Dubai Municipality introduces new planning rules to allow home extensions and updated building code.

Read the full article on Arabian Business

The Real Estate Report is a reader-supported publication. To receive new posts and support my work, consider becoming a paid subscriber.

SOL Properties has launched SOL Levante, a AED 1 billion mixed-use project in Dubai's Jumeirah Village Triangle. The development includes 612 apartments, 100,000 sq ft office space, 50,000 sq ft retail area, and numerous lifestyle amenities, aiming to blend modern living with nature and community-focused spaces for residents and investors.

Read the full article on Business Outreach

Sharjah's real estate market transforms with the AED 25 billion Ajmal Makan City—Sharjah Waterfront, covering 60 million sq ft. The project includes residential, commercial, tourism facilities, green spaces, 1,500 villas, schools, hotels, an 800-berth marina, and a theme park, significantly boosting economic diversification, sustainability, and attracting global investors.

Read the full article on Zawya

Aldar has announced that it has sponsored 1,000 UAE nationals to gain real estate agent accreditation across Abu Dhabi and Dubai and upskilled more than 100 individuals through an advanced training programme.

Read the full article on Arabian Business

Dubai’s hotel sector will add over 11,300 rooms by 2027, reaching 162,600 rooms across 769 hotels. In 2024, the city welcomed 18.7 million visitors, boosting occupancy rates to 78%. Continued growth supports Dubai's strategic goal of becoming a top global tourism destination, significantly contributing AED236 billion to the UAE economy.

Read the full article on Zawya

Three land plots in Downtown Dubai were recently sold for a combined profit of Dh715 million, underscoring Dubai's booming real estate market. One investor notably earned Dh225 million profit within just 18 months. Robust demand, limited supply, transparency, and strong governance have significantly boosted investor confidence, driving record-high resale gains.

Read the full article on Khaleej Times

Dubai's real estate market expects a record 72,365 residential units delivered in 2025, up 171% from 2024, significantly boosting economic growth. Leading developer ORO24 has already delivered the resort-style Torino community, emphasizing luxury amenities and sustainability. Dubai’s population surge and expanding urban landscape underscore the market’s robust growth and investment appeal.

Read the full article on MSN

Emaar Properties plans significant investments of AED 65 billion ($18 billion) over the next five years, including AED 14 billion ($3.81 billion) on Creek Tower and Creek Mall. The company will spend AED 30 billion ($8.2 billion) replenishing its extensive land bank, strengthening its market position, alongside expansions like Dubai Mall and residential rental portfolios.

Read the full article on Zawya

The Dubai real estate sector recorded AED14.88bn ($4.1bn) of transactions last week, according to data from the Land Department.

Read the full article on Arabian Business

Dubai maintained its position as the top global city for foreign investment in 2024, attracting AED 52.3 billion, a 33.2% rise from 2023. Real estate transactions hit $142.4 billion, up 27% YoY, driven by new builds and increased Chinese investment, now the fourth-largest investor group, contributing around 8% of total deals.

Read the full article on Dao Insights

With an average household size of four people per unit, the population increase in January–February translates to a demand for more than 51,126 additional homes in 2025, sector experts said.

Read the full article on Arabian Business

Dubai's real estate expands with Meraas' launch of The Acres in Dubailand, offering luxury, eco-friendly villas and mansions. Awarded LEED Gold pre-certification, the final development includes 3-7 bedroom residences, abundant green spaces, sustainability-focused designs, and premium lifestyle amenities, highlighting Dubai’s commitment to sustainable and wellness-oriented living.

Read the full article on Zawya

Abu Dhabi's DMT launched the "Value Housing Programme," aiming to deliver affordable, high-quality homes to enhance community integration and sustainability. Partnering with developers, the initiative seeks to create vibrant neighborhoods, fostering inclusivity and innovation, while diversifying Abu Dhabi's housing market and strengthening its social infrastructure.

Read the full article on Khaleej Times

Saudi Arabia has initiated a one-month public consultation on a new off-plan real estate law designed to protect buyers, enhance transparency, and clarify developer procedures. Coinciding with the Vision 2030 economic drive, the law aims to regulate the booming property sector, projected to reach SAR 353 billion ($94 billion) by 2028.

Read the full article on Zawya

Over 29,000 new trading and services companies joined the Dubai Chamber of Commerce in 2024, highlighting its role in Dubai’s economic diversification. Significant growth was also recorded in construction, transport, and financial sectors, with a total of over 29,000 new firms joining, underscoring Dubai's appeal as a global business hub.

Read the full article on Zawya

Photo by Laurence Elbana

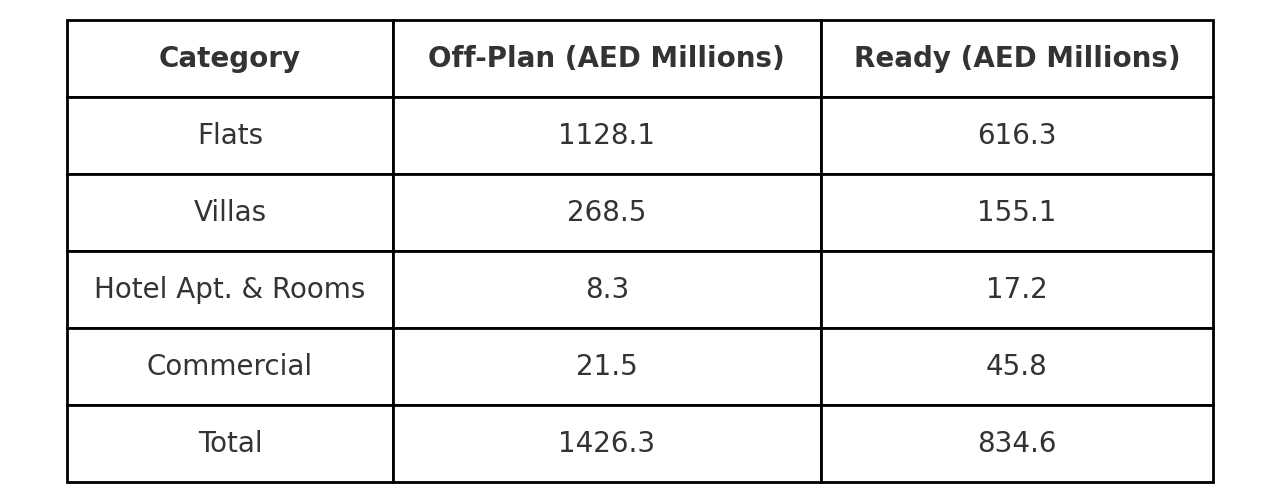

Dubai Real Estate Transactions as Reported on the 17th of March 2025

On 17 March 2025, Dubai’s real estate transactions reached a total value of AED 2.26 billion, underscoring ongoing strong market activity and sustained investor confidence.

Off-Plan Properties

Off-plan properties contributed significantly to the day's transactions, accounting for 63.1% (AED 1.43 billion) of the total value. The breakdown within this segment includes:

Flats: Dominating this segment, flats accounted for 79.1% (AED 1.13 billion), emphasizing strong investor demand for residential apartments.

Villas: Represented 18.8% (AED 268.5 million), indicating sustained interest in spacious and luxurious properties.

Hotel Apartments & Rooms: Contributed 0.6% (AED 8.26 million), reflecting a niche investor preference within hospitality assets.

Commercial Properties: Made up 1.5% (AED 21.48 million), showcasing diversified interests.

Ready Properties

Ready properties made up 36.9% (AED 834.6 million) of the total transaction value. Within this category:

Flats: Constituted the largest share at 73.8% (AED 616.3 million), highlighting consistent preference for move-in-ready residential units.

Villas: Made up 18.6% (AED 155.1 million), demonstrating continued demand for high-quality, ready-to-occupy homes.

Commercial Properties: Represented 5.5% (AED 45.83 million), indicative of sustained business and retail sector activity.

Hotel Apartments & Rooms: Comprised 2.1% (AED 17.25 million), indicating steady market activity in the hospitality sector.

Key Takeaways

Off-Plan Dominance: More than half of total transactions came from off-plan sales, with flats contributing nearly 79% of the segment.

Flats Lead Across Segments: Flats accounted for 79.1% of off-plan sales and 73.8% of ready transactions, underscoring strong demand for apartments.

Villas Maintain Appeal: While villas represent a smaller share of the total market, their consistent transactions indicate a steady preference for larger residential units.

Hotel Apartments & Commercial Properties: These segments continue to play a niche role but contribute to overall market diversity.

Conclusion

Overall, these transactions indicate Dubai’s real estate market remains dynamic and attractive for both local and international investors. Strong performance across diverse property segments further positions Dubai as a leading global investment destination, promising continued growth and sustainability.

Data Source: Dubai Land Department