Omniyat Group said 2025 sales hit AED20bn, led by Omniyat Holdings (AED15.1bn) and Beyond Properties (AED4.8bn). OHL revenue rose 150% to AED4.1bn, net profit AED1.2bn, and backlog reached AED19.6bn. It launched major ultra-luxury projects and issued $900m in sukuk.

Read the full article on Zawya

Markaz expects GCC real estate to stay strong through H1 2026 on population growth, non-oil expansion, infrastructure spending and easier liquidity. UAE leads: Dubai’s 2025 deals rose 28% to Dh554bn; Abu Dhabi sales jumped 76% to Dh58bn. Dubai yields remain high (6–8%), with rent growth moderating.

Read the full article on Khaleej Times

Ayat Development has broken ground on Ayami Residence in Warsan First, a G+podium+6 mid-rise with 376 units (studios to 2-beds) due for completion in 2028. The project targets end users and investors, highlighting connectivity, affordability and an amenity-heavy offering including multiple pools, gyms, yoga room, paddle court and outdoor cinema.

Read the full article on Zawya

ADREC now requires developers to register off-plan Expressions of Interest digitally via the Madhmoun platform. EOI payments will be held in a government-managed escrow account supervised by ADREC, reducing risks from manual handling and enabling digital refunds. The first project using it is Manchester City Yas Residences by Ohana, boosting transparency and investor protection.

Read the full article on Gulf News

Dubai South is shifting from investor-led activity to end-user demand as infrastructure and population growth improve livability. Dubai’s housing market is expected to enter a balanced phase in 2026, with moderate price growth forecast at 4–7% and population nearing 4.7m. Airport expansion supports Dubai South’s long-term “live-work” appeal.

Read the full article on Zawya

Y A S Developers launched Casa Altia, a boutique luxury project in Al Furjan, with enabling works started and completion due Q1 2028. The 72-home scheme (1–3 beds) starts from Dh1.7m, including six ultra-luxury units with private pools. The developer plans Dh1bn of Dubai projects in 2026, citing strong 2025 market growth and Al Furjan’s connectivity and returns.

Read the full article on Khaleej Times

Takmeel launched Divine Elements, a AED100m G+4 residential project in Dubai South, offering studios to two-beds with handover in Q4 2027 and flexible payment plans. The developer says ~60% of units sold at launch. Amenities include pools, gym and kids areas, plus rooftop cinema, padel court, lounges and BBQ zones.

Read the full article on Zawya

Rents continue to climb across six prime Dubai communities, driven by strong demand, limited supply, and lifestyle-led master planning.

Read the full article on Construction Week Online

Union Properties declared a 3-fils/share cash dividend, its first in 11 years, after FY2025 revenue rose 39% to Dh736.9m and operating profit exceeded Dh240m. Cash hit a record Dh494.2m and legacy debt was fully repaid. It launched Dh2bn Motor City project “Mirdad” and ServeU acquired House Keeping LLC.

Read the full article on Khaleej Times

CBRE says Saudi real estate shifted in Q4 2025 from planning/regulation to faster execution, aided by easing inflation, stronger GDP growth, rising FDI and new reforms (foreign ownership law, Saudi Properties portal, broader market access from Feb 2026). Office demand is tight in Riyadh; residential stabilising with higher supply; retail turning experiential; hospitality absorbing new supply; logistics rents rising.

Read the full article on Middle East Construction News

Rising UAE traffic is reshaping housing choices: residents increasingly pay more and accept less space to live nearer work and amenities. Dubai’s average 10km trip rose to 19.1 minutes in 2025 (13.7 in 2024), with drivers losing 45 hours to congestion, boosting demand for integrated communities.

Read the full article on Khaleej Times

Dubai Real Estate Transactions as Reported on the 16th of February 2026

On the 16-Feb-2026, the total transacted value reached AED 1,558,783,763. Off-plan dominated with AED 846,228,291 (54.3%), while Ready accounted for AED 712,555,472 (45.7%).

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 523.1 | 481.0 |

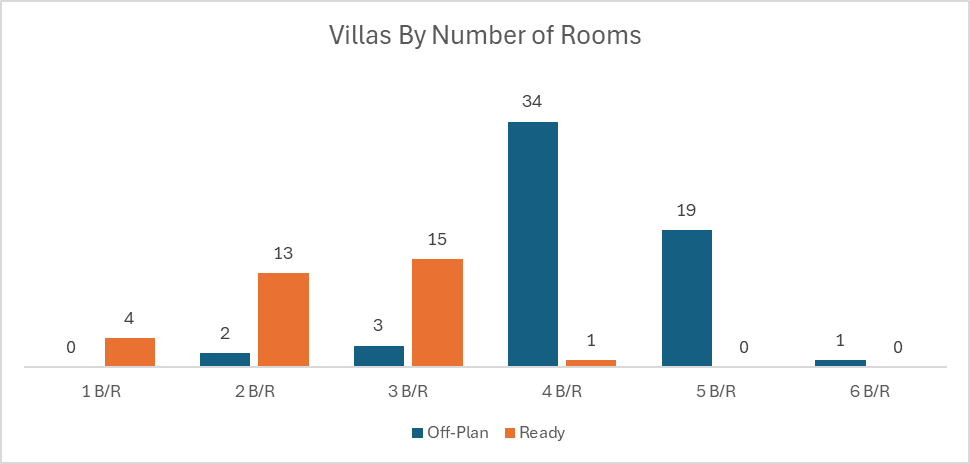

Villas | 237.0 | 93.9 |

Hotel Apt. & Rooms | 6.6 | 28.6 |

Commercial | 79.6 | 109.0 |

Total | 846.2 | 712.6 |

Off-Plan Market Performance

Total Value: AED 846.2 m

Flats: AED 523,112,008 (61.8%)

Villas: AED 236,998,784 (28.0%)

Hotel Apts & Rooms: AED 6,559,784 (0.8%)

Commercial: AED 79,557,715 (9.4%)

Off-plan activity was decisively apartment-led, with villas providing a meaningful secondary contribution and commercial activity adding a notable tailwind.

Ready Market Performance

Total Value: AED 712.6 m

Flats: AED 480,979,750 (67.5%)

Villas: AED 93,949,731 (13.2%)

Hotel Apts & Rooms: AED 28,641,540 (4.0%)

Commercial: AED 108,984,451 (15.3%)

The ready market was also flat-driven, while commercial deals formed a relatively larger slice than in off-plan, supporting overall liquidity.

On The Micro Level

Market Insights & Outlook

With off-plan capturing a modest majority of total value, today’s mix points to continued confidence in new supply, particularly apartments, while the ready segment remains robust and more diversified via higher commercial share. Overall, the market is being powered by end-user and investor demand concentrated in flats, with villas acting as the swing factor across both segments.

Data Source: Dubai Land Department