Mubadala is forming a real estate debt joint venture with Barings (backed by MassMutual), with Barings managing the platform. It will provide senior and subordinated real estate loans across the US, Europe, and Asia-Pacific, leveraging Barings’ $30bn+ real estate debt AUM amid rising private credit demand and refinancing needs.

Read the full article on Dubai Eye

Croatian property prices are rising as sales slow, pushing investors overseas, especially to Dubai. Rijeka agency Dogma Nekretnine says it brokered about 40 Dubai deals this year, often for buyers who’ve never visited. Tours highlight high-amenity buildings priced near €6,000/sqm, cheaper than comparable Croatian cities.

Read the full article on The Dubrovnik Times

India’s Casagrand launched Casagrand HERMINA on Dubai Islands, a $114.4m premium project marking its Middle East expansion. The development will offer 131 furnished 1–4BR residences, smart and eco-focused design, and extensive amenities. Completion is targeted for Q2 2028, aligned with the Dubai 2040 plan.

Read the full article on Middle East Construction News

Profile of Muhammad Binghatti, architect and chairman/CEO of Binghatti Holding, credited with scaling the family developer into a luxury brand known for “hyper-properties” and partnerships (Bugatti, Jacob & Co, Mercedes-Benz). It cites a Dh40bn portfolio, Dh2.66bn 9M-2025 profit, and a reported Dh550m penthouse sale.

Read the full article on Gulf News

Regional listed REITs head into 2026 with stronger confidence as growth, population inflows, and deeper debt markets (including Sukuk) support refinancing and acquisitions. Tight premium office/retail supply in Dubai and Abu Dhabi is lifting rents and returns. Sustainability, digital infrastructure/tokenization, and Saudi foreign-ownership reforms (Jan 2026) could broaden REIT opportunities.

Read the full article on Economy Middle East

Union Properties has broken ground on Mirdad in Dubai Motor City, a AED2bn ($544m) flagship spanning 356,931 sq ft with 1,087 units across four towers. The project emphasizes smart, sustainable living—26+ amenities, green spaces, and EV charging for 647 of 1,294 parking spaces—and targets Q4 2028 completion.

Read the full article on Zawya

The AI-in-real-estate market is projected to jump from $222.7bn (2024) to $975.2bn (2029). In Dubai, AI is accelerating pricing and demand forecasts by combining local infrastructure, mobility, tourism, and demographics data. Brokers shift toward advisory as AI automates leads, analytics, and tours.

Read the full article on Gulf News

The Dubai Metro Blue Line will open to the public in 2029 and a new map revealed by the Road and Transport Authority (RTA) provides further details on the major transport network upgrade.

Read the full article on Arabian Business

Dubai’s 2025 property market hit records, with November value jumping to Dh45.8bn across 17,777 deals and year-to-date transactions topping Dh624bn, driven by off-plan apartments and rising prices. New launches and sellouts (Casagrand, London Gate/Franck Muller) show demand, while RAK accelerates on off-plan, branded beachfront projects and strong yields.

Read the full article on Khaleej Times

Dubai’s luxury demand is shifting outward from the city centre as wealthy, long-term residents prioritise space, privacy, greenery, and resort-style amenities over “central” addresses. Masterplanned outer districts (Dubai Hills, MBR City, Tilal Al Ghaf, Dubai South, island-style waterfront enclaves) benefit from controlled density and wellness design, while stronger transport links, especially around Al Maktoum Airport/Expo City, make “remote luxury” feel both private and convenient.

Read the full article on Khaleej Times

Binghatti says it sold a Bugatti Residences penthouse in Business Bay for AED550m ($150m)—claiming a Middle East record—spanning 47,200 sq ft at AED11,650/sq ft. The firm also claims market-leading unit sales in 2025 and notes celebrity buyers, positioning the project as a flagship of Dubai’s ultra-luxury boom.

Read the full article on Zawya

Shurooq launched Phase 3 of Ajwan Khorfakkan, adding two new towers (Layan and Juman) and appointing Darwish Engineering Emirates as main contractor. The 89,100 sqm waterfront project totals 185 apartments across six buildings with resort amenities. Shurooq cites Sharjah transactions of AED44.3bn (9M 2025), up 58.3% YoY.

Read the full article on Zawya

BlackBrick says Dubai firms are increasingly choosing “15-minute” neighbourhood business hubs over traditional CBD commutes, even as major RTA mobility upgrades roll out. Demand is rising in mixed-use districts like Expo City, Dubai South, Dubai Hills, Motor City, and Dubai Science Park, where shorter commutes boost lifestyle value. The report highlights indicative rents/prices and improving road/metro connectivity driving this shift.

Read the full article on Gulf Business

Emirates NBD forecasts Dubai GDP growth of 4.5% in 2026, matching 2025 and beating global averages. Growth is driven by strong public/private activity, infrastructure spending, population gains, and tourism. Supportive tailwinds include expected easier US monetary policy and easing trade/geopolitical risks, with tourism and medical tourism highlighted as key accelerators.

Read the full article on Gulf News

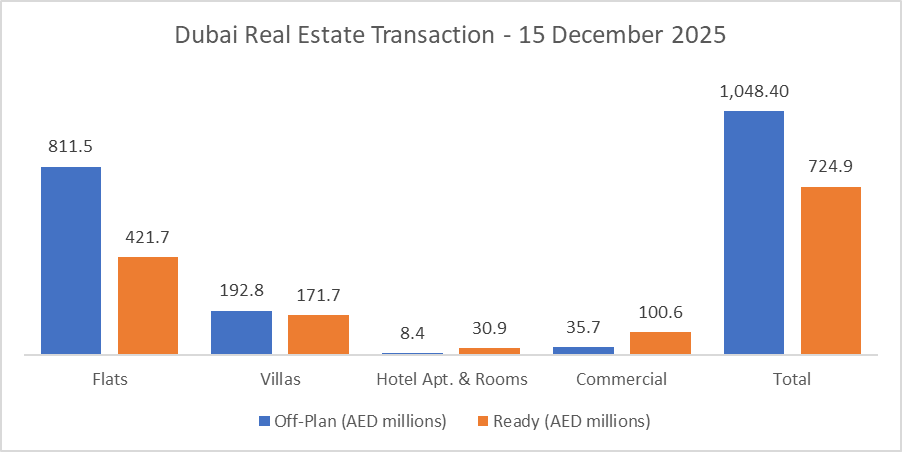

Dubai Real Estate Transactions as Reported on the 15th of December 2025

On the 15-Dec-2025, the total transacted value reached AED 1.77 bn. Off-plan dominated with AED 1.05 bn (59.1%), while Ready accounted for AED 0.72 bn (40.9%).

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 811.5 | 421.7 |

Villas | 192.8 | 171.7 |

Hotel Apt. & Rooms | 8.4 | 30.9 |

Commercial | 35.7 | 100.6 |

Total | 1,048.4 | 724.9 |

Off-Plan Market Performance

Total Value: AED 1.05 bn (59.1% of daily total)

Flats: AED 0.81 bn (77.4%)

Villas: AED 0.19 bn (18.4%)

Hotel Apts & Rooms: AED 8.4 m (0.8%)

Commercial: AED 35.7 m (3.4%)

Off-plan activity was overwhelmingly apartment-led, with villas a clear second pillar and minimal hotel apartment volume.

Ready Market Performance

Total Value: AED 0.72 bn (40.9% of daily total)

Flats: AED 0.42 bn (58.2%)

Villas: AED 0.17 bn (23.7%)

Hotel Apts & Rooms: AED 30.9 m (4.3%)

Commercial: AED 100.6 m (13.9%)

Ready transactions were more balanced than off-plan, with commercial meaningfully lifting its share of value.

On The Micro Level

(placeholder)

Market Insights & Outlook

The day’s market leaned decisively toward off-plan apartments, reinforcing end-user and investor appetite for new supply. Meanwhile, the ready segment showed a stronger commercial contribution, suggesting continued demand for income-oriented assets and/or business activity alongside steady residential turnover.

Data Source: Dubai Land Department