Sticking with the same home insurance could cost you

Home insurance costs are rising fast, up nearly 40% nationwide in just the past few years. With premiums changing constantly, sticking with the same provider could mean overpaying by hundreds of dollars. Shopping around and comparing multiple insurers can help lock in better rates without losing the protection your home needs. Check out Money’s home insurance tool to shop around and see if you can save.

Dubai’s boom is increasingly end-user led. Q3 2025 saw Dh138bn in sales (+18%) across 55,280 deals, 70% off-plan. Prices rose broadly, villas strongest; JVC, Dubai South, Business Bay led off-plan. Rents stabilise; AED5–10m segment surges. With easing rates, momentum likely into 2026.

Read the full article on Gulf News

Investor Rajesh Sawhney calls Dubai a “super bubble,” surpassing Gurugram. UBS’s 2025 index ranks Dubai 5th for bubble risk, with prices up 50% in five years and double-digit gains since mid-2023 amid population-driven tight supply. Fitch expects a moderate correction (≤15%) in 2025–26; Indian analysts voice similar overheating fears.

Read the full article on MSN

Calgary Properties launched Flora Shore Beachside Residences, a 14-storey tower on Dubai Islands, with 2–4BR homes and sea views, targeting handover in Q3 2027. Co-developed with Flora Realty and marketed by OCTA, it offers resort-style amenities including gyms, yoga, co-working, kids’ facilities and outdoor cinema.

Read the full article on Zawya

The Dubai property market defied seasonal trends in the third quarter of 2025, with total residential transactions climbing 22.7 per cent year-on-year and commercial sales value rising 31 per cent, according to Engel & Völkers Middle East data.

Read the full article on Arabian Business

UN-Limited Limit Orders in DeFi

CoW Swap limit orders offer:

Unlimited order management: Limit orders on CoW Swap are completely FREE to place or cancel. Yes, really!

Unlimited order placement: Use one crypto balance to place multiple orders at once, even if you don’t have the full amount yet. That’s useful!

Unlimited order surplus: All upside captured after a price is hit goes to you and not to order takers. As it should be!

Plus everything else you know and love about CoW Swap, like gasless trading and MEV protection.

Dubai Municipality and Dubai Land Department formed a GITEX 2025 partnership to integrate urban planning and real estate data. Using Digital Twin and a Smart Buildings platform, they’ll enhance evidence-based decisions, transparency and services, optimize infrastructure, and support sustainable smart-city growth for residents, investors and developers.

Read the full article on Zawya

GCC now offers long-term residencies without sponsors. UAE’s Golden Visa set the model; Saudi’s Premium Residency, Qatar’s property-linked permits, Bahrain’s 10-year visa, and Oman’s investor visas follow. Thresholds vary. Programs attract skilled residents, boost investment, and give expats family-friendly, renewable 5–10-year options.

Read the full article on Gulf News

At GITEX 2025, Dubai’s Rental Disputes Center launched a Digital Indicators Platform for real-time judicial analytics and highlighted its Smart App for filings and digital verdicts, plus online tools, automated service-charge execution, self-judgment evictions, Rental Good Conduct Certificates, and a virtual judge, advancing Dubai’s digital justice.

Read the full article on Zawya

Al Mal Capital REIT bought NMC Royal Hospital’s Dubai Investments Park real estate, its first healthcare asset, raising the REIT’s portfolio to ~AED 1.4bn (six assets). NMC will lease it back for ~17 years, providing stable income. NMC restructured in 2022 after a $4bn hidden-debt scandal.

Read the full article on Gulf News

Samana Developers launched SAMANA Imperial Garden in Arjan. AED398m, 344 units, handover Mar-2029. Debuts “Flexible Homes” (smart furniture converts studios to larger layouts). Prices from AED859k, many with private pools, rich amenities, and flexible payments. Reinforces Samana’s top-five off-plan status, with 18 projects planned by end-2025.

Read the full article on Zawya

Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

Alef Group and Emaar Hospitality will bring Palace Residences to Al Mamsha Seerah, Sharjah, luxury homes with hotel-style services. The project blends Arabesque elegance with modern amenities: sky terraces, landscaped courtyards, pools, community gardens, and curated retail/dining, setting a new benchmark for upscale living.

Read the full article on Sharjah 24

Driven | Forbes Global Properties will exclusively sell Corinthia Dubai residences by Dubai General Properties. Twin 500m+ SZR towers by AtkinsRéalis feature Dubai’s first Corinthia hotel, branded/non-branded homes, dramatic sky lobby, and luxury amenities. Completion slated for 2030, positioning it as a new global-benchmark landmark.

Read the full article on Zawya

Aldar sold out Yas Living on Yas Island within days, generating AED1.3bn. The 678-apartment project offers rich amenities across three buildings. Buyers were 65% expats/international and 65% under 45; 71% were first-time Aldar customers. Strong demand underscores Yas Island’s appeal and Aldar’s community strategy.

Read the full article on Zawya

RAK apartment sales value jumped 242% (Q2 2017→Q2 2025), per official stats. Major Developments launched Colibri Views in RAK Central with Patrice Evra’s rooftop football simulator, modular furnished units, 30+ amenities, and post-handover plans. Near Wynn Al Marjan, it targets strong yields and capital appreciation.

Read the full article on Zawya

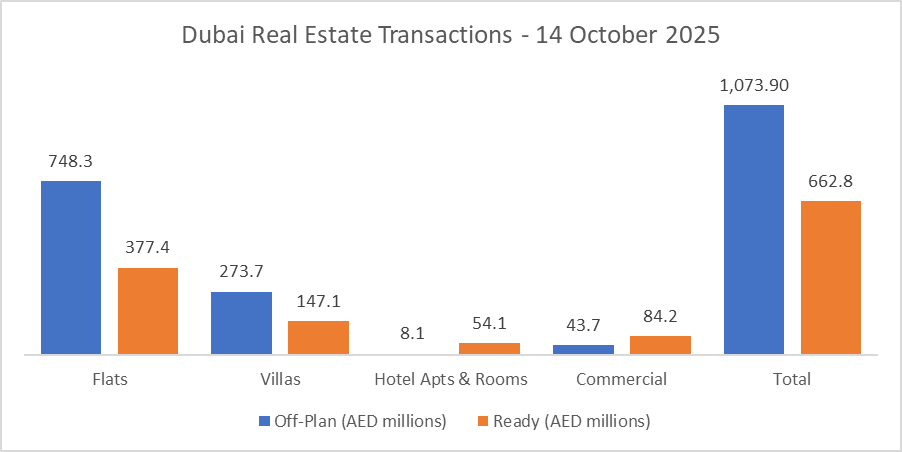

Dubai Real Estate Transactions as Reported on the 14th of October 2025

On 14-Oct-2025, the total transacted value reached AED 1,736,666,153. Off-plan dominated with AED 1,073,877,875 (61.8%), while Ready accounted for AED 662,788,277 (38.2%).

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 748.3 | 377.4 |

Villas | 273.7 | 147.1 |

Hotel Apts & Rooms | 8.1 | 54.1 |

Commercial | 43.7 | 84.2 |

Total | 1,073.9 | 662.8 |

Off-Plan Market Performance

Total Value: AED 1,073,877,875

Flats: AED 748,317,372 (69.7%)

Villas: AED 273,698,965 (25.5%)

Hotel Apts & Rooms: AED 8,113,150 (0.8%)

Commercial: AED 43,748,388 (4.1%)

Off-plan activity was led decisively by flats, with villas providing a solid secondary pillar and limited hotel-apartment and commercial volume.

Ready Market Performance

Total Value: AED 662,788,277

Flats: AED 377,447,577 (56.9%)

Villas: AED 147,097,469 (22.2%)

Hotel Apts & Rooms: AED 54,062,837 (8.2%)

Commercial: AED 84,180,395 (12.7%)

Ready transactions skewed toward flats, villas come second with more than a fifth of the market share, while a notable share in commercial and hotel units signaled mixed end-user and income-focused demand.

On The Micro Level

Market Insights & Outlook

A balanced day with off-plan setting the pace and ready deals reinforcing depth. Strong flat-led liquidity suggests sustained absorption, while villa demand remains resilient. If developer offers persist and financing conditions stay stable, the mix points to steady momentum into late October.

Data Source: Dubai Land Department