Dubai’s 2025 real estate market stayed strong across both luxury (Dh15m+) and affordable (under Dh2m) segments. Emaar led by sales value (Dh65.8bn) and construction activity, while Binghatti topped sales volume (17,061 deals). Nakheel led luxury value; Binghatti led affordable value.

Read the full article on Khaleej Times

Dubai’s luxury property market has gained another wellness-focused development with R.Evolution’s announcement of Eywa Way of Water, a waterfront residence along the Dubai Water Canal. The project comprises 65 private residences designed around regenerative principles and longevity-focused amenities.

Read the full article on Arabian Business

Tomorrow World Real Estate Development partnered with OCTA Properties to develop next-generation residential and commercial projects in Dubai. Tomorrow World holds 10 plots (eight in Dubai Islands) and targets Dh8bn+ GDV with 20+ projects (2026–2028). The partnership launches with a Dubai Islands marina-front plot featuring ~132 branded waterfront units and retail.

Read the full article on Khaleej Times

The Dubai real estate market showed broad-based strength in 2025, with new data revealing that leading developers drove sales across both luxury and affordable segments, reinforcing confidence among investors and end-users.

Read the full article on Arabian Business

Abu Al-Naga says Dubai real estate hit record 2025 sales, AED624bn by end-Nov, with year-end near AED700bn, driven by Golden Visas, foreign ownership, population growth and off-plan demand. It expects 2026 to bring 3–5% price gains and 6–8% yields, highlighting its new Production City project.

Read the full article on Zawya

Emerging residential districts like Palm Jebel Ali, Dubai South and Dubai Maritime City are driving the next phase of the city’s property market expansion, as buyers and investors increasingly look beyond established locations including Business Bay and Jumeirah Village Circle (JVC).

Read the full article on Arabian Business

Arada launched Inaura, a fitness-led hospitality and residential brand built around “kinetic wellness.” Its first project, Inaura Downtown in Downtown Dubai, goes on sale by end-January and includes a luxury hotel tower with 114 branded residences, from 1–4BR apartments to sky villas and a three-storey six-bedroom penthouse.

Read the full article on Zawya

A Trump–Powell clash could pressure the Fed into faster cuts, which the GCC would “import” via dollar pegs, boosting liquidity, credit growth, real estate demand, and mega-project financing. The downside is a weaker dollar and higher imported inflation. Investors may favor yield-sensitive stocks and GCC sukuk/bonds as rates fall.

Read the full article on Gulf Business

Mace Consult was appointed project manager for Phase 1 of ORA Developers’ Bayn, a 4.8m sq m mixed-use coastal project in Ghantoot, Abu Dhabi with 1.2km beachfront. Bayn will total 9,000 homes; Phase 1 includes 800+ villas/townhouses due from December 2028. The project targets sustainability, including Estidama 2 Pearl.

Read the full article on Zawya

Ras Al Khaimah heads into 2026 with strong real estate momentum: sales exceeded Dh2.33bn by Q2 2025, prices rose ~14–15% YoY, and prime coastal areas saw sharp gains (Al Hamra villas +42%/sqft). Major catalysts include Wynn Al Marjan and new launches: ELEVATE’s Dh1.8bn Mondrian residences (Dh700m sold in 2 hours; completion Q4 2028) and ATARA’s 159-unit Sheraton-branded residences (completion Q3 2028).

Read the full article on Khaleej Times

Discovery Gardens introduced paid parking: one free permit per home, but a second car costs Dh945/month to park within the community. Operator Parkonic says it’s to curb long-term vehicle storage, illegal parking, congestion and space shortages, part of Dubai’s broader shift toward charging for previously free parking.

Read the full article on The National

Mashreq launched a fully digital home-loan pre-approval for eligible salaried expatriates in the UAE (min income AED15,000) buying in Dubai or Abu Dhabi. Users apply online anytime and can receive a verified pre-approval letter the same day, reducing paperwork and uncertainty. Future updates will add more customer types and full end-to-end mortgage stages.

Read the full article on Zawya

Dubai Real Estate Transactions as Reported on the 15th of January 2026

On the 15-Jan-2026, the total transacted value reached AED 2,302,192,960. Off-plan dominated with AED 1,540,191,366 (66.9%), while Ready accounted for AED 762,001,594 (33.1%).

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

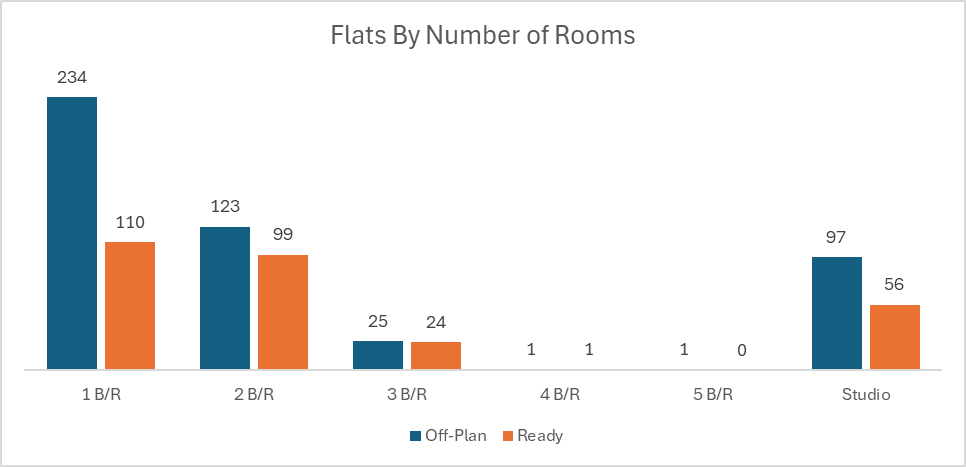

Flats | 992.1 | 439.3 |

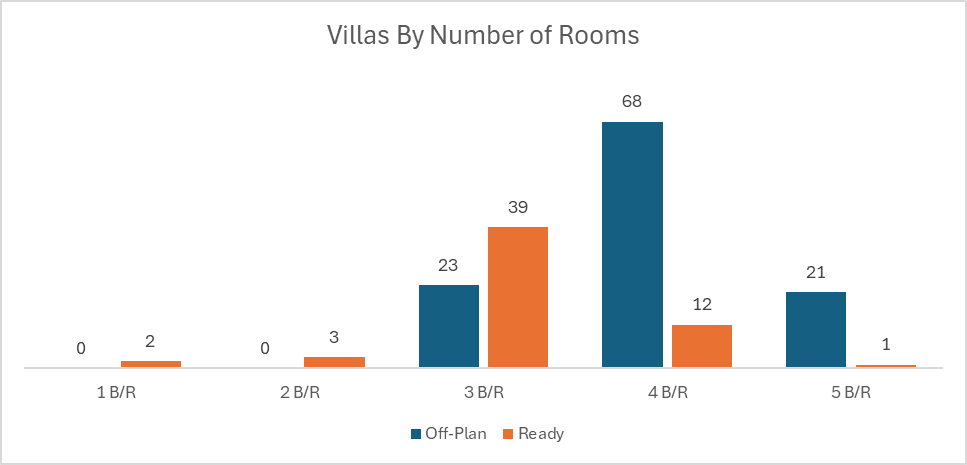

Villas | 456.6 | 181.3 |

Hotel Apt. & Rooms | 4.9 | 36.4 |

Commercial | 86.5 | 105.0 |

Total | 1,540.2 | 762.0 |

Off-Plan Market Performance

Total Value: AED 1,540,191,366

Flats: AED 992,130,385 (64.4%)

Villas: AED 456,591,829 (29.6%)

Hotel Apts & Rooms: AED 4,928,532 (0.3%)

Commercial: AED 86,540,620 (5.6%)

Off-plan activity was led overwhelmingly by flats, with villas providing a strong secondary pillar and minimal hotel-room contribution.

Ready Market Performance

Total Value: AED 762,001,594

Flats: AED 439,285,565 (57.6%)

Villas: AED 181,349,269 (23.8%)

Hotel Apts & Rooms: AED 36,370,650 (4.8%)

Commercial: AED 104,996,110 (13.8%)

Ready transactions were more diversified than off-plan, with a notably higher commercial share and a meaningful hotel component.

On The Micro Level

Market Insights & Outlook

The day’s market was decisively off-plan-driven, pointing to continued appetite for pipeline inventory, especially flats. Meanwhile, the ready segment showed broader demand spread across flats, villas, and commercial assets, suggesting end-user and investor interest remains active beyond purely residential stock.

Data Source: Dubai Land Department