Home insurance costs continue to climb, with premiums rising over 9% this year and more than 60% in the past five years. However, coverage hasn’t kept pace, leaving many homeowners paying significantly more for less protection. With affordability becoming a growing concern, it’s more important than ever to compare options—check out Money’s handy home insurance tool to find the best fit for you.

AMIS Development launched Derby Heights in Meydan District 11, with Q4 2027 handover. One- and two-bedroom apartments feature Casamia’s “spatial edit” design and amenities, gym, rooftop infinity pool, outdoor cinema, kids’ play area. Fifteen minutes from Downtown, it champions refined, locally branded urban living.

Read the full article on Zawya

Dubai Land Department and Emirates NBD partnered at GITEX to digitise rentals, streamlining deposits, payments and financing via DLD’s app/portal. The initiative boosts transparency and efficiency, aligns with Dubai Real Estate Strategy 2033 and D33, and positions Dubai as a leader in real-estate digitalisation.

Read the full article on Gulf News

Dubai’s real estate is becoming a digital-first market. PropTech, AI analytics, and DLD’s online services enhance transparency and decisions. Blockchain and smart contracts speed secure transactions; smart-city infrastructure lifts asset values. Emerging tools, VR tours and tokenized ownership, broaden access. Strong regulation plus data-driven governance make Dubai a global model for tech-enabled property investment.

Read the full article on TechBullion

MERED CEO Michael Belton highlights the developer’s focus on quality, distinctive design, and innovative amenities. He spotlights ICONIC Residences by Pininfarina in Dubai, growth on Al Reem Island, and a forthcoming branded Abu Dhabi project. Belton links teamwork from sports to collaborative, long-term real estate leadership.

Watch the full Podcast on Gulf News

Fact-based news without bias awaits. Make 1440 your choice today.

Overwhelmed by biased news? Cut through the clutter and get straight facts with your daily 1440 digest. From politics to sports, join millions who start their day informed.

Coraly launched the AI-driven Global Property Portal Index, benchmarking the top 100 portals on listing quality, market experience, discoverability, and feature depth. Guided by an independent advisory board (e.g., Kadir Karaman, Alain Duffoux), the first report arrives in late November from its Dubai hub.

Read the full article on Zawya

Sharjah real estate developer Arada has awarded a construction contract worth AED397m ($108m) to build the Rove Aljada hotel cluster, a key hospitality development within the AED35bn ($9.5bn) Aljada megaproject.

Read the full article on Arabian Business

Jubail Island named its first retail partners for Souk Al Jubail, advancing a walkable, wellness-led community hub. Brands include Spinneys, 1847 Men’s Salon, Bedashing, Artigiano, Daily Press Coffee, Functional Fitness, Medicina, Redwood Nursery, and Washio. The expansion prioritizes sustainability, convenience, and quality of life in a mangrove setting.

Read the full article on Zawya

Al Ghurair launched the super-prime “Al Ghurair Collection,” debuting with Wedyan, a 46-storey, Kengo Kuma–designed waterfront tower on the Dubai Canal. Featuring 149 three- to five-bed homes, two penthouses and a sky villa, Wedyan emphasizes craftsmanship, nature-inspired design, generous outdoor spaces, and bespoke amenities for ultra-luxury living.

Read the full article on ME Construction News

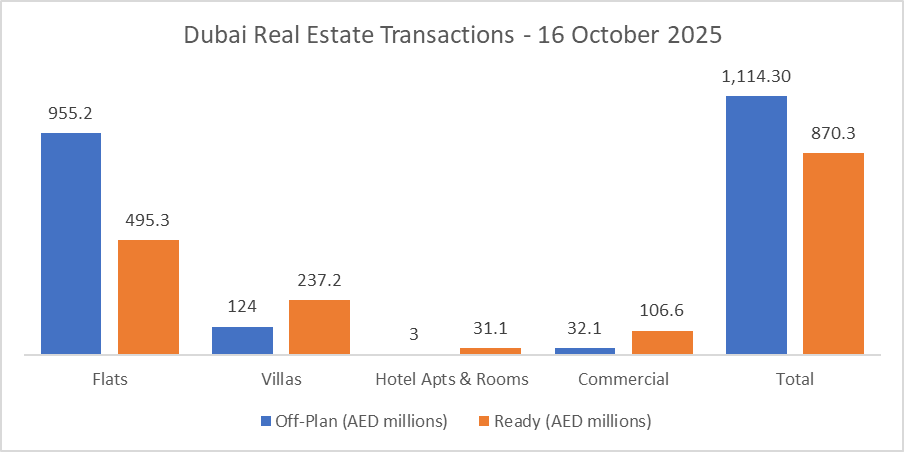

Dubai Real Estate Transactions as Reported on the 16th of October 2025

On 16 October 2025, the total transacted value reached AED 1,984.6 million. Off-plan dominated with AED 1,114.3 million (56.1%), while Ready accounted for AED 870.3 million (43.9%).

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 955.2 | 495.3 |

Villas | 124.0 | 237.2 |

Hotel Apts & Rooms | 3.0 | 31.1 |

Commercial | 32.1 | 106.6 |

Total | 1,114.3 | 870.3 |

Off-Plan Market Performance

Total Value: AED 1,114.3 million

Flats: AED 955.2 m (85.7%)

Villas: AED 124.0 m (11.1%)

Hotel Apts & Rooms: AED 3.0 m (0.3%)

Commercial: AED 32.1 m (2.9%)

Off-plan activity was led decisively by flats, with limited hospitality and commercial volumes.

Ready Market Performance

Total Value: AED 870.3 million

Flats: AED 495.3 m (56.9%)

Villas: AED 237.2 m (27.3%)

Hotel Apts & Rooms: AED 31.1 m (3.6%)

Commercial: AED 106.6 m (12.2%)

Ready transactions skewed to flats, with notable villa and commercial participation.

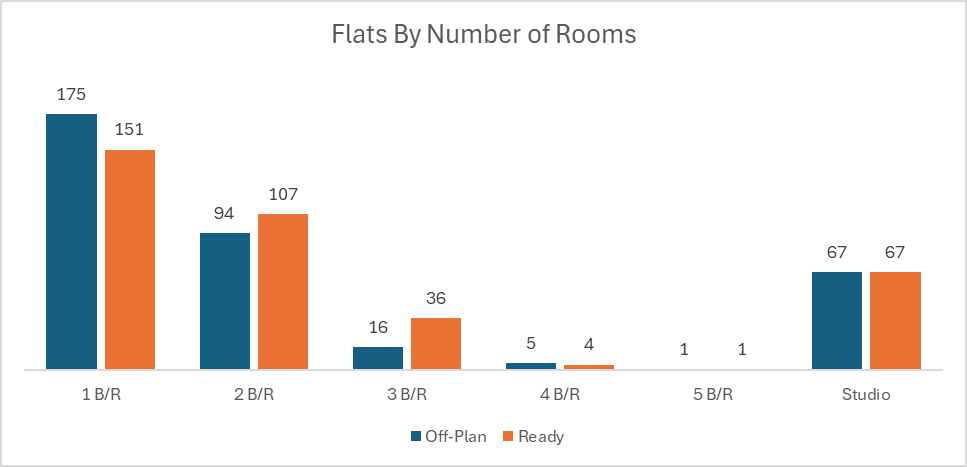

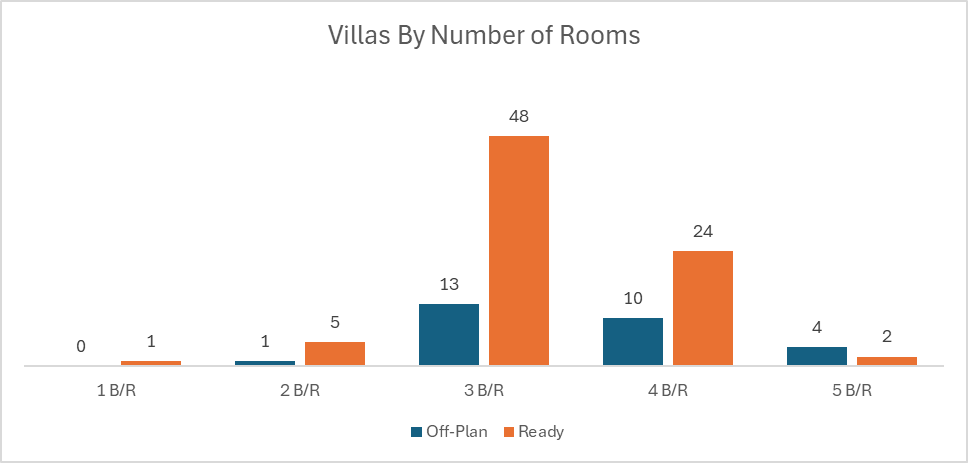

On The Micro Level

Market Insights & Outlook

A balanced day overall, with off-plan still edging ready. The flat-led mix signals steady end-user and investor demand; elevated ready villas and commercial trades suggest selective repositioning ahead of year-end launches.

Data Source: Dubai Land Department