|

|

Do You Want To Be Featured As An Area Expert? Click Here |

|

AboutTheUAE is your definitive guide to Dubai – discover top Real Estate, schools, visa requirements, housing insights, transport tips, shopping hotspots, entertainment and more. |

Dubai’s residential market achieved a record Q2 2025 with 49,606 transactions, a 22 percent rise from Q2 2024, and AED 147.6 billion in sales. The average sale price climbed to AED 2.97 million, and price per square foot reached AED 1,823, reflecting robust demand from local and international investors.

Read the full article on Zawya

UAE developers embrace AI, BIM, digital twins, and 3D printing for efficiency, but true differentiation lies in preserving brand identity and emotional resonance. Technology should enhance not replace human creativity, cultural context, and storytelling, ensuring developments deliver meaningful experiences and uphold a project’s narrative and brand values.

Read the full article on Construction Week Online

AVENEW Development launched MODO, the AED 1.3 billion AVENEW 888’s first phase in Dubai South. Featuring 217 1–3-bed apartments and duplexes, it offers wellness-oriented amenities—from gyms and pools to kids’ play areas and a dog park—retail outlets, and panoramic views. Prices start at AED 800 000.

Read the full article on Zawya

|

|

Do You Want To Be Featured As An Area Expert? Click Here |

|

AboutTheUAE is your definitive guide to Dubai – discover top Real Estate, schools, visa requirements, housing insights, transport tips, shopping hotspots, entertainment and more. |

Developers are quietly offering strong incentives on new Dubai launches, obscuring true value as price indices lag. Starting prices across areas like JVC, Arjan, and DSO appear flat pre-incentives. Global trends hint at a market inflection, so savvy investors should seize hidden bargains before data catches up.

Read the full article on Gulf News

The development marks the third Jacob & Co residential project in the UAE, following projects in Dubai and Abu Dhabi.

Read the full article on Arabian Business

Madar Developments unveils Tulip Oasis 11 Residences, 99 one- and two-bedroom apartments in Majan, launching July 14 2025 for completion September 2026. With AED 130 million GDV, the project offers wellness amenities and retail, priced from AED 988 000 (one-bed) and AED 1.42 million (two-bed) on a 40/60 payment plan.

Read the full article on Zawya

Samana Developers ranked fifth in Dubai off-plan sales for H1 2025, posting 40 % growth and Dh 1.1 bn June sales. With a 4.4 % market share, a Dh 17 bn portfolio, and 86 % foreign buyers, they plan 18 project launches by year-end. They specialize in resort-style living with private pools, green spaces, and wellness amenities.

Read the full article on Khaleej Times

|

|

Do You Want To Be Featured As An Area Expert? Click Here |

|

AboutTheUAE is your definitive guide to Dubai – discover top Real Estate, schools, visa requirements, housing insights, transport tips, shopping hotspots, entertainment and more. |

Dubai’s new ‘First Home’ initiative offers up to 10 percent discounts on properties (≤ AED 5m) and waives or cuts processing fees, but won’t lower mortgage rates. Buyers could save AED 8k– AED 10k over 2–3 years, with future US rate cuts potentially reducing costs further.

Read the full article on Gulf News

Metropolitan Capital Real Estate has launched an Exclusive Sales Department in Abu Dhabi, offering end-to-end advisory, marketing, sales execution, and compliance services. Launched amid AED 96.2 billion in 2024 transactions and AED 25.3 billion in Q1 2025, it’s closed AED 1.2 billion in sales year-to-date.

Read the full article on Zawya

Dubai Investment Real Estate (DIR) has completed all landside villas and made progress on breakwater villas and the apartment tower.

Read the full article on Arabian Business

Most Dubai tenants renewed June leases for 5–10% hikes instead of paying 10–30% more on new contracts. Renewals outpaced new leases citywide except in Business Bay. Arjan studios average AED 50k and 1 BR AED 72k; Business Bay studios AED 80–85k, 1 BR AED 120k; Downtown studios AED 60k, 1 BR AED 100k.

Read the full article on Gulf News

Lincoln Rise launched Lincoln Star Residence II in Dubai South, a wellness-focused community of studios to 3 BHK duplexes. Amenities include a pool, jacuzzi, halotherapy room, yoga and jogging paths, BBQ and kitchen garden, park, school, 24/7 security, and retail outlets—blending sustainable design with affordable luxury.

Read the full article on Khaleej Times

Tucked quietly between the flashier glitz of Dubai and the sprawling sands of Ras Al Khaimah, Umm Al Quwain might be the UAE’s best kept secret. UAQ real estate outpaces Dubai, averages $619 per square metre, report shows 50% price increase.

Read the full article on Arabian Gulf Business Insight

Azizi Developments launches Milan Heights within its AED 75 billion Azizi Milan masterplan on Mohammed bin Zayed Road. The enclave offers studios to three-bedroom apartments, six infinity pools, fitness and leisure amenities, 20 000 m² of retail space, and direct access to a future metro. Sales begin July 17 at Conrad Hotel.

Read the full article on Zawya

Dubai Real Estate Transactions as Reported on the 15th of July 2025

On 15 July 2025, Dubai’s real estate market recorded AED 1.82 billion in transactions. Off-plan properties accounted for 67.8% of the total, while ready properties made up 32.2%.

Category | Off-Plan (AED million) | Ready (AED million) |

|---|---|---|

Flats | 1,073.0 | 362.6 |

Villas | 54.1 | 139.6 |

Hotel Apt & Rooms | 15.4 | 38.2 |

Commercial | 93.0 | 46.3 |

Total | 1,235.5 | 586.7 |

Off-Plan Market Performance

Total Value: AED 1.235 billion

Share of Total Transactions: 67.8 %

Flats: AED 1.073 billion (86.9 % of off-plan)

Villas: AED 54.1 million (4.4 %)

Hotel Apartments & Rooms: AED 15.4 million (1.2 %)

Commercial: AED 93.0 million (7.5 %)

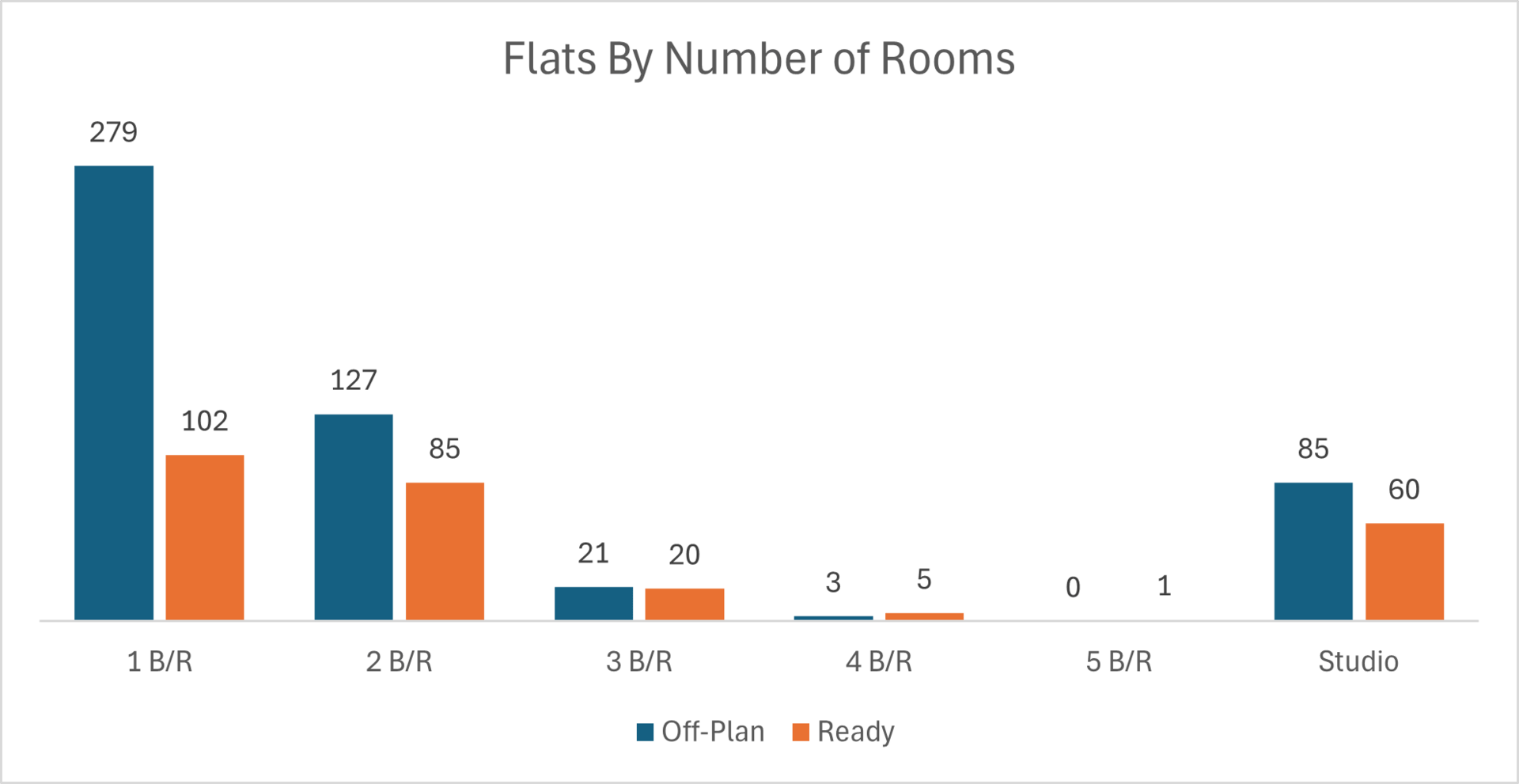

Flats dominated off-plan sales, reflecting continued investor appetite for high-yield residential units.

Ready Market Performance

Total Value: AED 586.7 million

Share of Total Transactions: 32.2 %

Flats: AED 362.6 million (61.8 % of ready)

Villas: AED 139.6 million (23.8 %)

Hotel Apartments & Rooms: AED 38.2 million (6.5 %)

Commercial: AED 46.3 million (7.9 %)

Ready-market flats led activity, though villas captured nearly a quarter of secondary-market value.

On The Micro Level

Market Insights

Strong demand for off-plan flats continues to steer Dubai’s market, while ready-market villas are carving out a notable niche. Commercial assets remain a small but steady contributor. With a heavy off-plan pipeline and sustained appetite for core residential products, the city’s real-estate momentum looks set to continue through the summer.

Data Source: Dubai Land Department