Dubai real estate is shifting toward wellness and sustainability, with green, low-density, walkable communities driving long-term value. H1 2025 saw ~94,700 investors (+26% YoY) and 91,000 deals worth Dh262.1bn (+36.4%). Top wellness-led districts: Meydan, MBR City, Dubai Hills, Palm Jumeirah, Emirates Hills.

Read the full article on Khaleej Times

UAE developer AD Global Real Estate has launched J188, its latest residential development in Dubai, as demand grows for wellbeing-led urban living across the emirate.

Read the full article on Arabian Business

Acube Abodes Realty broke ground on Altair 52, a premium residential project in Dubai South, kicking off 2026 construction activity. The launch highlights Dubai’s strong 2025 market and a large 2026 supply wave. Altair 52 is 70% sold and targets 2027 delivery of 52 apartments.

Read the full article on MENA FN

Saudi Arabia’s new real estate law (effective January) lets foreigners, including UAE citizens and expatriates, buy freehold property in designated zones, starting with Riyadh and Jeddah, with more cities in 2026. The system is more regulated than the UAE’s, requiring approvals, and suits long-term, due-diligence-heavy investors.

Read the full article on Gulf News

AMIS GPD Development (AMIS Group) has partnered with luxury watch and jewellery brand Jacob & Co. to develop an ultra-luxury villa community in Meydan, Dubai. The project aims to set a new benchmark for high-end living through premium materials, design, and technology.

Read the full article on Zawya

Dubai enters 2026 on strong fundamentals, not speculation: 2025 sales already topped AED500bn across 186k deals. Expect steady growth with mid-market stabilisation as supply rises. Apartments and villas can both deliver ~5–9% yields. Oversupply risk is mostly mid-market, but delays, Golden Visa demand, and global buyers should support absorption.

Read the full article on Construction Week Online

Dubai’s property market grew ~20% in 2025, beating slowdown forecasts (including Fitch’s predicted price drop). DLD data shows 270k+ transactions worth Dh917bn and investments over Dh680bn, driven by population growth, residency schemes, and HNW inflows. Executives expect resilient demand and potentially stronger momentum into 2026.

Read the full article on Khaleej Times

Dubai’s real estate market grew further in 2025, recording around 270,000 transactions worth AED917 billion ($250 billion), up 20 percent year on year. The expansion was driven by a broader investor base, including a surge in new buyers, as well as transparent regulations, UAE state-run Wam news agency reported.

Read the full article on Arabian Gulf Business Insight

TownX data says Dubai buyers are shifting from price-led decisions to lifestyle-led ones: 63% now prioritise location, amenities, and community value. Demand is strongest for walkable, mixed-use, master-planned areas with retail, schools, and wellness facilities, reflecting a focus on long-term liveability and quality-of-life returns.

Read the full article on ME Construction News

R.Evolution launched “Eywa Way of Water,” a 65-home ultra-luxury waterfront project on Dubai Water Canal focused on wellness and longevity. It features purified air and “structured” water, EMF-shielded bedrooms, extensive spa facilities, and advanced connectivity. The development targets LEED and WELL Platinum, plus water-saving tech cutting use up to 40%.

Read the full article on Zawya

Ras Al Khaimah’s real estate market delivered a strong performance in 2025, with rising demand for integrated residential and tourism developments driving sharp price growth across key coastal communities, according to a market report.

Read the full article on Arabian Business

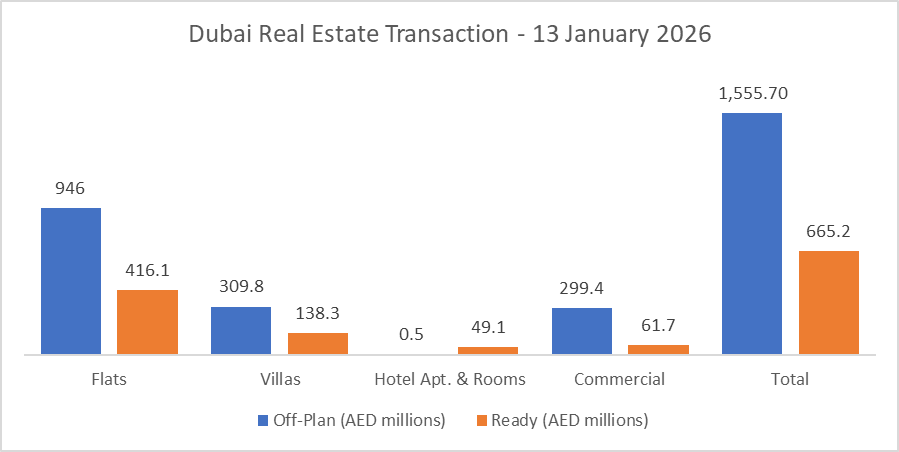

Dubai Real Estate Transactions as Reported on the 13th of January 2026

On the 13-Jan-2026, the total transacted value reached AED 2,220,993,073. Off-plan dominated with AED 1,555,747,100 (70.0%), while Ready accounted for AED 665,245,973 (30.0%).

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 946.0 | 416.1 |

Villas | 309.8 | 138.3 |

Hotel Apt. & Rooms | 0.5 | 49.1 |

Commercial | 299.4 | 61.7 |

Total | 1,555.7 | 665.2 |

Off-Plan Market Performance

Total Value: AED 1,555,747,100

Flats: AED 946,001,026 (60.8%)

Villas: AED 309,836,976 (19.9%)

Hotel Apt. & Rooms: AED 499,932 (0.03%)

Commercial: AED 299,409,166 (19.2%)

Off-plan activity was overwhelmingly flat-led, with commercial and villas contributing almost equally as the secondary drivers of value.

Ready Market Performance

Total Value: AED 665,245,973

Flats: AED 416,140,434 (62.6%)

Villas: AED 138,305,530 (20.8%)

Hotel Apt. & Rooms: AED 49,142,745 (7.4%)

Commercial: AED 61,657,264 (9.3%)

Ready transactions were anchored by flats, while hotel apartments stood out as a meaningful contributor compared to the off-plan segment.

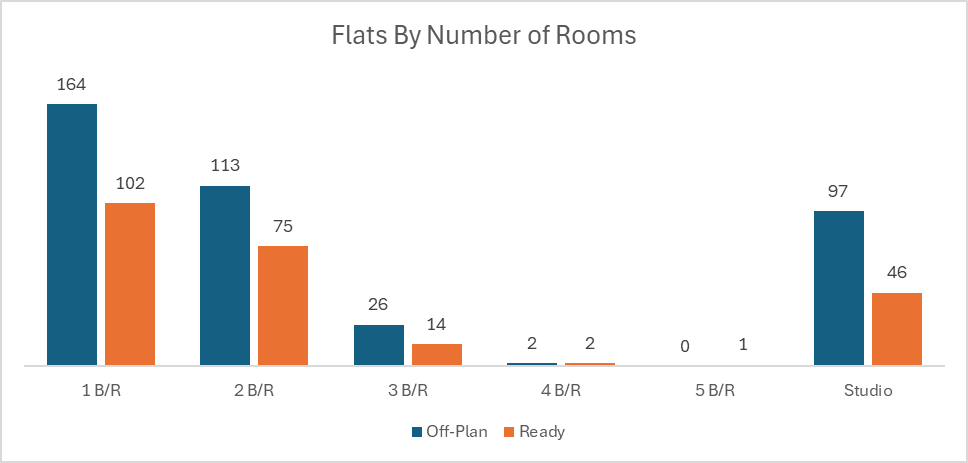

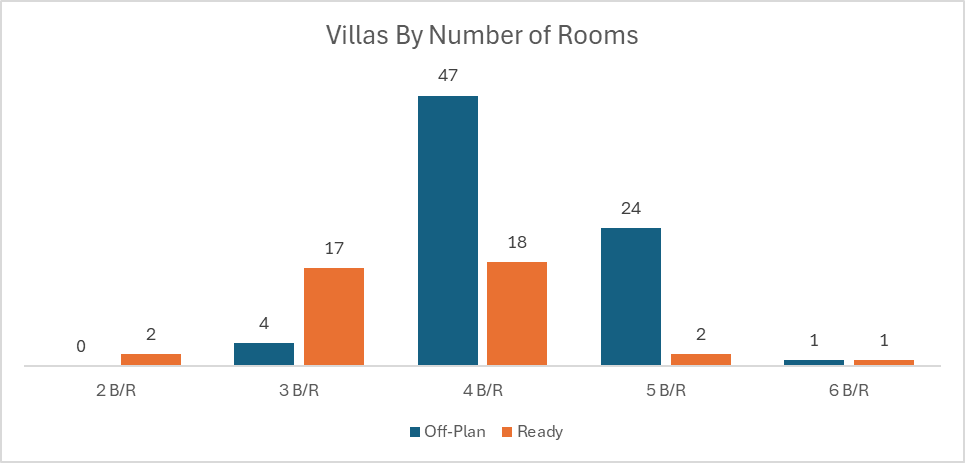

On The Micro Level

Market Insights & Outlook

The day’s performance points to a market still skewed toward forward-looking demand, with off-plan capturing ~70% of total value. Within off-plan, flats carried the story, while commercial value remained notably strong, suggesting investors are not only buying homes but also positioning for business and rental-led opportunities. In the ready market, flats and villas remained the core, but the higher share of hotel apartments highlights continued appetite for income-oriented, hospitality-adjacent assets as Dubai’s lifestyle and tourism ecosystem stays active.

Data Source: Dubai Land Department