|

|

Do You Want To Be Featured As An Area Expert? Click Here |

|

AboutTheUAE is your definitive guide to Dubai – discover top Real Estate, schools, visa requirements, housing insights, transport tips, shopping hotspots, entertainment and more. |

Dubai’s real estate market remains resilient and dynamic thanks to economic growth, regulatory incentives, and foreign investment. However, off-plan purchases carry risks: arbitration clauses may be unenforceable if they breach public policy or lack mandatory DLD registration. Buyers should seek legal review to understand their rights and dispute options.

Read the full article on Economy Middle East

Shapoorji Pallonji has completed Imperial Avenue, its first international residential project in Downtown Dubai. The 45-storey tower offers ultra-luxe amenities, sustainability elements, and panoramic views. RERA-certified and backed by AED 1.4 billion, this milestone underscores the group’s strategic entry into Dubai’s luxury property market.

Read the full article on Zawya

OMNIYAT, led by Mahdi Amjad, captured over one-third of Dubai’s ultra-luxury residential market in 2024. It has expanded into premium commercial projects (Enara, Lumena), issued a $500 million Green Sukuk, and delivered design-driven, sustainable landmarks like Marasi Bay.

Read the full article on Economy Middle East

Dubai’s Metro Blue Line launch is boosting real estate demand in areas like Dubai Silicon Oasis, Academic City, and Mirdif. Improved connectivity, attractive pricing, and planned amenities have driven sales and rentals, pushing home prices up 5.6% YoY and rental yields higher amid strong international investment.

Read the full article on Gulf News

|

|

Do You Want To Be Featured As An Area Expert? Click Here |

|

AboutTheUAE is your definitive guide to Dubai – discover top Real Estate, schools, visa requirements, housing insights, transport tips, shopping hotspots, entertainment and more. |

Mira Developments invested $3 million to launch Percent&Co, an AI-powered real estate investment agency targeting global investors. Partnering with top UAE developers and backed by a $71 billion market and AED 761 billion in 2024 transactions, it plans to scale AUM, expand into Europe and Asia, and leverage advanced tech.

Read the full article on Zawya

VARA CEO confirms over 400 registered entities in Dubai’s crypto ecosystem as new pilots target DeFi and tokenised gold.

Read the full article on Arabian Business

In H1 2025, Dubai’s residential market hit 98,603 sales worth AED 326.7 billion (+40 % YoY), driven by a record Q2, villa price gains, robust rental yields and strong off-plan demand. Growth is fueled by GDP expansion, investor-friendly policies and rising international, tech-savvy buyers targeting new hubs.

Read the full article on Zawya

Turkish investments in Dubai real estate soared from $400 million to $3 billion in two years, driven by high yields, zero taxes, mortgage access and Golden Visa perks. In 2024, Dubai’s market hit $142.1 billion, while Turkish investors’ overseas property purchases reached $2.51 billion (+20.5 % YoY).

Read the full article on Turkiye Today

|

|

Do You Want To Be Featured As An Area Expert? Click Here |

|

AboutTheUAE is your definitive guide to Dubai – discover top Real Estate, schools, visa requirements, housing insights, transport tips, shopping hotspots, entertainment and more. |

Rents in Jumeirah Village Triangle have fallen 2.6 percent, with studios at Dh50,000 and one bedroom units at Dh78,000 to Dh100,000. Mid income areas like JVC and The Springs (down 6.6 percent) also see declines. The Lakes and Jumeirah Park lead with 10.8 percent and 9.7 percent annual drops.

Read the full article on Gulf News

The Dubai Metro Blue Line has spurred demand and price growth in metro-linked areas, boosting Q1 residential sales by 18% and off-plan transactions. Strong international investment, supply constraints, high mortgage rates, and regulatory incentives underpin a resilient market, with 2026 price growth forecast at 3.5–5.2%.

Read the full article on Zawya

Julius Baer’s 2025 report ranks Dubai as the world’s seventh most expensive city for the ultra-wealthy and fourth in EMEA, driven by 17% residential and 13% car price rises. Dubai’s millionaire count doubled to 81,200, and with 72,000 homes due, rents may ease despite strong prime-property demand.

Read the full article on The National

Dubai Real Estate Transactions as Reported on the 14th of July 2025

On the 14th of July, total transaction value reached AED 2.400 billion, with off-plan assets contributing 72.6 % (AED 1.743 billion) and ready properties 27.4 % (AED 0.657 billion) of the total volume.

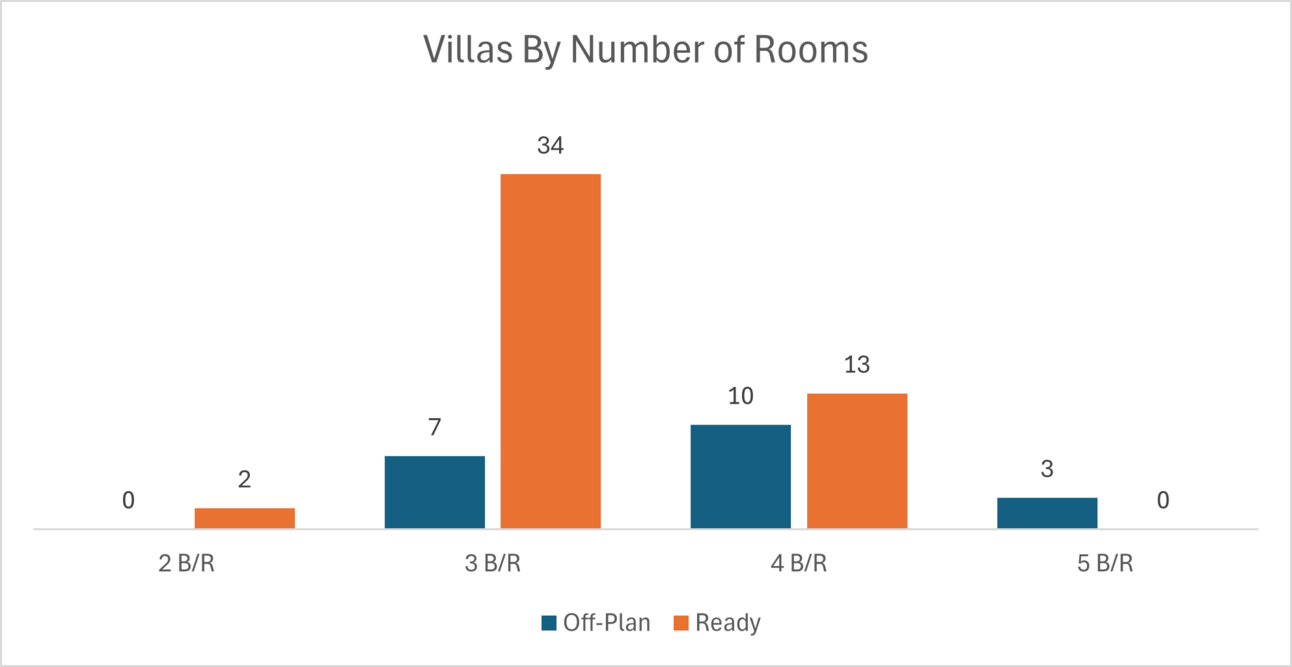

Property Type | Off-Plan (AED million) | Ready (AED million) |

|---|---|---|

Flats | 1194.1 | 435.0 |

Villas | 500.9 | 140.4 |

Hotel Apt & Rooms | 7.5 | 27.8 |

Commercial | 40.9 | 53.3 |

Total | 1743.4 | 656.6 |

Off-Plan Market Performance

Total Value: AED 1,743,445,978

Share of Total Transactions: 72.6 %

Subcategory | Value (AED) | % of Off-Plan |

|---|---|---|

Flats | AED 1,194,140,516 | 68.5 % |

Villas | AED 500,876,198 | 28.7 % |

Hotel Apt & Rooms | AED 7,546,019 | 0.4 % |

Commercial | AED 40,883,245 | 2.3 % |

Flats dominated the off-plan segment, accounting for more than two-thirds of its value, while villas made up nearly 29 %.

Ready Market Performance

Total Value: AED 656,591,994

Share of Total Transactions: 27.4 %

Subcategory | Value (AED) | % of Ready |

|---|---|---|

Flats | AED 434,998,383 | 66.3 % |

Villas | AED 140,436,673 | 21.4 % |

Hotel Apt & Rooms | AED 27,842,000 | 4.2 % |

Commercial | AED 53,314,937 | 8.1 % |

Within the ready market, flats led activity, followed by villas, while commercial assets contributed just over 8 %.

On The Micro Level

Market Insights

Off-plan projects remain the driving force behind Dubai’s weekly volume, reflecting strong buyer confidence in early-stage developments. Ready properties continue to play a significant secondary role, with steady participation from flat and villa buyers. Looking ahead, sustained off-plan demand and balanced ready-market supply will be key to maintaining overall market momentum.

Data Source: Dubai Land Department