Find out why 1M+ professionals read Superhuman AI daily.

In 2 years you will be working for AI

Or an AI will be working for you

Here's how you can future-proof yourself:

Join the Superhuman AI newsletter – read by 1M+ people at top companies

Master AI tools, tutorials, and news in just 3 minutes a day

Become 10X more productive using AI

Join 1,000,000+ pros at companies like Google, Meta, and Amazon that are using AI to get ahead.

Under Sheikh Hamdan’s patronage, the RTA has opened registration for the 4th Dubai World Congress for Self-Driving Transport (24–25 Sept 2025), themed “Redefining Mobility: The Path to Autonomy.” The event showcases integrated autonomous systems, crowns the 2024 challenge winner with $3 million, and advances Dubai’s goal of 25% autonomous transit by 2030.

Read the full article on Zawya

Azizi Developments invites Dubai investors to preview its AED 75 billion Azizi Milan project, an Italian-inspired, sustainability-led, 40 million sq ft mixed-use community hosting 144,000 residents and 800 hotel keys—at the Conrad Hotel on May 19 and 26, 2025, as part of its global roadshow.

Read the full article on Zawya

Ras Al Khaimah real estate investors will be able to buy properties in Fairmont Residences Al Marjan Island from June 1.

Read the full article on Arabian Business

Dubai’s residential market saw a 23% YoY Q1 transaction rise, led by off-plan deals (69%) and apartments (76%). Peripheral micro-markets accounted for 55% of volumes. Prime segment exceeded 1,300 transactions over AED 10 m (up 31%), with villas holding 73% share. Outlook remains positive despite global uncertainties.

Read the full article on Economy Middle East

Ajman’s real estate transactions rose 24.3% in April to AED 446.8 million across 189 transactions. Residential assets led with AED 207.4 million, followed by over AED 180 million in commercial assets. Golden Residence–related valuations totaled AED 303.3 million (154 deals), up 21.3% month-on-month.

Read the full article on Zawya

Disrupt-X and Tecpro Solutions have teamed up to resell ALEF 360°, an integrated IoT-powered real estate management platform, across the UAE and Middle East. Combining facility and asset management, iBMS, and energy-sustainability tools, it delivers real-time insights and automation to optimize operations and cut costs.

Read the full article on Zawya

Dubai’s beachfront market boomed in early 2025—Palm Jebel Ali transactions hit Dh11.3 bn, Palm Jumeirah Dh5.87 bn—fueled by high rental yields (7–10%), 21.3% YoY value growth and strong HNWI demand. Luxury sales surged (190 homes over Dh36 m), while affordable mid-market options expanded amid an 18% short-term rental uptick.

Read the full article on MSN

UAQ FTZ and the Dubai Land Department signed an MoC letting UAQ FTZ-registered companies acquire and register freehold property in Dubai under their business name, streamlining digital registration, ensuring legal clarity and compliance, and empowering firms to diversify and secure long-term real estate assets.

Read the full article on Zawya

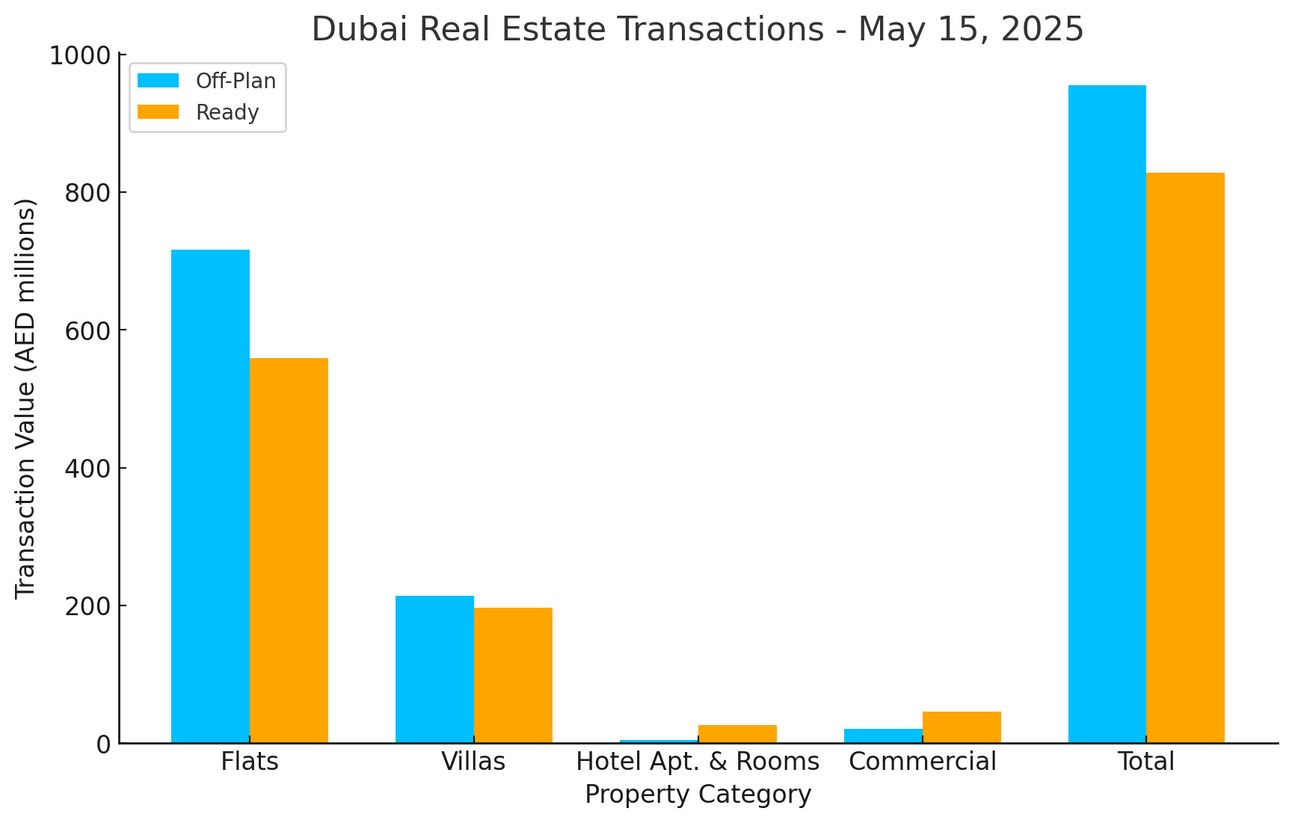

Dubai Real Estate Transactions as Reported on the 15th of May 2025

On 15 May 2025, Dubai’s residential transactions totalled AED 1.78 billion. Off-plan deals accounted for AED 955 million (53.6%), while ready properties made up AED 828 million (46.4%), reflecting a balanced market split between new launches and completed assets.

Category | Off-Plan (AED millions) | Ready |

|---|---|---|

Flats | 716.7 | 558.9 |

Villas | 213.5 | 196.7 |

Hotel Apt. & Rooms | 4.2 | 26.4 |

Commercial | 20.7 | 45.9 |

Total | 955.0 | 827.9 |

Off-Plan Market Performance

Total Off-Plan Transactions: AED 955 million (53.6% of the total transactions)

Flats led off-plan activity at AED 716.7 million (75.1% of off-plan), driven by attractive payment plans and rising investor confidence.

Villas contributed AED 213.5 million (22.4%), signalling steady demand for spacious family homes.

Hotel apartments and rooms recorded AED 4.2 million (0.4%), indicating niche interest in hospitality-style investments.

Commercial properties stood at AED 20.7 million (2.2%).

Ready Market Performance

Total Ready Transactions: AED 828 million (46.4% of the total transactions)

Flats led the ready segment as well, accounting for AED 558.9 million or 67.5% of all ready property transactions. This underscores strong resale demand in established communities.

Villas contributed AED 196.7 million, about 23.8% of the ready total, reflecting solid demand from both end-users and long-term investors.

Hotel apartments and rooms brought in AED 26.4 million, which made up 3.2% of ready property activity.

Commercial units accounted for AED 45.9 million, or 5.6% of the segment, suggesting consistent interest in income-generating assets.

On The Micro Level

Market Insights & Outlook

The slight off-plan advantage underscores developer confidence and buyer willingness to engage early, particularly in high-density residential towers. Ready-market strength - especially in flats - highlights continued end-user demand. Villa sales in both segments demonstrate Dubai’s appeal for family living. Looking ahead, robust off-plan launches and steady ready-stock absorption suggest sustained market momentum, supported by attractive financing options and ongoing urban expansion.

Data Source: Dubai Land Department