Dubailand Residence Complex is emerging as a leading mid-market hotspot, driven by affordability, connectivity and steady off-plan absorption. An investor event booked Dh50m in 48 hours. Apr–Oct 2025 saw 3,721 deals; values rose 8.9% to Dh871k and prices 11.9% to Dh1,332 psf.

Read the full article on Khaleej Times

Dubai’s ultra-luxury property market, which saw villa transactions surpass AED 400 million in 2025, is expected to remain supported in 2026 by continued migration of British high-net-worth individuals, according to Sotheby’s International Realty.

Read the full article on Arabian Business

Emaar Properties is focusing on a narrower set of large masterplanned communities in Dubai as its land bank shrinks and it prioritises delivery in the second half of the decade, investor disclosures show.

Read the full article on Arabian Gulf Business Insight

JLL says UAE industrial/logistics real estate is shifting toward institutional-grade assets, supported by mega infrastructure, industrial policy and strong trade growth. Tight occupancy and rising rents are boosting demand for modern, flexible warehousing and last-mile logistics. Yields stayed stable at ~7.25%–8.25%, underpinning income-led investment.

Read the full article on Zawya

Zoya Developments launched Miorah by Zoya in Dubai South, a AED 37.5m fully furnished project of 60 apartments (28 studios from AED 640k, 32 two-beds from AED 1.1m), with Q2 2027 handover. It features wellness amenities, flexible payment plans, and sustainability elements like solar systems and EV charging.

Read the full article on Gulf Today

REACH Middle East launched an eight-month, DLD-backed proptech accelerator, selecting seven startups from ~100 applicants to scale toward “unicorn” potential. The cohort targets digital services, AI brokerage tools, immersive sales tech, rentals and construction finance across the UAE, Saudi and India, tapping a UAE proptech market estimated above $5bn and growing 17% annually.

Read the full article on Zawya

Dubai proptech Stake raised $31m Series B led by Emirates NBD, taking total funding to $58m, with investors including Mubadala, MEVP and Property Finder. It’s expanding in Saudi (three funds; SAR416m deployed), entered US industrial real estate (Oct 2025), and is pursuing regulated tokenisation with a VARA in-principle approval.

Read the full article on Zawya

The UAE property market enters 2026 strongly: Dubai hit 215,700 residential deals in 2025 worth Dh686.6bn (+30.9%), while Abu Dhabi saw Dh54bn in H1 2025 transactions and rents up 13%. New players launched projects: Urban Capital on Al Reem Island and ATARA’s Sheraton-branded residences in RAK from Dh2.4m.

Read the full article on Khaleej Times

Omoria opened its first private residence, Omoria Palme Couture, on Palm Jumeirah’s West Beach. The brand positions it as ultra-luxury, blending Dubai standards with Japanese hospitality and Italian design. A Wellbeing Concierge provides personalised lifestyle support. Omoria plans to expand across iconic UAE locations and selected global markets.

Read the full article on Zawya

The Abu Dhabi residential sector is entering a new phase of expansion, with emerging communities generating up to AED22 billion in property sales as investors and end-users increasingly target value-led opportunities over established prime addresses.

Read the full article on Arabian Business

Ajman’s Land and Real Estate Regulation Department said 242 property valuations were completed in January, worth AED 1.06bn. Valuations covered commercial, residential and industrial assets, with commercial leading at AED 626.5m and residential at AED 329m. Golden Residence/court/institutional-related valuations totaled 167 deals worth AED 303m+.

Read the full article on Zawya

GAF Property launched Flow25, its first signature off-plan project on Al Reem Island. Built around nature, innovation and community, it features biophilic landscaping with Ghaf trees, shaded walkways, smart homes and a balcony/outdoor cooling system. The scheme offers 1–3BR apartments plus penthouses/sky villas, with April 2029 handover and a 50/50 payment plan.

Read the full article on Construction Week Online

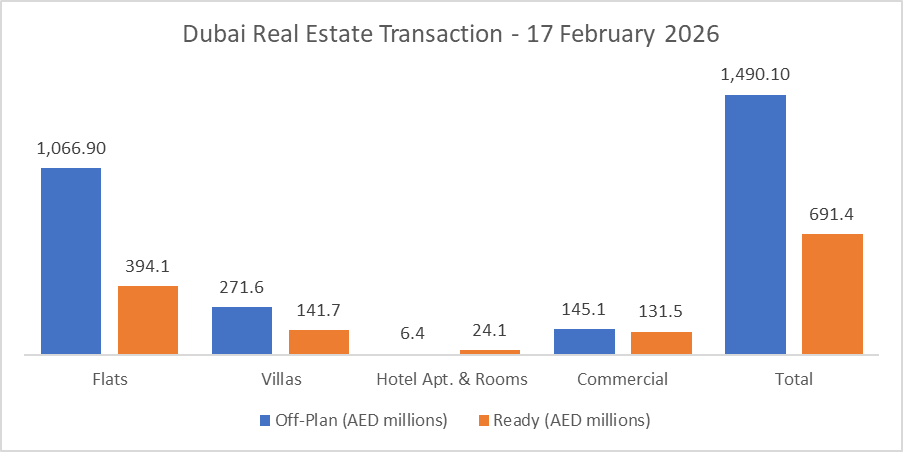

Dubai Real Estate Transactions as Reported on the 17th of February 2026

On the 17-Feb-2026, the total transacted value reached AED 2.18 billion. Off-plan dominated with AED 1.49 billion (68.3%), while Ready accounted for AED 691.4 million (31.7%).

Category | Off-Plan (AED millions) | Ready (AED millions) |

|---|---|---|

Flats | 1,066.9 | 394.1 |

Villas | 271.6 | 141.7 |

Hotel Apt. & Rooms | 6.4 | 24.1 |

Commercial | 145.1 | 131.5 |

Total | 1,490.1 | 691.4 |

Off-Plan Market Performance

Total Value: AED 1.49 billion

Flats: AED 1.07 billion (71.6%)

Villas: AED 271.6 million (18.2%)

Hotel Apts & Rooms: AED 6.4 million (0.4%)

Commercial: AED 145.1 million (9.7%)

Off-plan activity was overwhelmingly apartment-led, with villas providing a strong secondary contribution and commercial adding a meaningful slice.

Ready Market Performance

Total Value: AED 691.4 million

Flats: AED 394.1 million (57.0%)

Villas: AED 141.7 million (20.5%)

Hotel Apts & Rooms: AED 24.1 million (3.5%)

Commercial: AED 131.5 million (19.0%)

The ready market was more diversified, with commercial and villas together forming a substantial share alongside steady apartment demand.

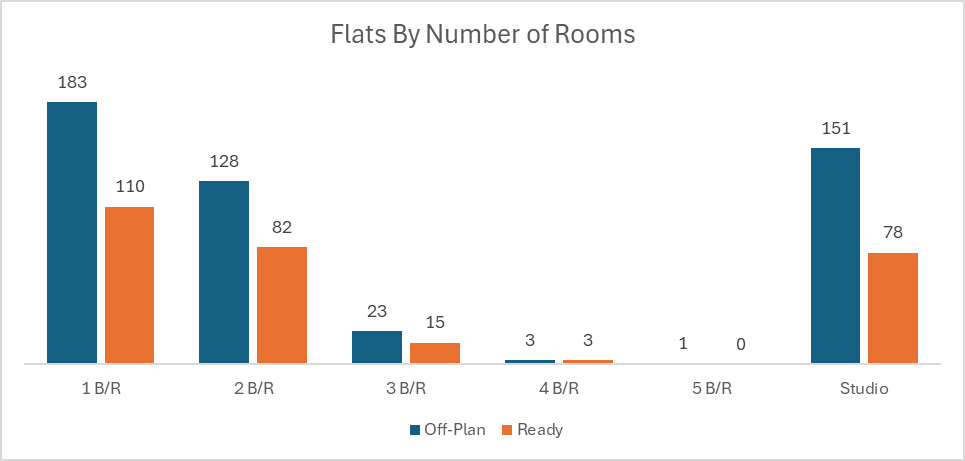

On The Micro Level

Market Insights & Outlook

The day’s flow points to continued investor appetite for off-plan stock, especially flats, while the ready segment shows broader end-user and commercial-driven demand. If this mix persists, liquidity should remain supported by off-plan launches, with ready transactions reflecting selective buying where quality and pricing align.

Data Source: Dubai Land Department