Dubai’s real estate market rebounded in November: sales value hit ~Dh64.4bn (+49% YoY). Primary market surged (+105% value; ready primary +220%), while secondary value rose 9% despite volumes dipping 4%. Apartments dominated searches, and mortgages stayed strong (4,400+ loans worth Dh8.03bn), led by Dh20k–40k earners.

Read the full article on Khaleej Times

Sophisticated investors choose Dubai real estate for fundamentals, not hype: clear regulation, diversified demand, USD-pegged currency stability, strong infrastructure, and more disciplined supply. They also value high-quality local advisors and data access. Dubai’s visas, tax setting, and connectivity make it a strategic, long-term allocation.

Read the full article on European Business Review

Dubai’s commercial real estate surged in 2025 (Dh15.5bn sales value, +77.9% YoY; 5,364 deals, +35.1%), but office stock has lagged residential in quality since 2008. New Grade A supply from 2028 is expected to trigger a “two-tier” market, pressuring older buildings and lifting premiums for modern offices.

Read the full article on Khaleej Times

Dubai luxury demand is surging. 800 AED20m+ deals in 12 months (more than AED16bn). Bayut says leads for AED20m+ homes rose 2.7x in three years and high-intent leads +46% YoY; ultra-luxury villa areas saw more than 500% growth. Reports cite $10.3bn HNWI capital targeting Dubai.

Read the full article on Economy Middle East

DD Group is expanding in Dubai with an end-to-end residential real estate platform covering acquisition, renovation, investment and resale. It launched two options: an “Asset Ownership Model” (clients keep title; DD manages sourcing/reno/resale) and a “Capital Performance Model” (fixed-return, contract-secured income). All services are managed in-house with one point of contact.

Read the full article on Khaleej Times

Pasha1 Developers launched Stax, its first Dubai project: a AED550m (GDV) two-tower, 528-unit development in JVC District 15, managed by Refine. It offers studios to 3-bed duplexes, 40,000+ sq ft of amenities, and prices from AED663k. Construction is underway, with completion due August 2028.

Read the full article on Zawya

Amali Properties (a DAMAC subsidiary) awarded DUTCO Construction a AED700m main works and interior fit-out contract for Amali Island on The World Islands. The private development includes 24 ultra-luxury waterfront villas priced AED50m–200m+. Dredging and soil works are complete; marine/infrastructure is over halfway done, with completion targeted for Q1 2027.

Read the full article on Construction Week Online

Ciel Dubai Marina, developed by The First Group and part of IHG’s Vignette Collection, was certified by Guinness World Records as the world’s tallest hotel at 377.127m. The 1,004-room landmark in Dubai Marina aims to set a new benchmark for luxury hospitality and tourism.

Read the full article on Travel and Tour World

The UAE’s 2025 boom is being driven by strong non-oil GDP growth, record business formation, and surging tourism, pushing demand across residential, commercial, and hospitality real estate. New laws and major infrastructure (Etihad Rail) are boosting investor confidence, while Dubai leads global hotels/branded residences and RAK accelerates around Wynn 2027.

Read the full article on Khaleej Times

The UAE’s 2025 growth was powered by non-oil expansion, trade and investment: non-oil foreign trade hit AED1.7tn in H1 (+24.5%). UNCTAD ranked the UAE 10th globally for 2024 inbound FDI (AED167.6bn). Real GDP rose 4.2% in H1; non-oil GDP +5.7% (77.5% share). Major strategies, record 2026 budget (AED92.4bn) and 220k+ new firms reinforced momentum.

Read the full article on Zawya

ONE Development launched ONE Residence on Al Reem Island, its first Abu Dhabi project: a 31-storey AI-integrated residential tower claiming the world’s first fully integrated aerial mobility ecosystem, with rooftop eVTOL access and a logistics drone port. Announced Dec 9 at Emirates Palace, it follows the firm’s Dubai launch (Laguna Residence) and regional expansion.

Read the full article on Khaleej Times

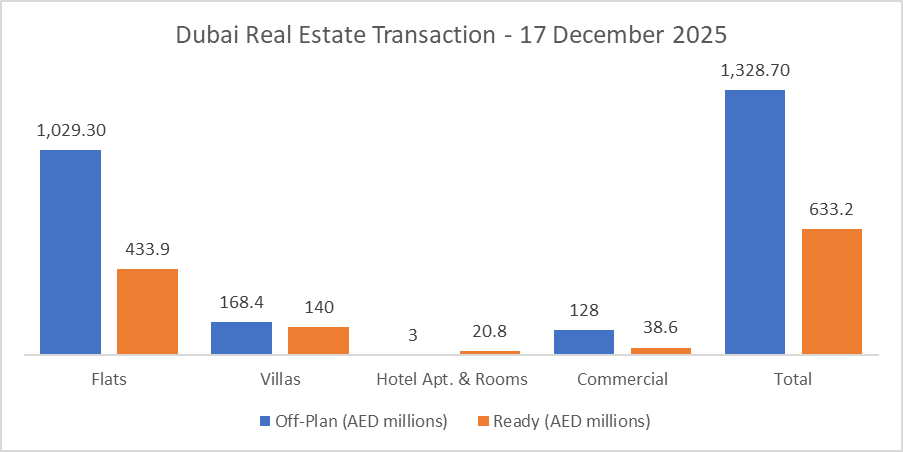

Dubai Real Estate Transactions as Reported on the 17th of December 2025

On 17 Dec 2025, the total transacted value reached AED 1,961,972,265. Off-plan dominated with AED 1,328,722,996 (67.7%), while Ready accounted for AED 633,249,269 (32.3%).

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 1,029.3 | 433.9 |

Villas | 168.4 | 140.0 |

Hotel Apt. & Rooms | 3.0 | 20.8 |

Commercial | 128.0 | 38.6 |

Total | 1,328.7 | 633.2 |

Off-Plan Market Performance

Total Value: AED 1,328,722,996 (67.7% of daily total)

Flats: AED 1,029,347,916 (77.5%)

Villas: AED 168,393,491 (12.7%)

Hotel Apts & Rooms: AED 2,988,376 (0.2%)

Commercial: AED 127,993,213 (9.6%)

Off-plan activity was overwhelmingly apartment-led, with flats accounting for over three-quarters of off-plan value, while villas and commercial contributed a meaningful secondary share.

Ready Market Performance

Total Value: AED 633,249,269 (32.3% of daily total)

Flats: AED 433,896,983 (68.5%)

Villas: AED 139,958,667 (22.1%)

Hotel Apts & Rooms: AED 20,792,672 (3.3%)

Commercial: AED 38,600,948 (6.1%)

Ready transactions were also led by flats, but villas carried a notably larger role versus off-plan, signaling solid end-user and upgrade demand in completed stock.

On The Micro Level

Market Insights & Outlook

The day’s value was driven by off-plan (67.7%), reflecting continued preference for new supply and forward-looking demand, particularly in apartment product. Meanwhile, the ready segment’s higher villa share suggests a steady market for immediate occupancy and family-oriented inventory, keeping the completed market resilient alongside the off-plan pipeline.

Data Source: Dubai Land Department