The UAE experienced the highest property price increase globally in 2023, with a 10.4% rise in the year and a 14.15% increase since pre-pandemic levels, ranking it 6th in the latter category according to the IMF. This surge is attributed to an influx of foreign workers and high demand from wealthy individuals, resulting in a shortage of luxury properties. Dubai's per-square-foot prices peaked at Dh1,271 in November 2023, breaking the 2014 record. The IMF report highlights that property prices in advanced economies, including parts of Europe, Africa, and the Middle East, are 10-25% higher than before the pandemic. Rising interest rates have impacted mortgage affordability, while limited housing supply constrains purchases. In the first half of 2023, mortgage rates in advanced economies rose significantly. Countries with a high proportion of adjustable-rate mortgages, like Australia, Canada, and New Zealand, saw notable decreases in real house prices. The IMF suggests that real house prices need to continue cooling from their 2021 and 2022 highs to return to pre-pandemic levels.

Read the full article at Khaleej Times

In 2024, the UAE's GDP is expected to grow by over 5%, outpacing the global economy's projected 2.8% growth, according to S&P Global Ratings. The UAE's GDP grew by over 3% in 2023, with the non-oil sector expanding by nearly 6%. Dubai's growth is driven by strong performance in hospitality, retail, and financial services. Despite global economic challenges, the UAE's real estate sector remains robust, with a significant increase in Russian buyers and continued dominance of Indian, European, and GCC investors. However, a World Economic Forum survey indicates global economic uncertainty in 2024. Over half of the surveyed economists expect a weakening global economy, with varying regional growth outlooks. While global inflation is easing, financial conditions remain tight, and geopolitical tensions are escalating. The outlook is positive for South Asia and East Asia, but Europe shows a significantly weakened outlook, with 77% of respondents expecting weak growth. The Middle East, North Africa, and the U.S. also have a weaker outlook, while Latin America, sub-Saharan Africa, and Central Asia show modest growth expectations.

Read the full article at Gulf Today

Hussain Sajwani, head of Damac Properties, one of Dubai's largest real estate developers, anticipates a 5-10% price increase in Dubai's real estate market in 2024. Speaking at the World Economic Forum in Davos, Sajwani expressed confidence in the market's strength, not expecting a correction in the next two years. The market has seen a boom post-pandemic, aided by relaxed residency rules and influxes of wealthy individuals and professionals due to global events like the Russia-Ukraine war. Damac, which delisted from the Dubai stock market in 2022 following a pandemic-induced slump, is focusing on growth, especially in the high-end and luxury segments. The company, having recovered from the pandemic downturn, also has successful investments in Britain and Miami and is exploring opportunities in the Saudi market.

Read the full article on Khaleej Times

In 2023, Dubai apartment prices saw a 15.4% rise, the highest annual increase in a decade, with the ValuStrat Price Index (VPI) for apartments reaching 103.1 points, a 19.9% annual growth. December witnessed a slower monthly increase of 2%. Discovery Gardens led the apartment market with a 26.4% increase, attributed to the Route 2020 Metro extension, followed by gains in Palm Jumeirah, The Greens, Motor City, and Town Square. Villa prices also rose, with a 2.3% monthly and 24.9% annual increase, with Jumeirah Islands, Palm Jumeirah, Dubai Hills Estate, and Mudon showing the highest growth.

Off-plan sales declined sharply, representing only 28.2% of total sales in December. Ready home transactions slightly decreased but were 37.5% higher than the previous year. High-value transactions were noted in areas like Palm Jumeirah and Dubai Hills Estate. Emaar, Damac, Falcon City of Wonders, and Nakheel were the top developers in sales, with Jumeirah Village Circle leading in both off-plan and ready home sales.

Read the full article at Khaleej Times

Dubai's property market, post-Covid-19, experienced one of the world's fastest booms, driven by investor-friendly reforms and increased demand from expatriates, especially Russians following the onset of the conflict between Russia and Ukraine. This led to luxury developments in Dubai catering specifically to Russian buyers. However, DAMAC Chairman Hussain Sajwani notes a decline in Russian demand, with a new wave of interest from China. Chinese investors are increasingly drawn to Dubai due to challenges in China's domestic economy, the lifting of travel restrictions, and the search for foreign investment havens. Emaar Properties reported that Chinese investments doubled in the first half of 2023, accounting for 7% of total sales. Dubai's attractive rental yields, relaxed tax laws, and neutrality in international conflicts like the Israel-Hamas war, along with stable political policies, security, and long-term visas, continue to make it a favored destination for diverse international investors, including those from India and Europe.

Read the full article at CNBC

In 2024, the global real estate sector is set to show resilience and growth despite economic challenges, propelled by transformative trends. The global real estate and infrastructure market grew to $365.51 trillion in 2023, a 3.4% increase from the previous year, driven by the residential segment. Key trends for 2024 include:

Co-living Spaces: The rise of digital nomads is fueling the growth of co-living and flexible spaces, which offer community-focused, convenient living arrangements with both private and communal areas.

Heightened Digitalization: The real estate sector is embracing digitalization, including the use of digital currencies and AI for predictive analytics, property valuation, virtual tours, and mortgage processing.

Smart and Sustainable Development: Smart technology and sustainability are increasingly influencing real estate, with a focus on green and blue infrastructure. The UAE and Saudi Arabia are investing in smart city projects, like Masdar City and NEOM, aligning with global initiatives for sustainable, low-emission buildings.

Luxury Property Segment: The Middle East and Africa's luxury homes market, especially in Dubai, is expanding, with high-value home sales increasing significantly in 2023.

Diversified Real Estate Portfolio: Real estate markets, particularly in Dubai and Abu Dhabi, are diversifying with the development of greener spaces, off-plan projects, and a boost in ready property sales.

Overall, these trends indicate a shift towards more sustainable, technologically advanced, and diversified real estate markets.

Read the full article at Economy Middle East

Dubai Real Estate Transactions as Reported on the 16th of January 2024

Robust Growth in Off-Plan Transactions

The real estate market on the 16th of January exhibited strong activity, with total transactions reaching an impressive AED 2,628,476,394. A significant portion of this activity was driven by off-plan property transactions, which accounted for AED 2,138,709,239 of the day's total.

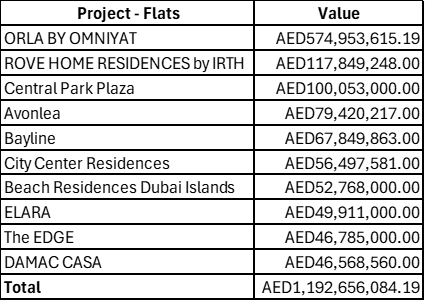

In the off-plan segment, flats were the most sought-after, with transactions totaling AED 2,003,568,018. This indicates a robust demand for residential apartments that are yet to be completed, suggesting investor confidence in the market's future and the quality of ongoing developments. Villas followed with a substantial AED 111,025,066, highlighting a stable interest in more luxurious, spacious living options. Hotel apartments and rooms, which are often attractive to short-term investors or those seeking hospitality revenue, saw transactions of AED 19,445,355.

On the other hand, the ready property market, representing completed units, saw transactions worth AED 489,767,154. Within this category, ready flats led the way with AED 304,920,392, a figure that underscores the ongoing demand for immediately available residential space. Ready villas secured AED 92,096,706 in transactions, pointing to a healthy appetite for high-end, family-oriented properties. Lastly, the completed hotel apartments and rooms contributed AED 36,461,660 to the total, indicating a less pronounced but still noteworthy interest in the hospitality sector.

The disproportion between off-plan and ready transactions could be indicative of several market trends. Investors may be capitalizing on the potential of off-plan properties, which often offer competitive pricing and the promise of appreciation upon completion. The higher volume of transactions in the off-plan flats could also reflect a market trend toward urban living, with a focus on residential apartments as a staple investment.

Furthermore, the ready property segment, while smaller in total volume, demonstrates a continuing trend of investment in immediately available properties, which offer a different value proposition, including the absence of construction risk and immediate rental income potential.

Overall, the real estate market's performance on the 16th of January offers a snapshot of a dynamic environment where off-plan properties are currently dominating investor interest, yet the demand for ready-to-move-in properties remains substantial, ensuring a balanced and resilient real estate sector.

Data Source: Dubai Land Department