Drowning in Details? Here’s Your Life Raft.

Stop doing it all. Start leading again. BELAY has helped thousands of leaders delegate the details and get back to what matters most.

Access the next phase of growth with BELAY’s resource Delegate to Elevate.

Q3-2025 Dubai property hit records: 59,228 sales worth Dh170.7b, with off-plan 70% (37,995 deals; Dh79.34b). Apartments led. Rate cuts, upgraded infrastructure and affordability lifted hotspots (JVC, Meydan, Dubai South). New October launches from Tarrad (Celesto 1–3) and Symbolic signal momentum into 2026.

Read the full article on Khaleej Times

Dubai Land Department launched “Digital Sale” on Dubai Now, enabling 24/7 end-to-end property sales with UAE Pass e-signatures and instant title issuance. Eligible freehold units (single owner, no mortgage) can transact remotely. The move advances D33/Real Estate 2033 goals, boosting speed, transparency, and investment appeal.

Read the full article on GoD Media Office

Tarrad Development launched three Dubai projects: Celesto 1 (Dubailand) is 100% sold, escrow funded, construction on schedule. Celesto 2 and 3 on Sheikh Zayed bin Hamdan Street add 500+ furnished units with flexible plans. The developer cites strong market confidence and promises more launches ahead.

Read the full article on Biz Today

Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

The Abu Dhabi Real Estate Centre (ADREC) launched the region’s first government-backed digital buy and sell journey, enabling buyers and sellers to complete end-to-end property transactions entirely online.

Read the full article on Arabian Business

Amirah Developments began piling and shoring for Bonds Avenue Residences on Dubai Islands, moving swiftly from June 2025 groundbreaking toward Q1 2027 completion. The coastal project offers 1–4BR homes, townhouses and penthouses with sea views and resort-style amenities, reflecting strong investor demand and a focus on quality, transparency and sustainability.

Read the full article on Zawya

Dubizzle Group plans a DFM IPO of 30.34% (1.25bn shares: 196.1m new, 1.05bn existing). Subscriptions Oct 23–29; pricing Oct 30; trading Nov 6, 2025. Prosus commits $100m. Operates dubizzle/Bayut; H1-2025 UAE adjusted net profit $43m. Proceeds for ESOP, M&A, growth.

Read the full article on Zawya

Best Price. Every Trade.

Built for active crypto traders. CoW Swap always searches across every major DEX and delivers the best execution price on every swap you make. Smarter routes. Better trades. No wasted value. Find your best price today. So why trade on any one DEX when you can use them all?

Pakistani investors are now among Dubai’s top five buyers, lured by up to 10% yields, USD-pegged stability, and PKR weakness. Prices rose 11% YoY (UBS), near 2014 peaks. Villas/townhouses and Grade-A offices lead; experts favor government-backed waterfront projects. Amber Homes drives cross-border deals.

Read the full article on News Today

Qatar will grant title deeds and real estate residency within days to foreign buyers of property worth at least $200,000, launching at the Third Real Estate Forum. Purchases above QAR3.65m qualify for permanent residency. A one-stop digital platform streamlines processes amid strong market growth.

Read the full article on Gulf News

Dubai’s VARA enables compliant tokenization via a unified, retail-inclusive framework. Rigorous licensing (Tokinvest) and government alignment (e.g., DLD) build trust. Unlike hesitant global regulators, the UAE already runs a live market, setting a benchmark and first-mover advantage for digital asset issuance.

Read the full article on Economy Middle East

Al Ghurair launched the ultra-prime Al Ghurair Collection, debuting Wedyan on the Dubai Canal, Kengo Kuma’s first UAE project. The 46-storey landmark offers 149 residences, a sky villa, expansive amenities, and lush terraces, arriving amid record luxury demand and Al Ghurair’s six-decade legacy.

Read the full article on GCC Business News

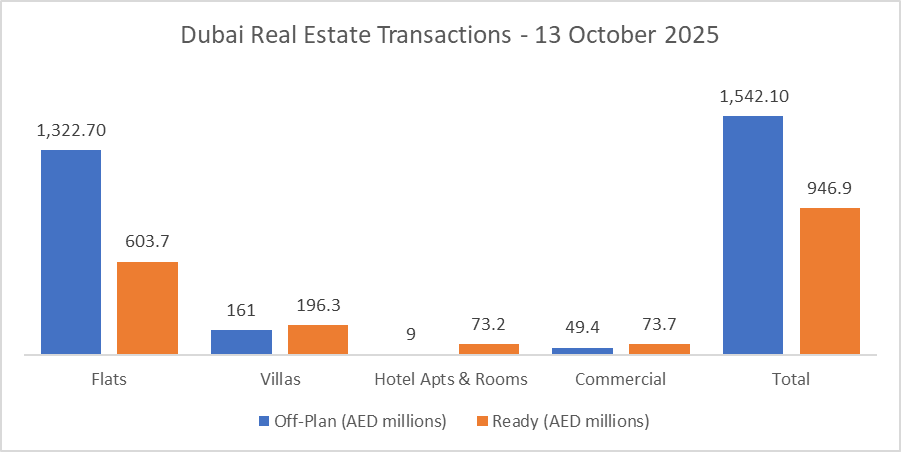

Dubai Real Estate Transactions as Reported on the 13th of October 2025

On 13-Oct-2025, the total transacted value reached AED 2.489 billion. Off-plan dominated with AED 1.542 billion (62.0%), while Ready accounted for AED 947 million (38.0%).

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 1,322.7 | 603.7 |

Villas | 161.0 | 196.3 |

Hotel Apts & Rooms | 9.0 | 73.2 |

Commercial | 49.4 | 73.7 |

Total | 1,542.1 | 946.9 |

Off-Plan Market Performance

Total Value: AED 1,542,078,819

Flats: AED 1,322.7m (85.8%)

Villas: AED 161.0m (10.4%)

Hotel Apts & Rooms: AED 9.0m (0.6%)

Commercial: AED 49.4m (3.2%)

Apartments led off-plan decisively, with villas a distant second; hospitality and commercial were minimal.

Ready Market Performance

Total Value: AED 946,944,864

Flats: AED 603.7m (63.7%)

Villas: AED 196.3m (20.7%)

Hotel Apts & Rooms: AED 73.2m (7.7%)

Commercial: AED 73.7m (7.8%)

Ready activity was flat-heavy, with balanced contributions from hotel and commercial segments.

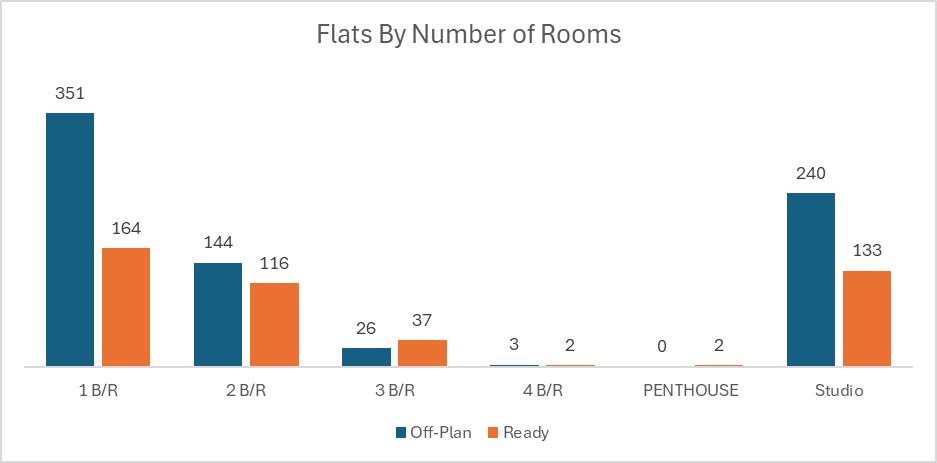

On The Micro Level

Market Insights & Outlook

Off-plan’s ~62% share signals continued preference for new launches, while ready demand remains resilient in flats and family villas. Expect momentum to persist near term, with pricing power concentrated in well-located apartment projects and established villa communities.

Data Source: Dubai Land Department