential debut. Parisian-inspired luxury, lagoon access, and a private clubhouse align with Dubai’s 2030 vision, expanding the brand’s global portfolio.

Read the full article on Zawya

PRYPCO partnered with Ovaluate to launch a DFSA-regulated instant valuation engine for fractional and full-ownership properties, delivering AI-driven, transparent valuations in 10 seconds on PRYPCO Blocks. The integration aims to boost investor trust and access, offering institutional-grade AVM tools to global users investing from AED 2,000, reinforcing Dubai’s PropTech leadership.

Read the full article on Khaleej Times

Etihad Rail and Dubai Metro Blue Line are set to boost values near stations. Analysts foresee 10–25% price gains (up to 30%) and 25–30% rental growth, especially in Dubai South, Al Jaddaf, Creek Harbour, Jebel Ali. Blue Line due 2029; early demand already lifting rents.

Read the full article on Gulf News

Farnek’s Hitches & Glitches reports surging demand for maintenance in Dubai’s luxury branded residences amid 13k units sold in 2024 (+43%). With buyers paying up to 69% premium, H&G leverages a smart app and specialist training. It manages 1,500 AMCs (AED 26m) via 240 technicians and growing concierge services.

Read the full article on Zawya

Sources tell Bloomberg that the two companies have each committed new capital to the partnership

Read the full article on Arabian Business

Amid Dubai’s boom, major UAE developers are internalising construction to cut costs, speed delivery and capture margins. Emaar formed Rukn Mirage; Samana, Ellington, Azizi and Arada followed. Launches rose 83% in 2024 while completions fell 23%, bids dwindled, heightening execution control, and risk, amid population-led demand.

Read the full article on Reuters

Dubai and Abu Dhabi offices are booming amid record occupancy. Dubai logged 83 sales over AED 10m in H1 2025 (+207%); Downtown AED 5,000 psf, Business Bay AED 2,000 psf; DIFC rents around AED 400 psf. Significant new supply is planned. Abu Dhabi requirements topped 5m sqft (+110%), lifting rents.

Read the full article on Zawya

Dubai Real Estate Transactions as Reported on the 13th of August 2025

On 13 August 2025, Dubai’s property market recorded total transactions worth AED 2.06 billion. Off-plan deals contributed AED 1.41 billion (68.8%), while ready properties added AED 641.9 million (31.2%).

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 1,302.6 | 322.8 |

Villas | 49.7 | 105.8 |

Hotel Apt. & Rooms | 9.0 | 13.9 |

Commercial | 52.9 | 199.4 |

Total | 1,414.1 | 641.9 |

Off-Plan Market Performance

Total Value: AED 1,414.1 m

Share of Total Transactions: 68.8%

Flats: AED 1,302.6 m (92.1% of off-plan)

Villas: AED 49.7 m (3.5%)

Hotel Apartments & Rooms: AED 9.0 m (0.6%)

Commercial: AED 52.9 m (3.7%)

The day keeps the same theme, a highly concentrated off-plan day dominated by apartment sales.

Ready Market Performance

Total Value: AED 641.9 m

Share of Total Transactions: 31.2%

Flats: AED 322.8 m (50.3% of ready)

Villas: AED 105.8 m (16.5%)

Hotel Apartments & Rooms: AED 13.9 m (2.2%)

Commercial: AED 199.4 m (31.1%)

Ready activity was balanced, with apartments leading and commercial assets capturing nearly a third of value (over AED 100 M was gifted).

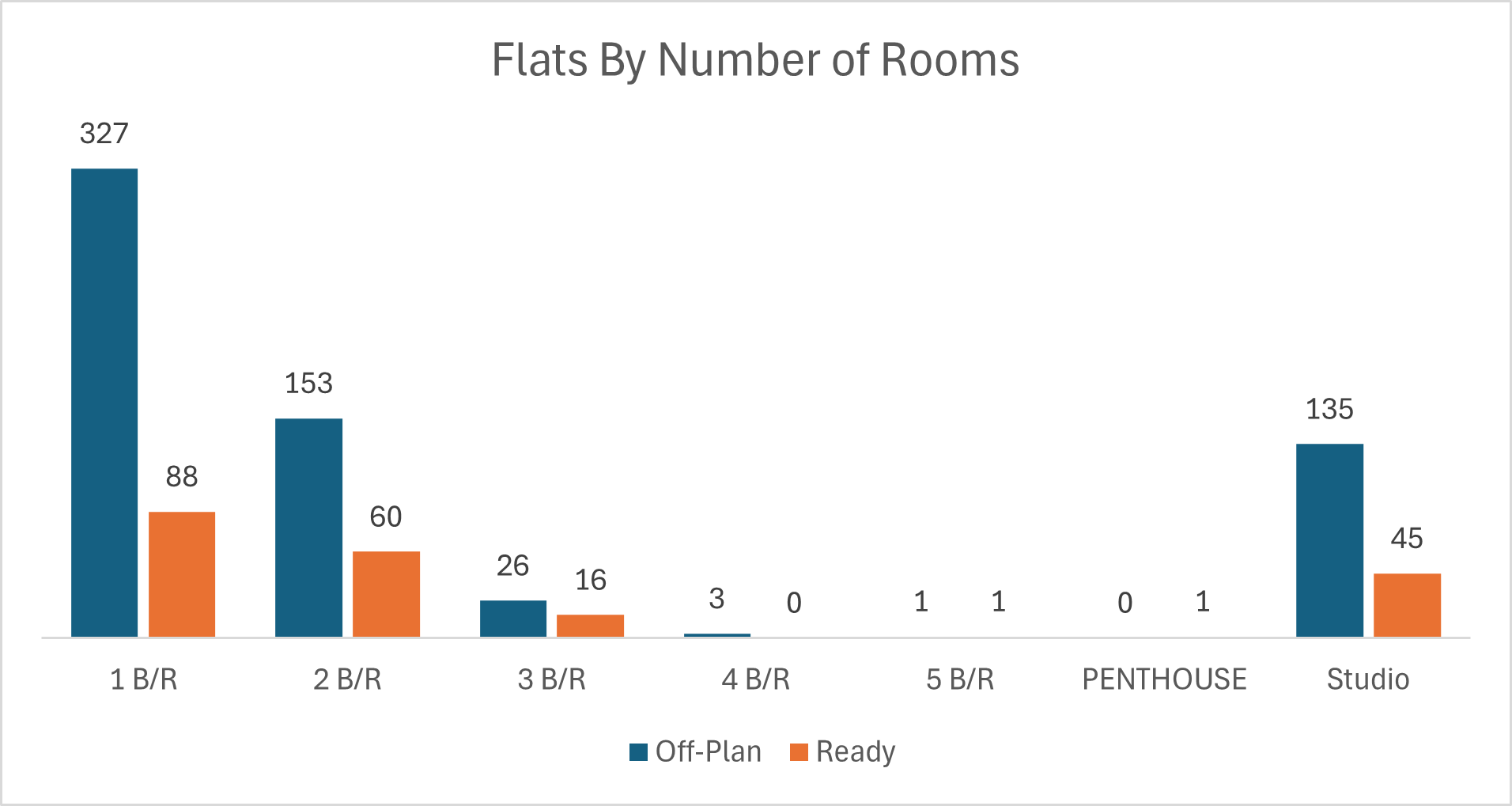

On The Micro Level

Market Insights & Outlook

Apartments set the pace: Off-plan flats formed over 92% of off-plan value, underscoring end-user and investor preference for new apartment inventory.

Commercial: The ready market’s 31% commercial share came mostly from over AED 100 M gifted offices in Burj Khalifa.

Muted off-plan villas: Limited villa value (3.5%) points to a quieter launch/transaction day for this segment.

Short-term view: Expect continued off-plan leadership, with ready commercial and mid-market apartments providing stability on quieter launch days.

Data Source: Dubai Land Department