Dubai real estate is booming (H1 2025: 98,000+ deals worth AED 327bn), but Sunlocate CEO Valentin Kulikov says sustainability now depends on long-term client relationships. His “Customer Happiness” system prioritizes lifetime value via behavioral insights, proactive support, and post-sale monitoring—not “sell and forget.”

Read the full article on CEO World

Binghatti launched an $8.2bn Mercedes-Benz branded project at Nad Al Sheba: 12 towers, 13,000+ units across 10m sq ft, completing in ~3.5 years. Prices start at Dh1.6m (studio). Funded by equity; chairman expects a stable 2026 market and plans Abu Dhabi expansion.

Read the full article on The National

Mohamed Alabbar said Emaar will launch the construction tender for Dubai Creek Tower within three months. The project has been redesigned multiple times, with the current focus on aesthetics and visual identity. The revival signals renewed momentum for Dubai Creek Harbour and investor confidence in Dubai’s long-term growth.

Read the full article on Gulf News

Arada launched Inaura, a kinetic-wellness hospitality and residences brand, with Inaura Downtown sales due by end-January. The 42-floor, 200m+ MVRDV-designed tower features a signature central orb with 360° views, 114 branded residences plus a 10-floor hotel, and extensive wellness amenities (Formative gym, clinic, spa). LEED Gold precertified.

Read the full article on MENA FN

Dubai’s housing demand is shifting toward wellness, green living and community planning. DLD says H1 2025 saw ~94,700 investors (+26% YoY) and 91,000+ residential deals worth AED262.1bn (+36.4%). Amaal highlights five wellness-led districts driving AED10m+ sales: Meydan, MBR City, Dubai Hills, Palm Jumeirah, and Emirates Hills.

Read the full article on Construction Week Online

Ejari is Dubai’s mandatory DLD system (since 2010) that registers rental contracts, making them legally recognised. It’s essential for DEWA activation, disputes, and residency processes. Legally the landlord registers, but often delegates to tenant/agent; tenants usually pay. It must be renewed annually and updated for contract changes.

Read the full article on Gulf News

Betterhomes says Dubai hit a 2025 residential record: AED547bn sales (+28% YoY) across 203,000 deals (+20%). Off-plan led (65% of transactions), prices rose 12% to AED1,673/sq ft, and mortgages reached 52%. Demand stayed concentrated in affordable, investable apartments; leasing volumes surged while rents remained stable.

Read the full article on Zawya

International developers often assume speed guarantees success, but Thomas Wan (Refine) says Dubai rewards execution quality, delivery credibility, and transparency in a data-driven market. Refine’s Development-as-a-Service helps foreign developers manage approvals, escrow, contractors, and go-to-market end-to-end. Fast-selling luxury projects combine authentic branding, functional layouts, privacy, disciplined pricing, and strong local partnerships.

Read the full article on Construction Week Online

Deca Properties has begun construction on Avana Residences in JVC, with piling and contracts underway after a groundbreaking. The wellness-led project offers studios to two-bed apartments, targeting Q4 2027 completion. Federal Engineering Consultants leads design/compliance, with Aviva Collective on interiors. Amenities include rooftop pool, gym, yoga deck, padel court, and EV charging.

Read the full article on Zawya

AHS Properties is redeveloping an abandoned Sheikh Zayed Road building into AHS Tower, a 328m, 69-storey Grade A commercial project overlooking DIFC. After 2025 freehold rules enabled strata sales, AHS switched from leasing to selling offices—~95% sold. Designed by Killa Design, it adds hospitality-style amenities, wellness floors, and extensive parking.

Read the full article on Gulf News

Alef Group launched Palace Residences Al Mamsha in Sharjah with Emaar Hospitality, bringing the Palace Residences brand to Sharjah for the first time. The AED500m project in Al Mamsha offers 1–3BR apartments across two towers, with branded services, pools, fitness/wellness, lounges and ~300 parking spaces, emphasizing walkability, sustainability and community living.

Read the full article on Zawya

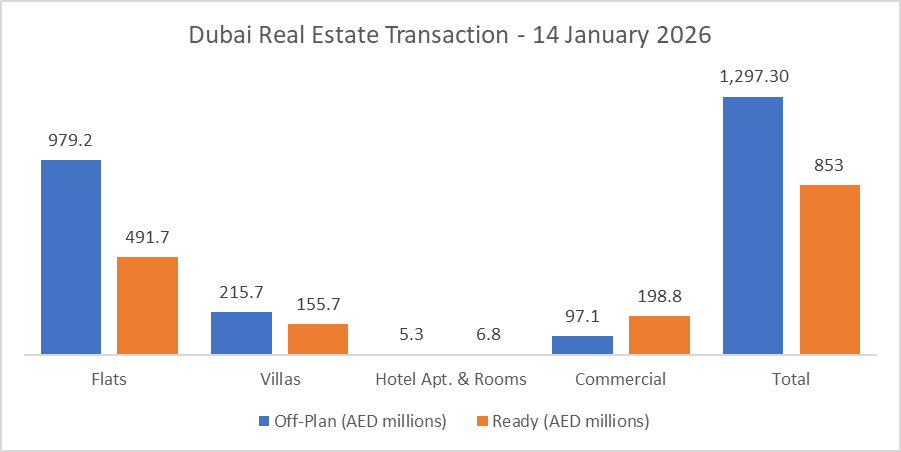

Dubai Real Estate Transactions as Reported on the 14th of January 2026

On the 14-Jan-2026, the total transacted value reached AED 2.15 billiob. Off-plan dominated with AED 1.30 billion (60.3%), while Ready accounted for AED 853.0 million (39.7%).

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 979.2 | 491.7 |

Villas | 215.7 | 155.7 |

Hotel Apt. & Rooms | 5.3 | 6.8 |

Commercial | 97.1 | 198.8 |

Total | 1,297.3 | 853.0 |

Off-Plan Market Performance

Total Value: AED 1.30 billion

Flats: AED 979.2m (75.5%)

Villas: AED 215.7m (16.6%)

Hotel Apts & Rooms: AED 5.3m (0.4%)

Commercial: AED 97.1m (7.5%)

Off-plan activity was overwhelmingly flat-led, with apartments accounting for over three-quarters of off-plan value.

Ready Market Performance

Total Value: AED 853.0 million

Flats: AED 491.7m (57.6%)

Villas: AED 155.7m (18.2%)

Hotel Apts & Rooms: AED 6.8m (0.8%)

Commercial: AED 198.8m (23.3%)

Ready demand was more diversified, with commercial assets taking a notably larger share than in the off-plan segment.

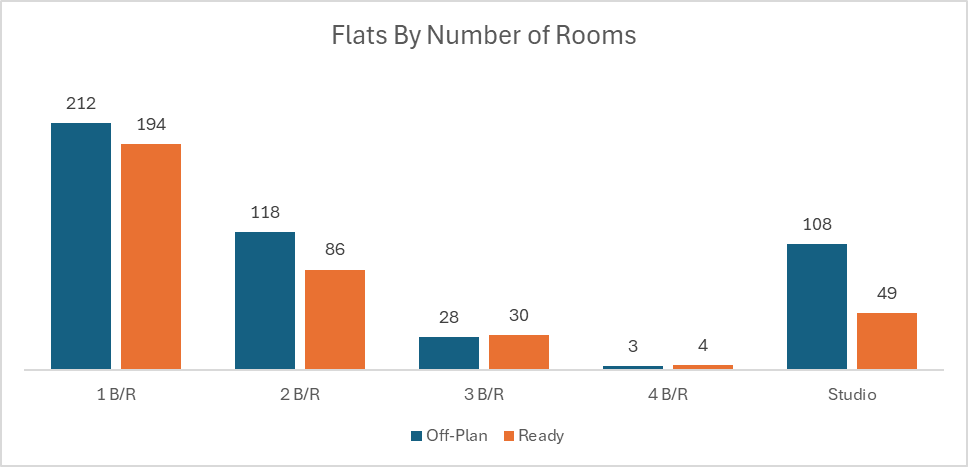

On The Micro Level

Market Insights & Outlook

The day’s performance reflects a familiar Dubai pattern: off-plan value driven by apartment launches and investor appetite, while the ready market shows stronger breadth, particularly in commercial transactions. If this mix persists, expect developers’ apartment pipelines to remain a key volume engine, with ready commercial continuing to attract buyers seeking income-oriented, immediately usable assets.

Data Source: Dubai Land Department