Stay Ahead of the Market

Markets move fast. Reading this makes you faster.

Every weekday, you’ll get a 5-minute Elite Trade Club newsletter covering the top stories, market-moving headlines, and the hottest stocks — delivered before the opening bell.

Whether you’re a casual trader or serious investor, it’s everything you need to know before making your next move. Join 160k+ other investors who get their market news the smart and simple way.

Some Abu Dhabi rents up 21 per cent as demand grows for luxury waterfront living in ADGM’s residential hub.

Read the full article on Arabian Business

ValuStrat’s July 2025 report shows Dubai housing surging, villas at 296.9 (+1.8% MoM, +27.9% YoY), overall VPI 224.1 (+1.5% MoM, +23% YoY). Off-plan dominated 78% of sales; 26 deals topped AED30m. Hotspots include Palm/Jumeirah Islands; top sellers Emaar, Damac, Sobha.

Read the full article on Economy Middle East

Dubai’s Q1 2025 GDP rose 4% to Dh119.7bn, led by health (+26%) and strong wholesale/retail (Dh27.5bn). Real estate grew 7.8% to Dh9bn amid H1 deals up 26% to Dh431bn. Finance (+5.9%), manufacturing (+3.3%) and tourism (+6% visitors) also supported growth, aligning with D33 ambitions.

Read the full article on The National

Sharjah’s real estate market recorded its highest monthly transaction value of 2025 in July, with total deals reaching AED7.5bn ($2.04bn) across 11,377 transactions, according to the Sharjah Real Estate Registration Department.

Read the full article on Arabian Business

Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

The first six months of the year were certainly strong. The Dubai Land Department, repository of all data, reported that the value of transactions – residential and commercial, sales and resales – rose by a quarter to a weighty AED431 billion ($117 billion) in the first half. That, by the way folks, is about the GDP of the entire emirate.

Read the full article on Arabian Gulf Business Insight

RAK Properties’ Q2 net profit nearly doubled to Dh92.6m as H1 sales hit Dh1.5bn, buoyed by foreign investor demand linked to Wynn Al Marjan. The developer targets Dh3bn 2025 sales and 25% growth, launching multiple projects and expanding to Dubai South and Abu Dhabi ahead of Wynn’s 2027 opening.

Read the full article on The National

Average Dubai commercial property sale price triples year-on-year to $3.92m, with India, the Netherlands, Saudi Arabia and the UK leading investment.

Read the full article on Arabian Business

Dubai office sales values rose 84% YoY to AED5.4bn across 1,900 deals (H1 2025). Prices +22% to AED1,748/sq ft; rents +26% to AED166. Ready offices were 85% of sales as off-plan surged. Business Bay led. Supply to expand into 2026 amid strong FDI-driven demand.

Read the full article on Zawya

Employers are seeking pricier and larger office footprints in Dubai as they combine multiple locations into single, high-end regional hubs in a tight market for top-quality space, a new real-estate report has found.

Read the full article on Arabian Gulf Business Insight

Dubai-based DMDC is expanding into Abu Dhabi, launching with a luxury renovation at Four Seasons Residences. The move follows its new investment arm, DMDC Estates. Citing strong demand, the firm plans a pipeline of projects; headcount quadrupled since launch, says CEO Raji Daou.

Read the full article on Zawya

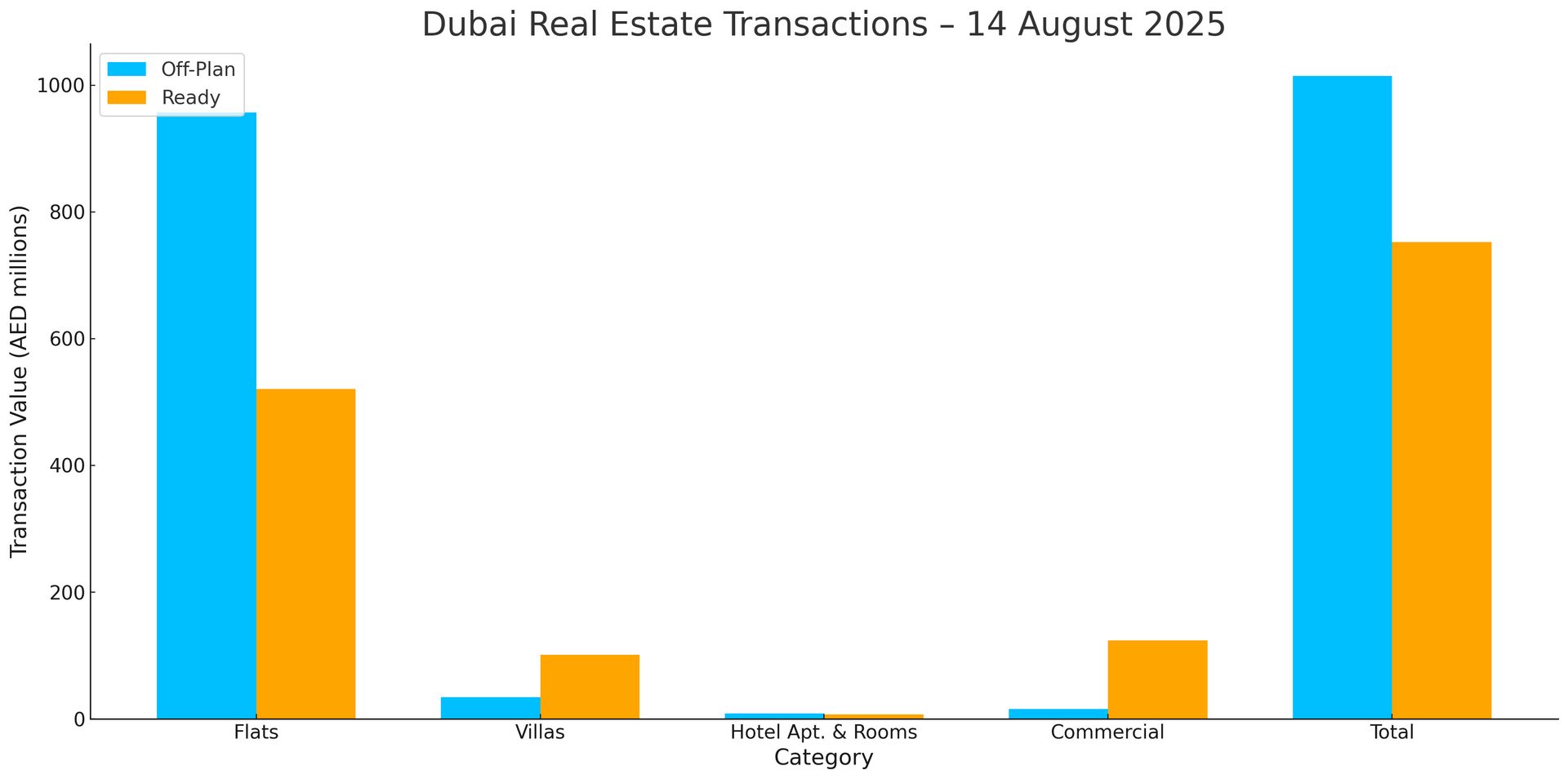

Dubai Real Estate Transactions as Reported on the 14th of August 2025

Dubai recorded AED 1.767bn in property transactions. Off-plan contributed AED 1.015bn (57.4%), while ready properties added AED 0.752bn (42.6%).

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 956.6 | 520.3 |

Villas | 34.2 | 101.4 |

Hotel Apt. & Rooms | 8.5 | 6.8 |

Commercial | 15.3 | 123.8 |

Total | 1,014.6 | 752.2 |

Off-Plan Market Performance

Flats: AED 956.6m (94.3% of off-plan)

Villas: AED 34.2m (3.4%)

Hotel Apartments & Rooms: AED 8.5m (0.8%)

Commercial: AED 15.3m (1.5%)

Off-plan activity was followed the same daily theme with flats in the lead, with limited villa and commercial contributions.

Ready Market Performance

Flats: AED 520.3m (69.2% of ready)

Villas: AED 101.4m (13.5%)

Hotel Apartments & Rooms: AED 6.8m (0.9%)

Commercial: AED 123.8m (16.5%)

Ready transactions were broad-based, with flats dominant and a notable 16.5% share from commercial assets.

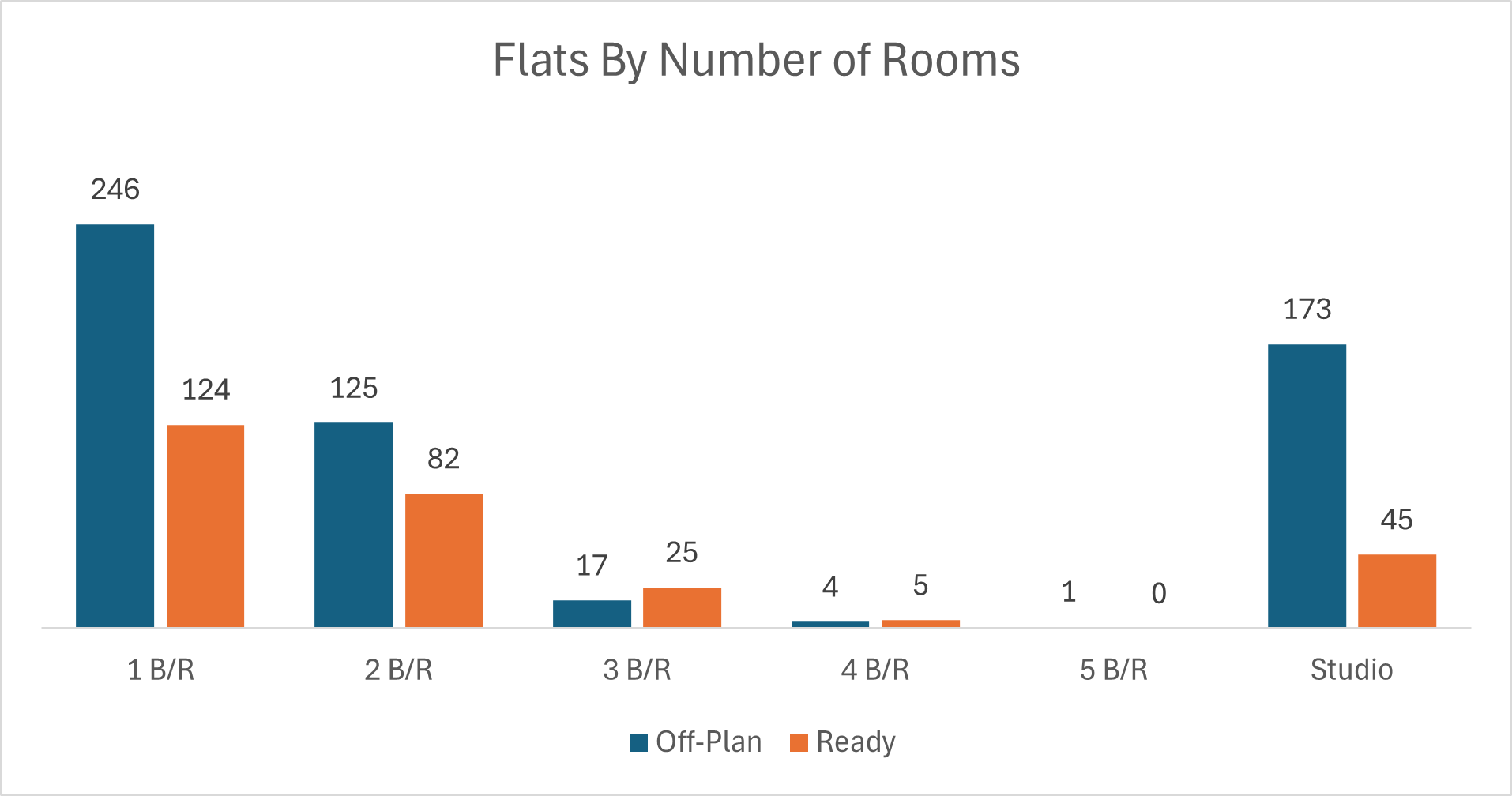

On The Micro Level

Market Insights & Outlook

Flats drove activity across both segments, underscoring end-user and investor demand for apartment stock. Villas were modest on the day, while the solid commercial share in the ready market hints at steady business-space appetite. Overall, momentum remains balanced but tilted toward off-plan launches.

Data Source: Dubai Land Department