Learn AI in 5 minutes a day

This is the easiest way for a busy person wanting to learn AI in as little time as possible:

Sign up for The Rundown AI newsletter

They send you 5-minute email updates on the latest AI news and how to use it

You learn how to become 2x more productive by leveraging AI

Betterhomes forecasts Dubai could welcome about 7,100 millionaires in 2025, bringing roughly $7.1 billion, fueling a shift from speculative buying to long-term investment. Drawn by tax efficiency, stability, and connectivity, HNWIs are anchoring wealth in Dubai’s real estate as a structural asset class.

Read the full article on Gulf Business

Sharjah’s real estate hit 7,206 transactions in April 2025, totaling AED 4 billion across 10.3 million sq ft. Growth is driven by supportive government policies, infrastructure expansion, freehold incentives, and foreign investment. Both residential and commercial markets surged amid sustainability challenges.

Read the full article on MSN

MultiBank is tokenizing $3 billion of premium UAE real estate with MAG and blockchain firm Mavryk on its regulated RWA marketplace, MultiBank.io. It’s launching $MBG—a utility token for access, staking, governance, yield and deflationary buyback-and-burn—in the world’s largest real estate tokenization, scalable to $10 billion.

Read the full article on Economy Watch

Crown Prince Sheikh Hamdan bin Mohammed approved over AED2 billion for 1,163 new Emirati housing units across Wadi Al Amardi, Al Aweer, Hatta, and Oud Al Muteena, highlighting modern designs, advanced infrastructure, quality services, and sustainable living environments to support citizens’ well-being.

Read the full article on Zawya

MAAIA targets growth in UAE with new projects announced in Dubai and $1.4bn sales target in 2025.

Read the full article on Arabian Business

Get access to vetted, private deals from around the world.

Invest in assets like racehorses, art, film, and more, the smart way.

Altea is the must-join community for serious alternative investors who want to diversify their portfolio into high-yielding alternatives like:

Art I: Seven unique paintings by a 20th-century British surrealist: 73% IRR

Racehorse I: Foals acquired, trained, and sold as yearlings: 36% forecast IRR

Film I: Bridge debt for highly-collateralised Hollywood films: 72% IRR

Join Altea today for as little as $99.

Wasl unveiled the “Next Chapter” masterplan for Jumeirah Golf Estates, spanning 4.68 million sqm and adding 12,345 homes—from villas and mansions to apartments—across six lifestyle districts. It features golf, equestrian and sports facilities, integrated retail, schools and parks, plus seamless transport links under Dubai’s 2040 Urban Plan.

Read the full article on Zawya

Dubai Land Department and BARNES Middle East Africa signed a Memorandum of Cooperation at the April 16, 2025 International Property Show to elevate Dubai’s luxury real estate sector. The partnership taps BARNES’s 30 years of global expertise and AI-driven tools for market data exchange, international roadshows, and strategic promotion to UHNW clients.

Read the full article on Zawya

Sharjah’s Shurooq marks 15 years of sustainable development with over 60 million square feet of completed projects across real estate, hospitality, culture, and retail.

Read the full article on Construction Week Online

German luxury brand BRABUS launched BRABUS Island - its first branded residential project in Abu Dhabi’s Al Seef District, featuring 352 units across four towers. Developed with Cosmo and Reportage Group, it shattered expectations with AED 4.2 billion in sales within 48 hours, doubling its initial goal.

Read the full article on Zawya

In early 2025, Abu Dhabi’s residential market boomed - driven by limited supply, strategic infrastructure, digital banking and the Golden Visa - fueling investor demand. Oia Properties cites Yas Island, Al Reem, Hudayriyat, Al Raha Beach and Saadiyat as top performers, with Ghantoot, Al Reef, Masdar City, Al Shamkha and Zayed City emerging.

Read the full article on Zawya

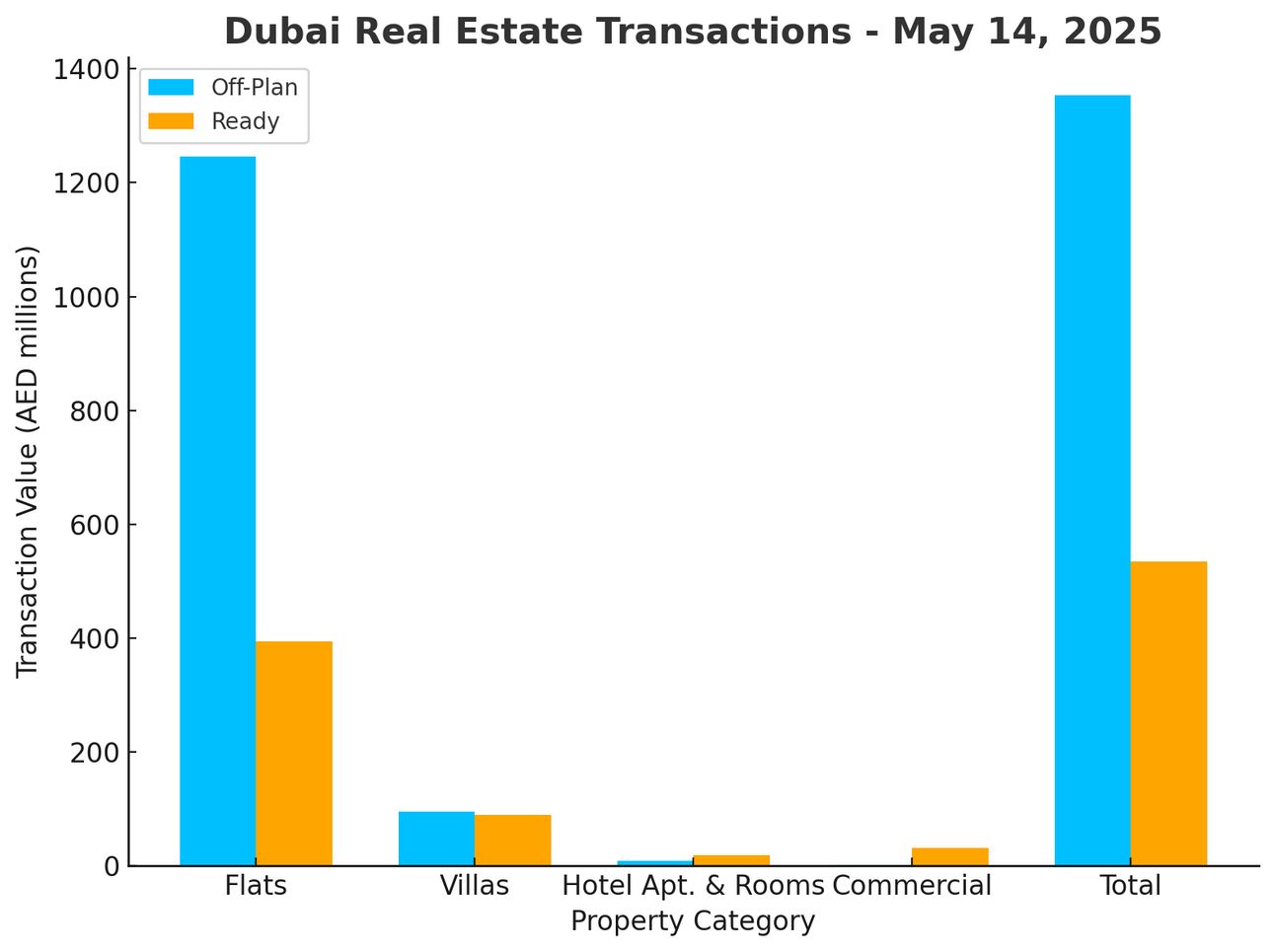

Dubai Real Estate Transactions as Reported on the 14th of May 2025

On 14 May 2025, Dubai’s real estate market recorded transactions totaling approximately AED 1.89 billion. The off-plan segment continued to dominate, accounting for 71.7% of the total value, while ready properties made up the remaining 28.3%. This ongoing trend highlights the strength of Dubai’s development pipeline and sustained investor confidence in pre-construction opportunities.

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 1,246.4 | 394.8 |

Villas | 95.7 | 89.9 |

Hotel Apt. & Rooms | 8.6 | 18.5 |

Commercial | 2.3 | 31.3 |

Total | 1,353.0 | 534.5 |

Off-Plan Market Performance

Total Off-Plan Transactions: AED 1.35 billion (71.7% of total)

Flats were the clear leader in this segment, contributing AED 1.25 billion, which accounts for 92.1% of all off-plan activity. This reflects strong buyer appetite for apartment-style living in new developments.

Villas followed with AED 95.7 million, or 7.1% of the off-plan total. While smaller in value, villas remain a sought-after product for families and lifestyle-focused investors.

Hotel apartments and rooms recorded AED 8.6 million, representing 0.6% of the off-plan segment, indicating moderate demand for hospitality-linked investments.

Commercial properties saw limited movement with just AED 2.3 million in value, contributing 0.2% of off-plan transactions.

Ready Market Performance

Total Ready Transactions: AED 534.5 million (28.3% of total)

Flats led the ready segment as well, accounting for AED 394.8 million or 73.9% of all ready property transactions. This underscores strong resale demand in established communities.

Villas contributed AED 89.9 million, about 16.8% of the ready total, reflecting solid demand from both end-users and long-term investors.

Hotel apartments and rooms brought in AED 18.5 million, which made up 3.5% of ready property activity.

Commercial units accounted for AED 31.3 million, or 5.9% of the segment, suggesting consistent interest in income-generating assets.

On The Micro Level

Market Insights & Outlook

Investor Behavior: The high proportion of off-plan transactions signals a preference for long-term investment, capitalizing on price growth and payment flexibility.

End-User Demand: The strong showing in ready flats and villas indicates continued movement from residents, supported by competitive mortgage rates and mature infrastructure.

Future Outlook: As new project launches continue and government incentives (e.g., Golden Visas, improved infrastructure) roll out, Dubai’s real estate market is poised to maintain its growth trajectory through the remainder of 2025—particularly in high-quality off-plan residential offerings.

Data Source: Dubai Land Department