Dubai First Instance Court found defendants in a 2008 Danish-investor real-estate dispute fraudulently transferred Dh27m assets to related parties to block enforcement of prior judgments. With only ~Dh3m recovered from Dh35m due, the court ordered joint Dh5m compensation plus 5% interest, costs and fees.

Read the full article on Gulf News

Burj Mayfair Real Estate Brokers completed its largest-ever nine-figure property transaction in Dubai Marina, partnering with BNW Developments (Ankur Agarwal and Vivek Oberoi). The deal highlights momentum in Dubai’s luxury market, strengthens both firms’ positions, and reinforces Dubai Marina’s status as a top waterfront investment destination.

Read the full article on Zawya

Savills says Dubai logged nearly 6,000 home sales above AED10m by mid-Nov 2025, up 24.4% YoY, extending five years of growth. Off-plan drove 73% of deals, led by villas (70% overall; 51% off-plan). Europeans were 58% of Savills’ prime buyers.

Read the full article on Economy Middle East

Dubai’s commercial real estate sector recorded a sharp rise in sales during 2025, with industry analysts predicting the emergence of a two-tier office market as new Grade A developments begin to reshape pricing and tenant demand later in the decade.

Read the full article on Arabian Business

Empire Developments broke ground on Empire Lake Views in Liwan, its sixth Dubai project. The 31-floor tower will have 634 apartments plus six 3-bed duplexes, smart-home features, extensive amenities and premium units with balcony pools. Completion is targeted for Q2 2028, amid strong suburban demand and off-plan momentum.

Read the full article on Zawya

Villa owners in Dubai are set to benefit the most as villa prices rise faster than apartment prices, with demand from families continuing to outpace limited supply heading into 2026, real estate industry experts said.

Read the full article on Arabian Business

Infracorp is expanding in the UAE with California Residences, phase three of its California Village in Wadi Al Safa (370 units; contract awarded Sept 2025). The AED1.2bn masterplan exceeds 600 units. CEO Majid Al Khan emphasizes “next-generation” community design and ESG-led, infrastructure-backed development aligned with Dubai 2040.

Read the full article on Zawya

Hotel operators in Dubai are increasingly being asked by their developers to add apartments to their properties, or do away with hotel rooms altogether, as owners look to cash in early on their investments and tap into a buoyant property market.

Read the full article on Arabian Gulf Business Insight

Binghatti and Mercedes-Benz plan Mercedes-Benz Places – Binghatti City, a Dh30bn, 10M+ sq ft master-planned branded “city” in Meydan. It will be a multi-tower, self-contained community mixing homes, retail, leisure, parks and mobility hubs, guided by Mercedes’ “Sensual Purity” design. Launch: Jan 14, 2026.

Read the full article on Gulf News

Prestige One unveiled Hilton Residences Dubai Maritime City at Atlantis The Royal, calling it the world’s first Hilton-branded standalone waterfront residential project. Executives from Prestige One and Hilton presented the concept, design vision (AE7), and positioned Dubai Maritime City as a key emerging luxury waterfront district.

Read the full article on Gulf News

Nabni Developments has started construction on Nabni Avenue 7 in Al Furjan, a 12-storey premium mid-rise due August 2027. It will offer 166 1–3BR units (950–2,050 sq ft) with smart-home tech and family amenities. Total Al Furjan investment reaches AED 800m; 65% is already sold.

Read the full article on Zawya

Bayut says its TruBroker credibility programme has surpassed 9,000 active agents, the highest since launch. 2,100+ agents earned the badge in December alone (first-time in 2025), reflecting rising adoption of Bayut’s AI-driven quality scoring and compliance tools. Agents say the badge boosts trust, visibility, and mandates.

Read the full article on Gulf News

RAK is gaining attention with Wynn and new beachfront projects, but Abu Dhabi may be the bigger long-term shift: a growing culture/entertainment ecosystem (Saadiyat, Yas), rising institutional capital via ADGM, and major developer investment. The emirates should be viewed as a connected “super-region” that strengthens the UAE overall.

Read the full article on Allsopp & Allsopp

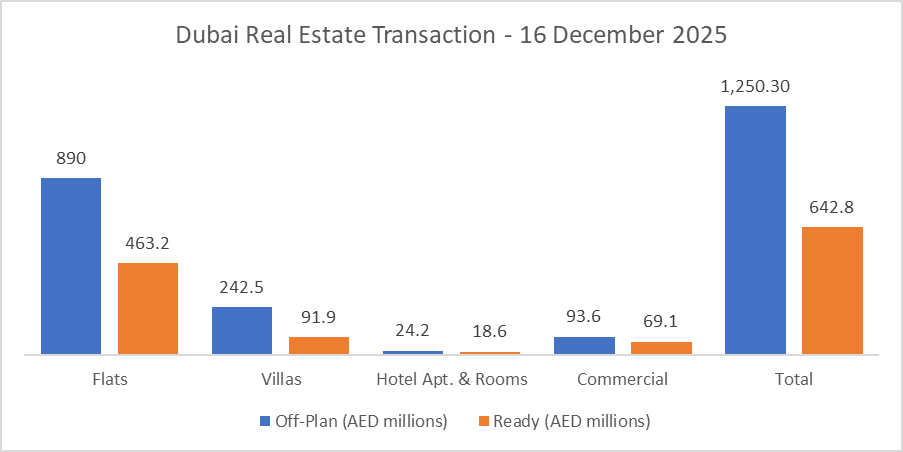

Dubai Real Estate Transactions as Reported on the 16th of December 2025

On the 16-Dec-2025, the total transacted value reached AED 1.89 bn. Off-plan dominated with AED 1.25 bn (66.0%), while Ready accounted for AED 642.8 m (34.0%).

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 890.0 | 463.2 |

Villas | 242.5 | 91.9 |

Hotel Apt. & Rooms | 24.2 | 18.6 |

Commercial | 93.6 | 69.1 |

Total | 1,250.3 | 642.8 |

Off-Plan Market Performance

Total Value: AED 1.25 bn (66.0% of daily total)

Flats: AED 890.0 m (71.2%)

Villas: AED 242.5 m (19.4%)

Hotel Apts & Rooms: AED 24.2 m (1.9%)

Commercial: AED 93.6 m (7.5%)

Off-plan flows were decisively apartment-led, with villas adding meaningful depth and commercial providing a solid secondary contribution.

Ready Market Performance

Total Value: AED 642.8 m (34.0% of daily total)

Flats: AED 463.2 m (72.1%)

Villas: AED 91.9 m (14.3%)

Hotel Apts & Rooms: AED 18.6 m (2.9%)

Commercial: AED 69.1 m (10.7%)

Ready demand remained flat-driven, while commercial stood out with a double-digit share of ready value.

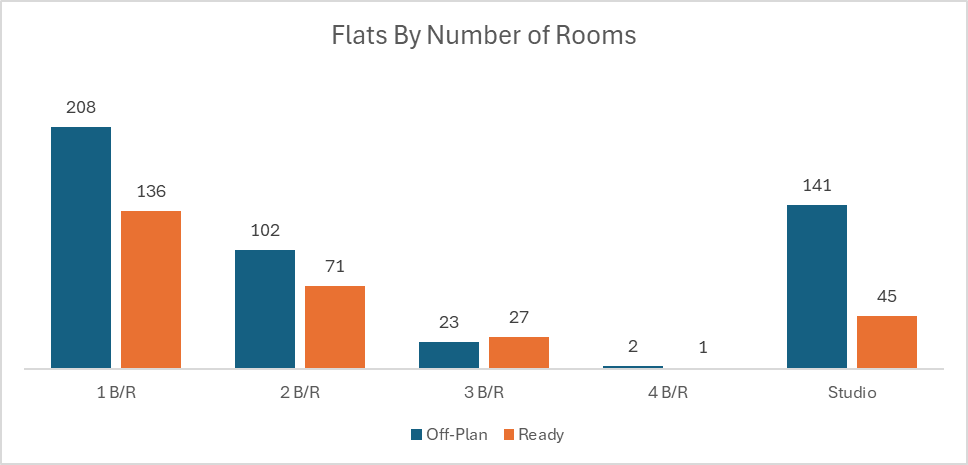

On The Micro Level

Market Insights & Outlook

Overall activity was off-plan-led, signalling continued buyer and investor preference for new launches and forward supply, anchored by flats across both segments. The ready market showed a slightly more diversified mix, with commercial playing a larger role relative to off-plan, suggesting steady end-user and business-led absorption alongside residential turnover.

Data Source: Dubai Land Department