Business news doesn’t have to be boring

Morning Brew makes business news way more enjoyable—and way easier to understand. The free newsletter breaks down the latest in business, tech, and finance with smart insights, bold takes, and a tone that actually makes you want to keep reading.

No jargon, no drawn-out analysis, no snooze-fests. Just the stuff you need to know, delivered with a little personality.

Over 4 million people start their day with Morning Brew, and once you try it, you’ll see why.

Plus, it takes just 15 seconds to subscribe—so why not give it a shot?

Record sales and rising residential prices in Abu Dhabi mean its leading listed real estate developer will outperform its Dubai counterparts based on estimated third-quarter profit growth, according to industry analysts.

Read the full article on Arabian Gulf Business Insight

Dubizzle Group will list on DFM, offering ~30.34% of shares (196.1m new, 1.053b existing). Subscriptions: Oct 23–29; pricing Oct 30; trading around Nov 6. Prosus will invest $100m. Retail gets 3%, institutions 97%. Proceeds fund ESOP settlement, M&A, and growth; offering deemed Shariah-compliant.

Read the full article on Gulf Business

Tiger Properties launched “Sky Gate” in JVT, a Dh600m, 45-storey tower with 403 furnished units and resort amenities. Flexible post-handover plans offered; studios 20% down, others 70/30. Completion in ~3 years, handover Q1 2028. It’s Tiger’s third major 2025 project.

Read the full article on Khaleej Times

Binghatti topped Dubai’s residential sales by volume in 2025, selling 12,000 units YTD. It launched 13 projects (GDV AED 12.28b), completed seven (~20% of completions), and sold 95% of Flare 01/02. Portfolio tops AED 80b; Nad Al Sheba plot AED 25b. H1 profit AED 1.82b on AED 6.3b revenue.

Read the full article on Economy Middle East

Sobha Realty launched Sobha SkyParks on Sheikh Zayed Road, a 109-floor (~450 m) tower among the UAE’s five tallest, housing 684 residences. The straight-line structure splits into five sub-towers with minimalist glass façades and four six-storey themed SkyParks featuring leisure, fitness and resort amenities, with seamless access to Dubai’s prime districts.

Read the full article on Gulf Business

Sticking with the same home insurance could cost you

Home insurance costs are rising fast, up nearly 40% nationwide in just the past few years. With premiums changing constantly, sticking with the same provider could mean overpaying by hundreds of dollars. Shopping around and comparing multiple insurers can help lock in better rates without losing the protection your home needs. Check out Money’s home insurance tool to shop around and see if you can save.

GCC property is increasingly tied to long-term residency, reshaping investor flows. UAE leads with 6–9% yields and rising rents; Saudi eases foreign ownership via Premium Residency; Oman’s ITCs (Al Mouj, Muscat Bay) link buys to Golden Visas. Property now serves both returns and mobility strategy.

Read the full article on Zawya

DLD announced partnerships with Google Cloud and Microsoft at GITEX 2025, launching an Investor AI Assistant (Gemini) for data-driven property decisions and a unified Dynamics 365 CRM for AI-powered customer service. Both support D33/Real Estate Strategy 2033 to boost transparency, efficiency, and investor confidence.

Read the full article on Gulf News

DHG Properties launched Helvetia Verde in Meydan Horizon: a 20-storey, 108-unit Swiss-inspired tower with one- to three-bed homes, garden residences, and resort-style amenities. Over 40% sold at launch. Construction begins early 2026, with handover in Q1 2028, reinforcing Dubai’s strong off-plan demand.

Read the full article on Khaleej Times

Holo unveiled a mobile-first, AI-powered internal platform at GITEX 2025 that streamlines mortgages and concierge workflows, auto-summarising notes, matching properties, validating documents, and flagging deal health. It centralises operations for faster, clearer client service and aligns with UAE’s fast-growing AI/PropTech markets.

Read the full article on Zawya

Abu Dhabi summer property sales doubled to AED 11.8bn (Jun–Aug), driven by off-plan and waterfront demand after Disney’s Yas Island announcement. Foreign buyers were 70% (notably India, China, UK). Prices stayed broadly stable amid record Saadiyat deals; Golden Visa and relative value vs Dubai fuelled demand.

Read the full article on Mansion Global

Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

Dubai’s H1 2025 market surged: 94.7k investors (+26%), 59k new (45% residents), AED 262.1b in residential deals (+36.4%). Six trends: off-plan >70% of sales; suburban shift; wellness amenities; sustainability as differentiator; mixed-use “vertical villages”; and tech-driven buying (AI, AR/VR, tokenization).

Read the full article on Zawya

Sharjah unified utilities, municipality and real estate systems, letting residents complete moves and rentals online in minutes. 2022–2024: Dh250m government savings, 1.2m hours cut; residents saved Dh1m and 79k hours. Digital Sharjah, AI DS Assistant and Aqari (2,000 transactions; 42k units; 1,300 buildings) showcase progress.

Read the full article on Khaleej Times

TownX finished Luma Park Views in JVC nine months early and will hand over 600 apartments. Features include 1–3BR units, two sky pools, Technogym gyms, a 32,000-sq-ft garden, smart security and door locks, EV charging, Siemens appliances, and energy-efficient design. TownX: 967 delivered; 1,774 in pipeline.

Read the full article on Zawya

IMF lifts UAE growth to 4.8% in 2025 and 5.0% in 2026, bucking a global slowdown. Upgrades reflect diversification, wider current account surplus, strong banks, and financial modernisation (Digital Dirham, stablecoin rules). Active but contained-risk real estate and structural reforms/trade pacts strengthen resilience and outlook.

Read the full article on Khaleej Times

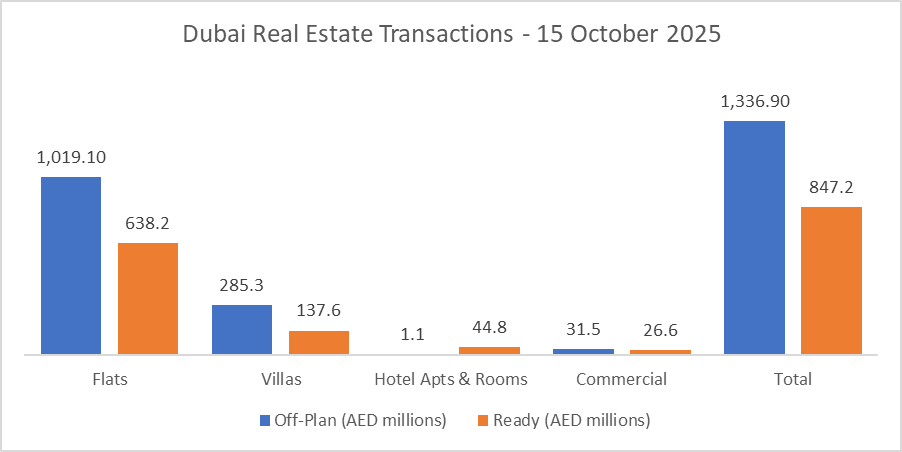

Dubai Real Estate Transactions as Reported on the 15th of October 2025

On the 15-Oct-2025, the total transacted value reached AED 2,184.2 million. Off-plan dominated with AED 1,336.9 million (61.2%), while Ready accounted for AED 847.2 million (38.8%).

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 1,019.1 | 638.2 |

Villas | 285.3 | 137.6 |

Hotel Apts & Rooms | 1.1 | 44.8 |

Commercial | 31.5 | 26.6 |

Total | 1,336.9 | 847.2 |

Off-Plan Market Performance

Total Value: AED 1,336.9 million

Flats: AED 1,019.1 million (76.2%)

Villas: AED 285.3 million (21.3%)

Hotel Apts & Rooms: AED 1.1 million (0.1%)

Commercial: AED 31.5 million (2.4%)

A flats-led session, with villas adding meaningful depth; non-residential and hospitality were marginal.

Ready Market Performance

Total Value: AED 847.2 million

Flats: AED 638.2 million (75.3%)

Villas: AED 137.6 million (16.2%)

Hotel Apts & Rooms: AED 44.8 million (5.3%)

Commercial: AED 26.6 million (3.1%)

Resales were similarly apartment-heavy, with steady villa activity and moderate hospitality/commercial prints.

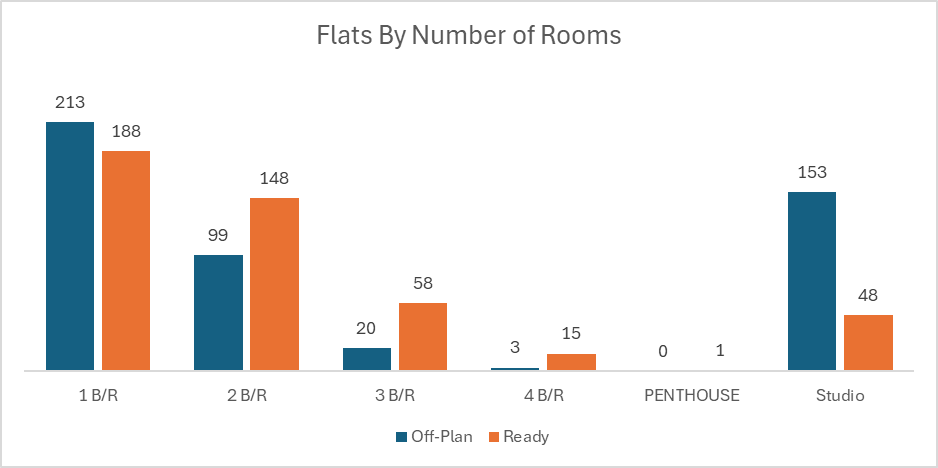

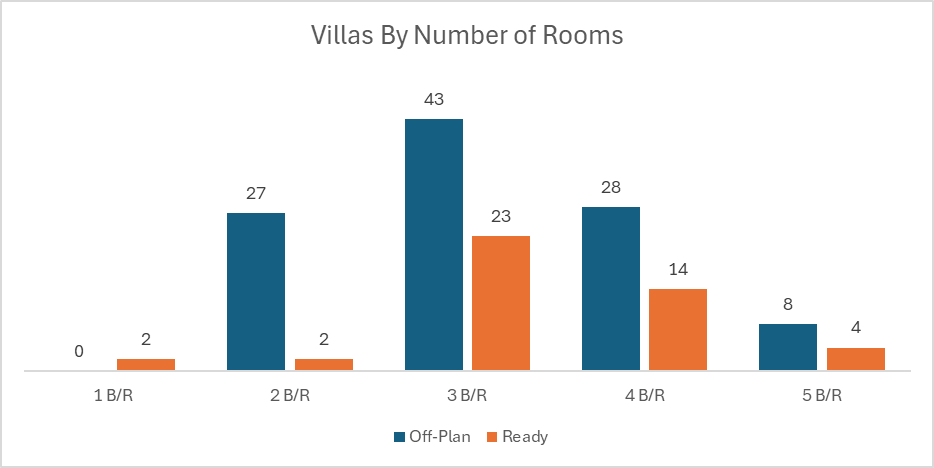

On The Micro Level

Market Insights & Outlook

Off-plan’s 61% share signals sustained buyer confidence in pipeline projects and payment-plan flexibility. Ready activity remains healthy, anchored by apartments. Watch for launch cadence and pricing in villa communities; if supply tightens, ready villas could see firmer values while apartments continue to drive daily liquidity.

Data Source: Dubai Land Department